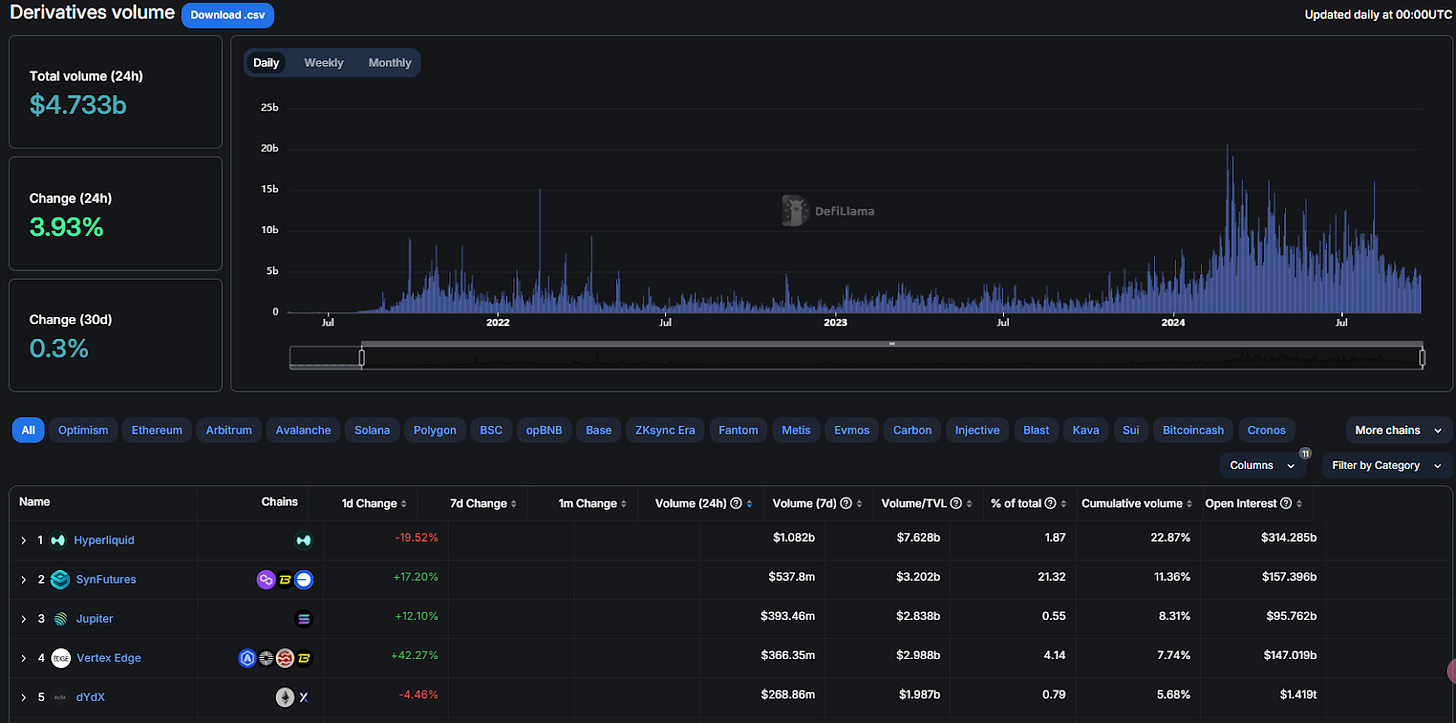

Current status of on-chain perpetual contract exchange (Perpetual DEX)

