Liquidity in the cryptocurrency markets is expected to surge in the fourth quarter of this year, creating a favorable environment for a potential rally in both Bitcoin (BTC) and altcoins. This influx of capital could push prices higher as investors look to capitalize on the anticipated momentum.

Today, Bitcoin’s price hit a significant milestone, surpassing $65,000. However, recent reports suggest that this rise is just the beginning of a potentially large price surge. The anticipated surge is likely to be fueled by the return of retail investors and the influx of billions of dollars in capital from Chinese markets.

More capital means bigger upside for Bitcoin and altcoins

The 50bp Federal Reserve rate cut earlier this month could explain Bitcoin’s recent rally, but it’s not just Bitcoin that’s benefiting from the decision.

Following the interest rate cut, altcoins that had been in a prolonged downtrend over the past two quarters are now seeing significant gains. Despite the improved market conditions, 10x Research analyst Marcus Thielen believes the recent rally will come in Q4.

“Altcoins are exploding. Further upside is expected as stablecoin issuance increases and Chinese OTC brokers report billions of dollars in inflows. With Bitcoin breaching $65,000, we expect a quick move to $70,000 and a new all-time high in the near future,” Thielen said in a Sept. 26 report.

Even as Bitcoin’s dominance has declined , the total market cap of altcoins has increased by 15% since September 17.

However, the decline in BTC dominance does not mean that the coin’s price will continue to decline. In a report by 10x Research, Theieln noted that the $ 142 billion that the Chinese government has been trying to inject into the market since Q4 could help Bitcoin. According to a Bloomberg report, the Chinese government is considering injecting 1 trillion yuan (about $142 billion) worth of liquidity into banks to help ease the economic slowdown.

“China’s $142 billion stimulus package could trigger a surge in cryptocurrency prices, which would be fueled by increased global liquidity ,” the report said.

If this happens, the price of Bitcoin could reach $70,000 before the end of the so-called “Uptober” in October. Another interesting development is the increased participation of retail investors.

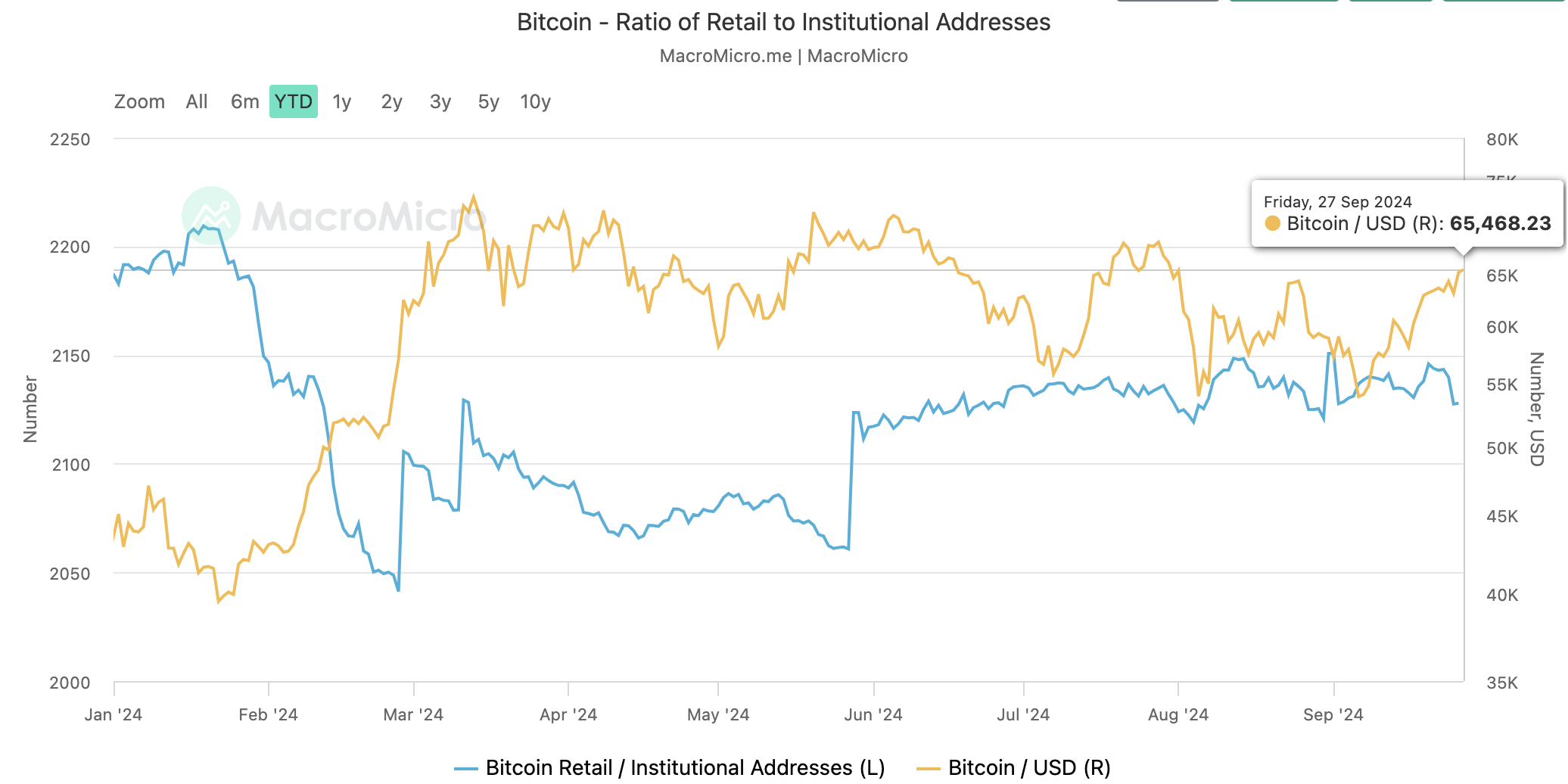

For most of this year, institutional investors have pushed Bitcoin’s price to all-time highs (ATHs) while retail investors have been left out. However, as of this writing, things have changed and there has been an increase in retail versus institutional addresses.

