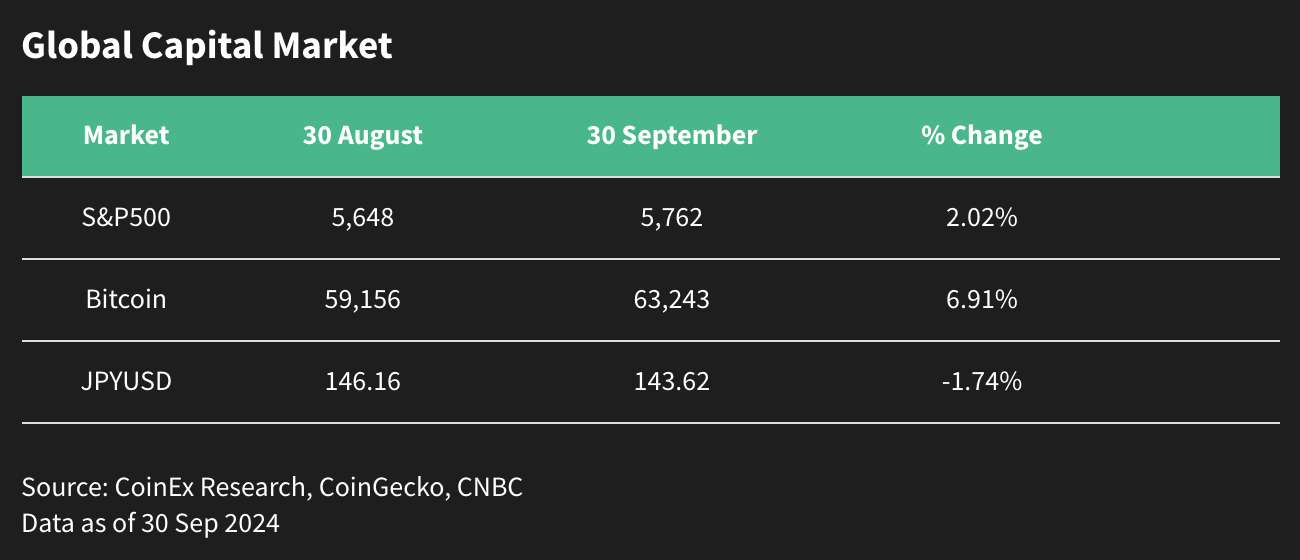

CoinEx Insight released a comprehensive report on the cryptocurrency market in September 2024. The crypto market was driven by major policy changes and new technological developments. The key event this month was the Federal Reserve's 50-basis-point rate cut, which brought a sense of optimism to the market and sparked a strong rebound in risk assets, including cryptocurrencies. This dovish stance was echoed by similar actions from the European Central Bank (ECB) and the Bank of England (BoE), reversing the previous market decline, with Bitcoin leading the way.

Bitcoin's Bullish Breakout

At the beginning of the month, Bitcoin's trading price was unstable, reaching a low of $52,700. However, after the Federal Reserve's rate cut announcement, Bitcoin rose from $58,000 to a recent high of $66,000, ultimately closing at $63,300, a gain of over 20%. This rebound was reflected across the entire cryptocurrency market. Bitcoin is now eyeing the critical $70,000 resistance level, and the macroeconomic outlook for the remainder of 2024 appears positive, especially with the continued impact of the Federal Reserve's policies.