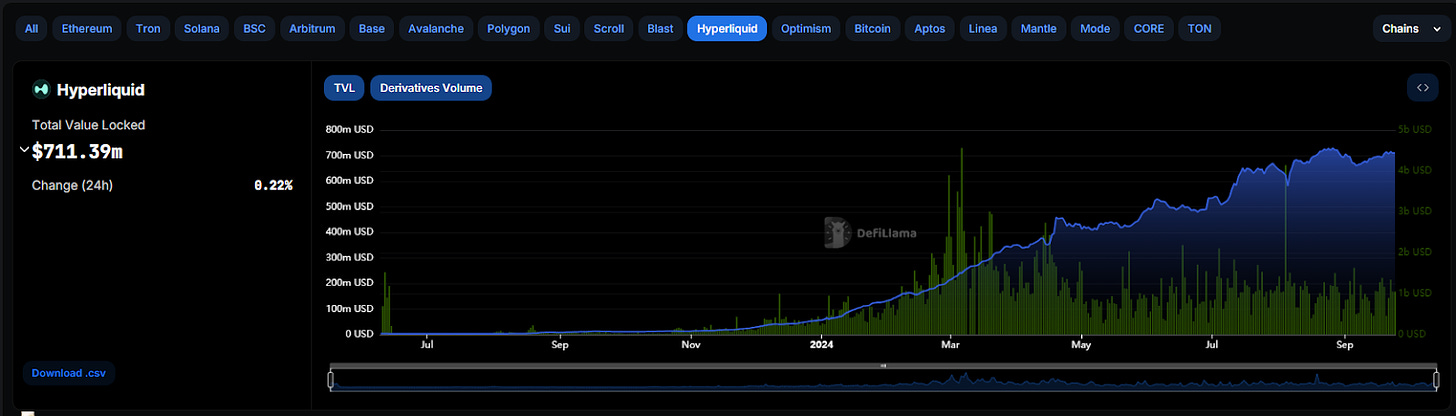

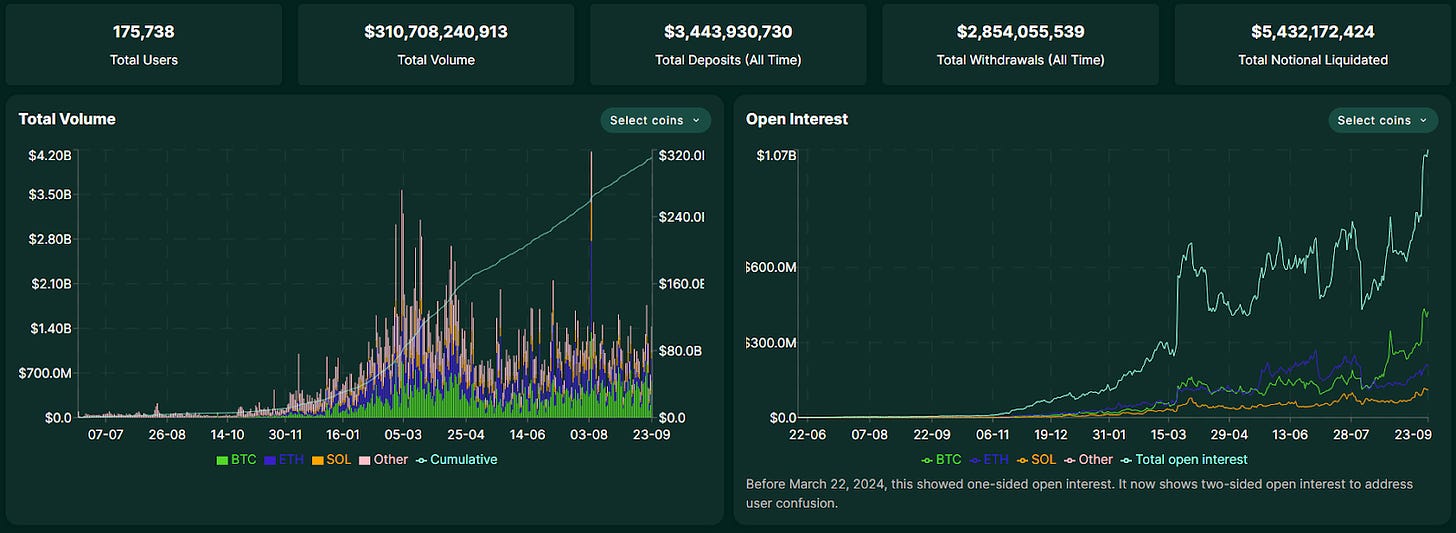

On-chain contract trading began in 2020. After experiencing the bull market in 2021, it fell back in the bear market until it increased again in 2024 this year. Hyperliquid TVL has now reached US$711 million, surpassing the well-known Ethereum Layer2 Optimism chain and ranking in the transaction volume ranking. Some Hyperliquids are also in the leading position. Recently, the daily trading volume accounts for more than 20% of the total trading volume, which is quite impressive. The second place SynFutures is only half of Hyperliquid, followed by Solana representing Jupiter, and other EVM ecosystems such as Vertex Edge, dYdX, etc.

Source: DefiLlama

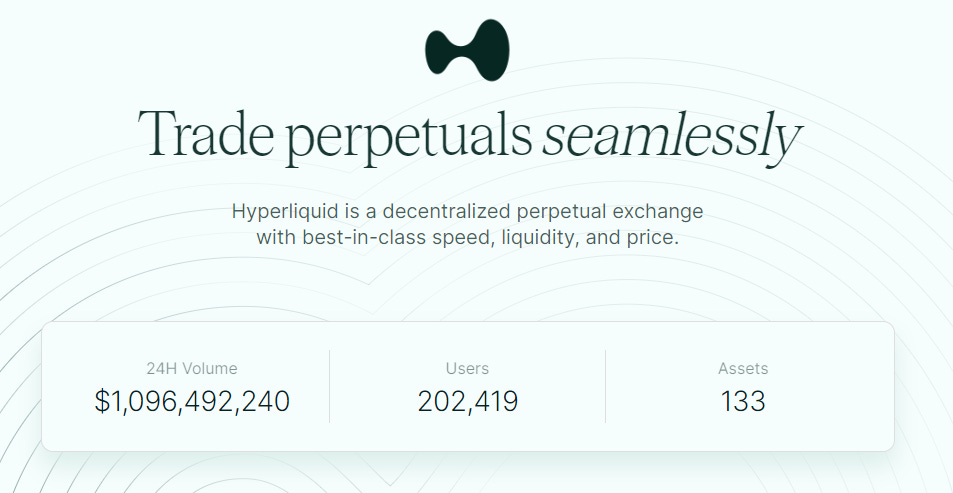

Hyperliquid currently has more than 200,000 users, a cumulative trading volume of more than 300 million US dollars, and more than 8,000 independent traders on the platform.

