Bitcoin staged a battle to defend US$60,000 last night. It fell below and then pulled back several times within four hours, and the tug of war between long and short was quite fierce. It wasn't until one o'clock at midnight that there was a relatively obvious increase, once exceeding US$61,000.

However, there has been a correction at the time of writing, now trading at $60,571. If the next trend can be successfully established, the next resistance level will be $62,300, which was touched a few days ago. If it successfully breaks through, it will rise again; but if it falls below $60,000, it may have to retest 58,500.

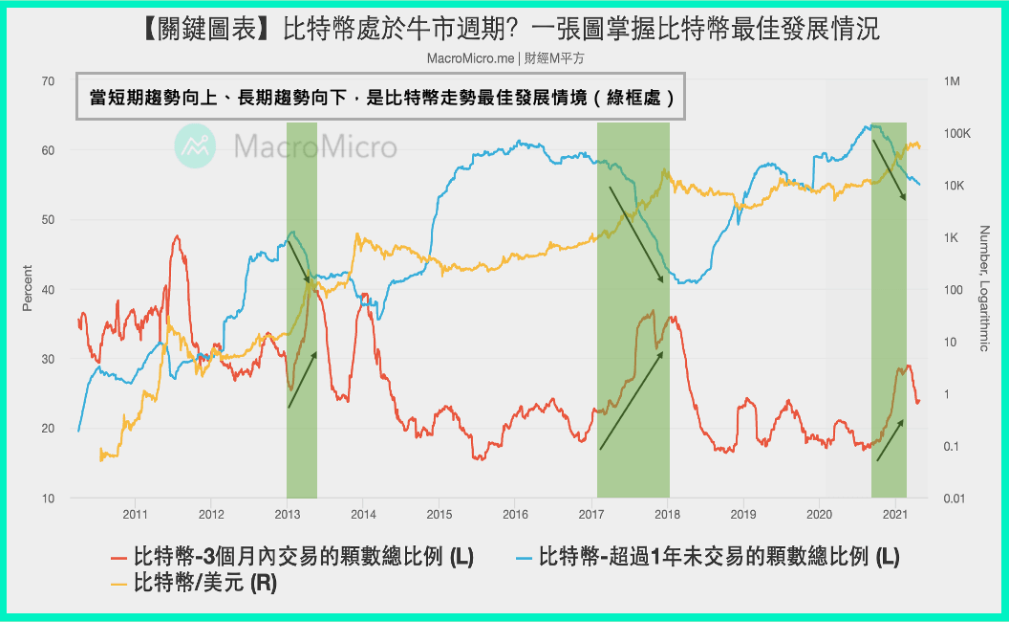

On the other hand, according to CMC Research, the research arm of the currency price tracking website CoinMarketCap (CMC), in the Q3 market research report released on October 3, they believe that this bull market has actually been accelerating and is faster than the typical four years in the past. A bull market cycle may be 100 days ahead of schedule, and cryptocurrencies appear to have entered a super cycle:

Between institutional adoption, Bitcoin spot ETFs, and changing market dynamics, Bitcoin may have entered a supercycle.

The peak of this bull market may come sooner than expected

We know that Bitcoin’s four-year bull market cycle is closely related to the Bitcoin halving mechanism. The block reward halving event every four years will lead to a reduction in the block rewards of Bitcoin miners, thus having a significant impact on the price of BTC. Influence.

However, CMC Research added that as of now, the progress of the Bitcoin bull market has reached 40.66%:

This time, the Bitcoin bull market is about 100 days earlier than before, indicating that Bitcoin may reach its peak between mid-May and mid-June 2025.

As for the reasons for the acceleration of this round of bull market, CMC Research said that it is mainly due to the fact that Bitcoin has developed so far and its correlation with traditional assets such as gold and technology stocks is increasing. At the same time, super bulls like MicroStrategy are also continuing to buy Bitcoin. , leading to the Bitcoin halving is not the only factor driving the bull run.

DeFi falls and Meme rises

In addition, CMC Research also pointed out that in the current market, the lending, storage and other sectors in the DeFi field no longer have the glory of the last bull market, replaced by the enthusiasm brought by meme coins.

In addition, the reach of artificial intelligence (AI) has also extended from the technology field to cryptocurrency. The combination of AI and blockchain has brought greater imagination and speculation to investors.

Standard Chartered Bank: Geopolitical conflict may cause Bitcoin to fall below $60,000

As for the possible short-term decline of Bitcoin, Geoff Kendrick, head of digital asset research at Standard Chartered Bank, also recently said that Bitcoin may fall below US$60,000 before the end of this week due to the impact of geopolitical tensions in the Middle East, which will bring the Fed's interest rate cut last month. All the previous market upward momentum was offset.

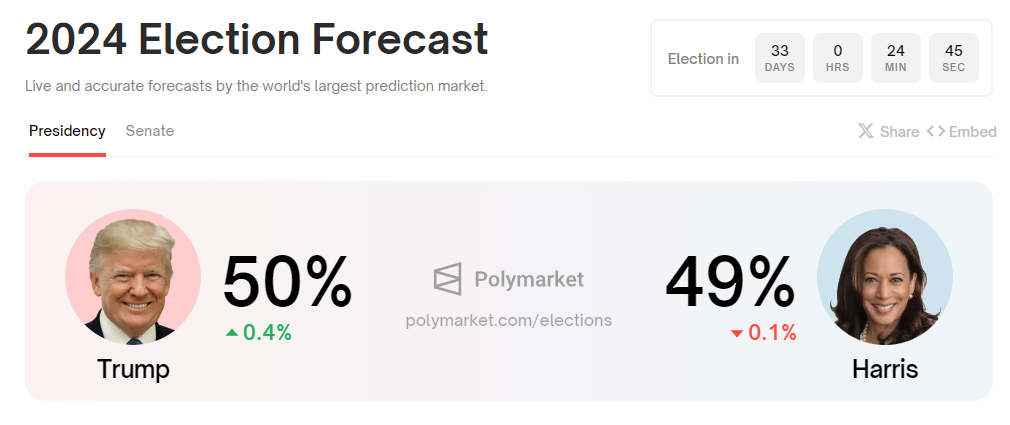

However, Kendrick is not pessimistic. He said that the current decline of Bitcoin may not be a bad thing for investors, because the current market decline may just bring them new buying opportunities, because Trump and Harris are in The election competition for the U.S. president is coming soon. As the Republican candidate Trump has repeatedly publicly supported cryptocurrency, his probability of winning on the prediction market Polymarket has once again surpassed Harris Harris, reaching 50%, which also indicates that the market may There will be a rise.