Alternating between fat and thin, Mai Shiranui, the gluttonous feast, where is it now?

Author: Zuoye Waiboshan

Cover: Photo by Shubham Dhage on Unsplash

Bitcoin is Time, ETH is Money, so What is Crypto?

Many years ago, I read an article, "Bitcoin is Time". The value of Bitcoin will be reflected through time. Whenever the industry and I are confused, I will read it repeatedly. I believe that the power of time will change people's existing cognition. If people do not change, then they will be eliminated, just like any technological advancement in history requires the sacrifice of "old aerospace".

Encryption technology has been around for a long time, and decentralized currency has been reflected in shells. The denationalization of currency is also the spiritual document of anarchism. What we see today is the weakness of technological narrative. Decentralization is no longer important, and nationalization is popular in the name of compliance. Cooperation with the government and traditional financial institutions sounds more respectable than cooperation with the underground world.

BTCFi may be the main consensus intersection between Wall Street and Crypto OG, but this will fundamentally change the non-national orientation of Crypto. If using cryptocurrency to fight Russia and North Korea is liberalism, then is it also conforming to the United States?

At least that's what CZ and SBF think, and maybe Vitalik too.

With the influence of Bankless, the attribute judgment of ETH is Money has become a hot topic in the industry. Although the popularity is not as high as before due to the violent performance of Big A, at least it is fortunate that there are still people thinking about the present and future of cryptocurrency. However, not many people care about the fire dance of Solana Firedancer, and no one cares about the performance battle.

After careful consideration, the last time people debated the underlying public chain technology was Ethereum's The Merge. After that, people got used to accepting it because the Core Memeber under the decentralized governance structure still effectively controls the overall direction of the public chain ecosystem. This was the case during TheDAO and TheMerge. There is no need to debate, just accept it.

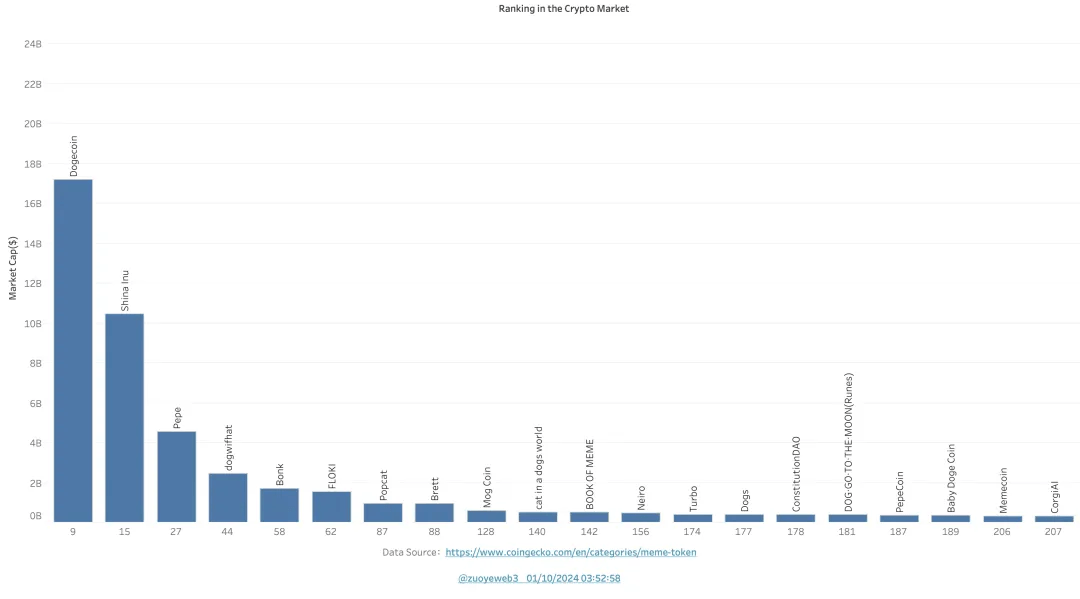

The weakness of technology is reflected in the market’s rejection of VC coins. The main theme of 2024 is the resistance to the pace of coin listing on exchanges. This violent resistance has brought Meme Coin to TON and Solana, but unlike the playful spirit of the first generation of Dogecoin, the biggest beneficiary of this round of Meme craze is the Meme Coin launch platform, while the market value of Memecoin itself is getting smaller and smaller, and each generation is worse than the previous one.