Source: Hyperliquid

Judging from the transaction volume data, we can find that Hyperliquid actually began to rise at the end of 2023, sweeping the army all the way, surpassing well-known on-chain contract exchanges such as dydx and GMX that we were familiar with in the previous bull market cycle. Let’s take a look next See how Hyperliquid does it.

Source: DefiLlama

Introduction to Hyperliquid

Hyperliquid is a sustainable exchange built on its own Layer 1 blockchain. It is committed to bringing the user experience of centralized exchanges to the chain, while providing a completely on-chain order book trading system, including spot and derivatives. and pre-release markets.

Official introduction video: Hyperliquid: a perpetual futures DEX on its own L1

Previously, the Hyperliquid team has studied the market structures used by multiple trading platforms, including on-chain automatic market makers (AMM), virtual automatic market makers (vAMM), hybrid orderbooks, and Peer-to used by GMX. -Pool mechanism, the combination of on-chain settlement and off-chain order books used by dydx and Aevo, and multiple market mechanisms such as intention trading, but all have their own risks and flaws. In the end, Hyperliquid decided to implement a new market mechanism: on-chain order book .

However, it is not easy to put all transaction orders on the chain. The Hyperliquid team challenged the performance of the existing blockchain and resolutely launched its own chain. In an era when Ethereum Layer 2 and various blockchains are contending, Hyperliquid’s decision is quite unique, and Hyperliquid Perpetual exchange has also become the most important product of Hyperliquid Layer 1.

Hyperliquid Layer1: Born for exchanges

The Hyperliquid Layer1 blockchain is built based on the Tendermint architecture. The generation, cancellation, trading and liquidation of each order in the exchange are all transparently performed on the chain. The block delay is less than 1 second. Under the Tendermint architecture, it can accommodate every second 20,000 transactions, but this is far from the processing speed of Binance (1.4 million/second).

Therefore, Hyperliquid developed its own algorithm - Hyper Byzantine Fault Tolerance Algorithm (HyperBFT). HyperBFT is a consensus algorithm that can divide the results of the original voting consensus mechanism (two-thirds pass) between the leader and the verifier. Delivery, since transaction ordering does not require waiting for block confirmation, it helps to significantly reduce block waiting time.

HyperBFT can theoretically increase the throughput by 100 times, that is, reaching a speed of 2 million per second. However, the Hyperliquid team is still optimizing. The current transaction speed has reached 200,000 transactions per second, which is enough to handle 10 transactions per day. The transaction volume of billions of dollars is quite astonishing.

Use Daily Biyan’s referral code: https://app.hyperliquid.xyz/join/CW to enjoy a 4% handling fee discount

Hyperliquid innovative services

For users, Hyperliquid provides a trading experience comparable to that of centralized exchanges, and some services are only available on Hyperliquid.

Perpetual contract

The perpetual contract gameplay was mentioned in Chapter 1, and the characteristics of Hyperliquid are as follows.

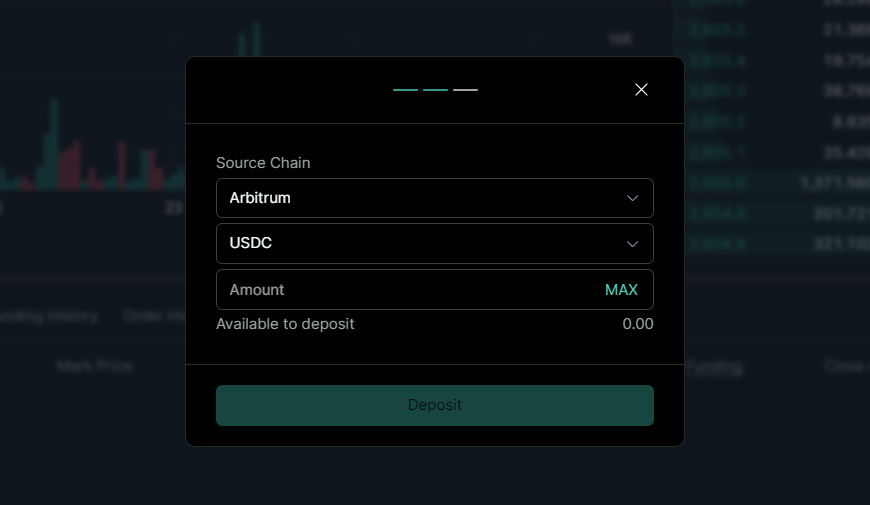

Deposit and withdrawal rules - lower the user threshold

It is relatively difficult to deposit and withdraw funds on the chain, so Hyperliquid developed a native cross-chain bridge that connects to the Arbitrum chain. This cross-chain bridge is also verified by Hyperliquid L1. Users can pledge USDT and USDC to Hyperliquid L1 through this bridge, and users do not need to pay. Arbitrum's Gas fee is charged 1 USDC by Hyperliquid instead, and to avoid malicious attacks, the native cross-chain bridge has been confirmed to be safe by Zellic auditing company.

Source: Hyperliquid

For users who are relatively unfamiliar with technology, Hyperliquid has also integrated Privy wallet , which can be created with just a mailbox, and the assets in the wallet can also be easily used on the Hyperliquid exchange.