Recession Risk

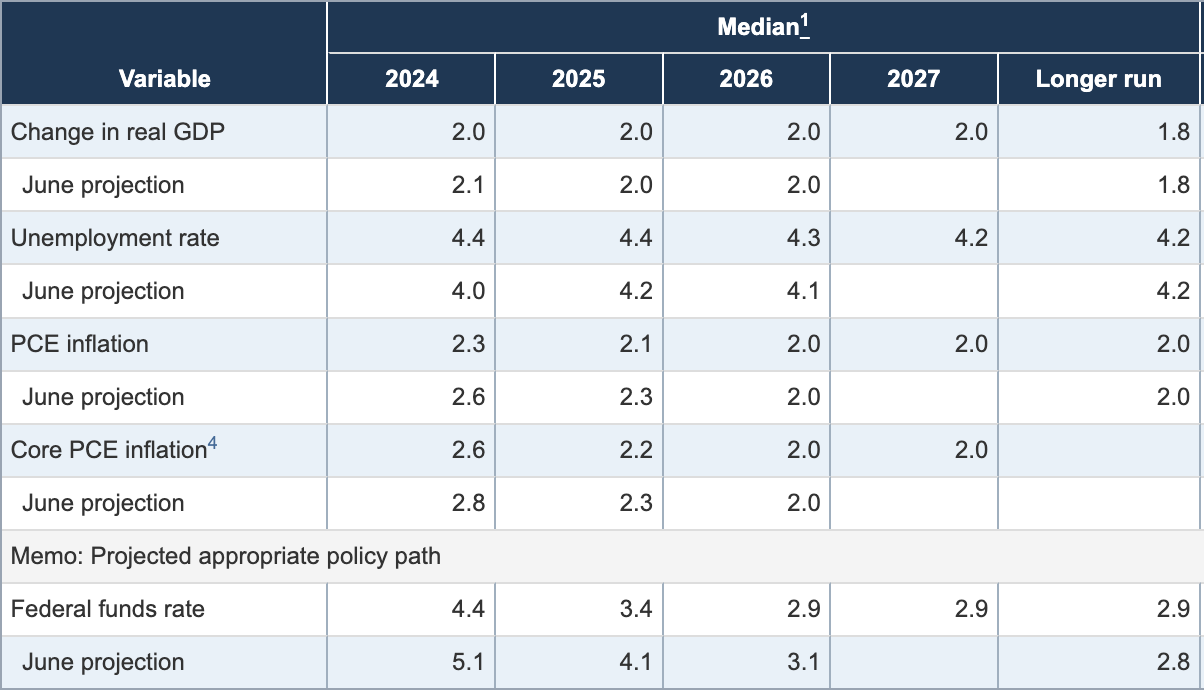

Global markets closely monitored central bank policies in September. The Federal Reserve's recent forecasts show that the GDP growth projections for 2025 and 2026 remain unchanged at around 2%, indicating confidence in the economy's resilience to ongoing policy changes. At the same time, the inflation outlook remains within manageable levels. However, with the expected rise in the unemployment rate, the Federal Reserve's actions reflect potential pressures in the labor market.

Source: Federal Reserve Data as of September 18, 2024

USD/JPY - A Key Variable to Watch

However, market participants are closely monitoring variables such as the USD/JPY exchange rate, as continued rate hikes by the Bank of Japan could impact global liquidity.

