Author: Grace Deng, researcher at SevenX Ventures; Translated by: 0xjs@ Jinse Finance

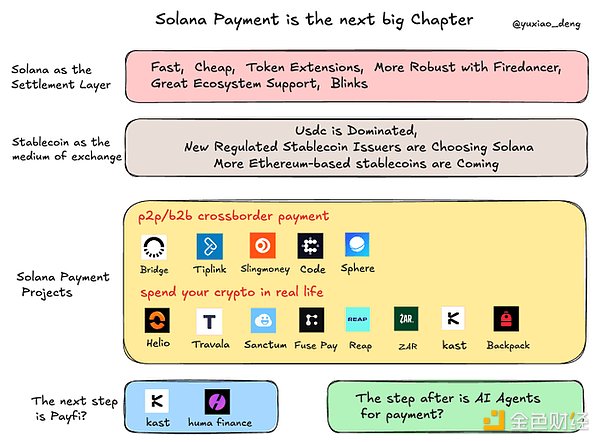

My biggest takeaway from Solana Breakpoint is that Solana Payments is the next big chapter.

Excellent team + excellent public chain + real PMF = Solana Payment.

1. Solana is an ideal public chain for payment settlement

1. Fast and cheap

Payments require high-performance chains: Visa processes about 720 million transactions per day, with an average TPS of 8.3k. In terms of performance, Solana is the most comparable blockchain.

2. Firedancer

Enhance Solana to surpass Visa in speed and robustness: Firedancer, developed by Jump, is Solana’s second validator client, which reduces single points of failure and improves performance; the Firedancer node is now on the mainnet in non-voting mode, producing more than 20,000 blocks at a 1% stake rate. With 10 validators, it can reach up to one million TPS.

3. Token expansion promotes stablecoin issuance and payment reconciliation

Token extensions provide new functionality such as confidential transfers, custom transfer pegs, and extended metadata beyond minting, transfers, and freezing.

Stablecoin issuers such as PYUSD, Paxos, and GMO Trust use token scaling to comply with regulations and enable complex behaviors while maintaining composability, which PayPal cited as a key reason for choosing Solana.

Using metadata pointers extended by tokens also allows metadata to be coupled with transactions, simplifying payment reconciliation.

4. Blinks

Blinks (aka blockchain links) developed by Dialect allow direct transactions and interactions with dapps through social platforms such as X

Blink makes blockchain experiences (including payment experiences) shareable, thereby expanding distribution channels and reaching a larger web2 user base.

Helio announced that Shopify merchants can use Solana Blinks to sell directly on X. This can increase conversion rates and attract more buyers. The blockchain feature also allows for the addition of loyalty programs and discounts to the payment process.

New Blinks features are coming soon, including a mobile SDK and advanced input types.

5. Strong ecosystem support

Last but not least, Societe Generale also mentioned the tremendous support and efficiency of the Solana Foundation.

2. Stablecoins as a Medium of Exchange for Payment Activities

Having different types of stablecoins on Solan provides payment projects with diverse options on the backend, balancing their regulatory needs, cost requirements, and different types of legal requirements.

1. USDC Dominates

Circle announced the establishment of a global liquidity network that enables seamless creation and exchange of USDC between banking systems in the United States, Europe, Singapore, Hong Kong, Brazil and Mexico.

EURC, issued by Circle, is Europe’s first MiCA-compliant stablecoin and is already available on Solana for use in various payment scenarios in Europe.

2. New Regulated Stablecoin Issuers Are Choosing Solana

More non-USD stablecoins issued by large financial institutions will also be available on Solana: EUROC is the first MiCA-compliant stablecoin issued by Societe Generale

PHOC, the Philippine Peso stablecoin issued by coins.ph, the largest regulated exchange in the Philippines, is coming to Solana

3. More Ethereum-based stablecoins are coming

Since May, PYUSD issued by Paypal has reached $1 billion in issuance on Solana in 4 months, thanks to the high yields of Kamino, Drift, and Orca. New features are coming soon, including integration with PayPal, Venmo, and Xoom to enable B2B international remittances.

Sky (formerly MakerDAO)’s incentive program is coming to Solana.