To this day, the first-generation Meme is still ranked the highest in terms of market capitalization. Just as the public chain track can only accommodate BTC and ETH, the remaining chains can only compete for the status of the "third chain". The last cycle was Avalance/Near and Solana, and this round is Solana and TON. The focus of Solana and TON is also coincidentally placed on Meme, mini-games and other online gambling games with a high degree of PVP color.

In the past six months, I have been deducing the future along the development history of encryption technology, from elliptic curve algorithms to Schnorr signatures, and from ZK to the vision of FHE ciphertext computability. But unfortunately, the technological narrative seems to have come to an end. Why?

Looking back, Satoshi Nakamoto created Bitcoin using only encryption technology and only wanted to do one thing: payment. Later, Ethereum proposed the grand vision of a world computer with the help of smart contracts. After sharding could not be implemented in the short term, it turned to PoS and Rollup-centered expansion routes, thus creating an L2/Rollup system that seamlessly transitioned from prosperity to chaos. Until now, high-performance L2s such as MegaETH and RISE Chain that make the most of hardware to optimize the experience have become Vitalik's new favorite.

Coincidentally, hardware, optimized Gas Fee and high performance are basically the whole point of Solana 1.0 and Solana Firedancer (2.0). If it develops in this direction, then Crypto is TPS.

If this path is feasible, then Solana will be the third chain. If this path is not feasible, then the technical narrative of Crypto needs to give new answers. What kind of capabilities are really needed by users, rather than by builders and VCs?

The Fast Food Protocol in an Age of App Scarcity

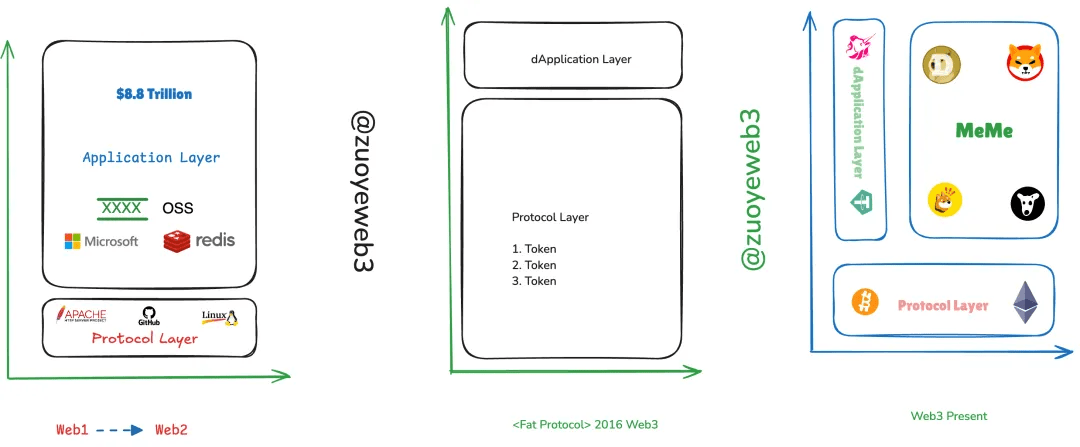

The 2016 “Fat Protocol” predicted the growth of Ethereum’s protocol value:

- ETH will serve as an incentive for early participants to build the first super economy in human history in a decentralized manner, which does not belong to any country or individual.

- Ethereum will change the dilemma that the Internet protocol layer cannot capture value. People who create the next generation of human communication infrastructure deserve the richest rewards, and such rewards will increase in value passively.

If you want to truly understand the current weakness of Ethereum and ETH, you have to go back to this article. In a sense, this is more important than the Ethereum Yellow Paper and the IXO incident. Before this, the Internet was a three-layer structure of "protocol -> application -> user", and these applications later became the large public chains we are familiar with. With the blessing of network effects, they eat the free creativity of genius programmers on the left and endlessly devour users' privacy on the right.