Accurate quotations: Integrate prices from mainstream exchanges

In order to ensure that the exchange price is always correct, Hyperliquid will update the oracle quotation every 3 seconds and include the spot prices of mainstream exchanges such as Binance, OKX, Bybit, KuCoin, etc. The oracle price will be calculated together with the Hyperliquid spot price and weighted as Mark price, which serves as the clearing standard in perpetual contract transactions to ensure fair operation of the exchange.

Margin and Liquidation Mechanism

Hyperliquid's contract trading is the same as that of general CEX. There are isolated margin and isolated margin cross margin modes. The margin size can be adjusted in the isolated margin mode, while the cross margin mode uses the account value as the liquidation standard. Unrealized profits and losses are also included in the book value. The calculation method is as follows:

Initial margin = position size * mark price / leverage multiple

Maintenance margin = 0.5 * Initial margin / Leverage multiple

If the trader's account value is lower than the maintenance margin, Hyperliquid will have two methods for liquidation. The first is to liquidate the position at the market price, which may result in full or partial liquidation. If the transaction can be completed, it will be liquidated by HLP, which is also Hyperliquid's unique mechanism.

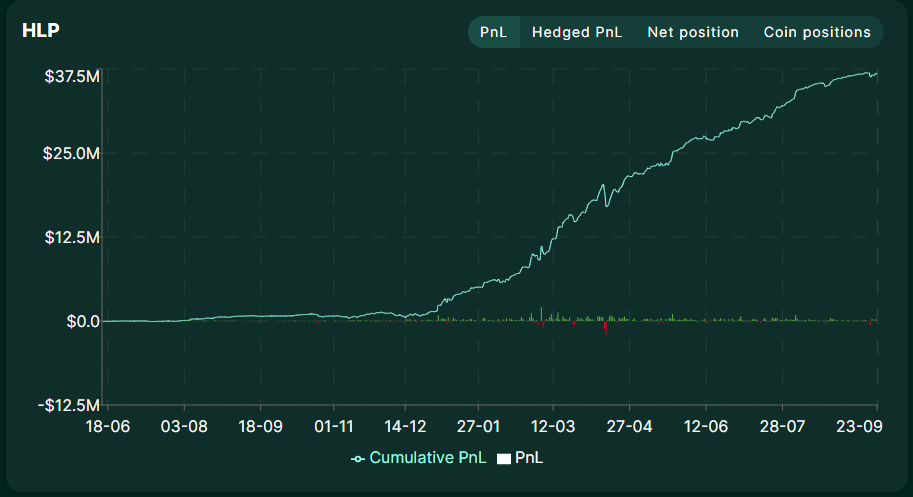

Invite users to participate in market making: Hyperliquid Liquidity Provider (HLP)

Hyperliquid is committed to implementing the concept of decentralization, and HLP is an innovation in on-chain contract exchanges like GMX's GLP. HLP allows anyone to use USDC to participate in the market-making strategy of Hyperliquid's sustainable exchange. On the one hand, users can obtain the original The benefits are only enjoyed by the market maker team, and the emerging projects on Hyperliquid can also ensure liquidity, which is a great plus for the entire market environment. Currently, HLP has accumulated nearly 40 million US dollars and continues to grow.

