Author: Michael Nadeau, The DeFi Report; Compiled by Tao Zhu, Jinse Finance

The cryptocurrency market is at a turning point.

Just as many market participants did not fully appreciate the impact of rate hikes on risk assets at the beginning of 2022, we believe the market may be underestimating the impact of rate cuts in 2024/2025.

For most of this year, our view has been that the market will continue to climb to the wall of worry, then peak in 2025.

In this week's report, we share our thoughts on how this scenario may play out and how you can position yourself in this risk environment.

Has ETH/BTC already bottomed?

We believe ETH/BTC may have already reached a cyclical bottom.

6 reasons:

Since 2016, ETH/BTC has consistently made higher lows. The ratio bottomed in early 2017, slightly below 0.01. At the end of 2019, the ratio bottomed, slightly below 0.02, and then bottomed again during the March 2020 crash. Fast forward to September 2024, ETH has just dipped below 0.04.

To me, this suggests that market confidence in ETH has been increasing over time. Let's see if it can hold above 0.04.

In previous cycles, when ETH/BTC has capitulated, it has made a low shortly thereafter. Over the past few months, the ratio seems to have capitulated, dropping from 0.057 to 0.038.

In past cycles, ETH has bottomed after rate cuts. The Fed started cutting rates a few weeks ago.

The Fed's balance sheet is the same way - last cycle we went from net contraction to net expansion, and ETH/BTC bottomed. With the improvement in liquidity conditions, we expect a similar dynamic this cycle.

Historically, as liquidity conditions improve, Bitcoin's dominance declines. It's currently at 57% (near a cycle high).

From a sentiment perspective, ETH has just gone through a period of disillusionment that we haven't seen in a while (due to EIP4844 causing fee reductions, "roadmap mess"). This is market psychology and crypto Twitter impatience. The reality is that Ethereum continues to execute on its roadmap. Kyle Samani's "Why SOL Will Flip ETH" talk at Token2049 seems to mark the bottom of ETH/BTC.

If we are correct that ETH/BTC has bottomed, it would mean that Altcoin season has officially begun.

Catalysts

Observing the sentiment on crypto Twitter over the past few months has been quite interesting. It seems crypto natives are trying to get ahead of the liquidity cycle by jumping to the furthest end of the risk curve (memecoins).

I'm sure many did well from October to March, but most were late, and also got in early to Altcoin season. After all, historically Altcoin season has started after rate cuts. So my sense is that most of the market gave back their gains in Q4 2023/Q1 2024. As the market declined, many sold. Others are reallocating.

"Retail will never come back."

This is exactly the sentiment we need to see from a psychological perspective. Now that the Fed has started the rate cut cycle, there are several catalysts pointing to another explosive top for the market:

Permissive easing. The Fed's rate cuts are effectively allowing all other central banks around the world to cut rates. We've already seen the domino effect in China - China is now aggressively stimulating its economy. It seems they were waiting for the Fed's green light. The key is that when the Fed cuts rates, the dollar will depreciate, reducing the risk of capital flowing into the dollar from China - this gives China more flexibility to lower rates while maintaining stability in its own currency. This dynamic can apply to all central banks globally.

Politics. I hate talking about politics. But we have to address this, as it is indeed quite important, at least in the short term. The key point here is that I believe the Democrats have realized that crypto is not going away. Look at what happened in '23 - the year started with the "Operation Choke Point" attempt by the Biden administration to unconstitutionally cut off crypto businesses from banking. It failed. And Bitcoin went up 187% that year.

What if we elect a president who is pro-crypto? What if we allow banks to custody crypto? What if we get a stablecoin bill? What if the CFTC becomes the primary regulator for digital commodity crypto assets?

Has the market already priced in this factor? Probably not yet. Even if Trump loses, we hope to see progress in these areas.

ETFs. Is this the cycle where your average TradFi friend capitulates and buys some BTC/ETH? We think it's possible. I remember a conversation I had with my friends in 2020, where they were adamantly against Bitcoin. I remember telling them to keep an open mind, and adding that I think not holding any Bitcoin could actually become risky in the not-too-distant future.

At the time, this sounded quite absurd. But my question is: how many cycles of capitulation do people need to observe before they surrender? If you consider yourself a serious investor, you've now seen BTC/crypto run up in 2013, 2017, 2021, and now 2024 (into 2025?).

Innovation. While crypto natives argue whether Solana's "scaling" is L2 or not, and whether we should consider L2s as part of the Ethereum version of Solana, if you look around, you'll see a lot of really cool things happening.

Bitcoin is starting to become more Ethereum-like, and the DeFi and L2 ecosystems are showing some promise.

Ethereum is scaling and executing on its roadmap. Blackrock has an on-chain money market fund, and Visa just announced a tokenization platform on Ethereum.

Solana's Firedancer is now in testnet. Citi and Franklin Templeton have announced plans to tokenize assets on Solana at Breakpoint. Paypal and Societe Generale have launched stablecoins on Solana.

Speaking of stablecoins - issuers are now the 16th largest holder of US Treasuries. We now have permissionless, yield-bearing stablecoins.

Sentiment. In early August, sentiment turned to extreme fear. This is exactly what we need to see before the next big move, and we believe that move is underway.

Altcoin season?

As mentioned earlier, we believe ETH/BTC may have already bottomed. This would mean that Altcoin season has likely officially begun - when long-tail risk assets outperform the majors.

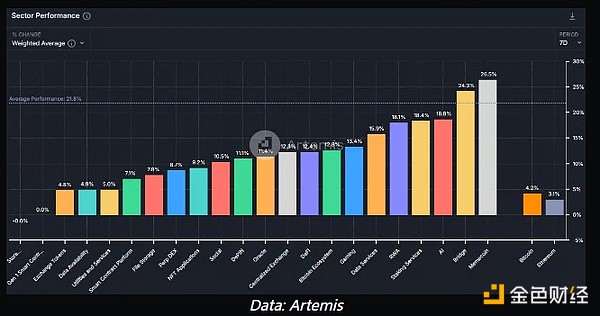

The market has already shown some strength. Here is the 7-day industry performance provided by Artemis, with memecoins leading the way.

Some thoughts and/or predictions on how the cycle may play out:

ETH's performance will clearly outperform BTC, with BTC dominance well below 50%.

SOL's performance will clearly outperform ETH, with Solana infrastructure outperforming Ethereum infrastructure + Solana memecoins outperforming Ethereum memecoins.

TIA and SUI will be the best performing "new L1s" in the current market (closely watching Berrachain and Monad - expected to launch later this year).

Over 10 memecoins will reach a valuation of over $10 billion (there are 2 today). In fact, we may see a $100 billion+ memecoin this cycle. *I will share my comprehensive deep dive on memecoins in November.

AI Coins and DePIN will likely perform similarly to how NFTs did in the previous cycle.

Stablecoin supply will grow to $500 billion (it's $160 billion today).