Author: Ansel Lindner, Forbes; Translated by: Tao Zhu, Jinse Finance

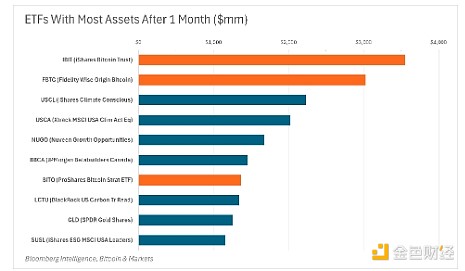

Overall, the launch of the spot Bitcoin exchange-traded fund (ETF) was the most successful ETF debut in history. Several key milestones stood out: No other ETF experienced $3 billion in inflows in its first month, while Bitcoin has two – BlackRock’s IBIT and Fidelity’s FBTC. All told, Bitcoin ETFs attracted an impressive $17 billion in inflows in their first nine months, breaking the previous full-year record of $13 billion1. IBIT also achieved another milestone, maintaining the 10th-longest inflow streak on record, with 71 consecutive days of positive inflows since launch.

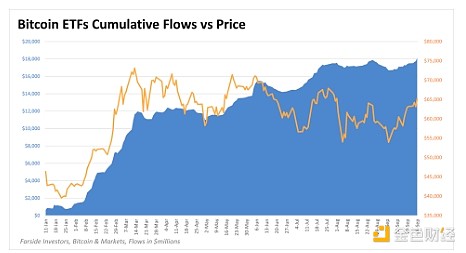

This record period demonstrates the importance of Bitcoin ETFs and their unique ability to generate large inflows into financial assets. Although inflows have slowed in recent months, they still outstrip Bitcoin’s price action. Inflows continue to increase despite Bitcoin’s price consolidating within a descending channel since March.

Bitcoin ETF cumulative inflows continue to rise, prices fall slightly

The divergence between fund flows and prices may provide important insights into understanding this consolidation period and future price action. First, it suggests that ETF buyers are relatively insensitive to price and continue to accumulate positions despite price declines. Second, these investors are less likely to panic sell, potentially buffering downside risk during corrections. Third, market corrections can occur through either a sharp price decline or a long period of consolidation, and ETF holders appear to be guiding Bitcoin toward the latter, thereby extending periods of stability. Finally, while fund inflows tend to correlate with rising prices, the steady accumulation of funds can build pressure and gradually push Bitcoin above key resistance levels.

This week, bitcoin prices broke through one of its key resistance levels to hit an eight-week high, marking their first higher high since March. The move sparked excitement about a potential year-end rally.

Bitcoin breaks lower and hits 8-week high

Bitcoin ETFs are changing the fundamentals of Bitcoin. As the most successful ETFs ever, they laid the foundation for Bitcoin's explosive growth in the fourth quarter.

Bitcoin Enters Q4 Amid Numerous Bullish Catalysts

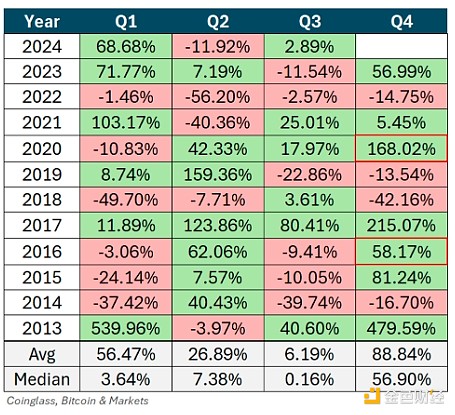

Historically, the fourth quarter has been the most bullish period for Bitcoin, with an average return of 88.8%. This trend is even more pronounced in halving years, such as 2016 and 2020, when fourth quarter returns averaged as high as 113%.

Historically, the fourth quarter has been very favorable for Bitcoin prices, especially in halving years.

As we head into the fourth quarter, Bitcoin is poised to benefit from a variety of tailwinds beyond ETF inflows. Last week, the SEC approved IBIT options trading months ahead of schedule, the first such approval for a spot Bitcoin ETF. The options, which will be listed on the Nasdaq ISE, are expected to attract more investors by providing more ways to gain exposure to Bitcoin. While further regulatory approval is required before these options are officially listed, market analysts such as Eric Balchunas, senior ETF analyst at Bloomberg, are very optimistic. "Bitcoin ETF wins big (because it will attract more liquidity, which in turn attracts more big fish)," Balchunas wrote on X.

The positive outlook is further reinforced by the ongoing FTX bankruptcy proceedings, which are expected to inject a significant amount of capital into the market in the fourth quarter. Creditor distributions are expected to begin in early October and could total up to $16 billion. Rumors of an immediate October 1 payout remain speculative, however, their latest press release confirms that the final vote will be announced on October 7, 2024, before the confirmation hearing. With over 95% of voting creditors giving strong initial support to FTX's revised reorganization plan, the plan seeks to return 100% of bankruptcy claims. These payouts are made in U.S. dollars, and a large portion is expected to flow back into the market, with Bitcoin likely to receive the largest share.

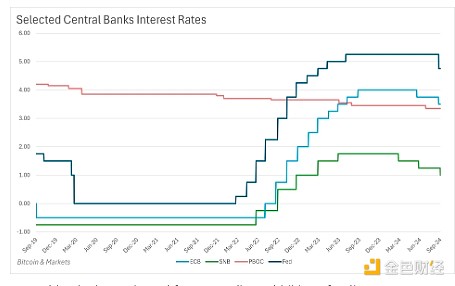

Fed rate cuts and global central banks easing policies

These catalysts for Bitcoin are unfolding at the same time as another major development – the first rate cut by the Federal Reserve since March 2020. Last week, the Fed cut interest rates by 50 basis points at the September FOMC meeting, marking a major shift in monetary policy toward easier monetary policy.

The Fed’s rate cuts are part of a broader trend. Other central banks, including the European Central Bank, the Swiss National Bank, and the Bank of Canada, have also begun cutting rates. Interestingly, the People’s Bank of China has also initiated rate cuts and large economic stimulus, although it has not participated in coordinated tightening elsewhere. This raises the question: Will we end up in the same economic situation regardless of what central banks do? This may be a discussion for a future article.

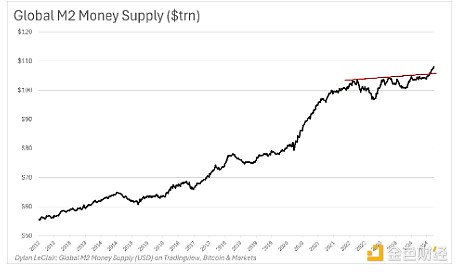

Nonetheless, the central bank’s shift toward rate cuts adds fuel to Bitcoin in the medium term. This coincides with an increase in the global M2 money supply, further fueling risk appetite. While central bank rate cuts typically reflect worsening macroeconomic conditions, they can boost markets in the short term by creating a more favorable environment for risk assets. We have already seen global M2 break out to new highs.

As we head into Q4, Bitcoin is at the crossroads of several powerful market forces. Historical trends show Bitcoin performing strongly in the final quarter, especially during halving cycles. This time around, regulatory developments, potential capital inflows from FTX distribution, and looser global monetary policy have further boosted Bitcoin. Taken together, these factors suggest that Bitcoin ETFs could gain new momentum and have the potential to see record inflows by year end. As price action begins to align with ETF flows, conditions are ripe for Bitcoin to be highly bullish by the end of 2024.