Compiled by: Shu Tu Blockchain Research Institute

Source: Shu Tu Blockchain

In recent years, stablecoins have gradually integrated into the global economy, particularly exhibiting strong growth momentum in emerging markets. VISA's latest report shows that stablecoins, as a new form of currency or representation, have expanded from their initial use as collateral or exchange medium for crypto assets to various aspects of ordinary users' financial lives. An increasing number of retail and institutional users have also started to embrace this emerging technology, driving further innovation in the global payment system.

In the report, VISA combined the survey results of cryptocurrency users from five key emerging market economies (Brazil, India, Indonesia, Nigeria, and Turkey) with new on-chain estimation data, along with qualitative analysis, to form a comprehensive picture of the global stablecoin usage. The report focuses on the use of stablecoins in non-crypto areas, such as remittances, cross-border payments, payroll, trade settlement, and B2B transfers.

I. Overview of the Stablecoin Market

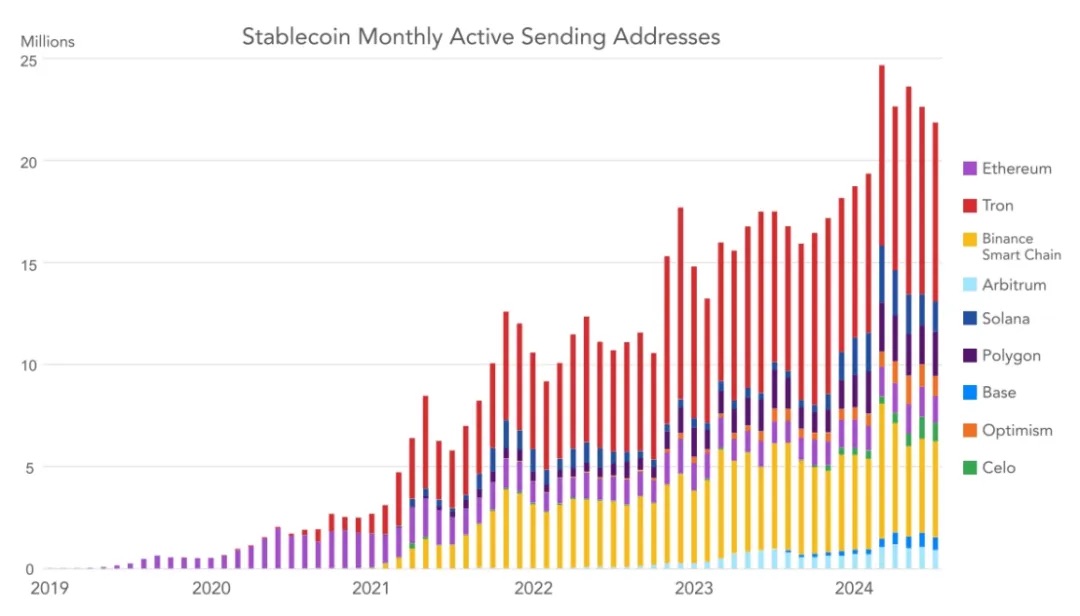

Stablecoins are the "killer application" in the crypto space currently. Today, the total value of stablecoins in circulation exceeds $160 billion, while in 2020 this figure was only a few billion dollars. More than 20 million addresses are engaged in stablecoin transactions on public blockchains each month. In the first half of 2024 alone, the settlement volume of stablecoins exceeded $26 trillion. Stablecoins have significant advantages over existing payment systems: on-chain programmability, strong auditability, instant settlement, self-custody of funds, and interoperability.

Although stablecoins were initially used by traders and crypto exchanges as collateral and a medium of exchange for asset trading, they have now transcended this domain and are being widely applied in the global economy. In emerging markets, the applications of stablecoins in payments, currency substitution, and accessing high-quality yields are accelerating.