Read more: 10 Best Altcoin Exchanges in 2024

The Return of Retail and the Potential for Bigger Bet from Institutions

This increase is beneficial not only for Bitcoin but also for altcoins. For example, the price of altcoins such as Shiba Inu (SHIB) has increased by 41% in the last 7 days. The price of SEI has increased by 31%, and so has Wormhole (W).

Interestingly, 10x Research also sees the move starting in Korea. Given this development, China’s stimulus liquidity and significant market participation in the Asian region could play a big role in the expected uptrend for the rest of the year.

“Retail crypto trading activity in South Korea is supporting this trend, with daily volume currently hovering around $2 billion. While this is still low compared to early March 2024, when crypto trading volume was twice that of the local stock market, and Shiba Inu trading in South Korea alone accounted for nearly 40% of stock market volume — altcoins have surpassed Bitcoin in terms of trading volume over the past week,” 10x Research wrote.

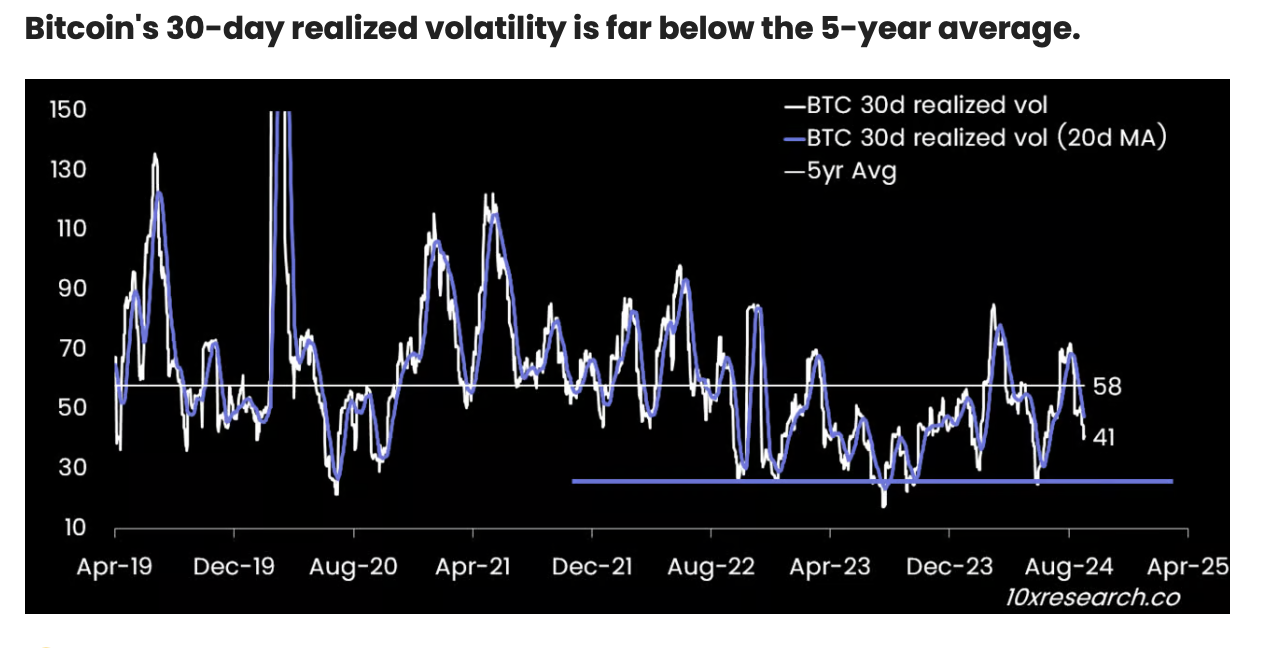

Additionally, Bitcoin has recorded a decline in its 30-day realized volatility. This decline could push BTC and the broader market to higher valuations as institutional investors increase their position sizes.

BTC Price Prediction: It's Clearly Bullish

From a technical standpoint, Bitcoin has finally broken out of its descending channel. Since July, this bearish pattern has limited the coin from breaking above $65,000.

However, with support at $62,825, BTC has successfully broken through that area. According to the daily chart, Bitcoin price may now find resistance at $68,253. This is a key point of interest. Breaking this hurdle could be crucial for a move up to $73,095.

If that happens, BTC could hit a new all-time high before the end of Q4. The target starts at $76,075.

Read more: How to Buy Bitcoin (BTC) and All You Need to Know

However, if the rally from $68,253 is broken and cryptocurrency market liquidity does not recover as quickly as expected, the Bitcoin price could fall to $58,188.