Binance Leads Capital Market and Community Support

Initia received investment from Binance Labs in October last year, and He Yi, the founder and CEO of Binance, said about this investment: "Binance Labs continuously identifies infrastructure providers that bring novel solutions to accelerate the growth of Web3 applications, and Initia's innovative architecture and tools are an important step in driving widespread adoption by developers." The market has also sparked curiosity about Initia.

Following Binance, Initia has received three additional rounds of funding this year, including a $7.5 million seed round led by Delphi Digital and Hack VC in February, a $14 million Series A round led by Theory Ventures in late September, and a $2.5 million community round (with 812 investors) also completed in late September. These rounds have also involved well-known industry figures, including Cobie, DCF GOD, and Zaheer, indicating that many are optimistic about its potential.

Introduction: What is Initia?

From an ecosystem perspective, Initia can be seen as an aggregation of various Rollup solutions, or a spider web of Rollup Layer 2 chains. Initia enables interoperability between chains, including asset transfers, cross-chain message exchange, and liquidity integration, with the goal of providing users with a unified operational process and enhancing the trading experience.

Team Background: Terra Team with Modular Technology

The core development team of Initia includes Zon and Stan, both of whom previously worked at Terraform Labs, the company behind Terra. Zon has developed smart contracts for multiple projects, while Stan served as a researcher and later left Terra out of passion for DeFi, founding Initia and hiring the development teams from Cosmos Hub (the Cosmos mainnet) and Terra Station (the largest wallet in the Terra ecosystem). Initia's team has a deep understanding of the pain points and flaws in the blockchain industry and is leveraging Cosmos' modular technology to address these issues.

Founding Principles

In a September interview on the Flywheel DeFi Podcast, Initia's co-founders Zon and Stan discussed the reasons behind the project's creation. At the time, Ethereum's Rollups were gaining popularity, and they recognized that the future would be multi-chain. As the industry evolved, they saw the need for a solution that could connect the entire ecosystem and address the problem of liquidity fragmentation, leading to the creation of Initia.

To be compatible with almost all chains, Initia not only supports the Ethereum Virtual Machine (EVM) but also integrates the advantages of the Move language system and other mechanisms. The project was intentionally designed to allow participants to grow with the ecosystem, avoiding the pitfalls of overvalued projects.

The author will now explore Initia in a straightforward and easy-to-understand manner.