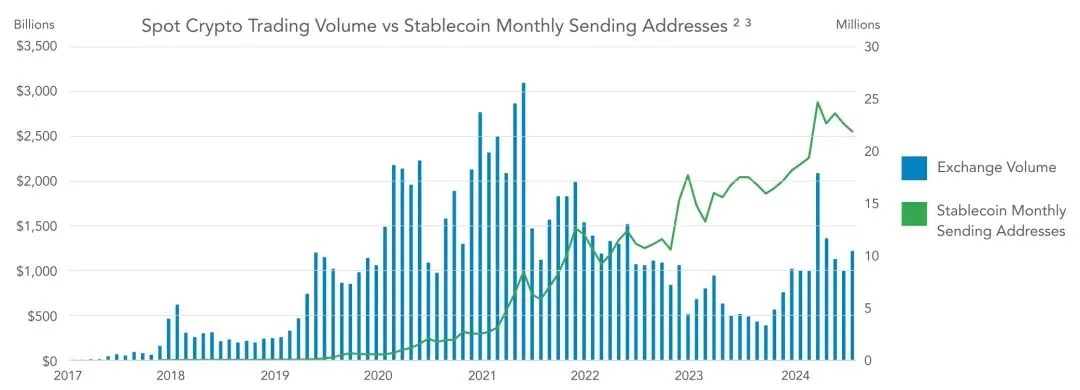

Based on the divergence between the level of stablecoin activity and the crypto market cycle, it is evident that the use of stablecoins is no longer solely serving crypto users and trading use cases.

The non-trading use cases of stablecoins are continuously increasing, particularly in emerging markets. They are used for currency substitution (to avoid volatility or local currency depreciation), as alternatives to US dollar bank accounts, for business-to-business and consumer payments, to access various forms of yield products, and for trade settlement. Stablecoins are particularly attractive in countries with high inflation or lacking a fiat financial system.

II. On-Chain Stablecoin Data

2.1 Stablecoin Market Growth Over the Years

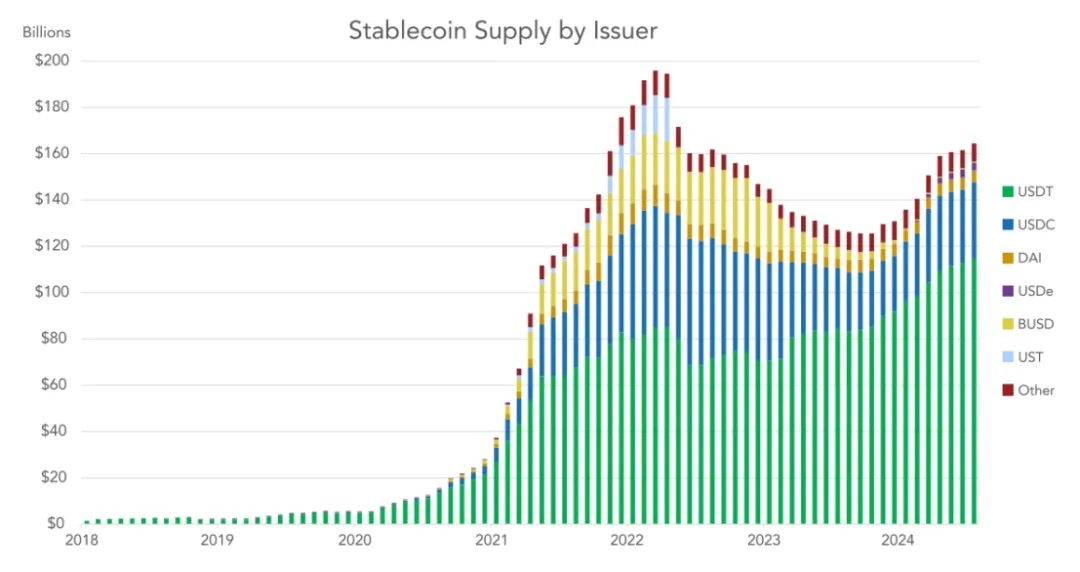

Since 2017, the total supply of stablecoins has grown rapidly. At that time, the total circulating volume of stablecoins was less than $1 billion, and it reached a peak of around $192 billion in March 2022, before the Terra UST collapse and the credit crisis. The credit crisis suppressed native crypto interest rates, reduced crypto trading volumes, and damaged the balance sheets of crypto-native companies. After the credit crisis subsided, from December 2023 onwards, as calls for a Bitcoin ETF approval in the US grew louder, major crypto assets began to rebound, and the stablecoin supply started to recover.

In recent months, with various regulatory bodies passing clear stablecoin legislation to attract issuers, new forms of stablecoins have been continuously emerging. Some of the most proactive jurisdictions in developing stablecoin regulatory frameworks include the EU, Singapore, Dubai, Hong Kong, and Bermuda.

