According to "The Block" reports , JPMorgan Chase analysts pointed out several key factors that may affect the cryptocurrency market in the coming months, and mentioned a number of technical, geopolitical and structural events that may drive price changes, including seasonality. The “Uptober” trend, the Federal Reserve’s interest rate cuts, the approval of Bitcoin exchange-traded fund (ETF) options, and the upcoming Ethereum Pectra upgrade.

Table of Contents

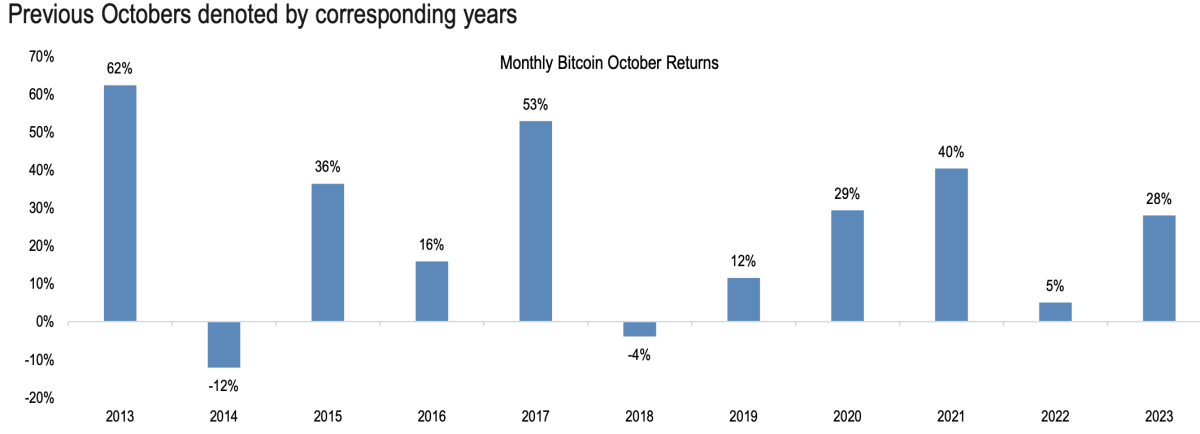

ToggleOctober tends to be a bullish month for cryptocurrencies

The JPMorgan Chase report pointed out the historical trend of strong performance in October, commonly known as "Uptober". Analysts highlighted that Bitcoin has achieved positive returns in October (more than 70%) in multiple years. The analyst wrote:

“Although past performance does not predict future performance, we believe that the promotion of ‘Uptober’ may influence people’s behavior and lead to positive returns for Bitcoin in October this year.”

The Fed’s rate cut cycle has yet to affect cryptocurrency market capitalization

Despite the recent rate cuts by the U.S. Federal Reserve, JPMorgan analysts noted that the broader cryptocurrency market has yet to see the expected positive effects. They said that while a falling interest rate environment generally supports risk assets, the correlation between total cryptocurrency market capitalization and the federal funds rate remains weak at 0.46.

“Since the Fed cut interest rates on September 18, we have yet to see the expected rise in cryptocurrency prices from lower interest rates,” the analysts wrote. The market may be waiting for more sustained stability before making a decisive decision. change.

Additionally, analysts admit that the lack of historical data makes it impossible to predict with certainty how cryptocurrencies will respond to interest rate cycles. They stated:

“Cryptoassets actually only emerged in the early to mid-2010s, and for most of their existence, interest rates were close to zero. Stable interest rates, not just low interest rates, may be best for these markets.”

Bitcoin ETF options could deepen market liquidity

Another potential catalyst is the recently approved trading of Bitcoin spot ETF options. In September this year, the U.S. Securities and Exchange Commission (SEC) approved BlackRock’s Bitcoin spot ETF (iShares Bitcoin Trust, IBIT) to be listed and traded on Nasdaq. However, final approval still depends on the Option Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC).

Analysts expect this will deepen liquidity in the market and attract new players. "With options, investors now have a more flexible way to participate in ETFs and drive liquidity in the underlying assets," they noted. Such a development could trigger a positive feedback loop, reinforcing The market structure makes it easier for institutional investors to adopt digital assets.

Pectra upgrade could have long-term impact on Ethereum

The upcoming Ethereum Pectara upgrade is also seen as an important development. Combined with Prague and Electra upgrades, Pectra will implement more than 30 Ethereum Improvement Proposals (EIPs) to improve network efficiency, validator operations, and expand account abstraction .

JP Morgan analysts said: "Pectra is expected to have a transformative impact on Ethereum's functionality, but we believe this upgrade is more structural than an immediate price catalyst." They believe that Pectra's long-term impact is to lift Ethereum However, it is unlikely to trigger a short-term surge in the price of Ethereum (ETH).

Overall, JPMorgan analysts concluded that the cryptocurrency market is in a wait-and-see mode, waiting for clearer macroeconomic or structural catalysts to drive continued growth. They stated:

“We continue to see the cryptocurrency ecosystem become increasingly more sensitive to macro factors, and as such we are awaiting the next major catalyst for development and enhanced retail participation for the long-term growth of the ecosystem.”