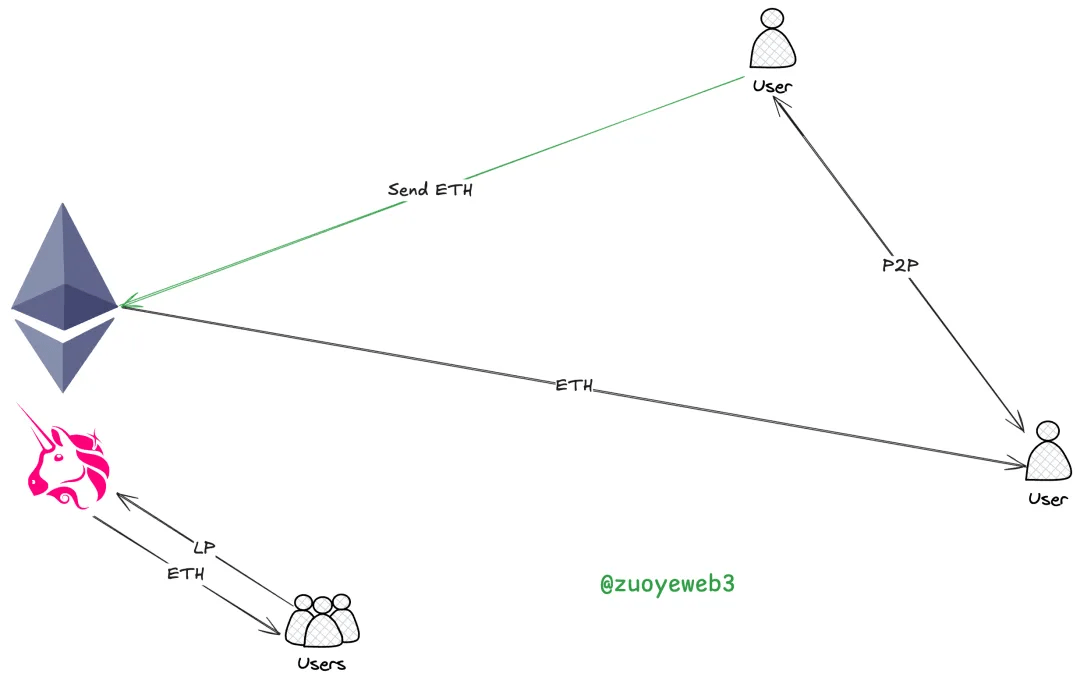

Another answer given by blockchain/Web 3.0/Ethereum is to remove the application layer and let the protocol and users interact directly. In this system, all economic activities are calculated based on ETH, so ETH is Money.

In fact, we can make a comparison. The core of Web3 compared to Web2 lies in the difference in value capture methods, rather than removing the application layer itself. Giants such as Microsoft need to make users pay for it, while Ethereum needs to build or create a rich on-chain ecosystem to attract users, even if they are speculative users in the early days.

In an ideal situation, blockchain systems such as Ethereum will gradually replace traditional Web2 giants and transform into a new generation of Internet infrastructure, providing decentralized on-chain versions of various applications for our online life. Because in this narrative, the technology of the protocol layer is the most important, and user needs are secondarily important. The only unimportant thing is the application layer in the middle. A variety of extremely rich dApps will replace super platforms, and people's on-chain data and value can flow freely.

First of all, we must admit that the narrative logic of Fat Protocol is completely technology-centric. Things like user needs and experience will not be recognized until 2023, with concepts such as chain abstraction and intent being accepted by Crypto Native users.

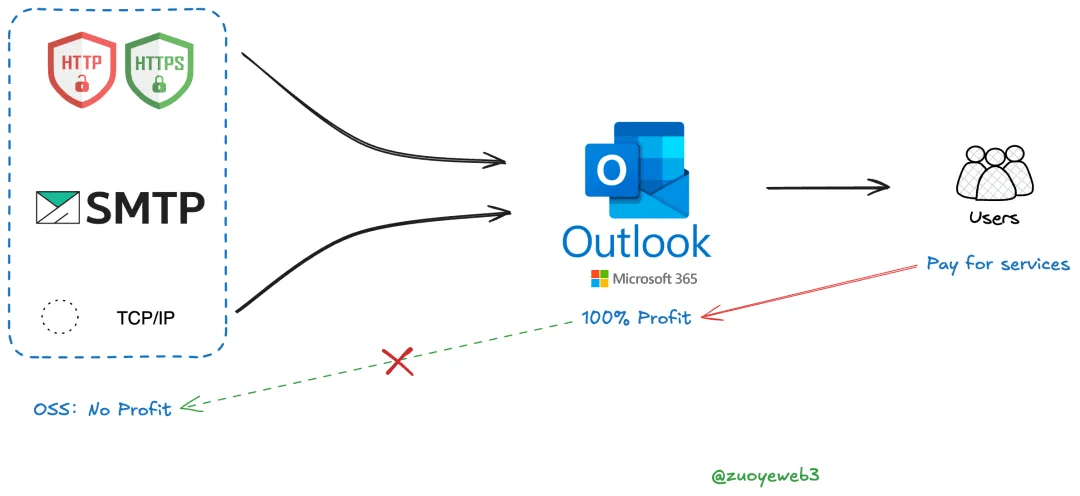

Secondly, we must admit that the application layer in the middle is not worthless. Pure token incentives will not allow developers to create protocols and ecosystems that better meet user needs. In other words, we must stop the trend of abuse of the term "protocol". Ethereum is a protocol, and Uniswap cannot be a protocol strictly speaking. Referring to the basic nature of SMTP, Outlook can only be an application.

