Author: Lawyer Liu Honglin

These days, I don't know if the players in the crypto world have noticed a piece of news that has been circulating online, which claims that USDT may face delisting due to non-compliance. As of the time of writing, a search for "USDT" on WeChat also brings up multiple related information. Other vertical media platforms, such as the discussion forum of a well-known crypto exchange, also have discussions about the relevant news.

As the old saying goes, "bad news travels fast." Especially in the crypto world driven by the fear of missing out (FOMO), USDT, as the most widely used entry-level crypto asset, if it "collapses," it will undoubtedly cause a "major earthquake" in the crypto world. You know, who in the crypto world doesn't have hundreds or thousands of USDT in their hands!

In the USDC de-pegging incident in March 2023, panicked crypto community members massively sold off USDC, and some well-known crypto institutions and market makers (such as IOSG and Jump) took emergency risk-aversion measures, and even top crypto exchanges temporarily suspended USDC exchange channels... Subsequently, on-chain pressure surged, and due to the DeFi ecosystem's heavy reliance on USDC, this de-pegging event caused severe imbalances in liquidity pools and triggered de-pegging of other stablecoins such as Dai and Frax, as well as subsequent on-chain liquidations.

But, will USDT really face delisting due to non-compliance? Lawyer Mankun said: Taking things out of context is unacceptable!

The Truth about USDT "Delisting"

Let's go back to October 4th, when we were still immersed in the joy of the National Day holiday, Bloomberg released a news about "Coinbase will delist stablecoins that do not comply with EU regulations," which kicked off the drama of "USDT is going to be delisted."

*Source: Bloomberg news screenshot

The news pointed out that with the full implementation of the EU's MiCA law in December, Coinbase, in order to comply with regulations, will restrict the provision of services related to stablecoins that do not meet the MiCA requirements to EEA users after December 30, 2024. In simple terms, after December 30, Coinbase will delist all stablecoins that do not meet the MiCA requirements, but only in the EU region.

We also know that so far, due to various factors, Tether (the issuer of USDT) has not yet obtained the EU stablecoin issuer license, which means that if Tether cannot meet the MiCA requirements and obtain the stablecoin issuer license within the remaining 3 months, Coinbase will delist USDT-related services in the EU region.

However, as the news spread, it turned into Coinbase delisting USDT at the end of the year.

So, if Tether really fails to obtain the MiCA stablecoin issuer license by the end of the year, and Coinbase delists USDT, what impact will it have on the crypto world?

Problems Only in the EU

Currently, in addition to Coinbase, other well-known crypto exchanges, such as Binance and OKX, have also announced the delisting of unlicensed stablecoins to comply with the EU's MiCA requirements. That is to say, starting in 2025, crypto players in the EU will not be able to buy and sell this type of stablecoin on compliant crypto trading platforms. However, crypto players in other countries and regions are not affected, so users who trade on compliant platforms do not need to be particularly concerned.

However, some people may still worry that if EU users cannot use USDT, a sell-off will occur, which may lead to selling pressure on USDT, causing it to de-peg and subsequent impacts? Lawyer Mankun believes that there will be some impact, but the problem is not very big. There are three reasons:

First, for EU users, the crypto trading platforms they can use are not limited to these compliant exchanges. More non-compliant but still "standing in the front line" centralized exchanges (CEXs), and even decentralized exchanges (DEXs), are still potential choices for them.

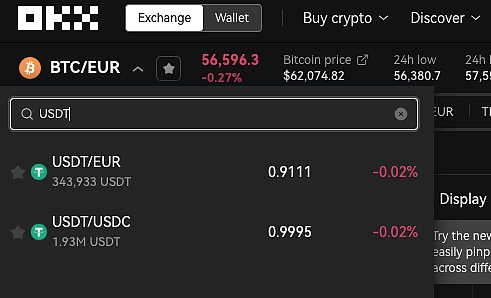

Second, according to TokenInsight, OKX had announced as early as March to stop providing crypto trading pairs with USDT as the quote currency for EU users. Currently, EU IP users can only use the USDT/EUR and USDT/USDC trading pairs on OKX. But obviously, the impact is not significant.