Source: Hyperliquid

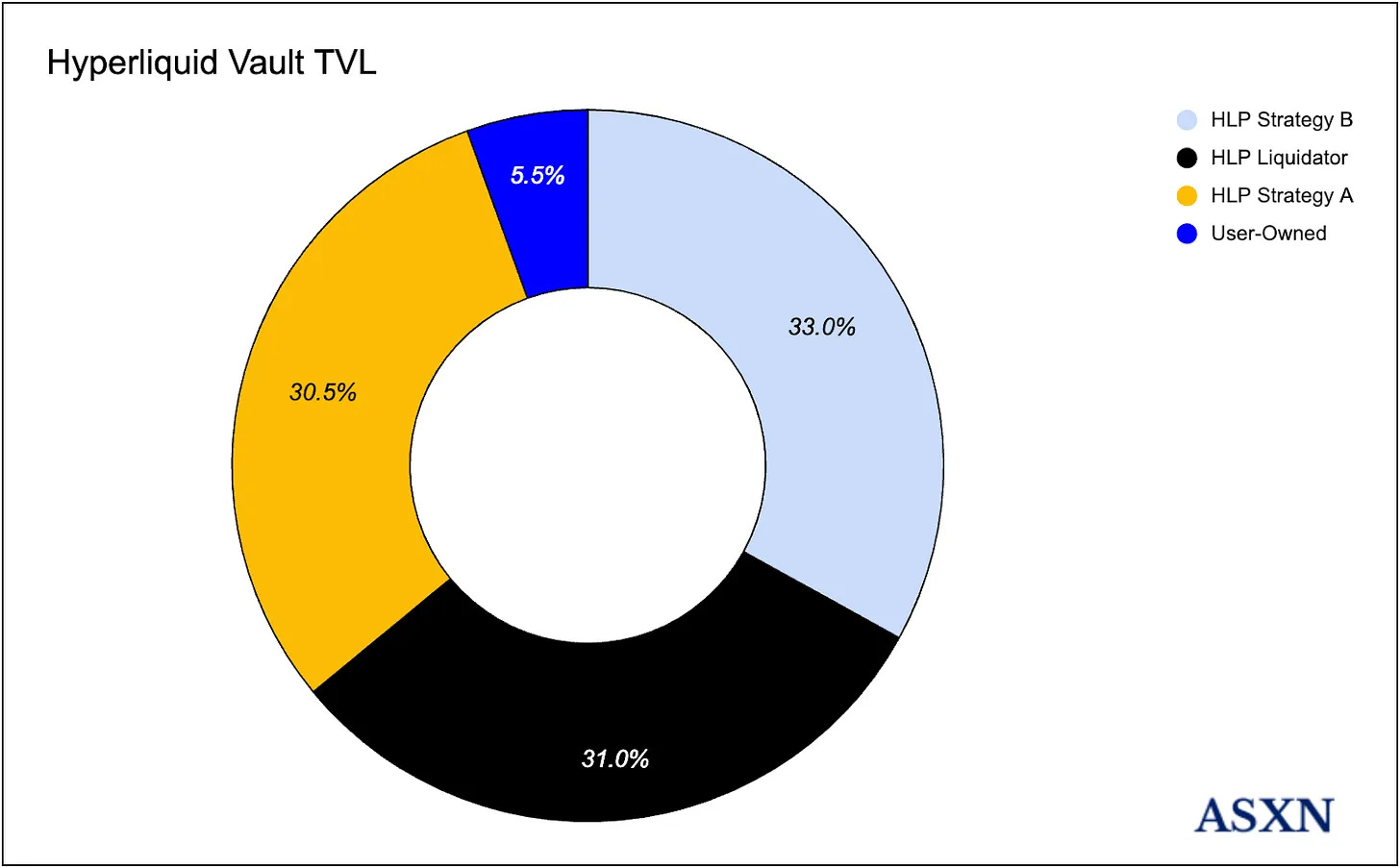

Permissionless - Hyperliquid Vault system that anyone can create

The Vault system designed by Hyperliquid is like participating in a hedge fund. Managers of Vault vaults can use Vault to carry out income activities such as market making, arbitrage, quantitative trading, etc. Users can also choose to join a trusted Vault to provide liquidity and earn Vault pool income. Vault managers can receive 10% of the total profits, and the rest will be distributed to participants in proportion.

Originally, this system was only used by officials. Later, users could also create their own Vaults and allow more participants to join. This also attracted professional market-making teams and individual traders to expand liquidity. Currently, there are nearly 90 Vaults on Hyperliquid. What’s interesting is that the three largest Vaults are all HLP’s market-making strategy vaults.

Source: ASXN

Handling fees are given back to the community and HLP

The Hyperliquid mainnet will be free of handling fees for the first three months. Later, transaction fees will be enabled in June 2023. The handling fee rate will be determined through a 14-day rolling transaction volume. It also includes a recommendation mechanism, and recommenders can get 10%. Handling feedback, in particular, the platform handling fee does not flow to the official, but is provided to the HLP liquidity pool and insurance fund, which is equivalent to feeding the handling fee back to the community.

Source: Hyperliquid

Use Daily Biyan’s referral code: https://app.hyperliquid.xyz/join/CW to enjoy a 4% handling fee discount

Explore the pre-market market early, with more products, more choices, and more ways to play.

In addition to the services introduced above, Hyperliquid also has:

pre-market

The pre-market market can provide a trading venue for unlisted but popular tokens or points. Currently, the Hyperliquid pre-market market is also online $EIGEN tokens for users to trade.

Index Perpetual Contracts

Index perpetual contracts are based on formulas rather than spot prices, but in other respects have the same functions as standard perpetual contracts. This type of product allows more users to bet on the rise and fall of a single track, such as the NFT track. , socialfi track, etc.

NFTI-USD: NFTI-USD is an index of blue-chip NFT series, including Bored Ape Yacht Club, Mutant Ape Yacht Club, Azuki, DeGods, Pudgy Penguins and Milady Maker NFT series

FRIEND - USD: The FRIEND index is designed for the previously popular Friendtech application. At the beginning, the account prices of the top 20 rankings were the tracking targets. It is updated every two weeks and has been removed from the shelves.

Uniswap Perpetual Contract

Some perpetual contracts on Hyperliquid use Uniswap V2 or V3 automatic market maker (AMM) prices as the underlying spot assets. These contracts are limited to isolated margin margins, but users cannot manually withdraw margins from open positions. Currently, only $RLB, $HPOS and $BANAN ($OX, $UNIBOT, $SHIA) are delisted.

Hyperps Perpetual Contract

Hyperps is Hyperliquid's unique perpetual contract. It does not use traditional spot or index oracle prices. The Hyperps contract captures the 8-hour exponentially weighted moving average (EWMA) of the previous day's mark price every minute, and the funding rate is calculated as well. Relative to the mark price of the indicator, if the trading currency is listed for spot trading on a mainstream exchange, the Hyperps perpetual contract will be converted into a general perpetual contract.