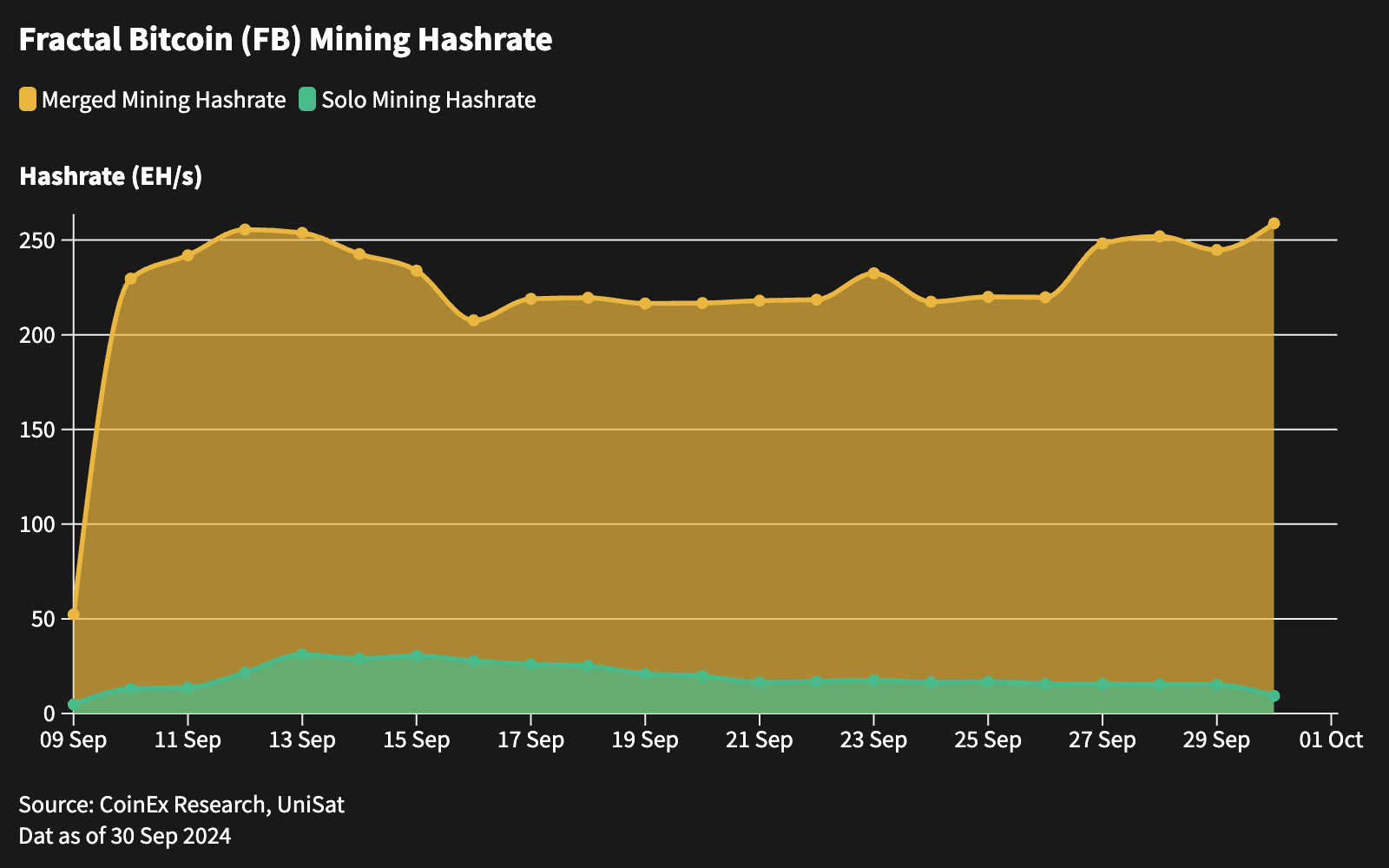

Technological Innovation: Fractal Bitcoin Mainnet

One of the most significant technological developments this month was the launch of the Fractal Bitcoin mainnet on September 9th. Fractal Bitcoin is a Layer 2 solution that improves Bitcoin's transaction efficiency while maintaining compatibility with the main Bitcoin network. It allows for the expansion of functionalities, such as the OP_CAT opcode, enabling developers to test new features without disrupting the core system. This innovation has made Fractal Bitcoin one of the top three proof-of-work chains by computational power, and it has received the support of the ViaBTC mining pool, with CoinEx being the first exchange to list its native FB token.

For CoinEx's analysis of Fractal Bitcoin, please refer to "Fractal Bitcoin: The Pioneering Network of Bitcoin - Analysis of Technical Innovation and Challenges".

