Bitcoin dominance (BTC.D) has reached its highest level since 2021. This phenomenon typically indicates an increase in market preference for Bitcoin and Bitcoin-based investment products.

However, this unusually high Bitcoin dominance also suggests the possibility of a short-term altcoin rally. This is why cryptocurrency analysts are anticipating the arrival of an altcoin season.

Bitcoin's supremacy may soon come to an end

Bitcoin dominance is an indicator that represents the percentage of the total cryptocurrency market capitalization that Bitcoin accounts for. As of the 17th, this indicator stands at 58.92, the highest level since April 2021.

The rising BTC.D indicates that Bitcoin occupies a significant portion of the market. However, analysts often consider this indicator as a marker of various market cycles, as dominance peaks often coincide with market price peaks. Some cryptocurrency analysts recently analyzed that the current rise in BTC.D signifies an imminent short-term correction in Bitcoin and a surge in altcoin prices.

Read more: How to Trade Bitcoin Futures: A Comprehensive Guide

In a post on October 14th, cryptocurrency analyst Elza Boom mentioned that Bitcoin dominance will drop significantly, hinting at the start of an altcoin season.

"Bitcoin dominance will drop significantly. This will lead altcoins to new highs. Altcoin season is approaching," he said.

Additionally, crypto investor Coach K Crypto mentioned in his post on X that Bitcoin's supremacy has peaked this cycle and that an altcoin season is about to begin.

"Bitcoin dominance (BTC.D) has recorded its highest level this cycle. It hasn't been this high since 2021. Nothing will happen until Bitcoin explodes first. Soon, a drop in BTC.D will occur, which will provide opportunities for memes and other major altcoins," Coach K Crypto said in his October 16th post.

In a post on Wednesday on X, Benjamin Cowen shared his opinion that BTC dominance will peak around 60%. Popular analyst Michaël van de Poppe expressed a similar view, stating that BTC.D may have reached or be reaching its peak in his post.

For this to be fully confirmed, there needs to be a divergence between Bitcoin's price and BTC.D. This pattern suggests that the momentum behind Bitcoin's price is weakening. However, Poppe noted that this bearish divergence has not yet been fully confirmed, and there is no clear evidence to confirm a reversal of the current trend.

Poppe added that the possibility of a market reversal depends on the performance of Ethereum (ETH). If ETH manages to break above the crucial resistance level of 0.04, it could trigger a broader reversal in the cryptocurrency market.

Such a breakout would indicate increased investor confidence in Ethereum and could lead to more capital flowing into altcoins, driving a significant shift away from Bitcoin.

But altcoin season still seems far away

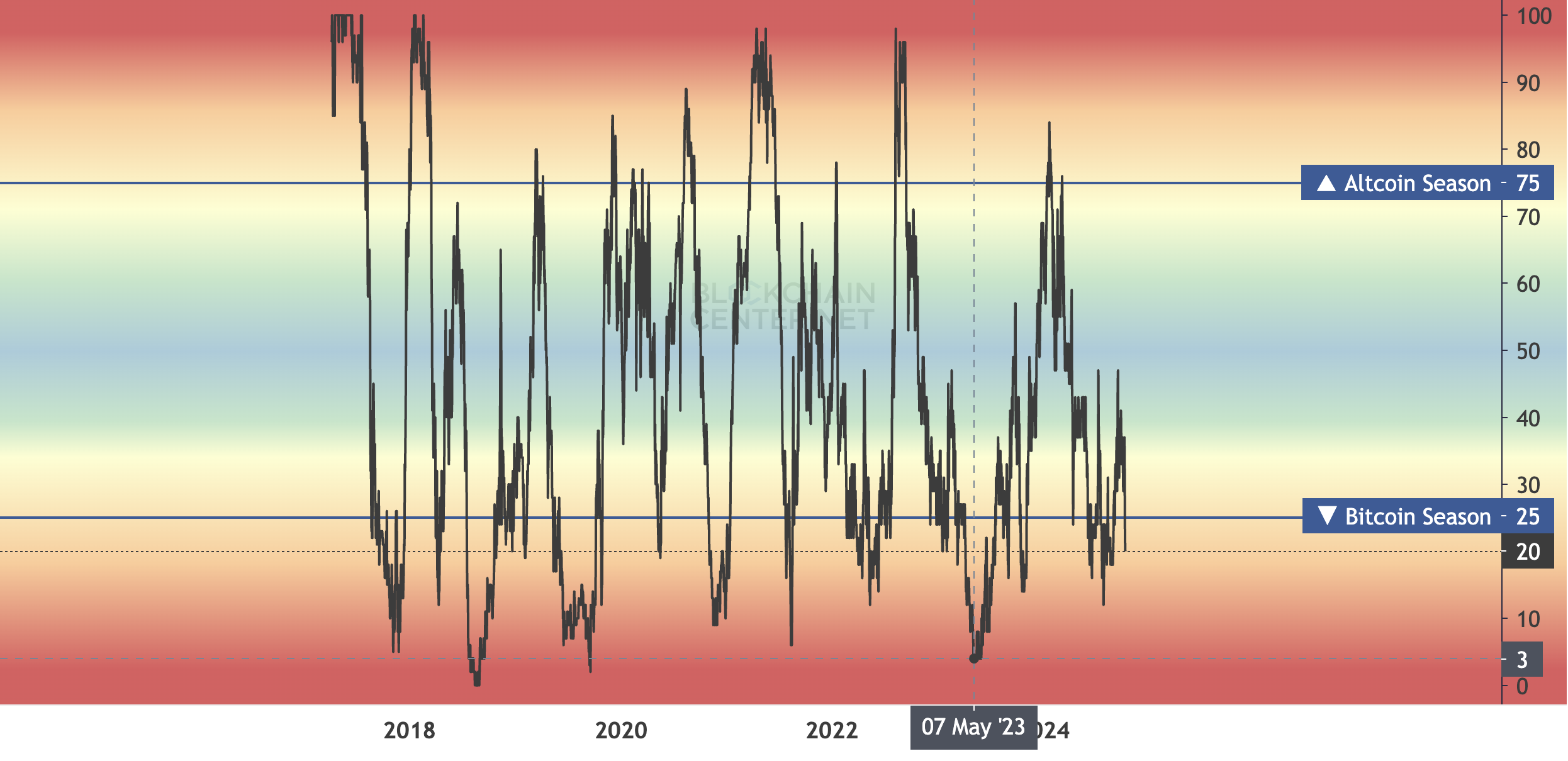

Altcoin season is considered to have arrived when at least 75% of the top 50 altcoins outperform Bitcoin over a 3-month period. Over the past 90 days, only 20 such assets have surpassed Bitcoin's performance. Therefore, the altcoin season has not yet arrived.

Read more: The 4 Best Cryptocurrency Brokers for Trading Bitcoin in 2024

Additionally, the ETH/BTC ratio, which is often cited when identifying altcoin seasons, is still at a low level. This indicator tracks the change in Ethereum's price relative to Bitcoin's price. As of the 17th, it is approaching a 3.5-year low.