- The Chinese government has transferred 7,000 ETH to exchanges in the past 24 hours.

- These coins are part of the 542,000 ETH recovered from a cryptocurrency Ponzi scheme in 2018, which may soon be sold on the market.

Ethereum [ETH] is trading at $2,401 at the time of writing, after dropping nearly 2% in value in 24 hours. This decline coincides with the negative sentiment across the cryptocurrency market, as the Fear and Greed index has dropped to its lowest level in seven days at 39, indicating that traders are in a state of fear.

However, Ethereum holders have an additional reason to be concerned with the possibility of 542,000 ETH, worth over $1.3 billion, being sold by the Chinese government.

Ethereum's "Unexpected" Supply

According to on-chain researcher ErgoBTC, ETH is facing an unwanted oversupply after 7,000 ETH were transferred to exchanges. These Tokens are part of the 542,000 ETH seized from the PlusToken Ponzi scheme in 2018.

This scheme had accumulated over 194,000 Bitcoin [BTC] and 830,000 ETH at the time it was forced to shut down. Most of the Bitcoin may have been sold during 2019 and 2020. One-third of the ETH was sold in 2021.

The remaining balance of 542,000 ETH was consolidated into multiple addresses in August 2024. According to the researcher, some of these coins are now on the move.

On October 9th, 15,700 ETH were withdrawn from these addresses, and nearly half of that was sent to the Bitget, Binance, and OKX exchanges.

The researcher states that these transfers are following a similar pattern to when authorities sold Bitcoin in 2020, putting ETH in a precarious position as the selling pressure could significantly increase in the coming weeks.