2.2 Adjusted and Refined Data

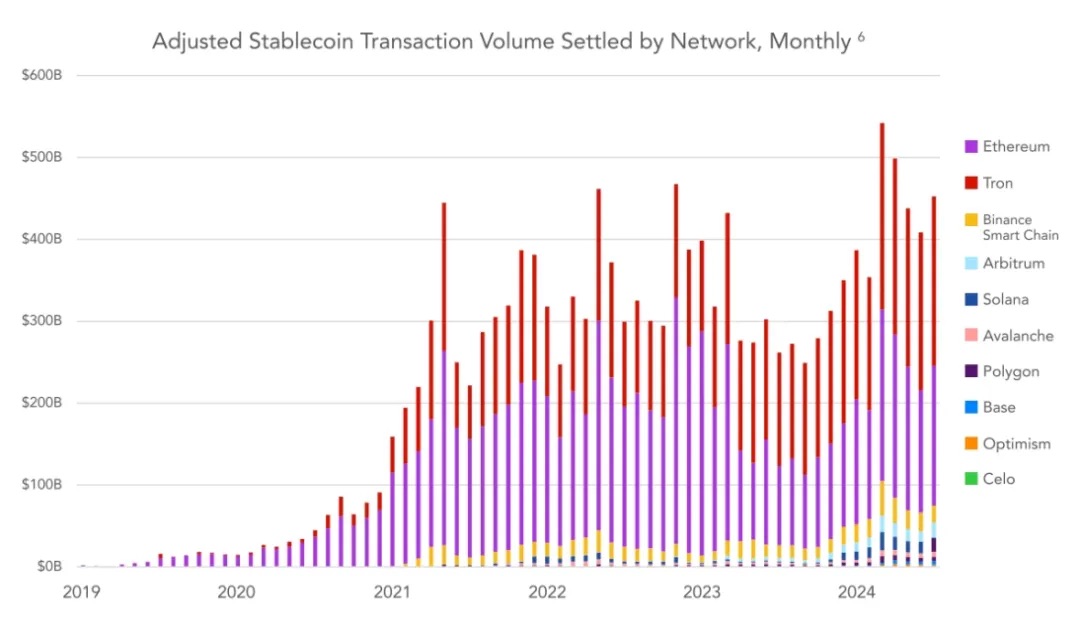

In this study, VISA conducted extensive de-noising and de-duplication work, ultimately arriving at a more conservative settlement volume estimate. The adjusted settlement volume is still an elusive figure, and VISA does not consider its estimate authoritative, but believes the data is still close to the actual situation.

According to VISA's adjustments, the conservative estimate for the total stablecoin settlement volume in 2023 is $3.7 trillion, and $2.62 trillion in the first half of 2024, with an expected $5.28 trillion for the full year of 2024. Notably, despite the crypto asset selloff and declining trading volumes in 2022 and 2023, the settlement volume of stablecoins has been steadily growing through the market cycle. This further demonstrates that stablecoins have attracted a new user base that is interested in using them for purposes beyond just crypto asset settlement.

After de-noising, the most popular blockchains by settlement value as of June 2024 are: Ethereum, TRON, Arbitrum, Base, BSC, and Solana.

