Source: The DeFi Investor Translation: Shan Ouba, Jinse Finance

Where are we in the cycle?

If you’ve seen my recent X posts, you know that I’m bullish on cryptocurrencies heading into Q4. This article will cover exactly where I think we are in this cryptocurrency cycle and explain why I remain bullish on the near-term outlook.

In short: there are lots of reasons to be excited.

Let’s start with some charts that I think are relevant to cryptocurrencies.

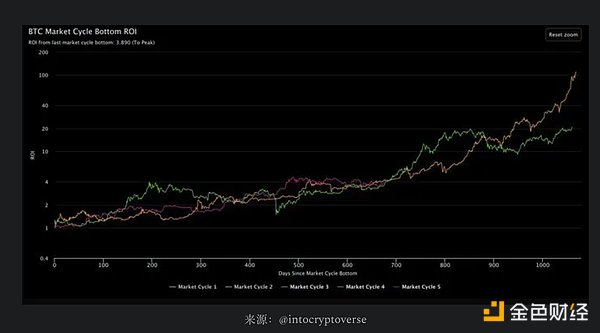

1/ BTC cycle ROI is at its usual position in the cycle

This market cycle is very similar to the bull runs of 2016 and 2020 in terms of BTC performance.

Financial markets tend to be cyclical because human nature never changes. That’s why it seems unlikely that Bitcoin has peaked.

The past two bull markets have two things in common:

The real Bitcoin uptrend starts about 170-180 days after the Bitcoin halving.

The Bitcoin cycle top is reached approximately 480 days after the Bitcoin halving.

Just 160 days have passed since the 2024 Bitcoin halving event.

Given what has happened in the past, there is a good chance that we are only a few weeks away from Bitcoin resuming its uptrend.

Of course, this assumes that history will repeat itself, but I can’t see any major reason why this time would be different.

2/ Bitcoin exchange reserves are falling at a record pace

Since January 2024, more than 500,000 Bitcoins have been withdrawn from exchanges.

When whale withdraw their tokens from exchanges, it is often a sign that they plan to hold them rather than sell them in the near future.

The chart from above seems to show that whale have been accumulating Bitcoin in large quantities over the past few months.

If this accumulation continues, a supply squeeze is imminent.

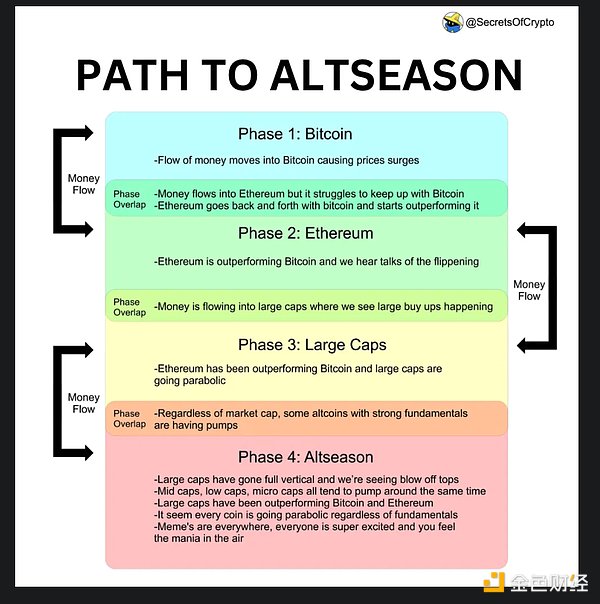

3/ Historically, Bitcoin seasons are the first phase of each new cycle

The infographic above was made many years ago, but it does a good job summarizing what happened in the 2016 and 2020 cycles.

First, BTC rises, dominance rises

Then attention started to turn to large-cap stocks (ETH, SOL, etc.)

Eventually, almost every Altcoin will start to rise regardless of its market cap or fundamentals.

Recently, BTC’s dominance hit a multi-year high.

This may indicate that we are still in phase 1. Historically, Altcoin seasons only start after BTC dominance starts to decline. I think we are about to enter phase 2.

All of the above charts, along with historical data from previous bull cycles, lead me to believe that there is a good chance that BTC will hit a new all-time high in Q4.

What could go wrong?

Let’s also briefly talk about the bear market situation.

There are still some macro uncertainties at present.

If a global recession sets in, cryptocurrencies will be severely affected.

However, the reason I think a recession is unlikely in the near term is that 2024 is an election year in the United States.

In order to give Kamala Harris a chance to win the US presidential election, the Democratic Party will do everything in its power to delay the election.

While I think a US recession could start sometime within the next 3-4 years, I definitely don't think it will happen in 2024.

Therefore, I am bullish on cryptocurrencies in the fourth quarter.