Initia's Overall Architecture

Ominitia

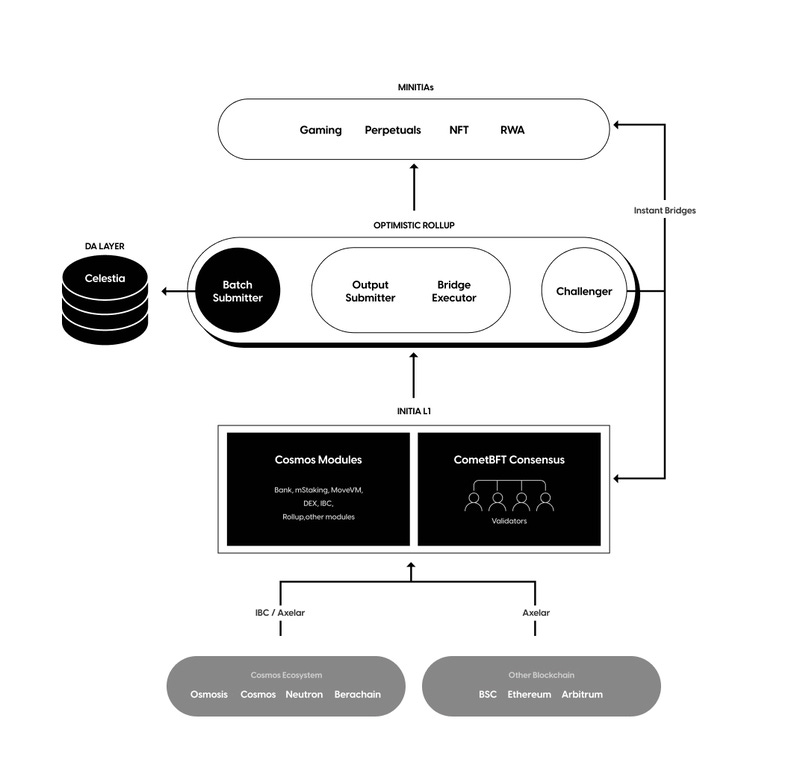

Ominitia is easy to understand, referring to the entire Initia ecosystem. It includes Layer 1, Layer 2, the OPInit Stack, and bridge protocols (IBC and cross-chain protocols).

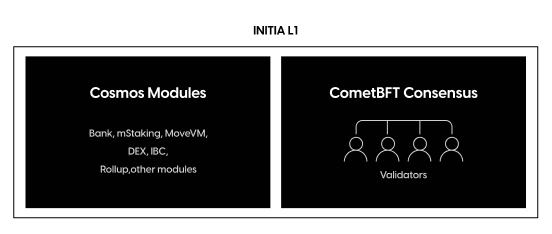

Initia (Initia Orchestration Layer)

Initia is the Layer 1 blockchain of the ecosystem, built on the Cosmos SDK, with a CometBFT (formerly Tendermint) consensus mechanism and the integration of the MoveVM to enable smart contract functionality. It is responsible for governance, consensus, liquidity integration, and cross-chain message transmission, while ensuring the security of the blockchain.

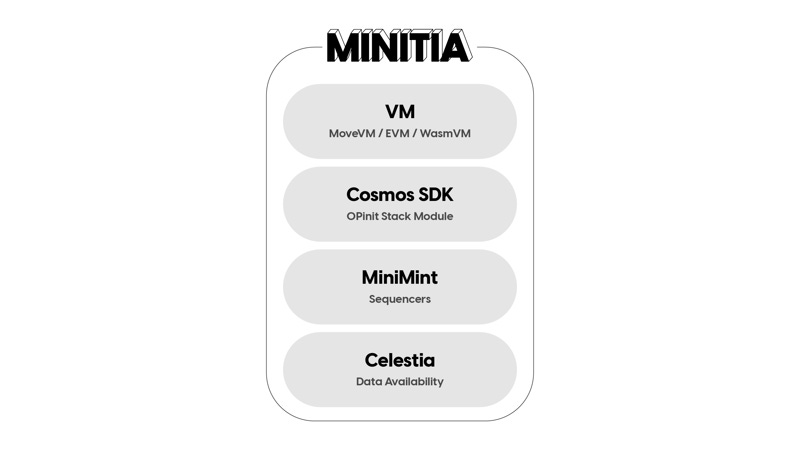

Minitia (Initia Rollups)

Minitia, also known as mini Initias, are the Layer 2 solutions in the ecosystem, developed using the Cosmos SDK. As Initia's Layer 2, Minitia has several features, including:

Over 10,000 TPS of high throughput and 500 millisecond block times

Support for Celestia data availability, with transaction settlements submitted to both the Initia (Layer 1) and Celestia DA layers

Supports MoveVM, WasmVM and EVM environments

Utilizes IBC (Cosmos communication protocol) to achieve Cosmos interoperability and share security with Omnitia

These features directly allow initia to seamlessly transfer a large number of developers and applications into the ecosystem, serving as an important base in the initia interconnected network.

OPInit Stack

OPInit Stack is the Optimistic Rollup framework in initia, also developed using the Cosmos SDK, primarily utilizing fraud proofs and rollback mechanisms to protect Minitia (Initia Rollups).

Unique Highlights of initia

Unlike other ecosystems, initia uses Cosmos technology to develop the ecosystem into a blockchain world where anyone can easily participate, and also has a complete distribution rule for benefit allocation, allowing active users and developers to share the ecosystem's earnings.

