According to CoinDesk, cryptocurrency options exchange Deribit said trading activity in the Bitcoin (BTC) market is likely to intensify in the next two days as options contracts worth billions of dollars are about to expire.

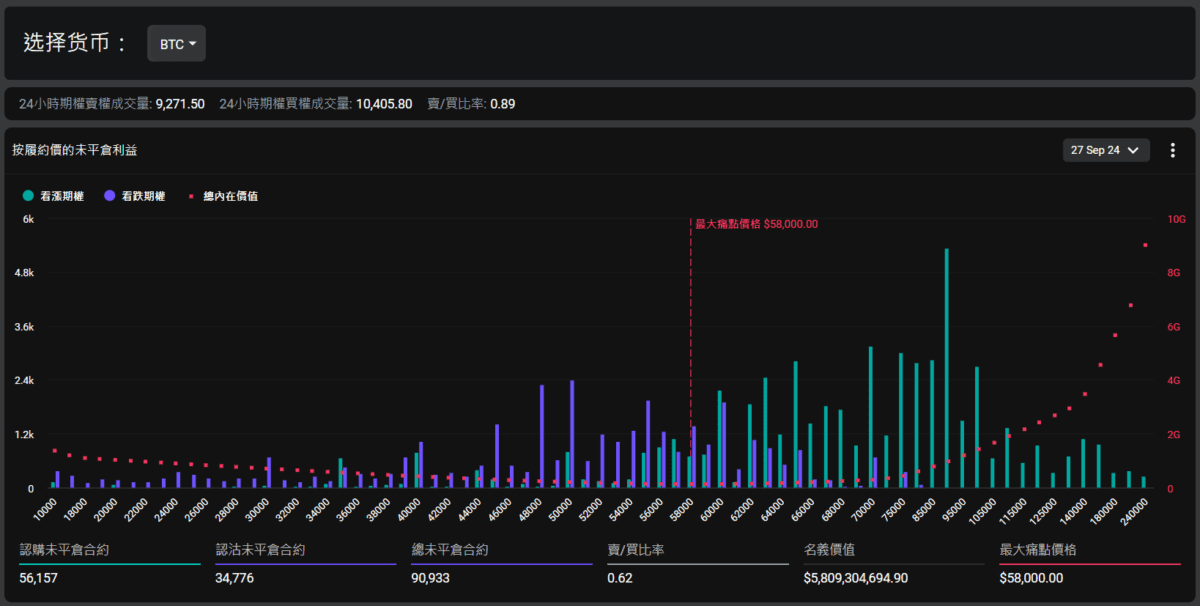

Deribit data shows that 90,000 BTC option contracts worth US$5.8 billion and nearly US$1.9 billion in ETH options will expire and be delivered at 4 pm Taiwan time this Friday. About 20% of the $5.8 billion in Bitcoin open interest is in-the-money, and a similar situation exists for Ethereum options.

Deribit CEO Luuk Strijers said in an interview with CoinDesk:

“About 20% of BTC options expiring soon are in-the-money options, and this larger expiration may increase volatility or activity as traders close or roll over positions, which may also Affect price.

Trading activity is likely to remain strong in the coming months as the U.S. Securities and Exchange Commission (SEC) approved options trading on the BlackRock Bitcoin Spot ETF (IBIT), which could accelerate institutional adoption. Strijers said:

“ETF options are one of the biggest potential drivers. The SEC has given the green light, but the OCC (Options Clearing Corporation) and CFTC (Commodity Futures Trading Commission) have not and are unlikely to do so this week.”

Strijers also noted that pricing of options expiring in the coming months suggests a bullish outlook. He said:

“BTC and ETH options skewness turned negative after September expiration, which is a bullish indicator as calls are relatively more expensive than puts.”

Biggest pain points reveal potential downside pressure

Maximum Pain Point refers to the price level at which option buyers suffer the greatest loss at expiration. In traditional markets, a popular theory is that as options approach expiration, the biggest pain point prices often act like a magnet, attracting prices closer because option sellers (usually large institutions with deep pockets) will look through The underlying asset is traded to influence the spot price, bringing it close to the maximum pain point price, thereby allowing the buyer to bear the maximum loss.

The biggest pain point for Bitcoin options expiring this Friday is $58,000, while the current trading price of Bitcoin spot is $63,800. Rick Maeda, an analyst at Presto Research, said in an interview with CoinDesk that this does create some potential downward pressure as it approaches expiration.

The biggest pain point theory has been circulating since 2021, although some believe that the cryptocurrency options market is still relatively small and not large enough to have a significant impact on spot prices.