@gizmothegizzer predicts that Solana is about to usher in an evolution in the stablecoin landscape, and Perena is developing the StableSwap AMM for stablecoins to solve liquidity issues.

3. Solana Payment Project

1. P2P/B2B cross-border payments

Using blockchain and on-chain stablecoins for cross-border payments is much more efficient than the traditional banking system.

TipLink: Through a simple tiplink, P2P and B2B payments can be easily realized even between people without crypto wallets. Also cooperated with Boba Guys and Superteam for NFT/token distribution or payment.

Sling Money: A real-time payment network for P2P and B2B transactions in 50+ countries with ultra-low fees, MSB and VASP licenses. Also supports receiving funds using a simple sling link.

Bridge: specializes in B2B cross-border payments between Latin America and the U.S.; provides APIs for companies; partners with Bitso and DolarApp

Code: Enables micropayments through its proprietary 2-layer structure (payment scenarios range from $0.05 to $0.50, especially suitable for tipping creators). They announced the launch of Tipcard, which allows creators to share their tip cards on the content platform and receive tips from viewers.

Sphere: Provides cross-border payment services mainly to companies and high-net-worth individuals in emerging markets, with built-in privacy and compliance features.

2. Use cryptocurrency in real life

Allowing users to seamlessly use cryptocurrencies in real life can help improve retention.

Sanctum: Announced the launch of the SOL "Cloud Card" debit card in partnership with Basedapp and Jupiter. The card will allow cardholders to use SOL and stablecoins in more than 100 countries. The focus is on providing an excellent user experience and integrating its creator tokens.

Bridge & Fuse: Launched Fuse Pay, a virtual global Visa prepaid card that allows users to use stablecoins directly from their Fuse wallet by creating a sub-account of their main Fuse account. The card was first launched in the United States and offers features such as daily spending limits. -

Reap: has processed over $2 billion in transactions and is now integrated with Solana to support loading stablecoins onto their cards. Users can then make real-life payments or pay other vendors seamlessly.

Zar: Zar focuses on emerging markets, leveraging a network of agents in Pakistan to help users trade stablecoins to fiat currencies, which they can then spend and withdraw cash using their ZAR debit cards globally.

KAST: Users can use KAST's virtual or physical cards to pay with USDC and other stablecoins at more than 50 million merchants in more than 50 countries. It has partnered with Kil to allow users to spend up to 60% of their SOL holdings without paying any fees.

Backpack and StraitsX: Simply scan a QR code to use Backpack’s cryptocurrency across Singapore. Merchants receive payments in SGD, backed by XSGD, the SGD stablecoin issued by StraitsX.

Helio: The developer of Solana Pay, which enables merchants to accept cryptocurrency payments and save on transaction fees. Users can pay with cryptocurrency directly in Helio-supported stores such as Shopify.

Travala.com : Announced an integration with Solana, allowing payments on the Travala website via the Solana network, and will soon launch SOL rewards on the platform.

4. Is Payfi the next step?

In a narrow sense, Payfi refers to the use of on-chain liquidity to transform the traditional Web2 payment system.

Providing stablecoin liquidity and earning double-digit returns is a compelling option, especially in the upcoming rate cut cycle. At the same time, traditional institutions can obtain short-term liquidity for cross-border payments, trade financing, and credit card businesses.

Huma Finance is at the forefront of this movement, building a comprehensive Payfi stack to connect these ecosystems.

Broadly speaking, Payfi encompasses more innovative concepts, such as leveraging on-chain yield opportunities to change consumer spending habits or provide merchants with additional revenue streams. Users can move from “pay now, get later” to “buy now, pay later/never pay”. This yield can come from staking (such as KAST) or CeDeFi strategies (AEON).

5. Long-term vision: AI intelligent payment?

Circle CEO Jeremy Allaire and Visa crypto chief Cuy Sheffield are both envisioning a future where AI agents will programmatically interact with microtransactions on blockchains such as Solana. This will enable AI to perform tasks and transactions on behalf of users, driving the development of the next wave of Internet financial systems.

This is a long-term vision, but there are already projects working in this direction, such as Payman.

It’s great to see that Solana is making a big push into payments, which could attract a wave of Web2 users, especially in emerging markets. The initial entry through payment methods could lead to broader participation in the Solana ecosystem, including DeFi, DePIN, etc.