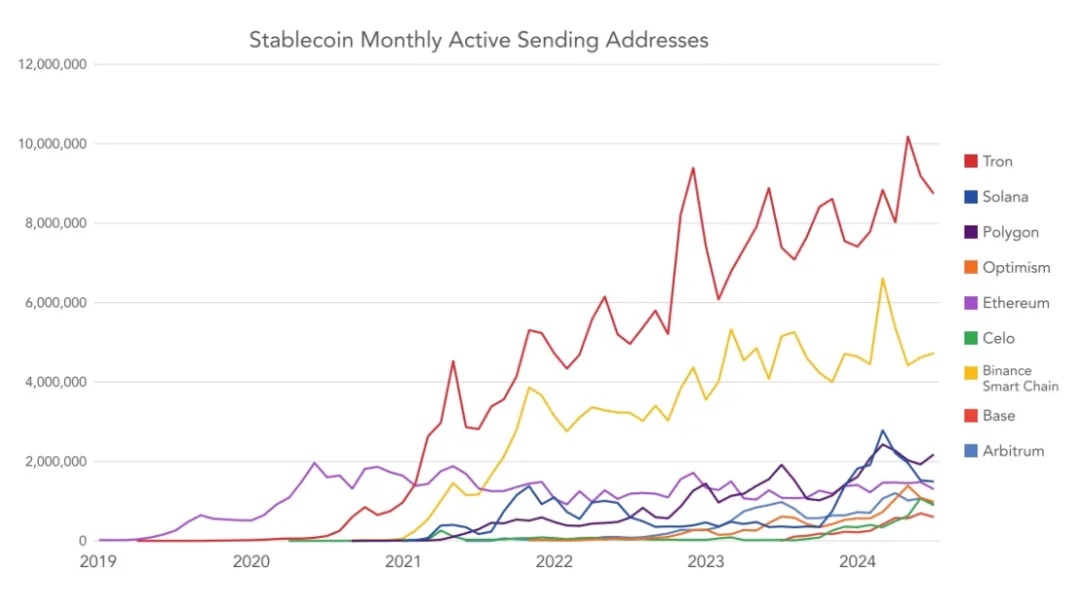

The most popular blockchains for stablecoin transfers are: TRON, BSC, Polygon, Solana, and Ethereum.

2.3 Dollarization of Stablecoins

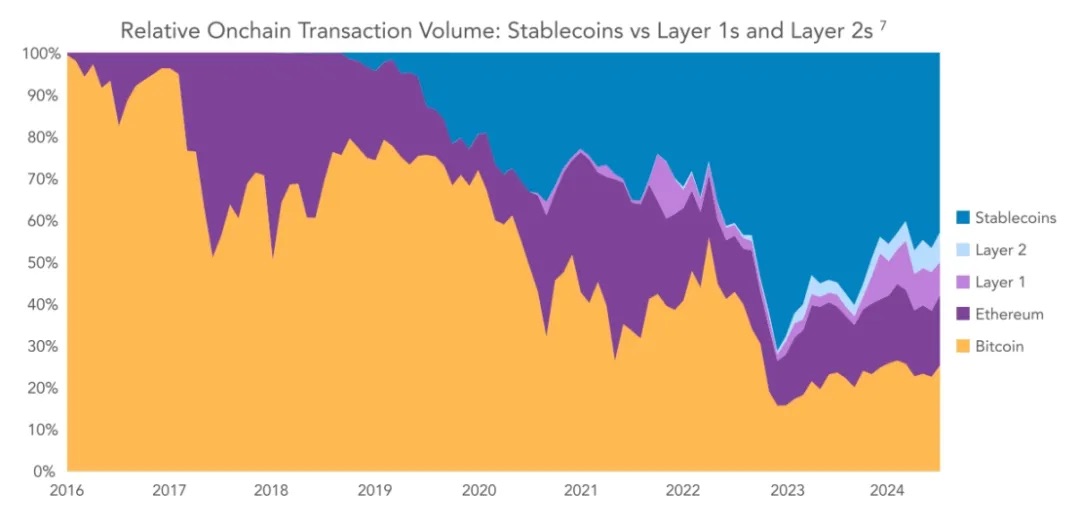

When comparing the stablecoin settlement volume to native crypto assets, a "blockchain dollarization" phenomenon emerges. While historically Bitcoin and Ethereum have been the primary mediums of exchange on public blockchains, stablecoins - and almost exclusively US dollar-pegged stablecoins - have gradually captured an increasingly larger market share.

