Several Bitcoin (BTC) addresses that had been dormant for a long time have recently become active, which is particularly noticeable following the recent rise in the Bitcoin price.

These long-term holders, known as strategic movers, or Bitcoin whales, can influence the coin’s short-term trajectory. In this analysis, BeInCrypto explains what this move could mean for investors who are expecting a big upside for BTC.

Old Bitcoin Wallets Are Moving

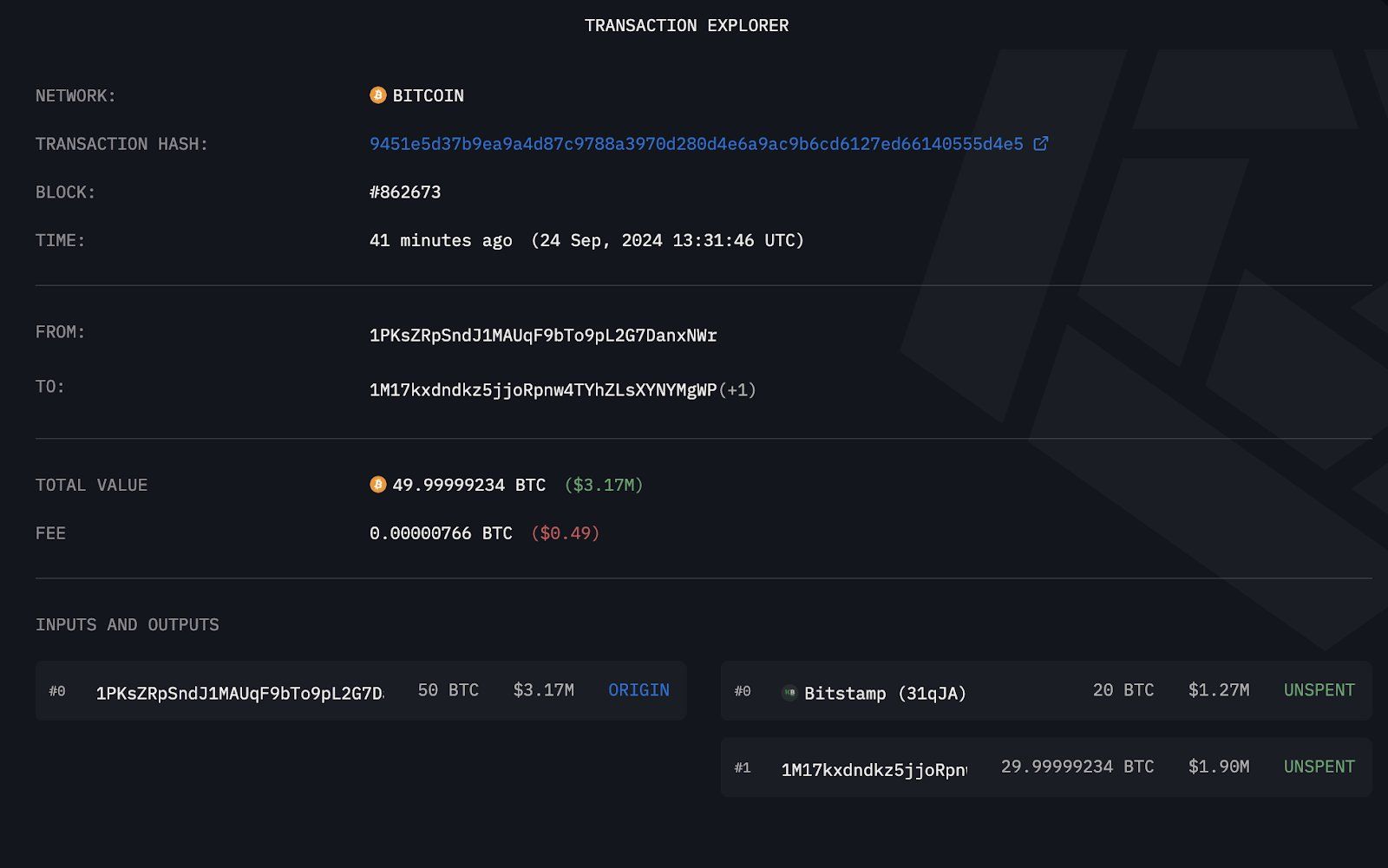

On Monday, September 24, blockchain firm Arkham Intelligence reported that a 13-year-old Bitcoin whale had transferred 20 BTC to Bitstamp. The whale holds 50 BTC and the last transaction took place four years ago.

