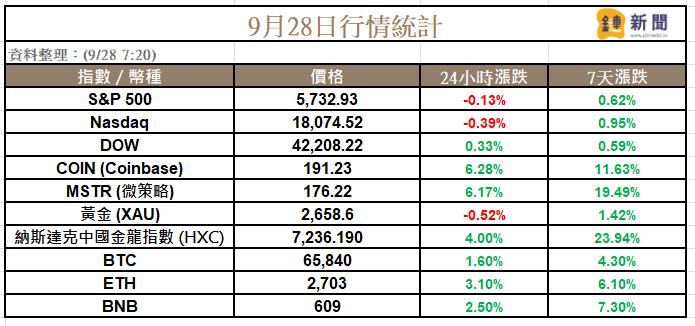

Looking back on the week, the overall stock market and cryptocurrencies performed well. After the Federal Reserve started a cycle of interest rate cuts and China introduced policies to release funds, the Nasdaq China Golden Dragon Index (HXC), which represents Chinese concept stocks, rose by 23.94% for the week. BTC broke through the 65K neckline, Binance founder CZ CZ confirmed that he regained his freedom on Friday, and BNB returned to $600

Table of Contents

TogglePCE shows inflation continues to fall

On Friday (9/27), the U.S. Department of Commerce released data showing that the personal consumption expenditures (PCE) price index increased by 2.2% year-on-year in August, slightly lower than market expectations of 2.3%, and down from the previous value of 2.5%; the monthly increase was 0.1%. , slightly lower than the previous value of 0.2%. The Federal Reserve's (Fed)'s favorite inflation gauge, core PCE, which excludes energy and food prices, rose 2.7% year-on-year in August, in line with market expectations.

PCE data showed that inflation continued to decline, and U.S. stocks generally rose in early trading. However, it was reported that the Beijing government does not encourage Chinese companies to purchase Huida AI chips. Huida (NVDA) fell 2.13%, which also dragged down the decline of overall semiconductor stocks.

However, looking back on the week, the overall stock market performed well. After the Federal Reserve started a cycle of interest rate cuts and China introduced policies to release funds, the Nasdaq China Golden Dragon Index (HXC), which represents Chinese concept stocks, rose by 23.94% for the week.

BTC breaks through the 65K neckline level

As optimism spreads in the market, cryptocurrencies have also seen general gains. Bitcoin once rose to $66,498 yesterday, the highest since August, and has increased by more than 10% this month. According to Bloomberg data, over the past ten years, Bitcoin has fallen an average of 5.9% in September, which has always been a bearish month. Other smaller altcoins have risen even more than 20%, showing that looser financial conditions are encouraging investors to take higher risks in the cryptocurrency market.

From a technical linear perspective, Bitcoin has indeed broken through the neckline level near 65K, but there are still many obstacles above. Whether it can challenge the historical high of $73,798 set in March this year still requires more bullish push.

CZ regains freedom, BNB returns to $600

According to a report in the Wall Street Journal , Binance founder CZ Zhao (CZ) regained his freedom on Friday ahead of schedule. Although CZ has resigned as CEO of Binance, as the largest shareholder and a key opinion leader in the crypto, CZ’s return to the stage still brings a lot of expectations to everyone. BNB also returned to the $600 level yesterday.

Crypto-related stocks have also performed well recently. Exchange Coinbase (COIN) and Bitcoin development company MicroStrategy (MSTR) both rose by more than 6% yesterday, and their weekly gains were as high as 11% and 19%.