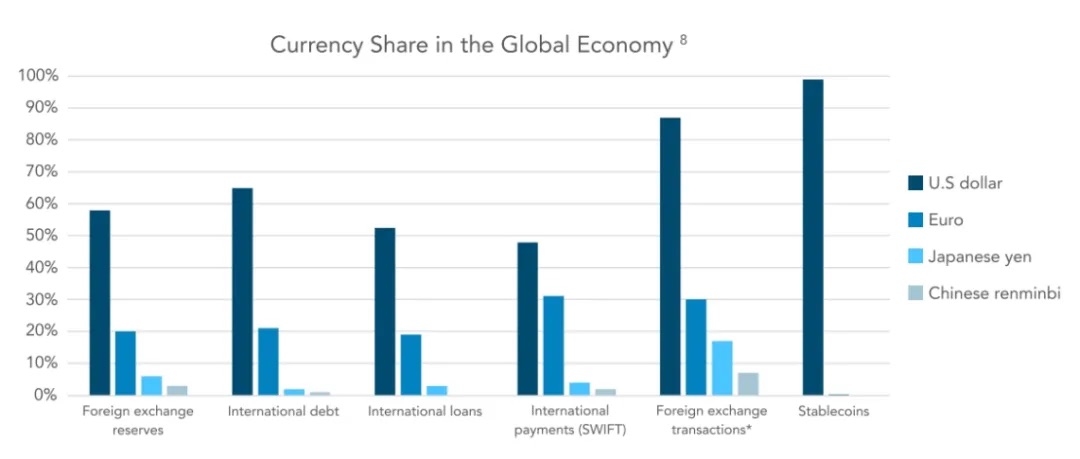

Currently, stablecoins account for around 50% of the total settlement value on public blockchains, reaching as high as 70% at times. The second most popular currency for stablecoin usage is the Euro, with a supply of $6.17 billion as of June 2024, representing 0.38% of the overall stablecoin market. While there are also stablecoins pegged to the Lira, Singapore Dollar, Yen, and other fiat currencies, apart from the US Dollar and Euro, no other currency-backed stablecoin exceeds $100 million in supply.

III. Emerging Market Survey Report

VISA surveyed approximately 500 individuals each from Nigeria, Indonesia, Turkey, Brazil, and India, for a total sample of 2,541 adults. VISA's objective was to better understand how individual users interact with stablecoins.

The survey data indicates that stablecoin usage is continuously growing, with increasing transaction frequency, significant penetration into investment portfolios, and diversification beyond just crypto trading use cases.

3.1 Stablecoin Activity Types:

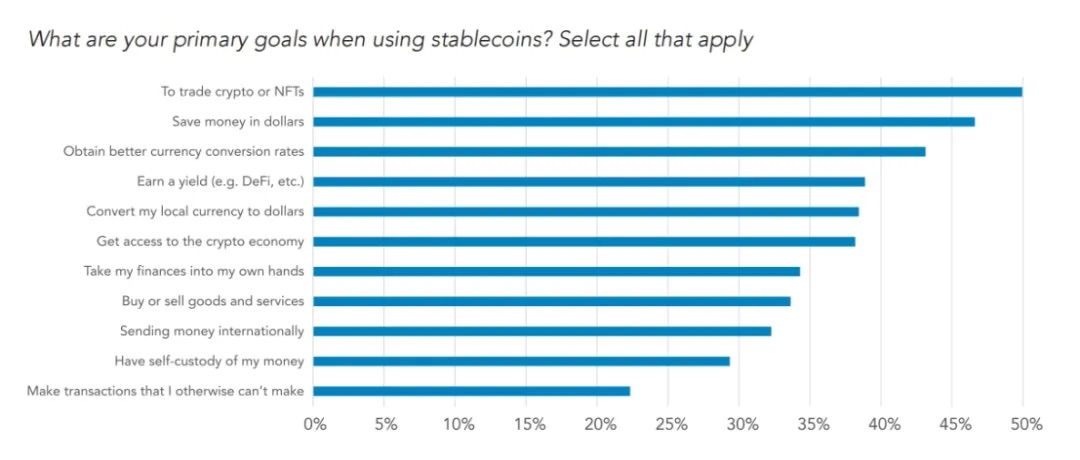

In VISA's sample, the primary purpose for using stablecoins is still trading Bit or Non-Fungible Tokens, but other non-crypto use cases are closely following. Overall, 47% of respondents said one of their main purposes is to store funds in US Dollars, 43% mentioned getting better exchange rates, and 39% stated a desire to earn yields.

The results are clear: in the countries surveyed by VISA, non-crypto use cases account for a significant portion of stablecoin usage.

