Written by: BitpushNews

Financial markets were volatile again on Wednesday.

The S&P opened higher but turned lower by midday and never recovered, while the Nasdaq gave up early gains and struggled to maintain its upward momentum. The Dow fell throughout the day and ended the day down 0.70%, the S&P fell 0.19%, and the Nasdaq closed flat.

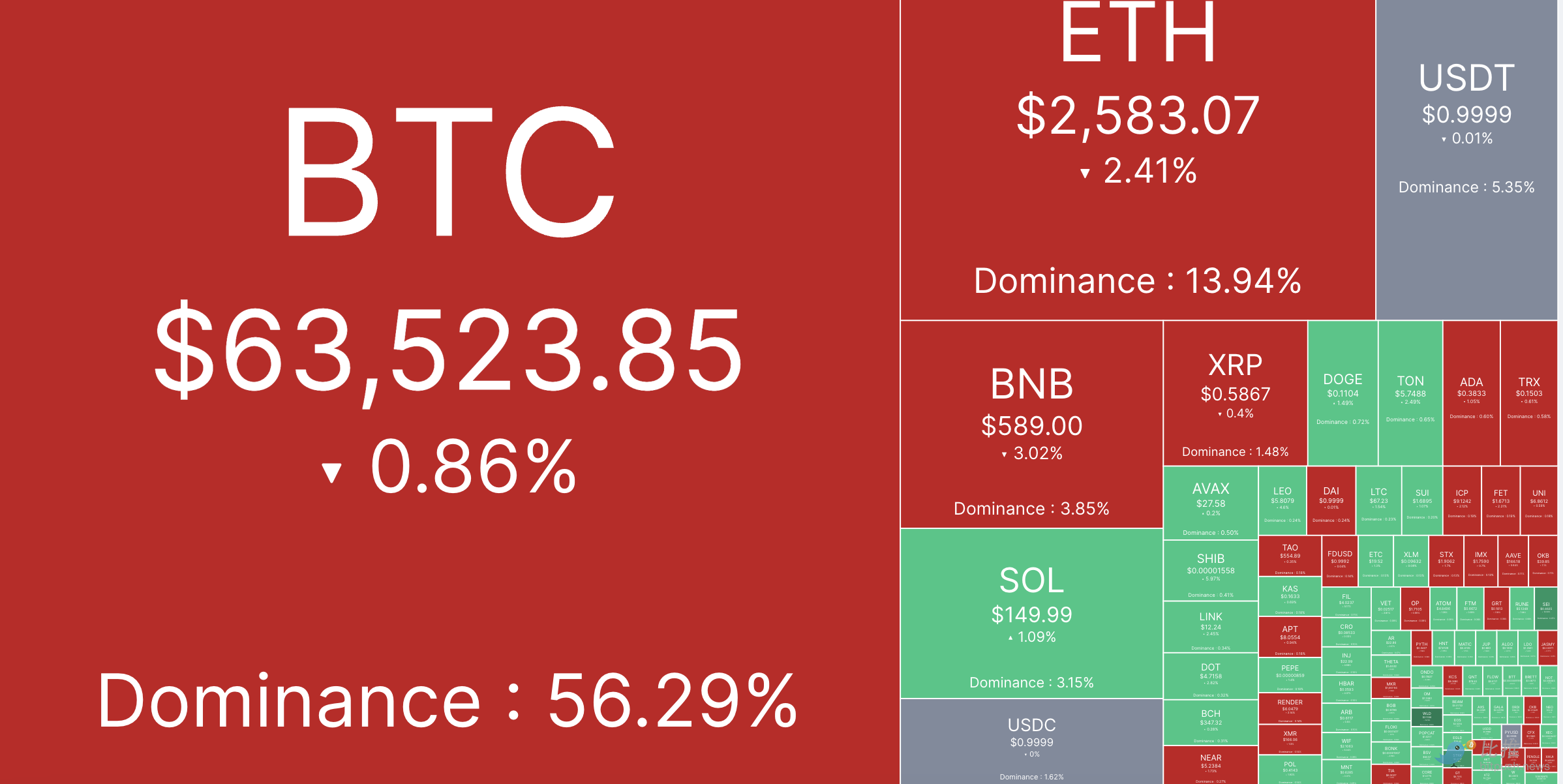

According to Bitpush data, Bitcoin consolidated and pulled back after soaring to $64,000 yesterday. The bulls were blocked at $64,800 and retraced to the $63,000 support level. As of press time, BTC was trading at $63,523, down 0.86% in 24 hours.

