Author: Stella L (stella@footprint.network)

Data Source: Footprint Analytics Games Research Page

In September, the total market capitalization of blockchain game tokens grew by 29.2% to $23.2 billion, and the number of daily active users (DAU) increased by 12.3% to 4.7 million. A notable trend is the rapid rise of Telegram games, which has sparked fierce competition between blockchain networks and centralized exchanges in user acquisition. However, this prosperous situation has raised questions about the sustainability of on-chain participation.

Meanwhile, new regulatory challenges are gradually emerging, and some established projects are beginning to rethink their blockchain integration strategies. As the industry continues to adapt to these changes, the focus remains on leveraging blockchain technology to effectively create sustainable and engaging gaming experiences.

Macro Market Review

The crypto market exhibited strong performance in September. Bitcoin opened at $57,429 and closed the month at $63,485, a 10.5% increase. While Ethereum also performed positively, it did not match Bitcoin's gains. Ether started at $2,426 and ended at $2,603, a 7.3% increase. Notably, the ETH/BTC price ratio reached a new cycle low of 0.0386 in mid-September.

Data Source: Bitcoin and Ethereum Price Trends

Several key factors contributed to this positive market sentiment:

- Monetary Policy Shift: On September 18, the Federal Open Market Committee (FOMC) unexpectedly implemented a larger-than-expected 50 basis point rate cut. Later in the month, Chinese policymakers implemented macroeconomic stimulus measures, providing support for global equity markets.

- Regulatory Progress: The US regulatory environment showed signs of improvement. The SEC approved the listing of spot BTC ETP (exchange-traded product) options, and more similar applications are expected to be approved.

- Institutional Adoption: Bank of New York Mellon appears to be preparing to offer crypto asset custody services, a move that could further solidify the legitimacy of cryptocurrencies in the financial sector.

- Political Support: The political landscape also saw positive changes. Former US President Trump announced a new DeFi protocol, and Vice President Harris made statements supporting digital assets and blockchain technology.