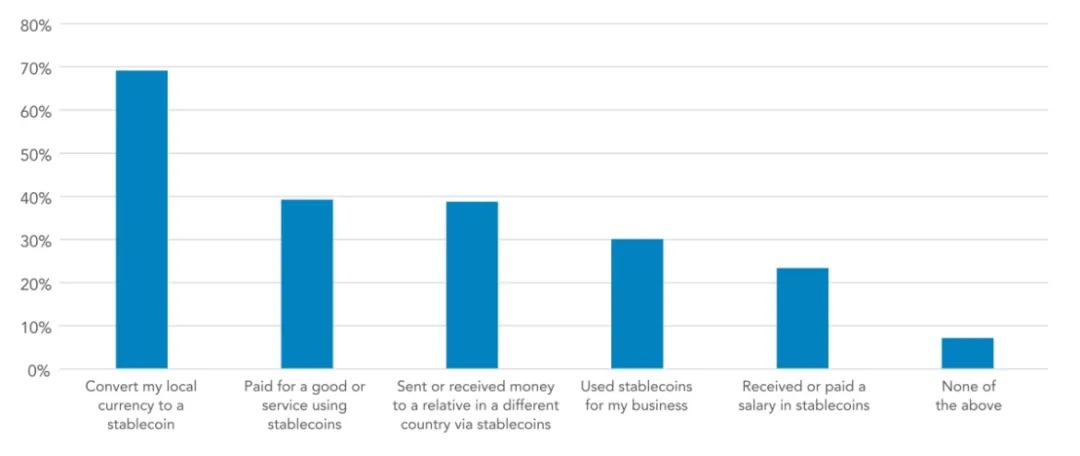

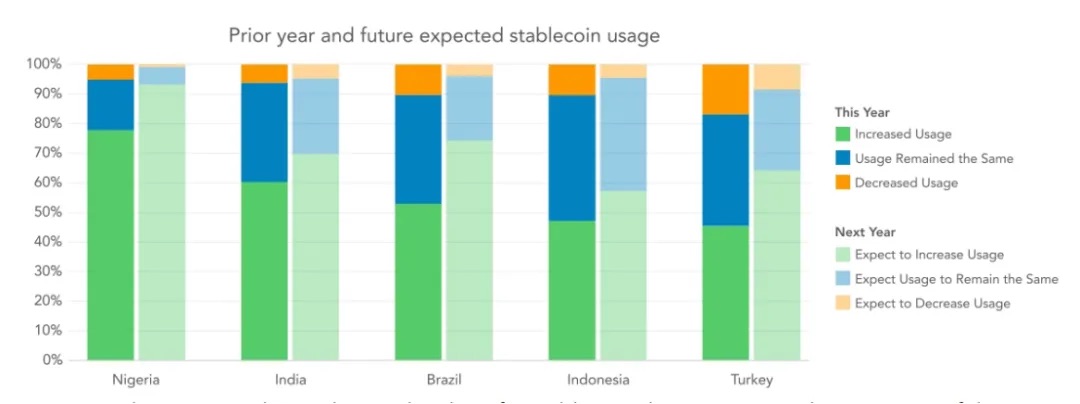

So far, the most popular use cases are currency exchange, followed by shopping and cross-border transactions. Notably, the majority of respondents in all surveyed countries reported having used stablecoins for non-crypto trading scenarios. In all the surveyed countries, the usage of stablecoins has been continuously growing over time. 57% of users reported an increase in their stablecoin usage over the past year, and 72% believe they will increase their stablecoin usage in the future.

3.2 Penetration of Stablecoins

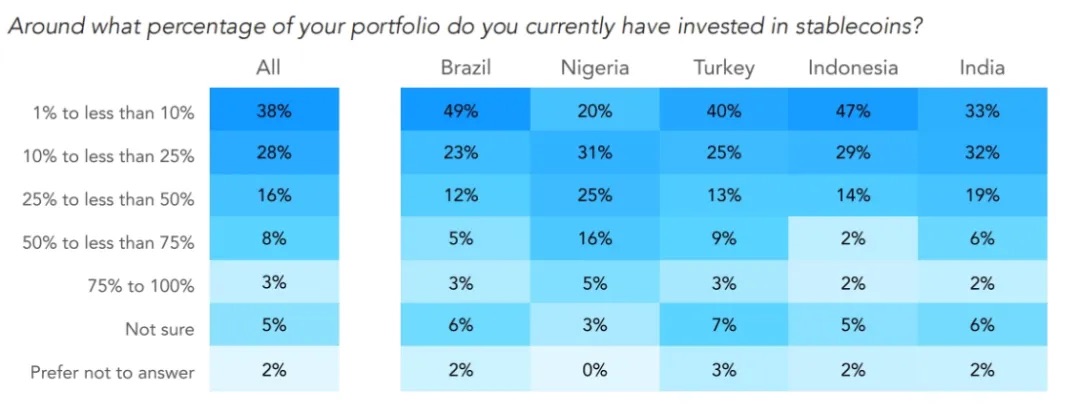

VISA is also interested in the penetration of stablecoins in users' investment portfolios. At the country level, the proportion of Nigerians is significantly higher than other countries, followed by Turkey and India. In the sample of Indian users, the wealthiest respondents reported a larger proportion of stablecoins in their financial investment portfolios.

Survey results by country:

VISA's survey found that among the countries surveyed, Nigerian users have the highest preference for stablecoins - far exceeding other countries. Nigerian users have the highest transaction frequency, the largest proportion of stablecoins in the respondents' portfolios, report the most non-crypto transaction uses, and have the highest self-awareness of stablecoins.