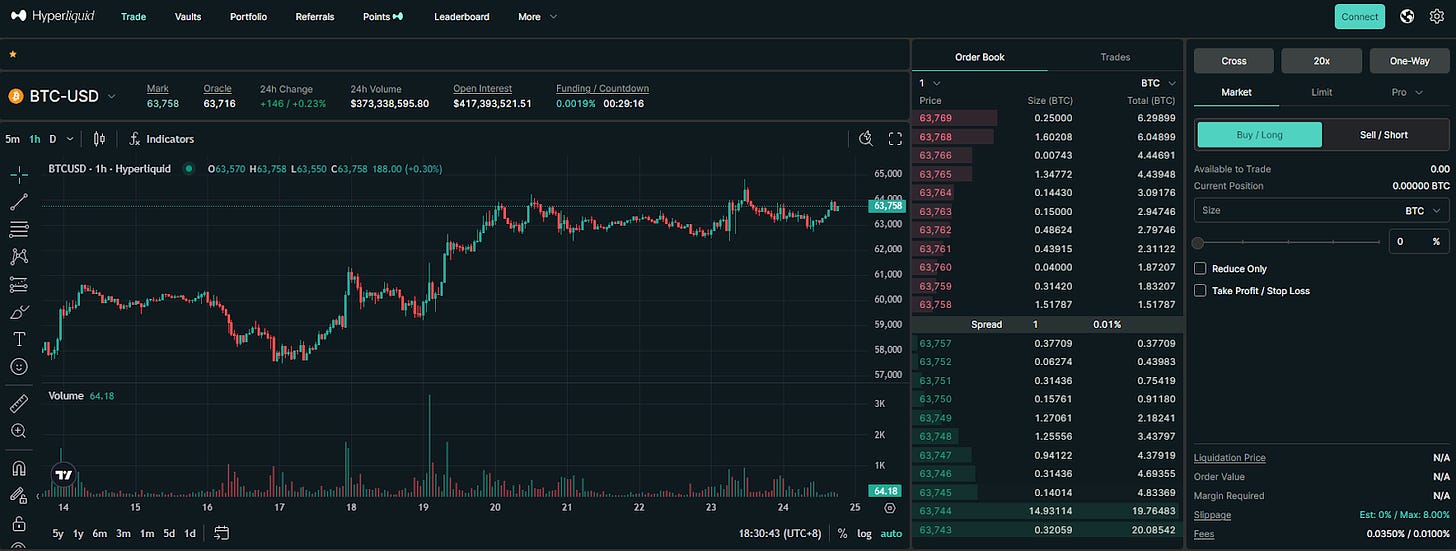

The trading method of perpetual contract - supports up to 50 times leverage!

Perpetual contracts are derivative financial products unique to the crypto market. They are modified from traditional futures commodities. Different from spot trading, contract trading, as the name suggests, is trading "contracts/contracts", which is somewhat similar to a gambling agreement. For example, I am long on BTC. , then you can long BTC/USD. Otherwise, there will be people in the market who are bearish on BTC and short BTC/USD. This is the beginning of a zero-sum game, with the funding rate as the coordination parameter. Hyperliquid serves as an on-chain platform for the smooth progress of the game. For players from all walks of life.

Perpetual means that the time of this transaction/contract can be permanent. Generally, futures have a delivery time, but there is no delivery time in a perpetual contract. As long as the user's margin is sufficient, the transaction/contract can be manually canceled by the user. It will exist forever. Of course, handling fees and funding rates must be paid within the contract period.

Arbitrage traders can conduct arbitrage transactions by charging funding rates as fee income and holding spot stocks.

Source: Hyperliquid

Another feature of contract trading is that leverage can be turned on. Taking Hyperliquid as an example, it supports up to 50 times contract trading, which means that the user’s profits and losses will increase exponentially. This is a very beneficial tool for traders, but of course it cannot Ignoring the risks involved, due to space constraints, I will not go into details here. For more details on contract transactions, please refer to the selected articles of Daily Coin Research:

Hyperliquid Eco-Cute Cat Universe$PURR

In April this year, Hyperliquid expanded their business technology scope and brought the spot concept into Hyperliquid L1.

HIP - 1: Native Token Standard

Hyperliquid has developed the native token standard HIP-1. You can think of HIP-1 as ERC-20. Similar to Ethereum's token standard, HIP-1 can deploy tokens with limited supply and create order books on the native chain, deploying The process requires 5 steps on Hyperliquid L1, including setting parameters such as the token name, decimal places, maximum supply, etc. The first token launched with this standard is $PURR, which is deployed by the Hyperliquid team with a cat theme. Meme coins.