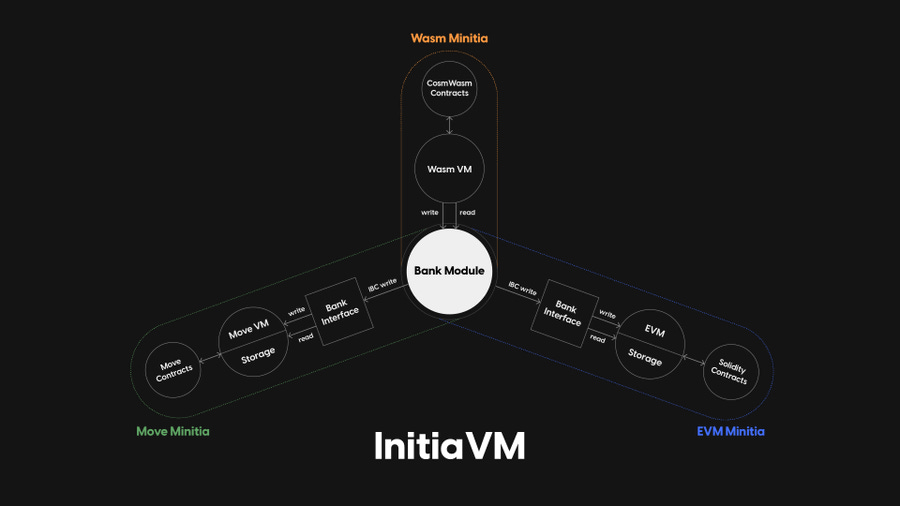

Multi-VM (Virtual Machine) Compatibility: Embracing More Developers and Users

initia's Layer 2 supports MoveVM, WasmVM and EVM environments. EVM and MoveVM are more familiar to everyone, while WasmVM is WebAssembly, a efficient and lightweight instruction set standard developed by the W3C (World Wide Web Consortium), which supports multi-language development such as C/C++, Go, and Rust, greatly expanding initia's development scope and allowing more applications to join the ecosystem.