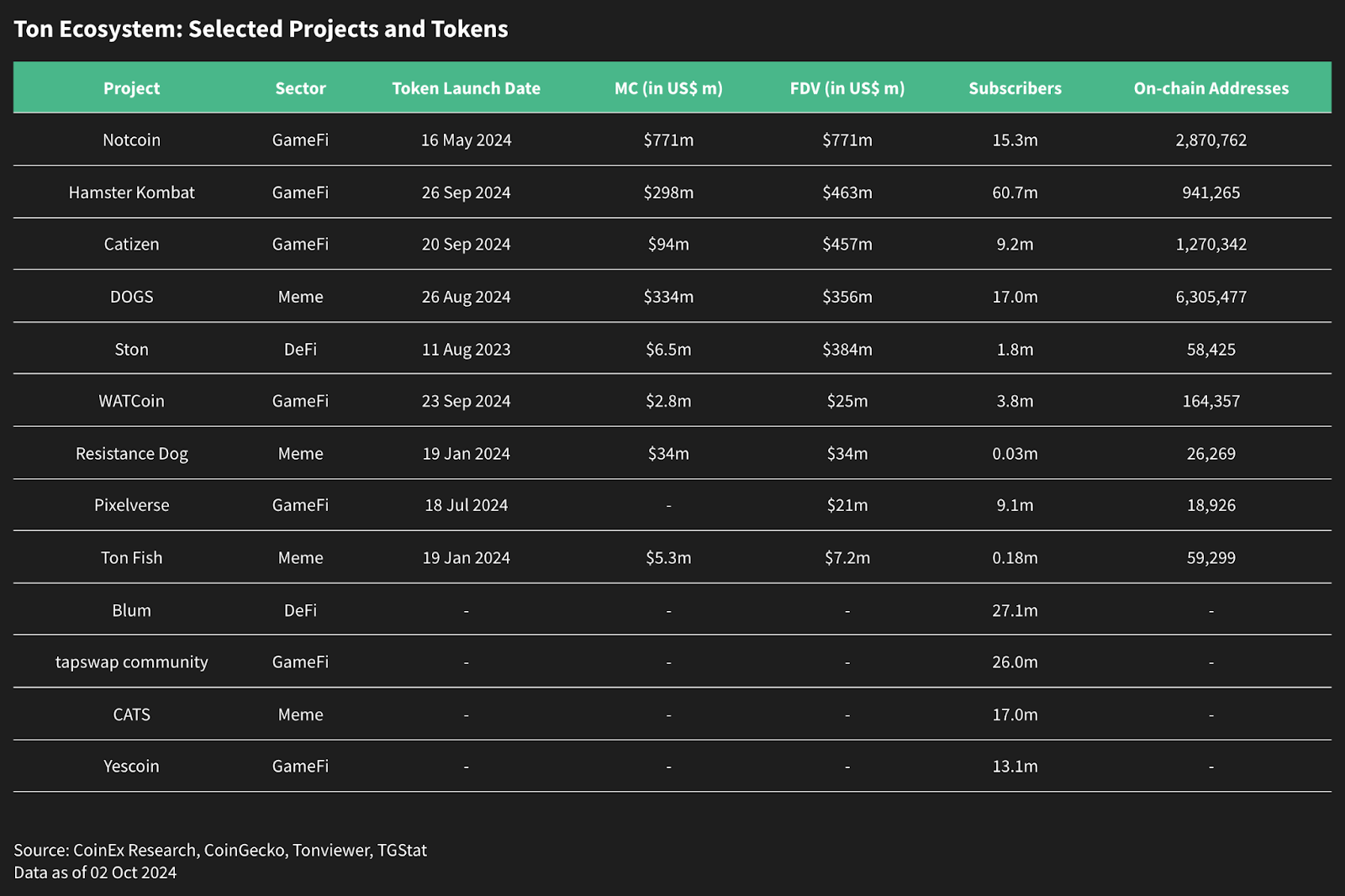

Challenges in the Ton Ecosystem

Despite the optimism in the crypto market, the Ton blockchain faced challenges with its new tokens, CATI and HMSTR. These tokens underperformed after their listings, declining by 55% and 35%, respectively. Concerns have been raised about the sustainability of the "click-to-earn" model, as market saturation may limit the appeal of similar projects. The future of the Ton ecosystem will largely depend on its ability to provide a unique value proposition to sustain long-term growth.

