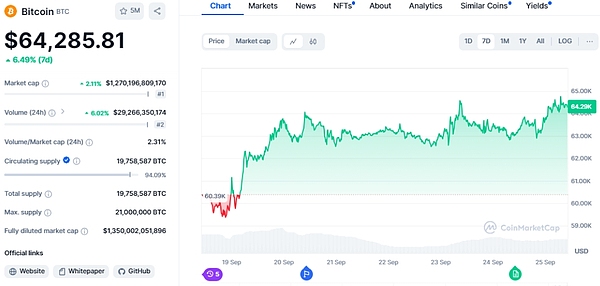

Bitcoin prices surged to $64,700 on Wednesday, moving closer to the $65,000 target. This was BTC’s seventh gain in eight trading days.

If you want to know more about the crypto and get first-hand cutting-edge information, please visit Weibo Dolphin 1 for more good articles .

The U.S. Bitcoin spot ETF market also showed positive signs, with total net inflows reaching $136 million on September 24. Major funds such as Fidelity Think Tank Wise Origin Bitcoin Fund (FBTC) and iShares Bitcoin Trust (IBIT) made up for the losses of Grayscale Bitcoin Trust (GBTC).

Bitcoin is at a critical juncture. The long-term trend remains bearish, but short-term indicators show bullish potential. If Bitcoin can break through key resistance soon, it could signal a reversal. However, failure to do so could confirm a bearish divergence, leading to more downside pressure in the coming weeks.

For a long-term bullish trend to form, a breakout above the long-term resistance line must be confirmed. This resistance level has been weighing down Bitcoin prices for the past six months and is currently just below $68,000. Until Bitcoin breaks through this resistance level, the uptrend may only be a short-term trend within a larger bearish market.

The market has just improved, but the risk point is after the second and third interest rate cuts?

1. BTC market share has been rising for two years. In the process of QT to QE, BTC market share will peak and will be accompanied by a long weekly decline.

2. During the Fed’s interest rate cuts over the past 40 years, the U.S. stock market has experienced a sharp drop, and most of them occurred around the second or third rate cut. BTC is certainly not immune.

3. The realization of QE will truly bring about an explosion of liquidity in the crypto, and only then will the raging bulls enjoy the bubble moment. This time is obviously after the second half of 2025.

4. From the market, BTC has gone through the complete three weekly waves. It could be that 73,000 has already peaked and is currently rebounding, and then continues to fall after the rebound. It could also be that BTC hits a new high, completes the 5th wave, and then falls.

In any case, unless BTC rises above 100,000, it will face a weekly top divergence or the weekly rebound will fail to create a new high, which will lead to a long and sharp correction.

CZ is about to return, and you can focus on the following projects:

1. BNB: The rising trend is obvious.

2. EDU: Led by Binance Lab, focusing on education.

3. CAKE: Binance’s eldest son.

4. BAKE: The youngest son of Binance.

5. HOOK: Led by Binance Labs, involving social and education.

What's next?

The next few days will be crucial. If Bitcoin can break above $64,500 soon, this bearish divergence may be invalidated. However, if the price fails to break above this resistance level within a week, the bearish divergence may strengthen, resulting in a short-term downtrend.

Bitcoin’s liquidation heatmap shows liquidity at around $62,200. While there is more liquidity on the downside, there is also some liquidity on the upside, starting around $64,800 and moving up to $65,400. This means that if Bitcoin tries to move higher, it may face resistance.

We may see a slight drop to $62,200 in the next day or two to clear this liquidity. After that, Bitcoin is still likely to continue its short-term bullish trend.

The article ends here. Follow Weibo Dolphin Dolphin 1 for more good articles. If you want to know more about the relevant knowledge of the crypto and first-hand cutting-edge information, please consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!