Blockchain Gaming Market Overview

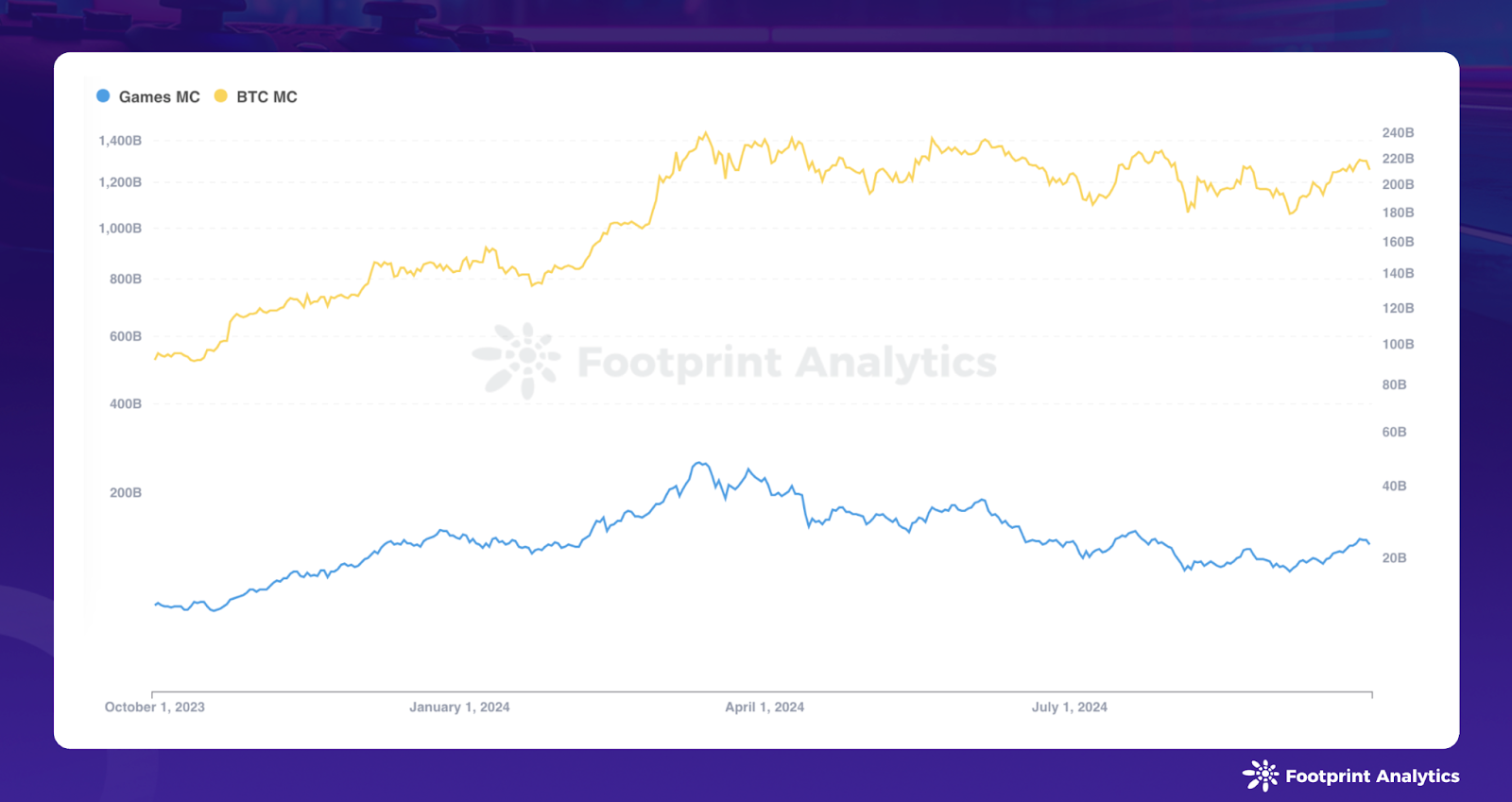

In September, the Web3 gaming sector experienced a rebound, consistent with the overall upward trend in the crypto market. The total market capitalization of blockchain game tokens surged from $18 billion to $23.2 billion, a significant 29.2% increase. This recovery, following the substantial decline in the previous month, demonstrates the close correlation between the sector and the broader crypto market dynamics.

