Bitcoin ETF (exchange-traded fund) has seen net inflows of over $1 billion in the past 3 trading days. BlackRock has been leading this positive trend, continuously providing institutional investors access to BTC through this financial instrument.

In a positive market sentiment, BTC is trading above $67,000, and there is a possibility it could reclaim its all-time high of $73,777.

Bitcoin ETF Inflows Surpass $1 Billion in 3 Days

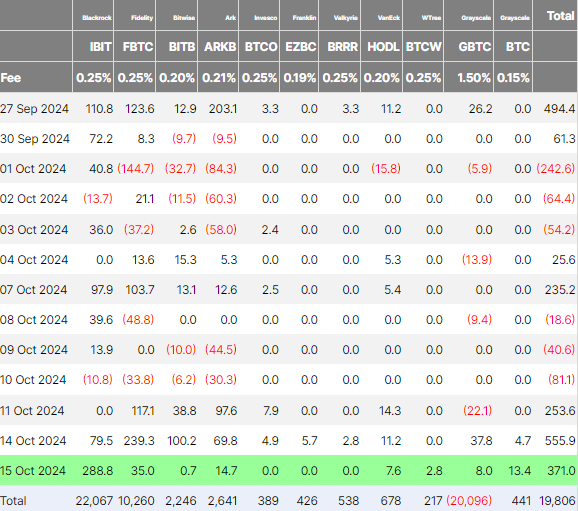

The net inflows into physical Bitcoin ETFs in the US amounted to a staggering $1.18 billion over the past 3 trading days. Meanwhile, the cumulative net inflows indicator reached a new all-time high of $19.73 billion. On Monday, October 14th, the largest single-day inflow of $555.86 million occurred.

Crypto investment inflows reached $407 million last week, reigniting interest, reversing the negative $147 million outflows seen in early October amid heightened US election interest.

Meanwhile, BlackRock remains a leading force in driving institutional interest in Bitcoin investments. Together with Fidelity, these two asset managers have attracted nearly $760 million over the past 3 days. On Tuesday, October 15th, BlackRock led the inflows, recording a positive $288.8 million.

Read more: What is a Bitcoin ETF?

The inflows have surged as Bitcoin's price has risen nearly 13% since Friday. Analysts at Standard Chartered predict this momentum could see Bitcoin reclaim its all-time high ahead of the US elections. Researchers at CoinShares also reflected this view, linking the surge in interest to US politics.

It is no surprise that BlackRock's dominance in the Bitcoin space is remarkable, given its embrace of cryptocurrencies. Along with MicroStrategy's Michael Saylor, BlackRock remains one of Bitcoin's strongest proponents. In its Q3 earnings report, CEO Larry Fink revealed that iShares' Bitcoin-linked products have reached a $23 billion market in just 9 months.

Read more: Who Owns the Most Bitcoin in 2024?

Despite its passion for Bitcoin, BlackRock's Ethereum-related products do not show the same enthusiasm. Robert Mitchnick, BlackRock's Head of Digital Assets, explained that the investment narrative for Ethereum is more complex, with some products seeing limited inflows and even outflows in certain cases.

"We believe in the potential of Ethereum, but we know it takes time for investors to understand the full scope of this asset," Mitchnick said in a speech at the New York Messari Mainnet Conference.