Article Highlights

- The largest NEIRO holder made a significant move by purchasing more than 1.466 billion NEIRO tokens worth $1.8 million.

- Following the breakout of the flag and flagpole patterns, NEIRO has a high chance of rising another 50%.

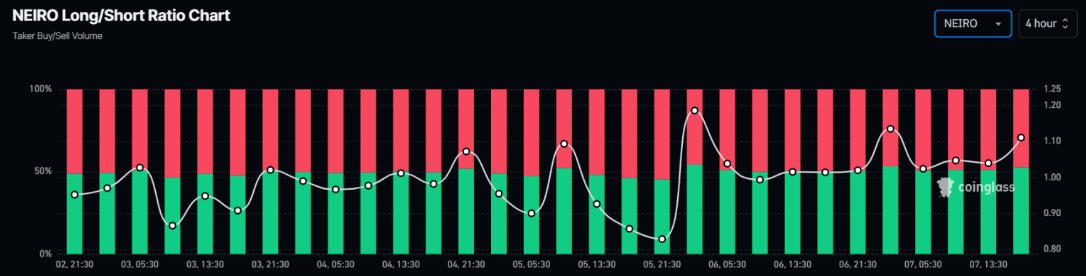

- NEIRO’s long-short ratio is currently at 1.11, indicating that traders are bullish on the market.

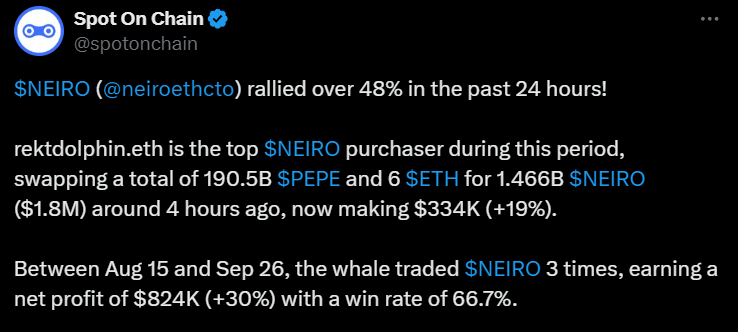

Amid the ongoing price reversal in the cryptocurrency market, whales have turned their attention to the first Neiro (NEIRO) on Ethereum. On October 7, 2024, blockchain transaction tracking platform Spotonchain posted on X (formerly Twitter) that the largest holder of NEIRO made a major move, purchasing more than 1.466 billion NEIRO tokens worth $1.8 million.

NEIRO Whale's recent activities

To accumulate this considerable amount of NEIRO tokens, the whale exchanged more than 190 billion PEPE and 6 Ethereum (ETH). It seems that the whale made a considerable profit by trading this newly listed meme token.

Source: X (Previously Twitter)

According to the data, the whale traded NEIRO tokens three times between August 15 and September 26, 2024, and made a profit of more than $825,000, with a win rate of 66.7%. However, with the recent purchase, the price of NEIRO has risen sharply, and the whale has now made a profit of more than $334,000.

Current Price Movement

At press time, NEIRO is trading near $0.001516, having gained more than 50% in the past 24 hours. During this period, participation from traders and investors has steadily increased, with trading volumes surging 405%, indicating positive market sentiment among cryptocurrency enthusiasts.

NEIRO technical analysis and upcoming levels

According to the technical analysis of experts, NEIRO looks very bullish and is expected to see another major rally in the coming days. It recently broke out of a bullish flag and flagpole price action pattern, surging more than 65% in the past two days.

Source: Trading View

Based on the data and historical price action, there is a high chance that NEIRO will rise by another 50% in the coming days to reach the $0.00233 level.

Bullish On-Chain Indicators

This bullish outlook is further supported by on-chain metrics. According to data from on-chain analytics firm Coinglass, NEIRO’s long-to-short ratio is currently at 1.11, indicating that traders hold bullish sentiment on the market.

Source: Coinglass

Additionally, NEIRO’s future open interest has surged 135% in the past 24 hours, indicating increasing trader interest and suggesting that significant long positions are forming during this period. Currently, 52.62% of top traders hold long positions, while 47.38% hold short positions.

Combining all of this technical analysis and positive on-chain indicators, it appears that bulls are currently in control of the asset, which could drive further price gains in the coming days.