Data Source: Blockchain Game Token Market Cap and BTC Market Cap

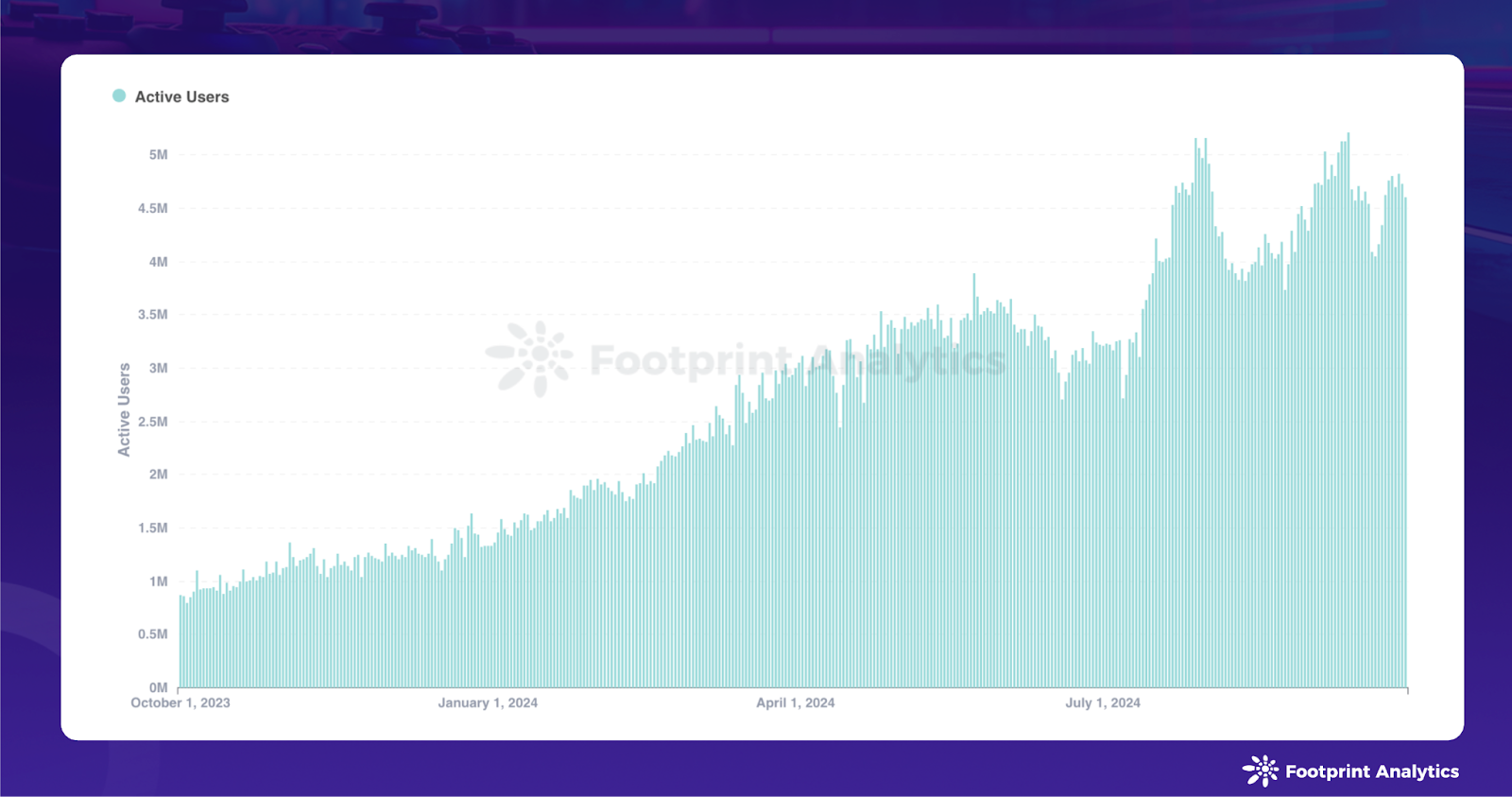

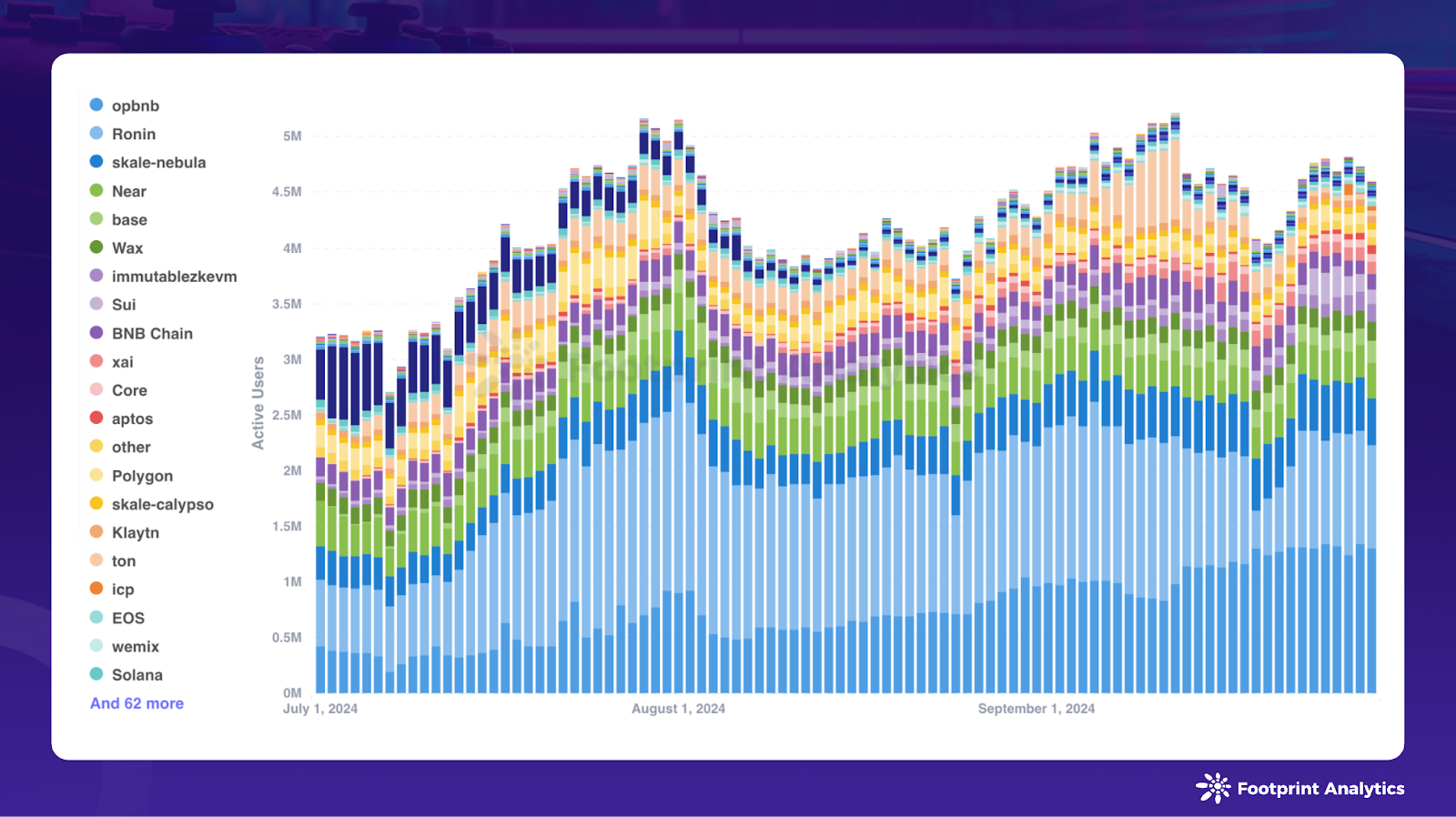

User engagement continued to show an upward trend, with daily active users (DAU) calculated by unique wallets reaching 4.7 million in September. Compared to August, this represents a 12.3% growth, primarily driven by increased activity on the opBNB network.

