Has Ethereum won the L1 war?

It is now clear that the answer is negative. This is also an important reason for the stagnation of the $ETH price.

But during the bear market, ETH as the 'L1 winner' was a common view. I learned this lesson myself.

We all know that the bull market will come, so many people sold their alt-L1 assets and held the two assets we think will not disappear: BTC and ETH.

All other L1s should have been gradually forgotten for two reasons:

First, alt-L1s compete with the same forked protocols (such as Aave and Uniswap V2) by offering liquidity mining rewards, attracting speculators seeking high yields.

At the application layer, there is almost no innovation besides Ethereum.

Avalanche, BNB Chain, Polygon... They are all about the same. Their only differences are:

- Lower gas fees

- Faster speed

- Branding

- How many tokens they can offer as liquidity mining rewards.

Secondly, the new narrative of Ethereum L2 has emerged with the advent of Optimism, Arbitrum, etc., promising scalability without sacrificing security.

Even during the bear market, they have performed well, while alt-L1s have been continuously losing TVL and users.

Alt-L1 is in a huge dilemma and needs to reinvent itself. And they have indeed done so.

Solana is the biggest blow to the extreme supporters of Ethereum.

SOL was heavily hit by the FTX collapse, but not only has it recovered, it has also shattered the illusion that Ethereum's rollup approach is the only viable scaling solution.

With more L2s coming out, the problem of liquidity and user experience fragmentation is exacerbated. With each new L2 launch, Solana's monolithic architecture becomes more attractive.

The debate between modularity and monolithicity has ended the narrative of "Ethereum winning the L1 war".

The speculators who hoarded ETH during the bear market are now continuing to sell ETH to buy SOL and other L1s.

Other L1s have also innovated and now have clearer and more diversified visions compared to a few years ago.

• Avalanche: Just launched Avax9000, allowing permissionless L1s (not L2s) to be spun up for specific application needs.

Compared to Ethereum L2, Avax L1 benefits from unified cross-chain communication. And Avalanche's value accrual to the mainchain is clearer.

Avalanche's biggest success is the "Off the Grid" game, proving that Avalanche's vision is being realized. It can also revive the once popular GameFi narrative.

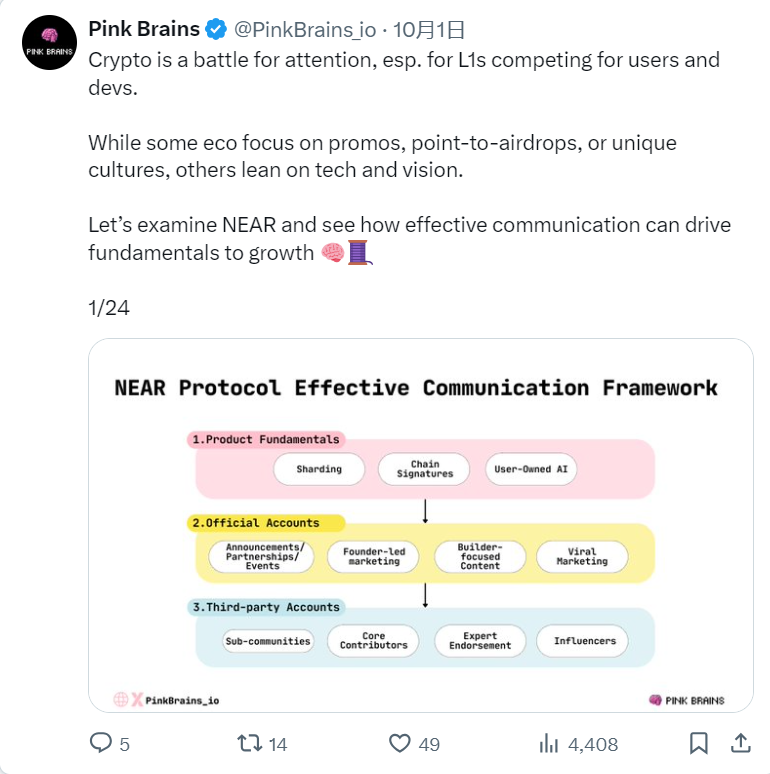

• Near: Established itself as both a monolithic and modular blockchain. Near also provides L2 abstraction services through a unified user interface (BOS), supporting L2 account aggregation, and implemented the sharding technology abandoned by Ethereum.

• BNB Chain: Launched opBNB L2 to reduce fees, but the more important upgrade is BNB Greenfield, focusing on the monetization of data and intellectual property (DataFi) and decentralized AI (with privacy-preserving LLM training).

• Fantom: Further strengthened the monolithic design through the Sonic upgrade, delivering 2000 TPS without sharding or L2. The goal is to attract the next generation of dApps.

• Gnosis: Building the financial dApps I use every day.

L1s that failed to innovate and adapt are struggling.

The most obvious example is Cosmos. Once a pioneer of the modular blockchain narrative, it is now losing users, liquidity, and market attention. $ATOM's current trading price has returned to pre-2020/21 bull market levels.

However, new L1s like Sui, Sei, and Aptos still benefit from the past "new shiny L1" strategy. To thrive in the long run, they need to innovate and differentiate themselves.

Meanwhile, today's new L2s are similar to the past L1s, with almost zero transaction fees, and have little difference besides branding.

They attract forked protocols born for airdrops, but lack innovation. As the airdrop fever subsides and TVL declines, L2s must diversify and attract unique dApps to survive. Meanwhile, their token economics are poor.

Those who fail to succeed may be abandoned like some EVM chains during the DeFi summer of 2020.

However, I also see signs of diversification: L2 interoperability alliances (OP Superchain, zkSync Elastic Chain, etc.), Base benefiting from Coinbase's support, and zkSync paying millions to attract unique dApps.

Overall, Ethereum is not the winner of the L1 war. The value accrual of all L2s is still unclear.

This is a good thing for the entire industry.

Even if Ethereum fails, the alternative L1s are still building their own futures. They also provide use cases that Ethereum may not be suitable for.

Now is also the time for L2s to prove themselves.