The BNB price has faced considerable difficulties in recent weeks, with repeated failed attempts to break through the key resistance levels of $606 and $618. For over two months, the altcoin has been struggling to overcome these barriers.

As BNB approaches these levels again, investors have started adjusting their positions to anticipate a bearish outcome and capitalize on potential price declines.

BNB Losing Support

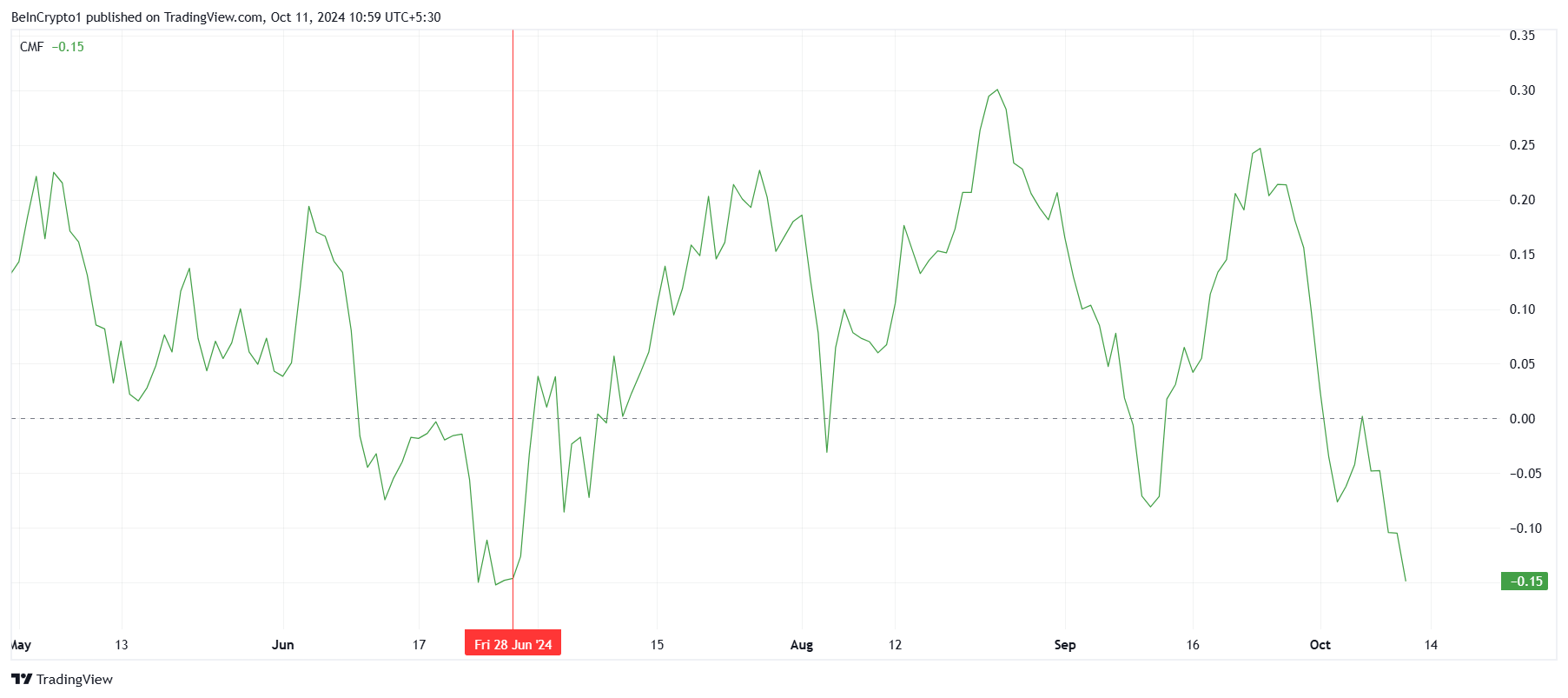

As can be seen from the Chaikin Money Flow (CMF), BNB's overall macro momentum remains weak. The current CMF is at its lowest level in 3 months, indicating low investor confidence in the asset. The last time net inflows were this low was back in June.

This sharp decline suggests that investors are withdrawing funds from BNB due to skepticism about the token's ability to maintain its price.

The low CMF indicates a lack of buying pressure, further reinforcing the bearish sentiment. When investors start withdrawing money from cryptocurrencies, it generally reflects growing uncertainty in the market. In the case of BNB, this trend may signal the potential for further price declines.

Read more: The Best BNB Wallets to Consider in 2024

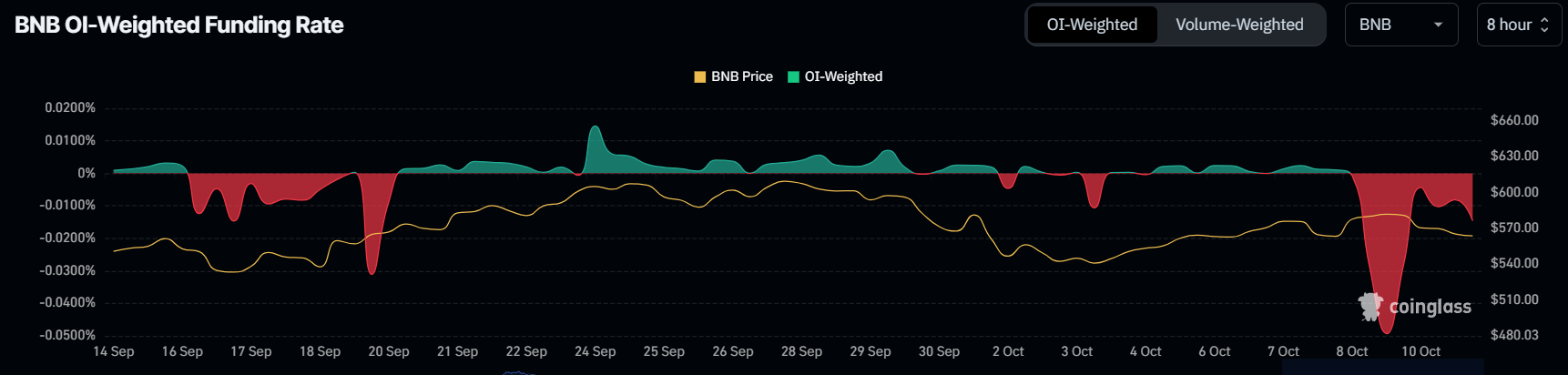

As can be seen from the funding rate, market sentiment towards BNB remains highly bearish. The negative funding rate indicates that traders are increasingly entering into short contracts, betting on price declines. This trend reflects a market environment where traders expect BNB's value to decline in the near future.

The increase in outflows, combined with the bearish funding rate, suggests that many traders are taking positions to profit from potential declines. This widespread pessimism can sometimes become a self-fulfilling prophecy, as the bearish sentiment drives additional selling, pushing the price lower.

BNB Price Prediction: Maintaining Uptrend

Despite the bearish market sentiment, BNB has continued its upward trend since early September. While it failed to break above the $606 resistance level last month, the altcoin has been testing the uptrend support line and maintaining its resilience despite the broader market weakness.

If BNB loses this uptrend support line, it could enter a downward trend and test the $533 support level, which has provided a strong floor for additional declines in the past.

Read more: Binance Coin (BNB) Price Prediction for 2024, 2025, and 2030

On the other hand, if BNB manages to bounce back from the uptrend support, the $569 level could become a new support, potentially allowing the altcoin to reach $606 again. Successfully testing the $606 resistance level would invalidate the current bearish outlook, even if the altcoin faces some frustration in reaching that level.