Data Source: Blockchain Game Daily Active Users

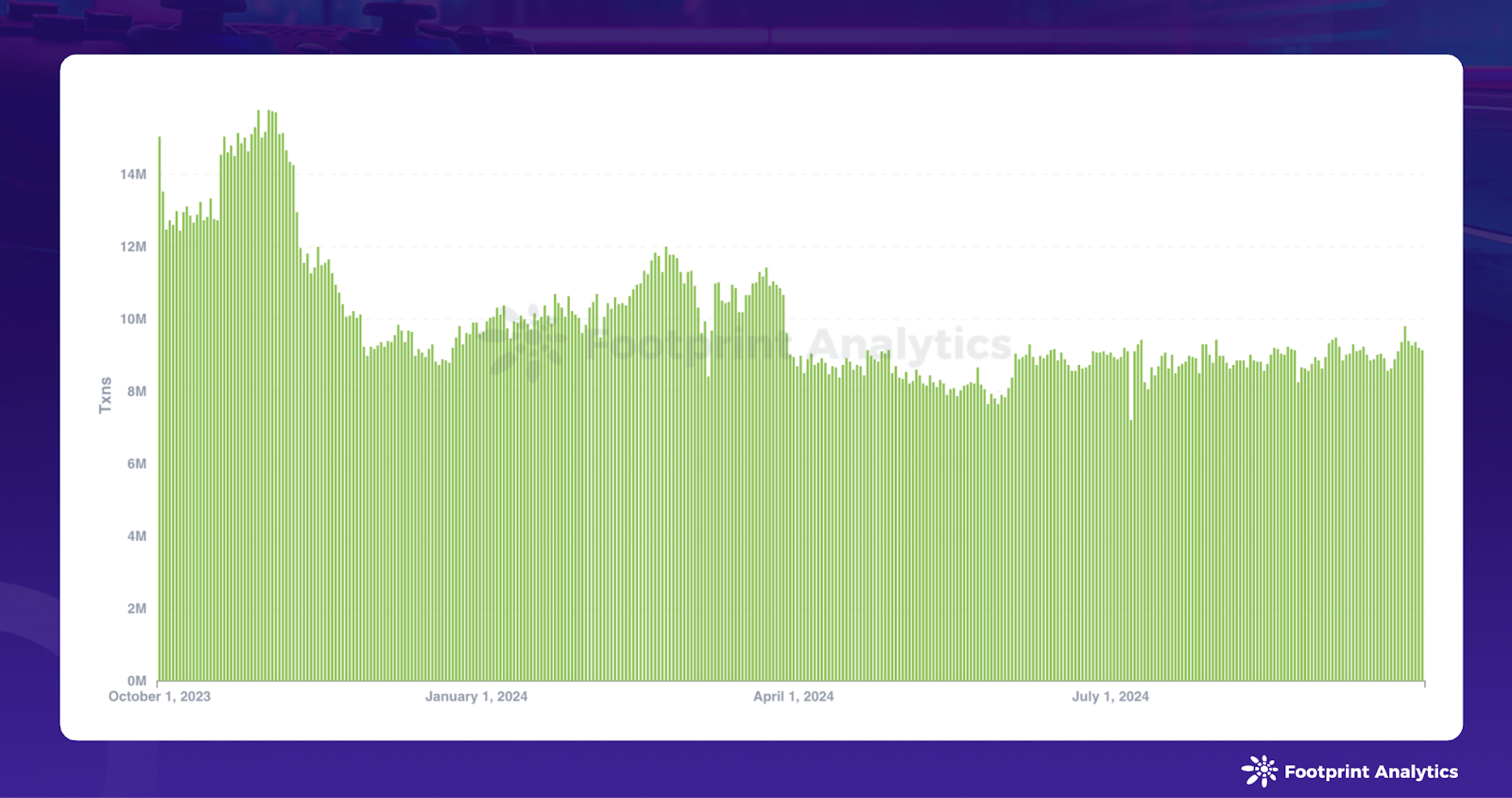

Transaction metrics also showed improvement, with the average daily transaction volume for blockchain games reaching 9.1 million, a slight 2.5% increase from August.