*Source: Screenshot of the OKX platform page for EU IP users

Third, even before the MiCA stablecoin issuer provisions came into effect, the market had already been rumoring that USDC had obtained the license, or would replace USDT, so it had already given EU users more expectations and a transition period. Additionally, from a market liquidity perspective, USDT's user base is more concentrated in Asia, rather than Europe.

Of course, according to the information disclosed by Tether, they are actively building new technologies and models to address the regulatory challenges brought by MiCA. Therefore, overall, apart from the panic caused by rumors, the delisting itself will not have a significant impact on the market. However, as more and more countries and regions around the world begin to seek regulatory legislation for stablecoins, such as Hong Kong launching the establishment of stablecoin issuer provisions and issuer regulatory sandbox, the stablecoin issuers represented by USDT will inevitably face more regulatory challenges in various regions.

Against this background, crypto players need to pay attention to understanding the regulatory policies in their locations and timely adjusting their investment strategies to avoid the impact of regulations.

Global Stablecoin Regulation

Currently, in addition to the already effective MiCA stablecoin issuer provisions, there are also multiple countries and regions that have already launched regulatory legislation and enforcement for stablecoins. In the popular Web3 locations, such as:

1 United States

The United States, known for its strict crypto enforcement, currently has no dedicated stablecoin regulations, but the Financial Crimes Enforcement Network (FinCEN) treats stablecoins as convertible virtual currencies (CVCs), and therefore subject to existing financial regulations. Although lacking specific stablecoin legislation, Congress has still proposed multiple bills aimed at establishing a clearer regulatory framework. Notable proposals include the Stablecoin Trust Act and the Stablecoin Bill, which propose that stablecoin issuers either become insured deposit institutions or obtain licenses under federal or state laws. These proposals reflect growing concerns about the regulatory environment for stablecoins, especially as their use in the financial ecosystem continues to expand.

In addition to FinCEN, other regulators such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) may also regulate stablecoins based on their structure or related products. The Federal Reserve and the President's Working Group on Financial Markets have also warned about the risks that stablecoins may pose, particularly regarding financial stability and systemic risk. Ongoing discussions suggest that to mitigate these risks, stablecoin issuers may face regulatory requirements similar to those for banks.

2 United Kingdom

There is currently a Digital Assets Framework Proposal, led by the UK Financial Conduct Authority (FCA), which focuses on regulating fiat-backed stablecoins, requiring stablecoin issuers and custodial service providers to be authorized and comply with strict regulatory standards, including asset segregation, sound governance controls, and maintaining detailed records. In addition to these requirements, the UK (FCA) also emphasizes that stablecoin issuers need to maintain robust prudential safeguards to protect consumers and the broader financial system. The proposed rules also strongly emphasize the importance of ensuring that stablecoins can be redeemed at par (i.e., 1:1 support with fiat currency). The FCA is actively collaborating with other global regulators to coordinate standards and ensure a consistent approach to stablecoin regulation across different jurisdictions.

3 Hong Kong, China

At the end of August, the Hong Kong Treasury and the Hong Kong Monetary Authority (HKMA) released a consultation summary on the regulatory regime for stablecoin issuers, and also launched a stablecoin issuer sandbox program, announcing the participation of three companies. Stablecoin issuers must obtain a license from the HKMA and strictly comply with requirements such as reserve management and financial resources. However, the sandbox program currently does not involve any native Web3 stablecoin issuers, and the issued stablecoin is pegged to the Hong Kong dollar, so it is uncertain whether the future Hong Kong stablecoin issuer regulatory policy will have an impact on stablecoins such as USDT and USDC.

4 Singapore

The Monetary Authority of Singapore (MAS) has released a consultation paper on the regulation of stablecoin issuers in 2023, confirming its intention to regulate stablecoin-related activities under a new Single Currency Stablecoin (SCS) framework. The introduction of this framework aims to ensure the stability of stablecoins and their compatibility with Singapore's financial system. Similarly, this framework requires stablecoin issuers to obtain official licenses and comply with a series of strict regulations, including but not limited to reserve asset management, guaranteed redemption at par value, and transparency disclosure. In addition, MAS will also impose prudential and solvency requirements on stablecoin issuers to ensure the soundness of the market and the protection of consumer interests. Although these measures increase the operational difficulty for issuers, they are considered necessary steps to maintain the stability and integrity of the financial market.

