The price of NOT coin has recently surged, but many holders are still experiencing losses. Despite the price increase, most investors are waiting for larger profits to recoup their initial investments. This could limit selling pressure and enable further upward momentum.

Strengthened technical indicators, including the golden cross formation and increased trend strength, suggest that bullish sentiment is growing. With multiple resistance levels emerging, NOT can continue to rise if the current trend is maintained.

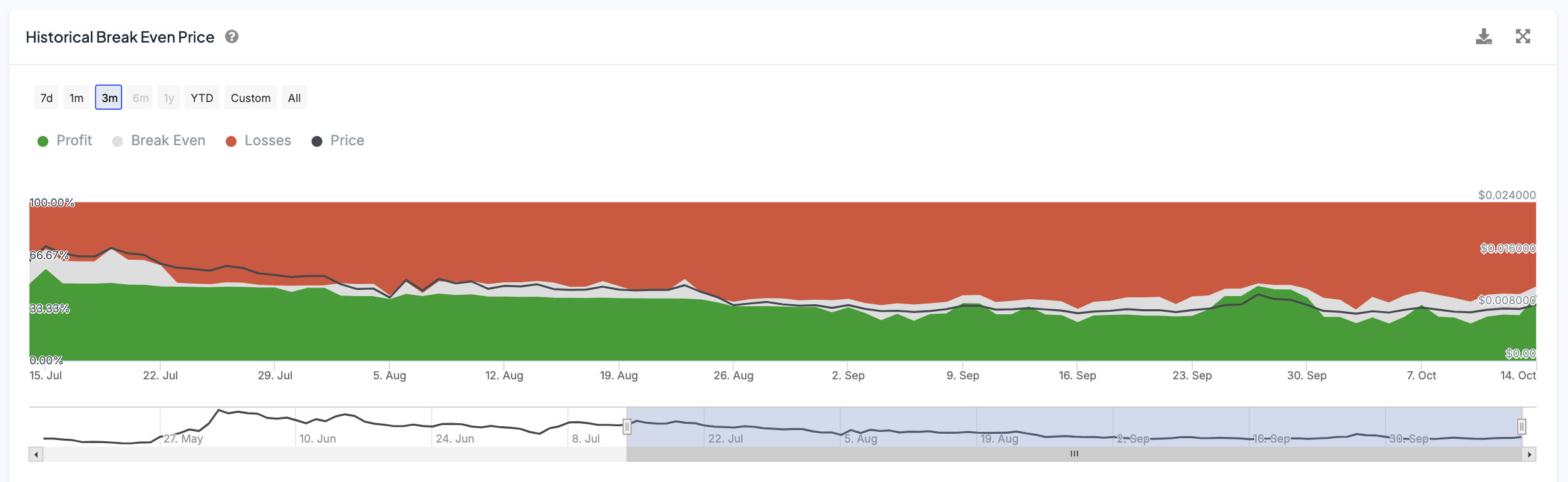

More than half of TON holders are in loss

According to the historical break-even price chart, 40% of TON holders are currently in profit. Despite the nearly 10% increase in the last 24 hours, a significant portion, 53%, of holders are still in loss.

This imbalance highlights that many investors, especially those who bought when the price was significantly higher, have not yet seen positive returns. The historical break-even price indicator serves as an important metric for evaluating the profitability of investors.

Read more: Top 5 NOT Wallets in 2024

Since TON's price is still lower than the levels observed in August, July, and June, many holders are waiting for the price to rise further. With many still in loss even after the 10% increase, there is little incentive to sell at current levels.

This scenario reduces the likelihood of immediate selling pressure, and holders are expecting additional price appreciation. Therefore, the current market environment can gain sustained buying momentum without a significant selling threat in the short term.

The current trend of NOT is strengthening

NOT's ADX is currently at 34, a significant increase from 18 the previous day. The rapid increase in ADX indicates that the strength of the trend has grown considerably in a very short time. An ADX above 25 generally indicates that the trend is gaining momentum.

The sharp rise from 18 to 34 signals a change in the direction of TON's price and suggests increased investor interest and strengthening price movements.

The Average Directional Index (ADX) is a measure of the strength of a trend, regardless of whether the trend is rising or falling. An ADX value above 25 indicates a strong trend, while lower values suggest a lack of momentum or market consolidation.

The strong ADX of NOT, which has recently entered an uptrend, suggests that the recent price increase may be just the beginning. The strength of the trend indicates sustained buying interest and the potential for further upside.

The combination of a new uptrend and a strong ADX level strongly implies that the price can continue to rise, and market participants appear willing to sustain this growth.