Coin movements to Bitstamp exchanges can be a cause for concern, as most exchange inflows indicate that investors are willing to sell. Depending on the volume, these transactions can put downward pressure on the price.

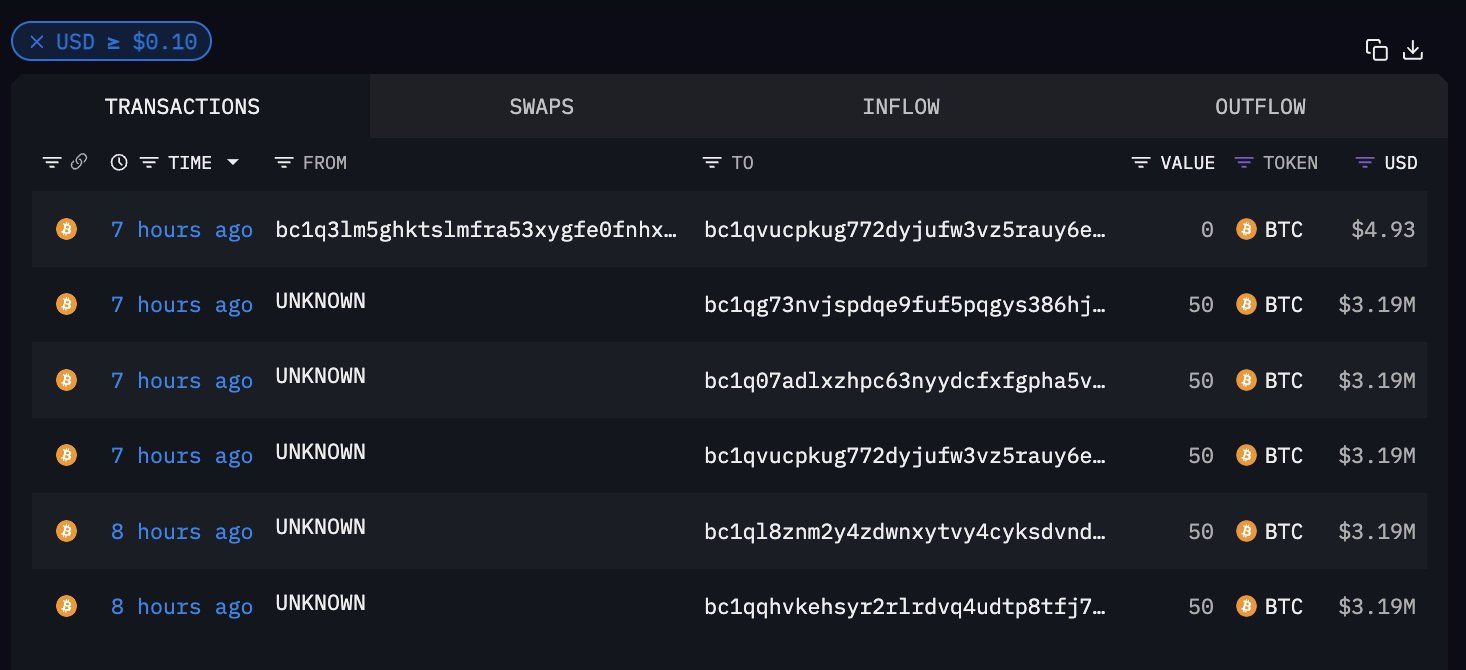

But this whale isn’t the only one to have recently woken up. On the same day, another Bitcoin whale, who had held 1215 BTC since 2009 , transferred 5 coins to Kraken .

In addition to these two whales, another inactive address from the same year transferred 250 BTC from the wallet on September 20th.

These transactions bring the total number of coins moved from idle wallets over the past five days to 275 BTC. With the Bitcoin price currently trading at $63,725, the value moved is approximately $175.2 million.

Read more: Who will own the most Bitcoin in 2024?

