Author: Jack Inabinet, Bankless; Translated by: Deng Tong, Jinse Finance

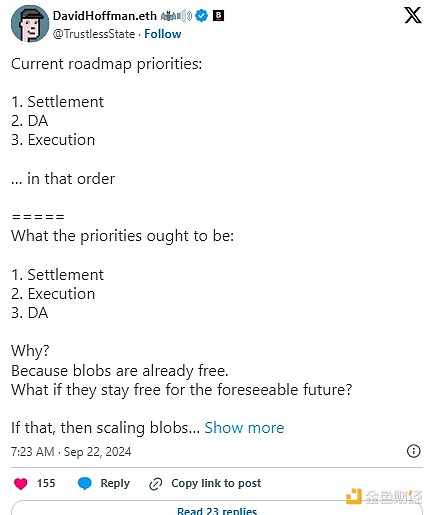

The dominance of Ethereum smart contracts has been challenged as never before in this cycle. Growing concerns about Ethereum losing users to alternative L1s like Solana have led some in the community to advocate for prioritizing technical improvements to the L1 execution layer over increasing aggregated data availability bandwidth.

This shift will have a significant impact on the network. It will also have interesting implications for the revenues of various ETH infrastructure protocols. Today, we’ll dive into how the shift in ETH priorities can bring huge benefits to the liquidity staking platform Lido and LDO holders.

Optimizing execution

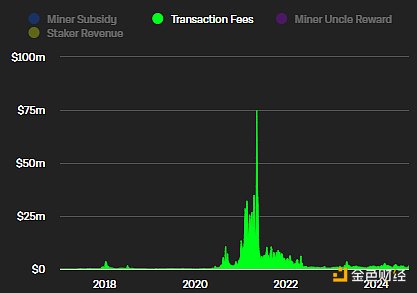

Over the past four years, Ethereum L1's daily transaction volume has remained at a relatively stable level of around 1 million transactions, but transaction fee revenue has dropped significantly; in early 2021, Ethereum's daily transaction fee revenue often exceeded US$20 million, but in 2024, it would be lucky to reach this level of transaction fee revenue in a month.

Despite the clear demand for Ethereum-adjacent block space, as evidenced by the almost uninterrupted upward trend in L2 transaction throughput, Ethereum’s revenue from such activity is extremely limited.

Due to its rollup-centric roadmap, Ethereum is optimized to provide relatively cheap data availability storage for its L2. This is the only direct service in the rollup relationship for which Ethereum stakers get paid, and it generates only a few cents per transaction.

While rollups and L2 offer fast transaction times and low transaction costs, their users lack the same security guarantees as Ethereum L1, where their transactions are processed by a decentralized set of validators and the integrity of the blockchain is maintained by proven economic incentive schemes such as slashing.

Ethereum’s greatest strength is its world-class settlement guarantee, which guarantees that any user transaction will be processed reliably (assuming they can afford the necessary transaction fees), and many ecosystem thinkers believe that the time is right to combine this core capability with improved L1 execution.

While the significant roadmap deviations required to achieve this vision would require some controversial changes — such as increased hardware requirements or native parallelization — the implementation of such upgrades could reinvigorate Ether’s faltering narrative power by making Ethereum L1 the default landing point for valuable financial transactions on all chains.

Simple staking economics

While a sudden shift to execution-first seems unlikely at this point, it is an attractive path forward for the Ethereum ecosystem to consider.

The forward-looking nature of the market means that investors often try to “front-run” each other by positioning themselves to take advantage of a shift before it actually happens, in which case LDO could be the leading performer in the coming weeks.

LDO prices have been performing well recently, rising 26% from their August 15 relative low, suggesting that investors may have spotted the bull run brewing in the token.

A renewed focus on execution will drive more transactions to Ethereum L1, especially the most ideal computationally intensive high-value DeFi transactions. Individual transaction costs will likely decrease, but in this case , the total fees generated by all transactions are expected to increase, positively affecting the main variable behind Lido's revenue: ETH staking yield.

Furthermore, assuming that the availability of Ethereum L1 leads to a measurable increase in blockspace demand while producing desirable second-order effects such as net ETH deflation, then Ethereum may become the more obvious smart contract platform choice from both an investment and usability perspective. If the restoration of this distinction increases the price of ETH, then Lido will see greater USD-denominated profits for a given level of on-chain activity.

While discussions about changing Ethereum roadmap priorities are still in the early stages (and controversial!), it’s undeniable that these potential shifts could provide some strong incentives to reinvigorate L1 as a place where real users are happy to pay transaction fees for strong settlement guarantees. If this grand vision can be realized, then LDO will finally hopefully start to perform well.