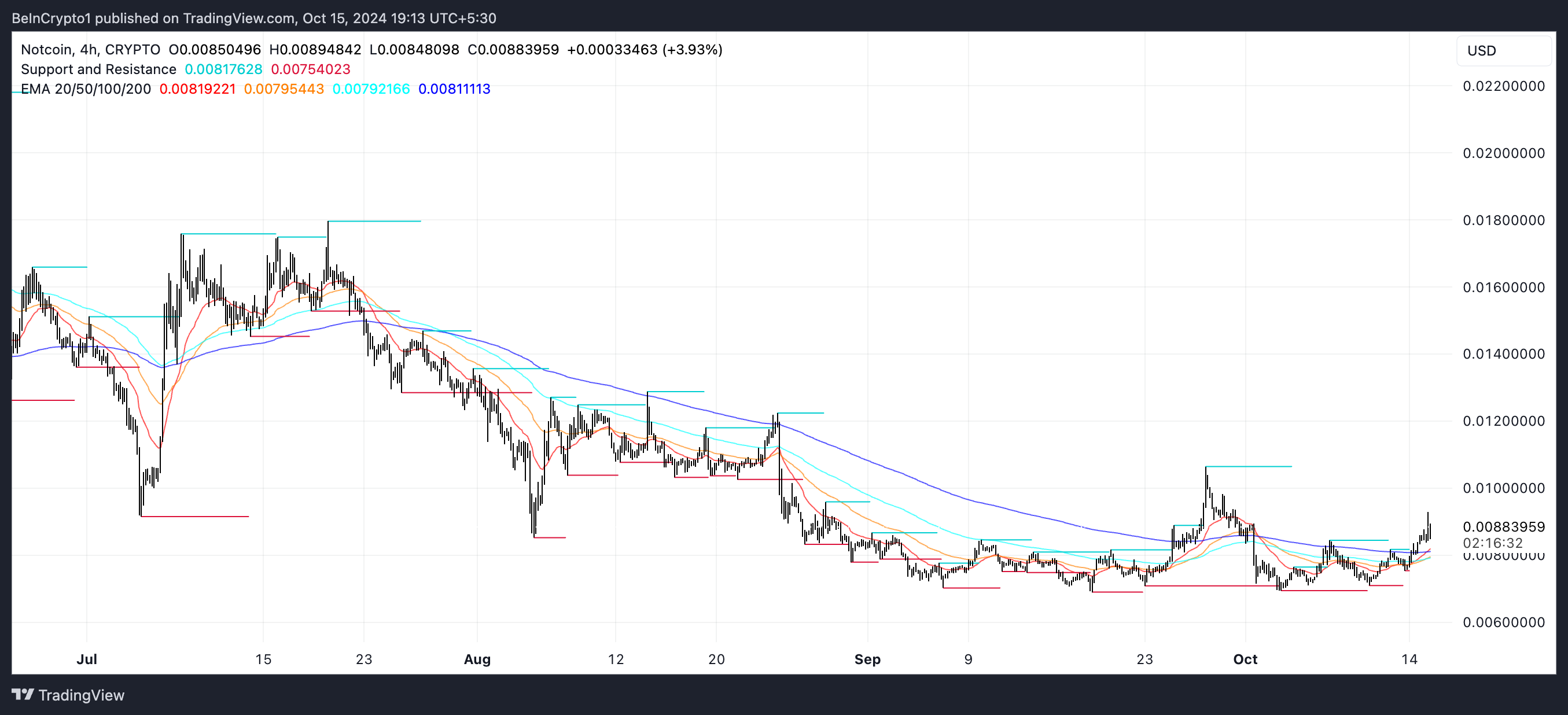

NOT Price Prediction: Overcoming the $0.016 resistance is key

NOT's EMA lines are currently approaching a golden cross, which is an important technical indicator in trading. A golden cross occurs when the short-term EMA crosses above the long-term EMA, signaling the start of a bullish market trend.

As the EMA lines approach this crossover point, it suggests that the current momentum in price action is strengthening. If confirmed, this could lead to a more significant upward movement. Traders often view this formation as a signal to enter long positions, expecting the price to rise further.

EMA lines represent the exponential moving average of a cryptocurrency's price over a specific period, with more weight given to recent data to better reflect the current trend. When the short-term EMA crosses above the long-term EMA, it often signals a transition from a bearish to a bullish market trend.

Read more: What is NOT Coin? A Telegram-based GameFi Token Guide

Given the strong ADX of NOT and the fact that many holders are still in loss, the conditions are favorable for further upward movement. If the golden cross forms and the trend continues, NOT could test the $0.0106 resistance and potentially rise to higher levels of $0.0122 or $0.01355.

Reaching these levels could represent approximately a 50% price increase from the current position. However, if the uptrend does not materialize and the trend reverses, the NOT price could decline and test the $0.007 support level, suggesting a more bearish short-term outlook.

This is a critical period that will define the market trajectory of NOT, depending on whether the golden cross is confirmed.