Data Source: Blockchain Game Daily Transaction Volume

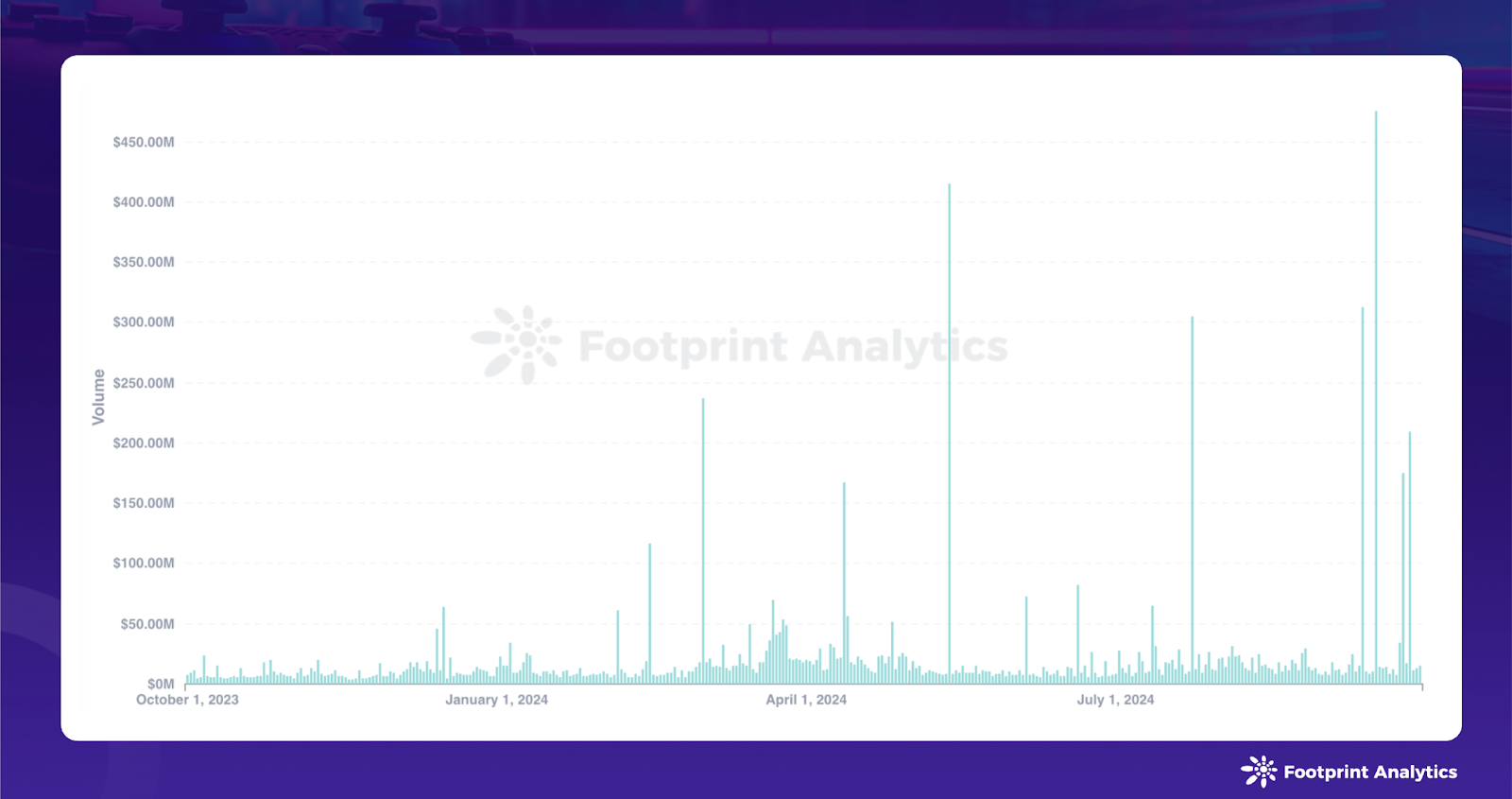

However, the daily transaction value for blockchain games declined by 22.9%, settling at $13.1 million. It's worth noting that this data excludes several anomalous data points on September 13, 17, 25, and 27 due to internal wallet transfers within a single game.

Data Source: Blockchain Game Daily Transaction Value

In September, the focus shifted significantly towards games based on the Telegram platform. This trend manifests in two key ways:

On one hand, the expansion of blockchain networks: In addition to TON, multiple blockchain networks are competing to attract users from the Telegram ecosystem, a trend that emerged in the previous month. For example, the BNB Chain has integrated with Telegram, providing a seamless onboarding experience for users and developers.

On the other hand, the competition of centralized exchanges (CEXs): CEXs are actively vying for Telegram's traffic, viewing it as a crucial user acquisition channel. Binance stands out in this regard, rapidly listing four Telegram and TON-based tokens. In September, Binance announced the 58th project, Hamster Kombat (HMSTR), and the 59th project, Catizen (CATI), on its Launchpool, continuing the momentum from the August listings of Toncoin (TON) and Dogs (DOGS). Other exchanges, such as Bitget, are also making strategic investments, such as a $30 million injection into the TON blockchain.

Catizen

This trend is not limited to exchanges, as various entities and projects are also launching their own Telegram-based initiatives. Binance is set to launch a Telegram mini-app game called Moonbix, while CryptoKitties has announced a Telegram game called "CryptoKitties: All The Zen".

At the 2024 Token2049 conference in Singapore, Bybit CEO Ben Zhou shared some data: "Some tokens have brought us hundreds of thousands of new registered users, with 400,000 to 500,000 of them becoming deposit users. (These new users) mainly come from Eastern Europe, Africa, South Asia, Nigeria, India, and some European countries."

TON has established effective user acquisition channels and conversion funnels with exchanges, inspiring similar strategies across the industry. However, there are signs that this acquisition effect may be weakening, as the same users may be circulating across various projects.

While these games have performed well in user acquisition, their contribution to on-chain activity seems limited. Most games only tokenize their assets, while the gameplay and assets remain off-chain. This structure raises questions about long-term sustainability and economic viability.

The data suggests a disconnect between user acquisition and sustainable on-chain engagement. Without sustained on-chain user activity, these games and developments may struggle to maintain economic vitality in the long run. As the industry evolves, bridging the gap between initial appeal and ongoing on-chain participation is crucial for the healthy development of the Web3 gaming ecosystem.