Interestingly, the main purposes for using stablecoins differ among users in different countries. Across the entire sample, trading cryptocurrencies is the most common purpose, but this varies at the country level. In Turkey, the most common purpose is to earn yield, followed by trading cryptocurrencies; in Indonesia, it is to get better exchange rates, followed by trading cryptocurrencies and saving in US dollars; in Nigeria, the primary goal is saving in US dollars, followed by trading cryptocurrencies and getting better exchange rates.

The countries with the most active stablecoin usage in the sample are Nigeria, India, Indonesia, Turkey, and Brazil. Ranked by the proportion of stablecoins in investment portfolios, Nigeria is still far ahead, followed by India, Turkey, Brazil, and Indonesia.

Survey results by age:

Overall, the results by age group are in line with expectations: younger people use stablecoins at a higher rate. Younger people are more likely to try different stablecoins and have a larger proportion of stablecoins in their overall financial investment portfolios.

While there are no significant age differences in most usage categories, compared to older respondents, younger people are more likely to use stablecoins to save in US dollars, convert local currency to US dollars, or gain access to the crypto economy. Across all non-crypto use cases, the younger age group uses stablecoins at a higher rate: paying for goods or services, remittances, and receiving wages in stablecoins.

3.3 Preference for Tether's USDT

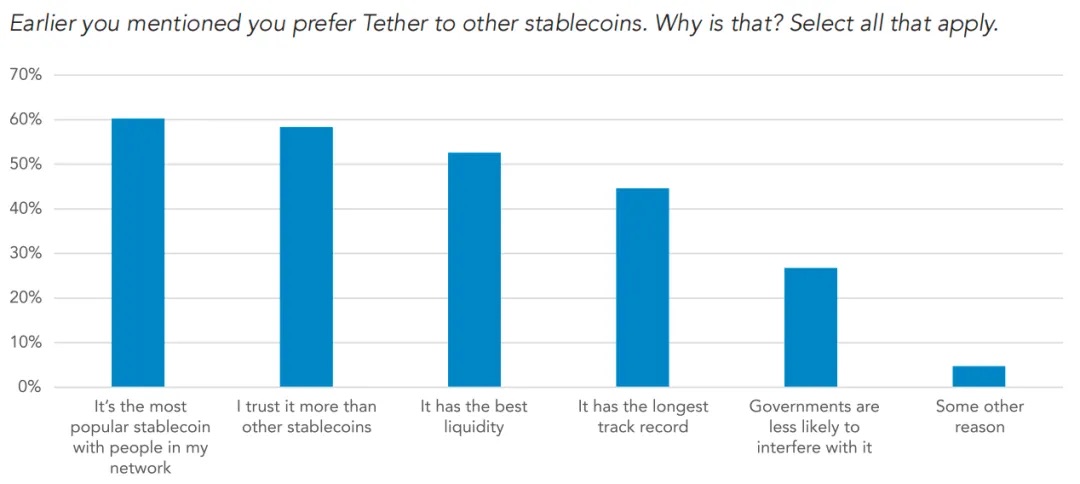

Tether is widely regarded as the most popular stablecoin among emerging market users. According to the report, the most commonly cited reasons for preferring Tether are its network effects, followed by greater trust in Tether, and Tether's superior liquidity.

3.4 Blockchain and Wallet Usage

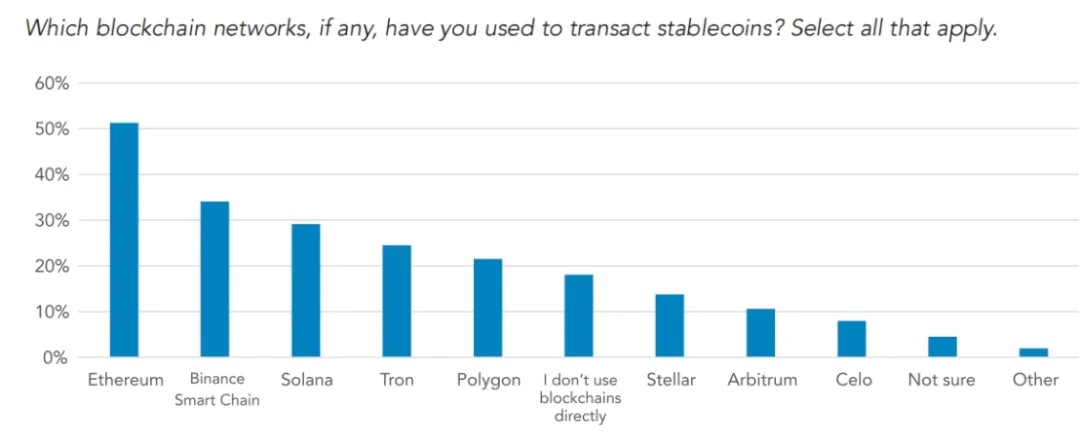

According to the report, Ethereum is the most popular blockchain network across all regions, followed by BSC, Solana, and TRON.