Ethereum Reserves on Exchanges Reach a Three-Week High

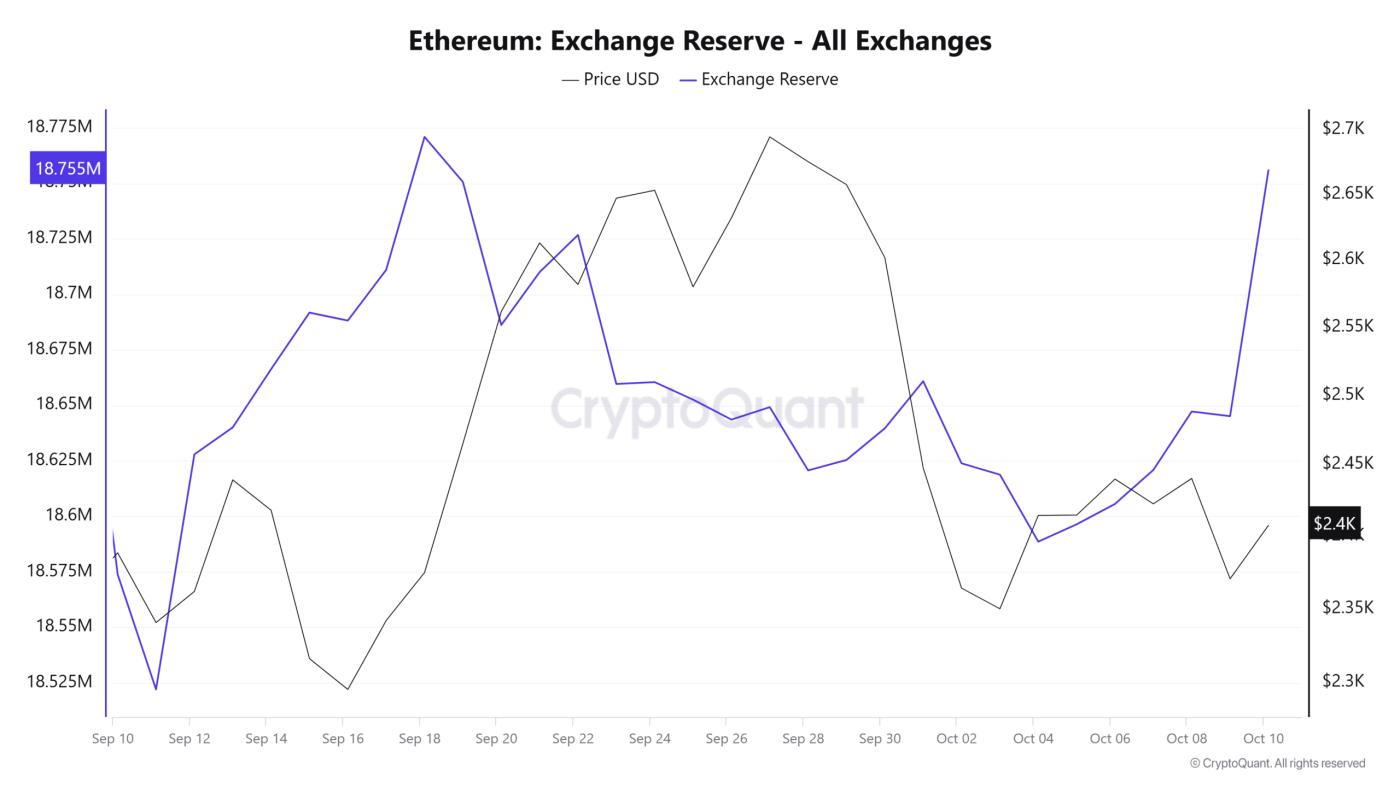

These deposits have triggered a wave of increasing Ethereum reserves on exchanges, reaching a three-week high, according to observations on CryptoQuant.

In the past 24 hours, the total ETH held on exchanges has increased by over 110,000 Tokens to reach the highest level in three weeks.

This data suggests that many traders are transferring their coins to exchanges with the intention to sell. Additionally, the highest increase in reserves has occurred on Derivative exchanges. This could lead to significant volatility for Ethereum.

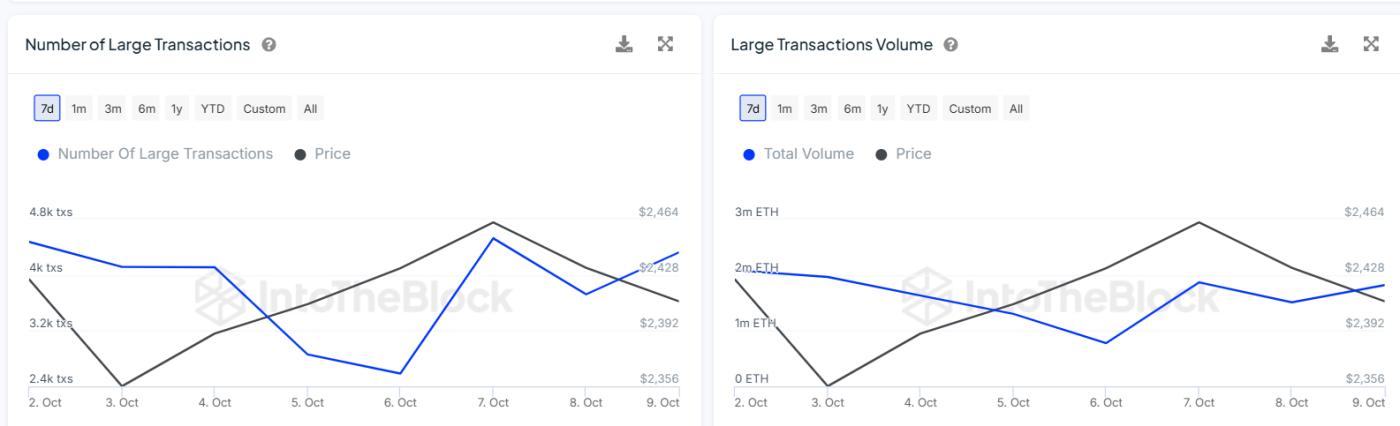

Data from IntoTheBlock also shows an increase in large transaction volume, implying that whale activity is on the rise. Since Ethereum is not increasing despite the increase in large transactions, this may imply that these transactions are on the sell side rather than the buy side.

Liquidation data shows that the high deposits on exchanges are having a negative impact on Ethereum. According to Coinglass, over $31 million worth of ETH has been liquidated in the past 24 hours, with $27 million being long liquidations.