Blockchain Game Chains

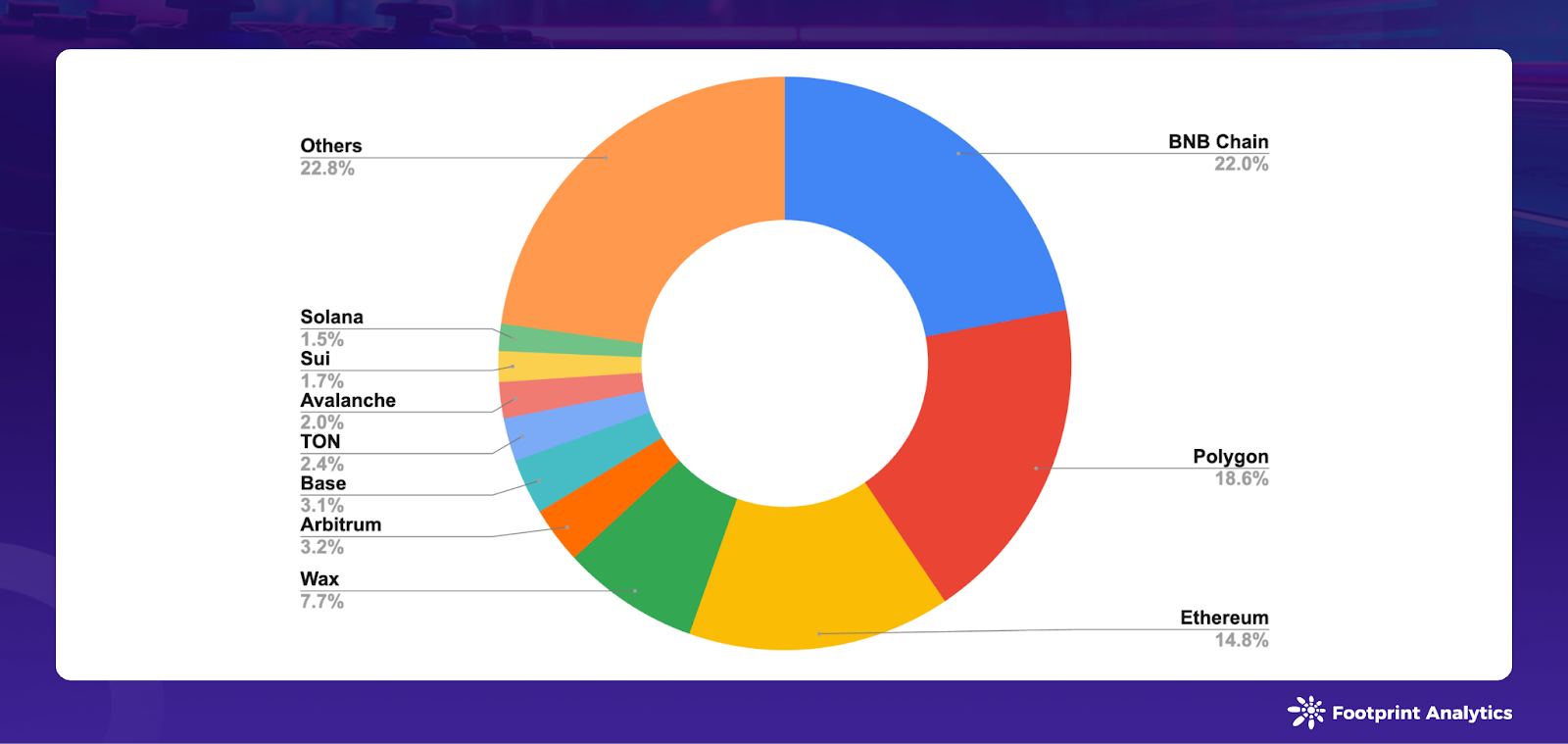

In September, the number of active games across blockchain networks increased to 1,563, a 4.5% growth from August. The market leadership remained stable, with BNB Chain, Polygon, and Ethereum accounting for 22.0%, 18.6%, and 14.8% of the total game count, respectively.

Data Source: Active Game Projects Across Blockchain Networks

The DAU landscape saw significant changes, with opBNB, Ronin, and Nebula (SKALE subnet) emerging as the best-performing chains, with average daily DAUs of 1.1 million, 1.1 million, and 458,000, respectively. As of the end of September, these chains accounted for 28.2%, 20.1%, and 9.2% of the total DAU share.

Data Source: Daily Active Users Across Blockchain Networks

opBNB showed significant growth, with its average DAU in September increasing by 62.0% compared to August, and its market share rising from 22.4% to 28.2% within the month. This growth was driven not only by the popular game SERAPH: In The Darkness, but also by the new game Elfin Metaverse launched in mid-September, which is an esports gaming platform and open-world metaverse.

In contrast, Ronin's DAU share continued to decline, dropping from 29.5% in August to 20.1% in September. This trend was mainly attributed to the declining performance of Pixels, whose DAU fell from over 700,000 to 470,000 within the month. It is worth noting that although Ronin's average DAU in August was nearly double that of opBNB, opBNB surpassed Ronin in September, marking a significant shift in the competitive landscape.

Sui's average daily DAU grew by 48.4% to 92,000, benefiting from the success of the Telegram game BIRDS, which attracted a large number of users in its first week of launch. This achievement highlights the trend of blockchain projects leveraging Telegram for user acquisition.

Core's average DAU grew by 66.9% to 62,000, driven by the second season of the Core Ignition Drop, which included not only BTCFi but also Web3 games. Games like World of Dypians and Pixudi played a key role in attracting users to the Core ecosystem.

Pixudi

The competition between blockchains in terms of games and users is becoming increasingly fierce. The Treasure DAO community is discussing a proposal to consider migrating its Web3 gaming ecosystem from Arbitrum to ZKsync. This potential migration is mainly due to the delayed implementation of Arbitrum's "Gaming Catalyst Program", which proposed to allocate 200 million ARB tokens over two years to incentivize game development on its blockchain.