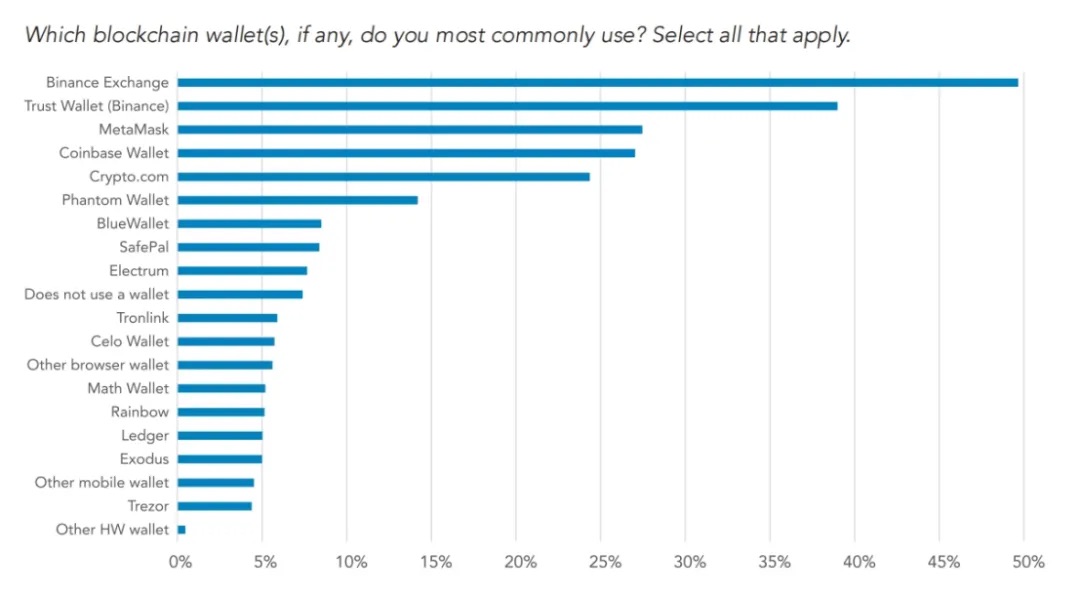

The most popular non-custodial wallets are Trust Wallet, MetaMask, and Coinbase Wallet. Among all respondents, over half reported using the Binance exchange as a wallet, which is more popular than any other non-custodial wallet. Notably, 39% of Nigerian respondents admitted to using the Phantom wallet (primarily a Solana client).

IV. Conclusion

In this research, VISA first proved from a chain-based perspective that the usage of stablecoins is growing, whether measured by monthly active addresses, total supply, or settlement amounts. Particularly, VISA's new transaction volume estimates indicate that stablecoins have become a significant settlement tool, comparable to existing remittance networks, while avoiding the common overestimation issues in past on-chain data.

VISA's survey results refute the widespread perception that stablecoins are only used for speculative crypto asset trading. 47% of surveyed crypto users said they use stablecoins for US dollar savings, 43% mentioned efficient currency exchange, and 39% cited earning yield. While accessing crypto exchanges remains the primary use case for respondents, a range of ordinary (non-crypto) economic activities are also represented.

When asked about non-crypto stablecoin activities, the most common use cases are currency substitution (69%), followed by paying for goods and services (39%) and cross-border payments (39%). It is clear that in the surveyed countries, stablecoins have evolved from being merely a trading collateral to a widely used digital US dollar tool.

Crucially, nearly all stablecoins (around 99%) are pegged to the US dollar. This fact cannot be ignored in the discussions around US stablecoin regulation, as individuals and businesses in many emerging markets rely on these networks for savings, cross-border payments, remittances, and corporate cash management. In almost all surveyed countries, stablecoins are increasingly becoming a substitute for scarce dollar banking services. The potential benefits to the billions of users in emerging markets of efficiently accessing an alternative hard currency must be part of the conversation when discussing the merits of stablecoins.