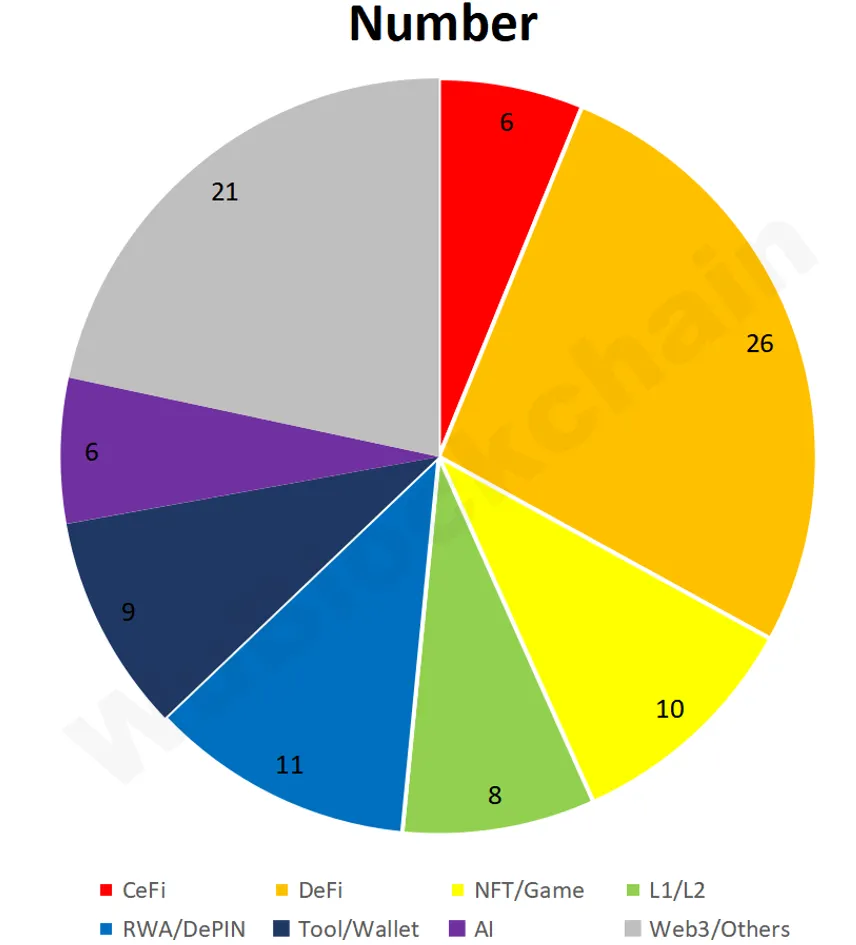

According to RootData statistics, there were 97 public investment projects in Crypto VC in September, a 13% decrease from the previous month (112 projects in August 2024) and a 4% increase from the previous year (93 projects in September 2023). Note: Since not all financing is announced in the same month, the above statistics may increase in the future. The sub-sectors are classified as follows:

Among them, CeFi accounts for about 6%, DeFi accounts for about 27%, NFT/GameFi accounts for about 10%, L1/L2 accounts for about 8%, RWA/DePIN accounts for about 11%, Tool/Wallet accounts for about 9%, and AI accounts for about 6%.

The total financing amount in September was US$610 million, a decrease of 23% from the previous month (US$790 million in August 2024) and a decrease of 12% from the previous year (US$690 million in September 2023). The top 10 rounds in terms of amount are as follows:

Modular blockchain Celestia has completed a $100 million financing led by Bain Capital Crypto. The financing was obtained by selling tokens over the counter (OTC) and announced during the countdown to the large amount of unlocking. The community suspected that there might be a conspiracy with VCs to take advantage of the opportunity to raise the price and sell.

Infinex raised $65.3 million through Patron NFT sales, with participants including Wintermute, Framework, Near, etc. Infinex is a decentralized perpetual contract trading platform launched by Synthetix. Currently, Infinex is not open for trading, and can only be used for depositing money and playing card games.

Huma Finance announced that it has completed a $38 million financing, including $10 million in equity investment and $28 million in real world asset (RWA) investment. The financing was led by Distributed Global, with participation from Hashkey Capital, Folius Ventures, Stellar Development Foundation and TIBAS Ventures. Huma will use the funds to expand its blockchain-based payment financing (PayFi) platform.

Bitget and Foresight Ventures jointly announced a strategic investment of US$30 million in TON, which will be achieved by purchasing TON through OTC.

The gaming platform Balance.fun has recently raised $30 million in funding, led by a16z and Galaxy Interactive. Its predecessor was the North American companion gaming platform Epal. They plan to conduct the NFT Mint of Pioneer Badge in early October and issue the governance token EPT in the future.

Solana ecosystem DeFi platform Drift has completed a $25 million Series B financing round, led by Multicoin Capital, with participation from Blockchain Capital, Primitive Ventures, Folius Ventures, etc. The platform is entirely based on Solana and focuses on derivatives trading.

Mert Mumtaz, CEO of Solana ecosystem development platform Helius, tweeted that Helius has completed US$21.75 million in financing, with participation from Haun Ventures, Founders Fund, Foundation Capital, 6th Man Ventures, Chapter One and Spearhead.

Web3 security company Hypernative announced the completion of a $16 million Series A financing round, led by Quantstamp, with participation from Bloccelerate VC, Boldstart Ventures, Borderless Capital, CMT Digital, IBI Tech Fund, Re7 Capital, etc. This round of financing brings the company's total financing to $27 million.

Hemi has completed a $15 million financing led by Binance. Hemi is a modular blockchain network that aims to achieve better scalability, security, and interoperability by integrating Bitcoin and Ethereum. This round of financing will be used to accelerate the development of Hemi's decentralized applications, enhance the interoperability between Bitcoin and the Hemi Virtual Machine (hVM), and increase the speed of blockchain settlement.

Initia announced the completion of a $14 million Series A financing round, with the company's token fully diluted valuation reaching $350 million. The round was led by Tomasz Tunguz's Theory Ventures, with participation from Delphi Ventures and Hack VC. To date, Initia's total financing has reached $22.5 million, including a $7.5 million seed round earlier this year and a pre-seed investment from Binance Labs. It plans to launch the mainnet and token in the next two months.