Overview of Blockchain Games

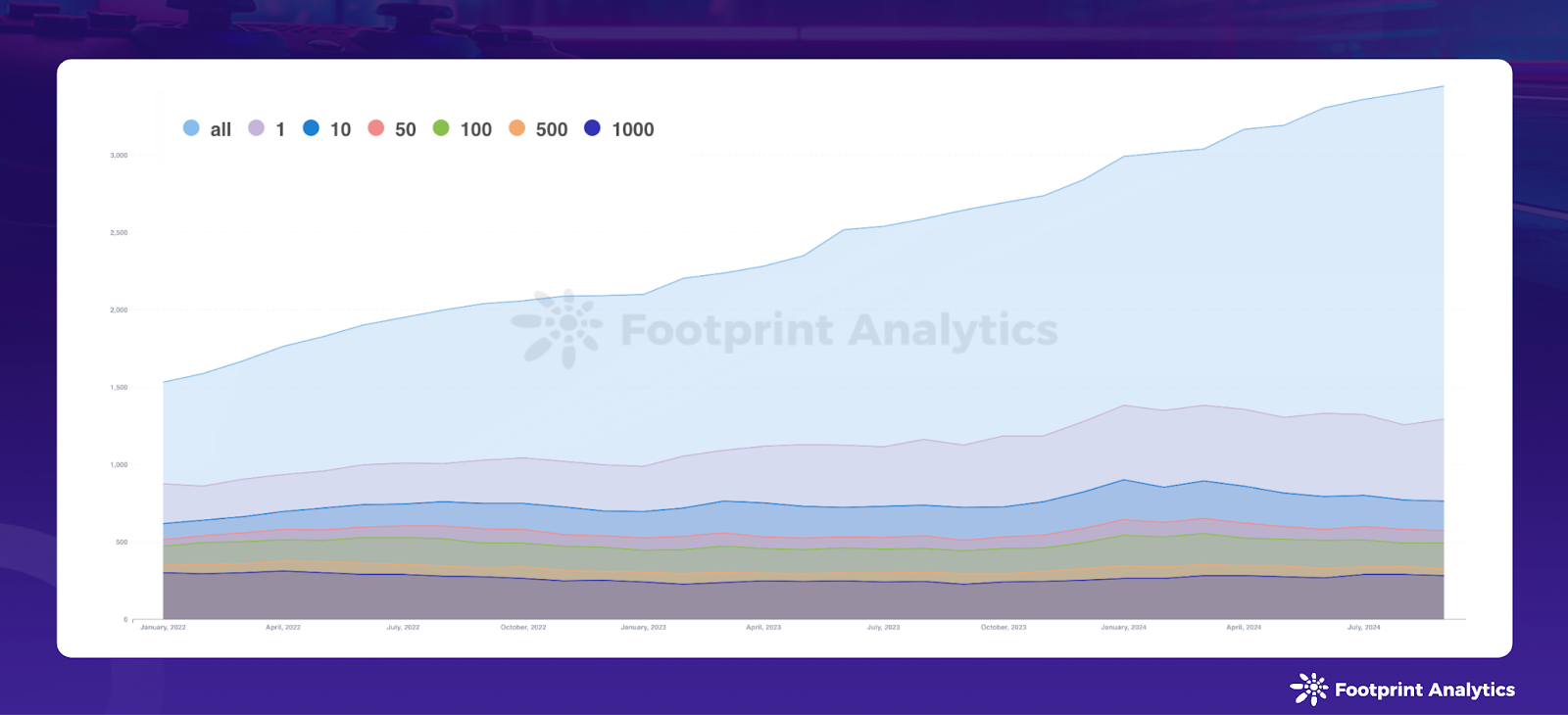

The blockchain gaming sector now includes 3,448 games, with 1,295 of them being active. Notably, 285 games have attracted over 1,000 monthly active on-chain users (MAU), accounting for 8.3% of all games and 22.0% of active games. This distribution highlights the ongoing challenges in user retention and engagement faced by the blockchain gaming industry.

Source: Monthly Active Blockchain Games

In September, the blockchain gaming industry faced new regulatory scrutiny, extending beyond the previous focus on CEXs, stablecoins, and DeFi. A notable case was the accusation against the fantasy sports company Sorare in the UK for "providing unlicensed gambling facilities". This case indicates that regulators are increasingly focusing on blockchain gaming platforms, especially those that blur the lines between gaming, gambling, and digital asset trading.

Also in September, the blockchain gaming sector witnessed the exit of certain projects. The Roguelike card-building game Dimensionals, developed by Mino Games, officially transitioned to a pure Web2 model, abandoning its initial blockchain and Non-Fungible Token (NFT) integration. Mino Games had received strong support from venture capital firms such as Andreessen Horowitz (a16z), Y Combinator, and Standard Crypto, with a total funding of $18.2 million.

The project's Web3 journey began with the launch of the Genesis Stone series in March 2023, but faced numerous challenges, including bot invasions and DDoS attacks during the whitelist giveaway event. This well-funded project's transition from Web3 to Web2 has sparked important discussions about the challenges of integrating blockchain technology into traditional game models, as well as the long-term viability of certain Web3 gaming paths.

Increased regulatory scrutiny and technical implementation difficulties are forcing companies to re-evaluate their strategies. Successful projects need to navigate compliance issues skillfully, ensure robust security, develop engaging game mechanics that demonstrate the value of blockchain integration, and strike a balance between meeting the expectations of traditional gamers and crypto enthusiasts.