The Altcoin market performed strongly, with most of the top 200 tokens by market cap rising. Celo (CELO) led the gains, up 23.5%, followed by Worldcoin (WLD), up 22.1%, and Baby Doge Coin (BabyDoge), up 19.5%. The biggest losers were ZetaChain (ZETA), down 6%, Conflux (CFX), down 5.7%, and Catizen (CATI), down 4.8%.

The current overall market value of cryptocurrencies is $2.22 trillion, with Bitcoin accounting for 56.2% of the market share.

ETF inflows strong

Lookonchain data shows that Bitcoin ETF inflows reached $136 million this week, mainly led by BlackRock, which contributed the largest inflow in two weeks, reaching $98.9 million. Ethereum ETF inflows were $62.5 million, one of the largest increases in recent times. BTC ETF trading volume increased by 18%, and ETH ETF trading volume increased by 8%.

"Uptober" is coming, and social media sentiment is optimistic

A survey by social media platform X shows that the majority of the crypto community is now in bull mode and expects Bitcoin to rise to $100,000 in the last quarter of 2024.

Market analyst Wolf said on X: "The second phase of the cryptocurrency bull market is coming. BTC has been consolidating for six months. Instead of sending a reversal signal, it has formed a clear consolidation pattern. My analysis shows that the cycle peak is expected to be around the fourth quarter of 2025."

Market analyst Wick highlighted the reversal line that emerged a few weeks ago and said a sustained breakout to the upside would validate the bullish outlook.

Analyst Luke Broyles pointed out that Bitcoin's 2021 all-time high was $83,000 after adjusting for inflation, and said that "by the time the next round of central bank stimulus is in the next 6-18 months, the price of Bitcoin will reach $95,000."

He also believes: "The nominal BTC price of $100,000 in 2025 will (most likely) barely reach the level of 2021. If you don't believe it, look at Bitcoin in Canadian or Australian political currencies. The comparison between nominal and actual is incredible. $100,000 in 2025 is equivalent to $69,000 in 2021."

Potential Volatility

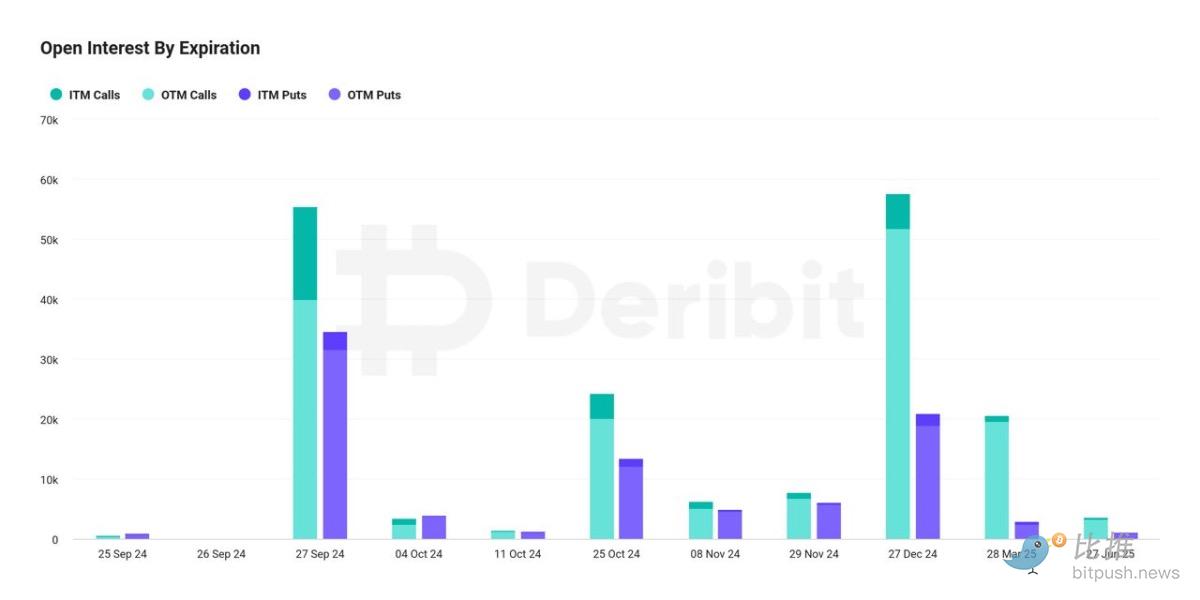

Deribit reported that $7.7 billion worth of BTC and ETH options contracts are set to expire this Friday, which could trigger significant volatility in the cryptocurrency market as traders adjust their positions by closing or rolling over, which could affect the prices of digital assets.

In addition, as major central banks turn to interest rate cuts, macroeconomic conditions become increasingly important, and investors should pay close attention to upcoming economic reports and earnings season to judge potential market trends.