The Meme Token Craze Fueled by Social Media

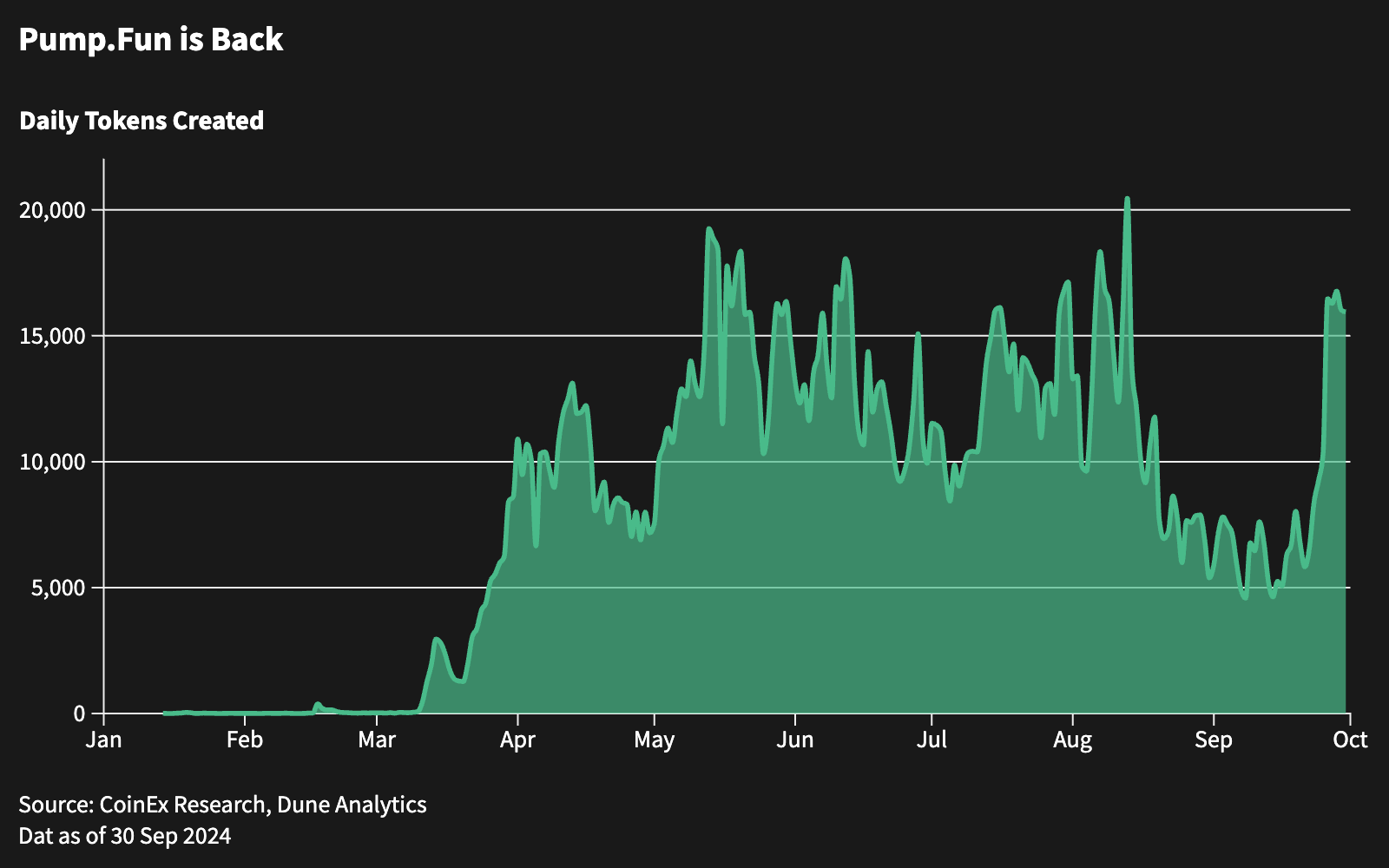

September also witnessed the resurgence of meme tokens, driven by viral trends on social media. Animal-themed tokens, such as the Thai Pygmy Hippo Moo Deng, Penguin (PESTO), and Frog (OMOCI), generated speculative interest, particularly on the Solana blockchain. The daily token creation rate on Pump.Fun has rebounded to the highs seen earlier this year. While meme tokens have garnered attention, their volatility remains extremely high, and investors are advised to exercise caution during such hype cycles.