Blockchain Gaming Investment and Fundraising

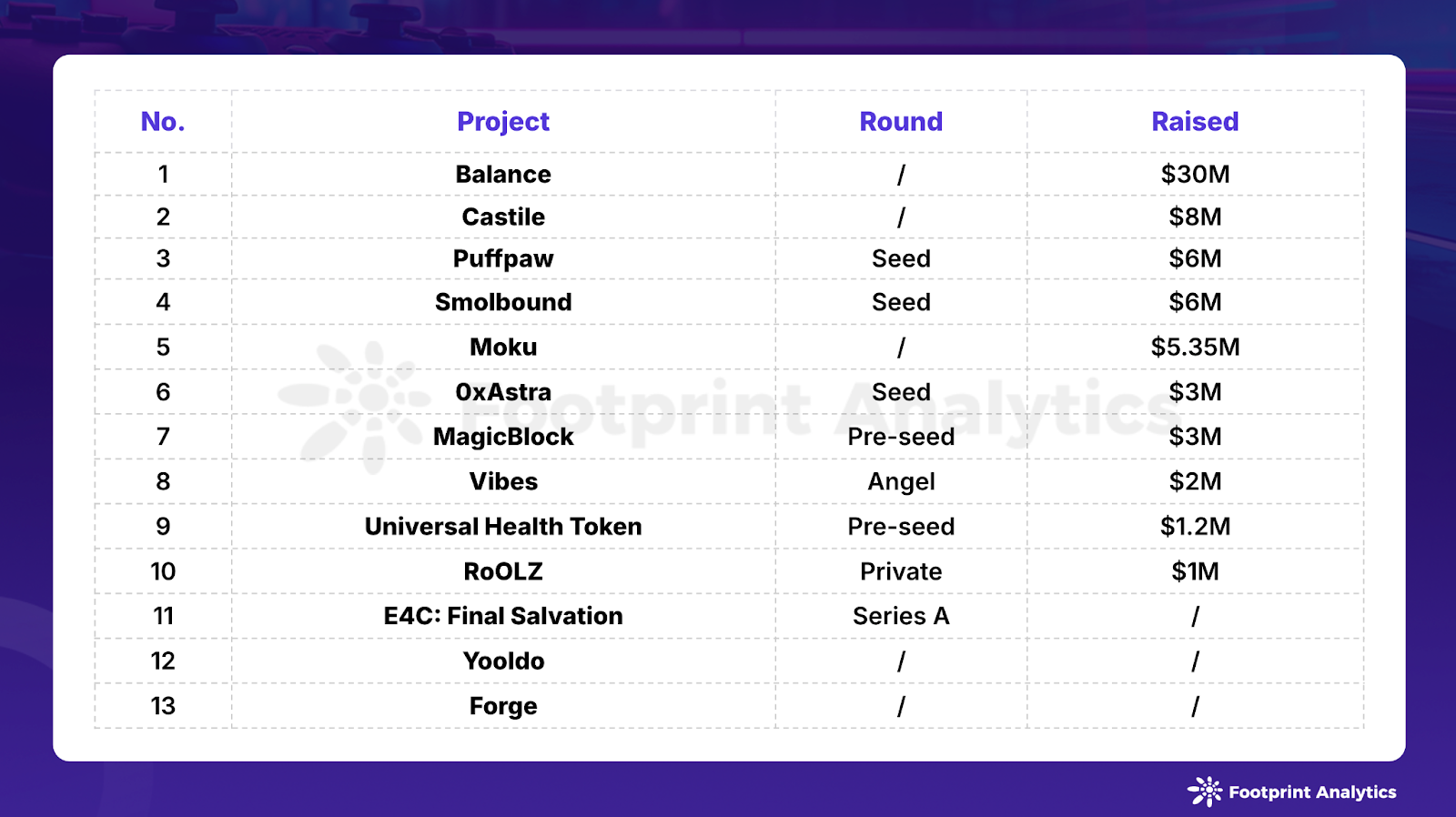

In September, the Web3 gaming sector raised $65.6 million across 13 funding events, an increase of 6.6% compared to August. Three of these funding events did not disclose the specific amounts.

Blockchain Gaming Fundraising Events in September 2024 (Source: crypto-fundraising.info)

The gaming and social platform E-PAL launched its AI-powered blockchain experience platform, Balance, following two successful funding rounds led by a16z and Galaxy Interactive. This major investment will primarily be used for the development of the Balance infrastructure, which is crucial for E-PAL's ambitious goal of building an open, inclusive, and fair Web3 ecosystem. This move also highlights the convergence of AI, blockchain, and social gaming platforms.

Speaking of a16z, its gaming fund, Game Fund One, with a launch size of $600 million, has achieved significant results in the past two years. The fund announced that it will invest $30 million in technology startups related to gaming, focusing on frontier areas such as AI, VR/AR, and Web3 games. The application window opened on August 26, 2024, and closed on September 30, 2024, with plans to officially launch in San Francisco in January 2025. Selected startups will receive comprehensive support, including expert talks, personalized mentoring, and a $750,000 investment per company, as well as access to the expertise and resources of the a16z SPEEDRUN team.

Additionally, some innovative projects have also secured new funding.

Puffpaw, an innovative platform that combines health initiatives with blockchain technology, raised $6 million in a seed round. Their "Quit Smoking & Earn" model, built on the Berachain, represents a new approach to incentivizing positive health behaviors through blockchain rewards.

Universal Health Token (UHT), which gamifies medical health through blockchain technology, successfully raised $1.2 million in a pre-seed round, attracting investments from industry leaders such as Animoca Brands and Polygon. This project demonstrates the trend of applying game principles and blockchain to traditional non-gaming domains, with the potential to revolutionize the way health participation and management are approached.

The data in this report is sourced from the Games Research page of Footprint Analytics, a real-time data dashboard that provides comprehensive and reliable Web3 gaming statistics. If you find any chains or games that are not included and would like to have them added to the dataset, please contact us. You can also self-submit contracts through this link.

___________________

The content of this article is for industry research and communication purposes only and does not constitute any investment advice. The market has risks, and investments should be made with caution.

About Footprint Analytics

Footprint Analytics is a comprehensive blockchain data analysis platform that simplifies complex analysis for enterprises and projects in the Web3 ecosystem. It provides customized solutions, eliminating the need for extensive professional knowledge and infrastructure maintenance. The platform offers tools aimed at helping build and manage long-term community growth, emphasizing sustainable growth and user loyalty. By combining powerful analytics tools and community management tools, Footprint Analytics enables projects to effectively leverage blockchain data for decision-making and growth strategies, covering areas such as GameFi, Non-Fungible Tokens (NFTs), and Decentralized Finance (DeFi).

Website | X (Twitter) | Reports | Blog | Telegram | Discord