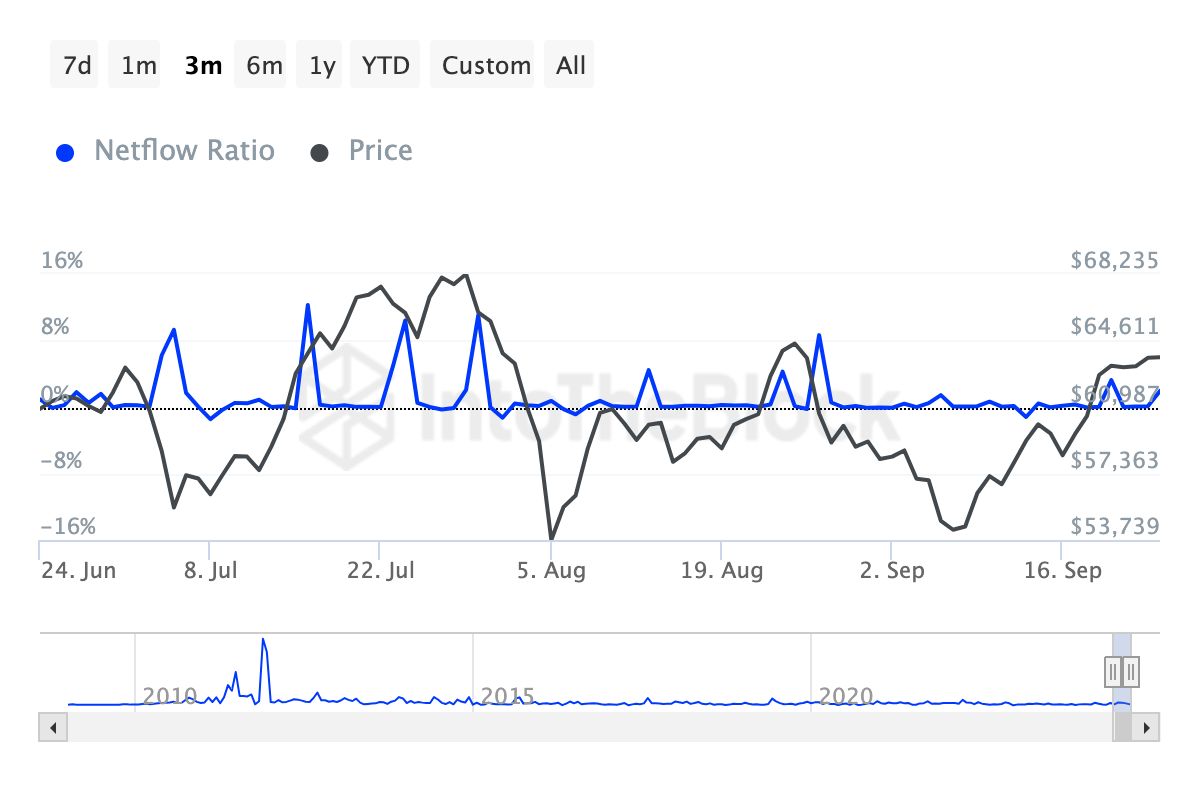

Despite the trades, the net inflow rate of large holders to exchanges has decreased significantly over the past seven days. This net inflow is the difference between the number of coins sent to exchanges by Bitcoin whales and the number withdrawn.

High values for this indicator foreshadow a price decline as selling pressure builds. However, a negative ratio, as it is now, can be seen as a period of accumulation and could be in anticipation of a notable BTC rally. Therefore, for now, BTC may not be experiencing significant downward pressure.

BTC Price Prediction: Next is $68,000

On the daily chart , Bitcoin’s price broke out of a descending channel that formed from March to mid-September . As you can see below, the $54,008 support level was crucial in preventing BTC from falling below $50,000. Additionally, the $6,296 support level ensured that the breakout was successful.

Also, the Moving Average Convergence Divergence (MACD) is positive. A positive MACD reading, used as a technical oscillator to identify trends, indicates that the momentum around Bitcoin is bullish.

Read more: How to get paid in Bitcoin (BTC): Everything you need to know

If this situation continues, the price of Bitcoin could move to $68,225 . On the other hand, if Bitcoin whales start distributing coins in large quantities, BTC may not reach this target. In that case, the price of Bitcoin could fall to $62,96.