Looking Ahead: Economic Data and Market Sentiment

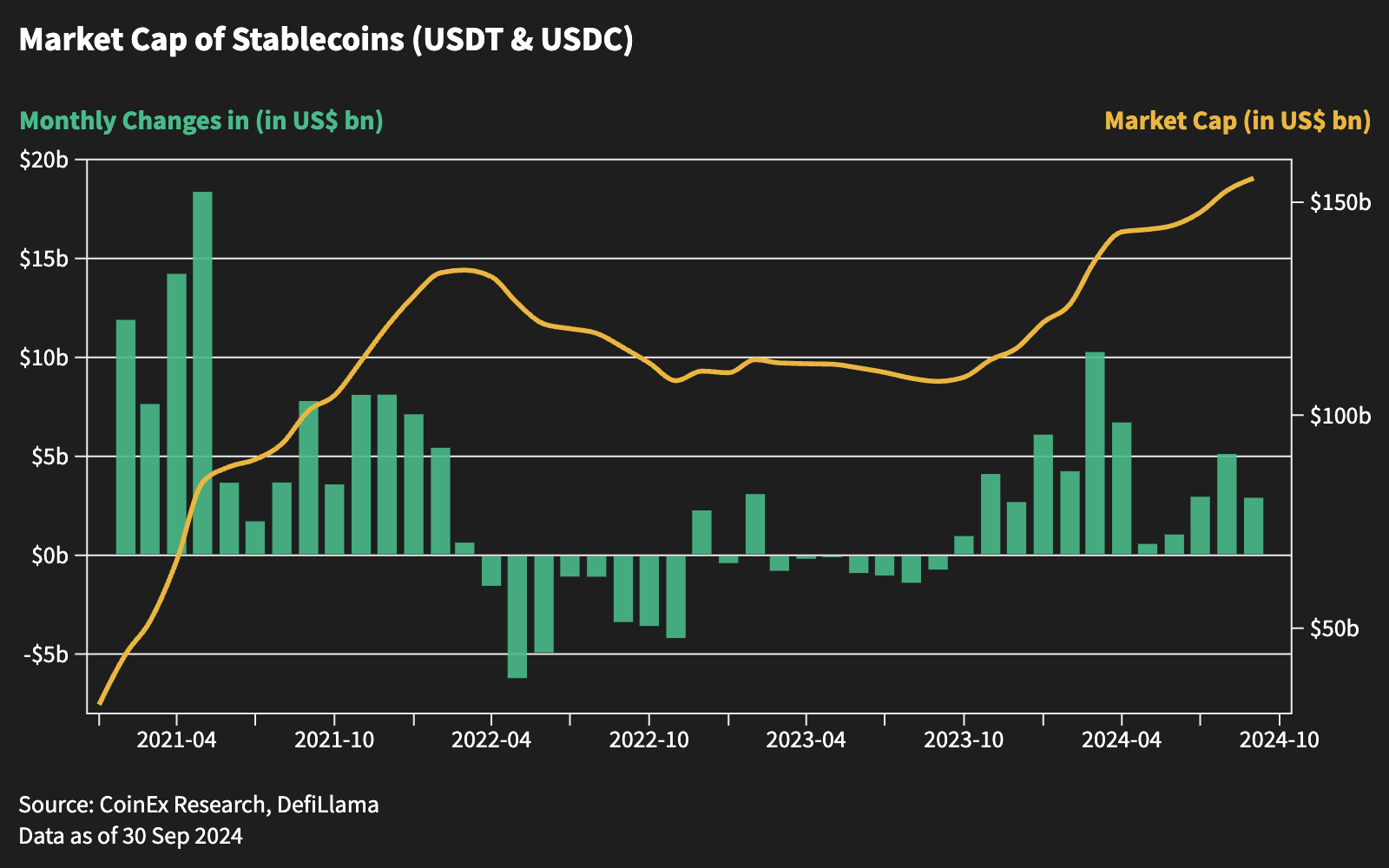

Although stablecoin inflows have slowed, September ended with $2.9 billion, reflecting the market's sustained investor confidence. As October unfolds, market participants will closely monitor economic data and the U.S. elections, which could spur the next wave of activity in the crypto space.

In summary, September 2024 was a pivotal month for cryptocurrencies, with macroeconomic policies, technological innovations, and speculative trends playing crucial roles in shaping the market's direction. With global monetary policies becoming more accommodative and technological advancements, the outlook remains optimistic as we move towards 2025.

About CoinEx

CoinEx, founded in 2017, is a global cryptocurrency exchange committed to simplifying crypto trading. The platform offers a wide range of services, including spot and futures trading, margin trading, swaps, automated market makers (AMMs), and financial management services, serving over 10 million users across more than 200 countries and regions. Since its inception, CoinEx has adhered to the principle of "user-centric" service, cultivating a fair, respectful, and secure crypto trading environment, enabling individuals of all experience levels to easily enter the world of cryptocurrencies with user-friendly products.

CoinEx Research is dedicated to providing in-depth analysis and insights to help investors navigate the ever-evolving cryptocurrency market and uncover the complexities and opportunities of the future.

To learn more about CoinEx, please visit: Website|Twitter|Telegram|LinkedIn|Facebook|Instagram|YouTube