Finally, we have to admit that in the past few years, what Web3 lacked was not the polishing of the underlying technology, but the indifference to the application layer. People mistakenly believed that only the protocol needed to be paid attention to, and the application layer only needed to provide transaction services. However, based on observed facts, the giants of Web2 did not neglect the underlying protocol. On the contrary, it can be said that they are now the cornerstone of Internet protocols.

Being misunderstood is the fate of giants

I must state that I have no intention of defending the giants. Each of us is a digital laborer on the Internet. Our daily online activities are part of exploitation by the giants. It is also a fact that user privacy is violated and excess profits are squeezed out, both in China and abroad.

But this does not mean that it is right to remove the application layer, because a world driven only by tokens cannot obtain real users. If we define real users, then they are non-trading users. We can imagine a scenario. If a crypto user neither uses Binance nor Uniswap, then is he a high-quality user? I think most project parties will think not.

The abuse of the token mechanism at least retains the seed users of the blockchain, but the current status of Web3 is simply speechless. Meme Coin has not occupied the mainstream of the market, but it has overwhelmed everything in terms of voice.

To sum it up in one sentence, what I wanted was a voyage to Mars, but what you gave me was $Terminus and disputes over uppercase and lowercase letters. If this is the great voyage of Web3 technology, it would be too sad.

In the commercial competition of Web2, the application layer close to users makes the most profit because they donate to open source projects while exploiting them. For example, the platinum members of the Rust Foundation are AWS, Google, Huawei, Meta and Microsoft. Even the main source of profit for the Firefox browser is advertising fees from its competitor Google.

Secondly, the entire process when people use Ethereum relies on smart contracts, and it is normal to pay for it, including Blob or Calldata, which are essentially designed to store user data. The magic of the entire chain lies here, and the price is also here. The traditional Internet is more about setting up a set of rules, and strictly speaking, it does not deal with user needs.

To give a simple example, the operation of the traditional network is like the relationship between the law and the judicial system. Legislation is a power owned by the whole people, the law is open to the public, and the legislators are only responsible for making rules. Daily legal practice needs to be handled by complex legal departments, so people only need to pay for the fees incurred in the process of legal practice. The price varies from person to person and from case to case, from big lawyers to rookies, from criminal cases to traffic violations, depending on the content handled by the judicial system.

However, in the on-chain world of Code is Law, the judicial process and legislation are two sides of the same coin, so efficiency cannot be improved. People are trapped in various technical terms, and the increasingly off-chain and centralized practices are actually a convergence of traditional giants and judicial practices. The chain only does evidence storage, and computing and storage are transferred to the off-chain.

Only from this perspective can we decode the same goal of MegaETH and Firedancer. Strictly speaking, there is no difference between the two. If blockchain is to continue to move forward, squeezing hardware is the only solution.

Conclusion

To summarize simply, the collapse of ZK and cross-chain bridge projects in 2024 is a preview of the end of the technology narrative. The user volume and transaction data of LayerZero and StarkNet have already told it all.

In the just-concluded Token2049, consumer-grade applications were the only redeeming feature. Although not as popular as user experience, customer acquisition, business development, and ground promotion, at least they did not play with abstract art such as chain abstraction and intention.

However, the pursuit of technological superiority and communities close to Discord and Twitter still lack the actual performance of real users. If one day, B2B companies and African people use Web3 applications on a daily basis, that will be the correct posture for the implementation of technology.

It has been 8 years since the fat protocol was introduced. I will be heartbroken if I complain too much. I hope the era of fat applications will truly arrive.

References:

- Fat Protocols

- Thin Applications

- The skinny fat protocol thesis

- The Rise of the "Fat App Thesis" in Crypto Token Valuation: A Paradigm Shift for Professional Investors

- Thin Protocols

- Fat Protocols Vs. DApps: Creating Long Term Value on the Public Blockchain

- What is Firedancer? A Deep Dive into Solana 2.0

- Solana Executive Overview

- Blockchain in Online Casino Sites

- ETHEREUM: A SECURE DECENTRALISED GENERALISED TRANSACTION LEDGER SHANGHAI VERSION 9fde3f4 – 2024-09-02

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group