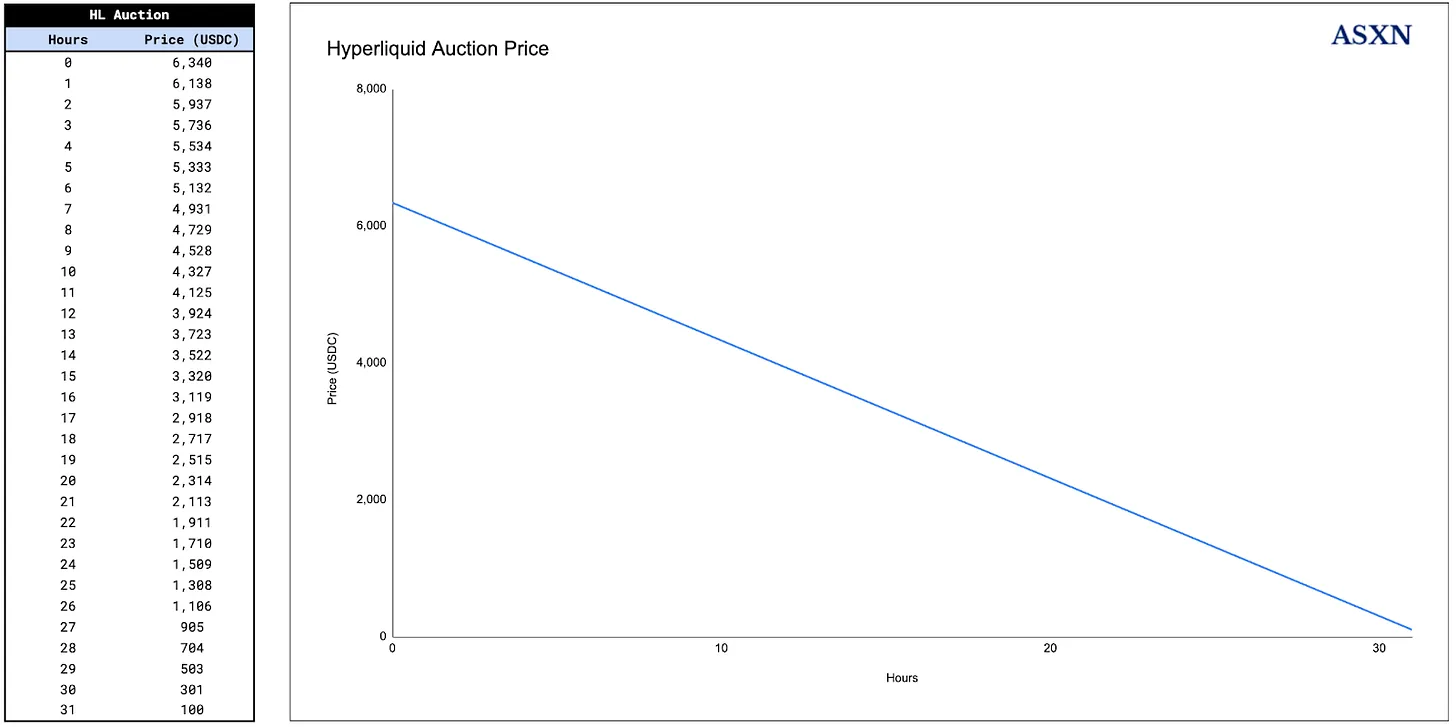

Token distribution is conducted using the Dutch auction method. Each auction lasts for 31 hours until the subordinate cost drops to 100 USDC. This mechanism effectively controls the total number of tokens issued on Hyperliquid L1. Only a maximum of 282 tokens can be listed on Hyperliquid each year. L1, dozens of HIP-1 tokens are currently online.

Source: ASXN

Since holdings also earn points, $PURR's market value quickly exceeded US$100 million after its launch, and it is also regarded as Hyperliquid's leading meme. It has now fallen slightly to 75 million, with a daily trading volume of approximately US$4 million.

Source: Hyperliquid

HIP-2: Hyperliquidity

Hyperliquidity is an innovative solution provided by Hyperliquid Liquidity, specifically designed to help projects with token marketing on spot order books. HIP-2 is a free option in step 5 of the token deployment process. Token deployers can execute "hyperliquidityInit" ” function to permanently submit liquidity to the spot order book of HIP-1 tokens.

The working principle of Hyperliquidity is to ensure that the price difference increases by 0.3% every 3 seconds. Using Hyperliquidity's completely decentralized strategy, in addition to integrating the project token into the conversion logic of Hyperliquid L1 and being protected by the Hyperliquid L1 verification mechanism, it can also Obtain good liquidity in the early stages of project creation and encourage other participants to join as liquidity providers. The most important thing is that through this method, you can directly tap into Hyperliquid’s active user group and start from currency issuance, trading and self-service. With a community, Hyperliquid provides a relatively complete one-stop solution.

For more details, please see the official documentation: HIP-2: Hyperliquidity | Hyperliquid Docs

Multi-chain perpetual contract aggregator Rage Trade

Rage Trade is a multi-chain perpetual contract aggregator that integrates Hyperliquid, GMX V2, Aevo and dYdX. It uses the total liquidity of all perpetual contracts to jointly create an on-chain contract trading market. Rage is publicly sold on Fjord Foundry and In August this year, the initial launch of TGE tokens was completed on Hyperliquid.

Source: Rage Trade

Lending platform Hyperland

Hyperland is a lending platform on Hyperliquid. HyperLend provides lending services through a non-custodial liquidity pool, where users can deposit and lend different assets, and supports flash loan services. The interest rate is jointly determined by the market.