5 Japan

Entities engaged in stablecoin-related businesses in Japan must obtain stablecoin-related licenses by registering as Electronic Payment Instrument Service Providers (EPISP). This requirement was introduced in the revised Payment Services Act (PSA) in June 2023. Japan's latest stablecoin regulatory regime imposes strict requirements on the issuance and management of stablecoins, such as the requirement that stablecoin issuance must be pegged to a specific fiat currency and promise to redeem at the issue price. Stablecoins like USDT and USDC are considered electronic payment instruments in Japan and are regulated under the PSA. Furthermore, non-electronic currency-type stablecoins such as DAI, which are not directly pegged to fiat currencies, are classified as crypto-assets and may be managed under the Financial Instruments and Exchange Act (FIEA).

As global stablecoin regulation continues to evolve, various policies are posing significant challenges for issuers. In the United States, the lack of specific legislation and the strict regulation of multiple government agencies have increased the compliance burden for stablecoin issuance, which may limit the innovation and operational flexibility of stablecoin issuers. Similarly, the strict requirements of the UK Financial Conduct Authority (FCA) regarding authorization and consumer protection may bring additional costs and operational restrictions. The regulatory uncertainty surrounding Hong Kong's current sandbox program has increased complexity, especially for stablecoins that are not directly aligned with the local currency. Similar to the aforementioned jurisdictions, Singapore and Japan have been criticized for the restrictive nature of their stablecoin regulatory regimes, with industry participants believing that this may stifle innovation, limit competition in the crypto market, and potentially lead to increased centralization of the stablecoin market.

It can be foreseen that the changing global regulatory dynamics will inevitably affect the market share of various stablecoins, and consequently impact users' virtual asset situations. Therefore, crypto players should consider what they can do themselves to adapt to the market changes caused by regulation.

Attention Points for Crypto Players

Previously, Manqun Lawyers has interpreted the judicial interpretation on virtual currency money laundering issued by the Supreme People's Court and the Supreme People's Procuratorate, which was also caused by the unclear media reports, leading to panic among crypto players. Therefore, in combination with this "earthquake", Manqun Lawyers believes that the following key issues need to be noted:

1 Understand Regulatory Policies

Fear often comes from the unknown. When we don't understand regulatory policies, we naturally get carried away by exaggerated media reports and market sentiment. For example, in this case, those who understand the specific content of MiCA and Coinbase know that the USDT issue is not a big problem. Therefore, when seeing media reports, it's better to trace the source first and understand the relevant regulatory policies, and be objective. If you really can't figure it out, consulting a lawyer is also a very smart choice. Previously, when the judicial interpretation on money laundering by the Supreme People's Court and the Supreme People's Procuratorate was just released, some friends in the Manqun exchange group consulted and got the answer immediately.

2 Use Compliant Platforms

Compliant participation is the biggest reliance to reduce losses. Those virtual currency exchanges that have fully complied with the laws and international regulations of their respective regions not only can provide higher security and fund protection, but they are also at the forefront of regulation, able to keep up with policy changes and make timely adjustments, and provide users with sufficient redemption and exchange transition periods, such as OKX currently providing two USDT trading pairs for EU users, which can ensure that EU users can exchange their USDT for compliant stablecoins before 2025.

3 Diversified Investment Strategies

Don't put all your eggs in one basket. Although the volatility of stablecoins is not as large as other virtual assets, the types of stablecoins are very diverse. Therefore, we should consider diversifying our investments into multiple assets, holding multiple compliant stablecoins, and even other virtual assets, in order to minimize the impact of regulatory changes on a single stablecoin.

Finally, Manqun Lawyers needs to remind that the crypto circle often overreacts to some regulatory news. If we have already achieved compliant participation, when facing FOMO, please remain calm, do a good analysis, and avoid making impulsive decisions due to panic selling.