Source: Hyperlend

Team background

The Hyperliquid team is small, with about 10 members, and is led by Jeff Yan and Iliensinc of Hyperliquid Labs. Jeff Yan is the founder of Hyperliquid, and Iliensinc is Jeff's Harvard alumnus. Jeff Yan previously competed in the International Physics Olympiad. He won gold and silver medals, and later went to Harvard University to study mathematics and information engineering. After graduation, Jeff worked at Google and the quantitative trading company Hudson River Trading. Before founding Hyperliquid, Jeff Yan also founded the top ten cryptographic companies in terms of trading volume. Chameleon Trading, a currency high-frequency trading company, has a very thorough understanding of the cryptocurrency trading market.

Most of the other team members are from Chameleon Trading and graduated from famous universities such as Caltech and MIT. They have experience in cloud technology company Airtable, well-known hedge fund company Citadel, robotics company Nuro and Hudson River Trading, etc. They are all leaders in technology and trading.

What's special is that the Hyperliquid team did not accept any external funding. The team built Hyperliquid internally. In this way, Hyperliquid does not need to face external pressure and directly escapes the dilemma of VC coins not being paid for by the market this cycle. For this group of elite traders, Hyperliquid is not just a chain. Building Hyperliquid into Binance on the chain is the vision of the Hyperliquid team.

Points Event - Can I still ambush Hyperliquid to issue coins?

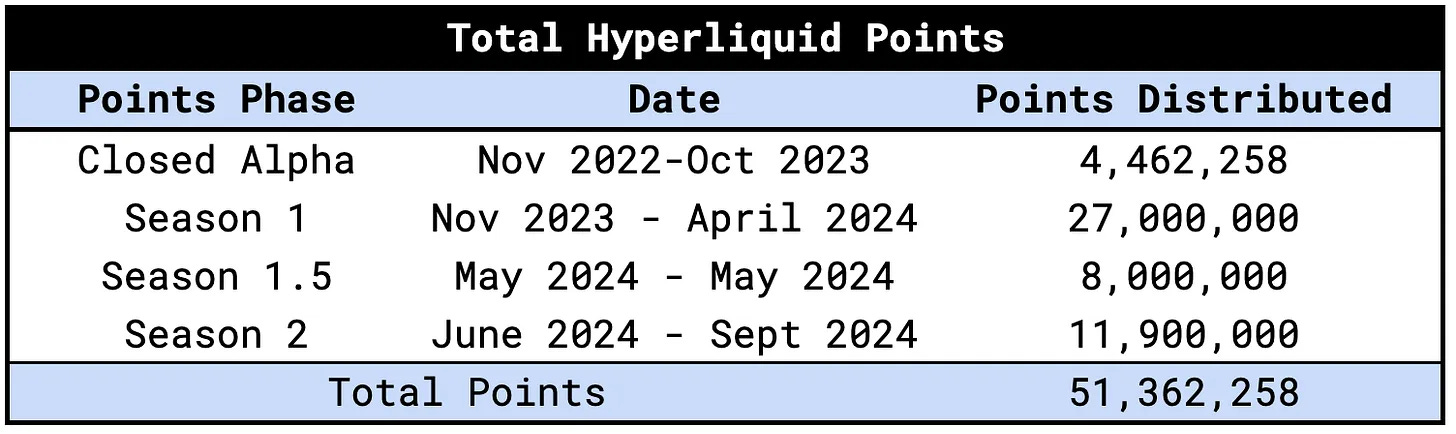

Finally, let’s take a look at Hyperliquid’s past points activities. Hyperliquid has released two points activities, and the points distribution is mainly determined by exchange trading volume:

first stage

Activity time: November 1, 2023 to May 1, 2024

Points reward: 1 million points will be distributed to active users every week

second stage

Activity time: May 29, 2023 to September 31, 2024

Points rewards: 700,000 points are distributed to active users every week

In addition to these two phases, snapshots and rewards are also given to early users. During the transition period from 2024/5/1 to 2024/5/28, Hyperliquid also provides an additional 2 million points per week to users. These points will It is the basis for receiving airdrops in the future, and more than 50 million points have been distributed so far.

Source: ASXN

Use Daily Biyan’s recommendation code: https://app.hyperliquid.xyz/join/CW to enjoy a 4% handling fee discount

Conclusion

For on-chain perpetual contract exchanges, Hyperliquid has too many innovations. In addition to the original trading platform functions, Hyperliquid has created a Layer 1 blockchain, launched native token standards and many other functions. In order to prevent Hyperliquid from becoming an island, the team It has also actively connected with Arbitrum and joined multiple channels such as multi-chain perpetual contract aggregator Rage Trade and bridge aggregator HyBridge to minimize user transfer costs and allow Hyperliquid to connect with the existing EVM system.

It can be said that what Hyperliquid has created is not just an exchange, but an on-chain ecosystem with a positive image. Although Hyperliquid has not yet issued coins, its innovative trading methods and points incentive system have helped Hyperliquid grow this year. Obtaining the leading position in on-chain contract trading, the surge in trading volume and total open interest also represents the rise of Hyperliquid. Perhaps Hyperliquid can really become "Binance on the chain"!

Source: Hyperliquid