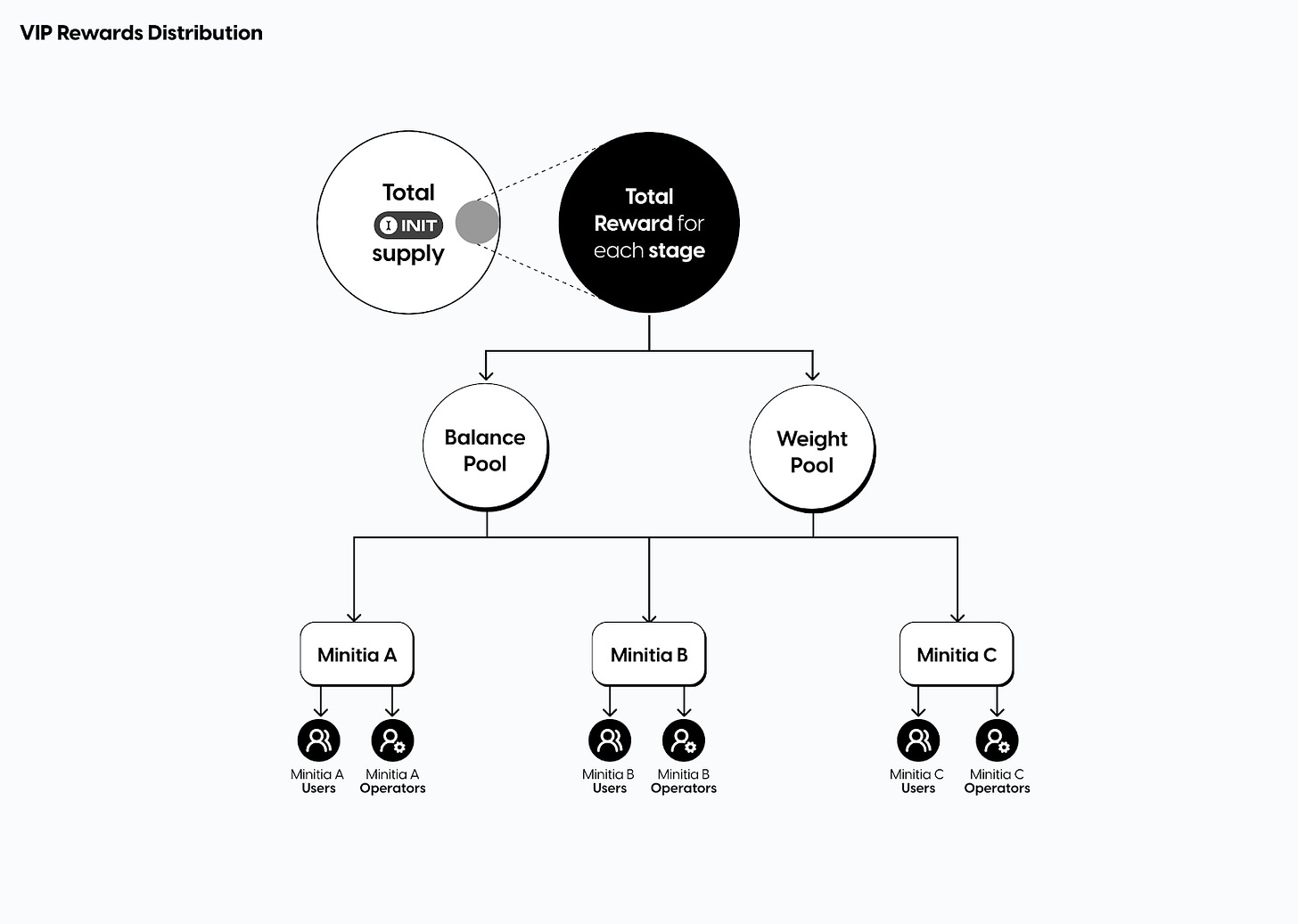

VIP Program: Allocate Earnings More Effectively Based on Activity

The Initia team, aware of the low efficiency of token usage and incentive distribution in many projects, has developed a revenue distribution plan:

In each phase, Initia allocates a certain amount of $INIT to the VIP program, with these rewards divided into a Balance pool and a Weight pool. The Balance pool distributes rewards based on the $INIT balance in each application, while the Weight pool is allocated through governance voting.

The VIP program can reduce the unfairness in POS systems where only large stakers can receive most of the rewards. Active users in the applications can also increase their reward proportion. In this way, regularly active users and developers will accompany the ecosystem's growth, and more users will be attracted to participate.

For more information, please refer to: Introducing VIP

Liquidity Infrastructure: The Prerequisite for the Interconnected Network

The vast interconnected network must have stable and fast liquidity, which initia achieves through the following infrastructure.

Enshrined Liquidity - Stake LP tokens to participate in governance

Enshrined Liquidity is a unique mechanism on Initia L1, allowing users to stake $INIT tokens or LP tokens containing $INIT to participate in consensus and governance, mainly implemented through the x/mstaking module, and LP tokens need to be whitelisted through governance before they can be staked.

This mechanism can improve asset efficiency, security and staking rewards, while also increasing the liquidity of Layer 1. For users, the staked tokens can be used to earn block rewards, participate in governance voting, and pay gas fees, and also increase the utility of the tokens.

InitiaDEX

InitiaDEX is a native DEX designed with Move language, primarily used to promote liquidity and ensure smooth exchange between Layer 1 and Layer 2.

Minitswap DEX

The main purpose of Minitswap DEX is to help users smoothly exchange tokens between Initia Layer 1 and Layer 2. Users who bridge their tokens from Minitia back to Initia L1 can easily use Minitswap (as well as IBC) to swap their tokens back to $INIT, without having to wait for the challenge period to expire.

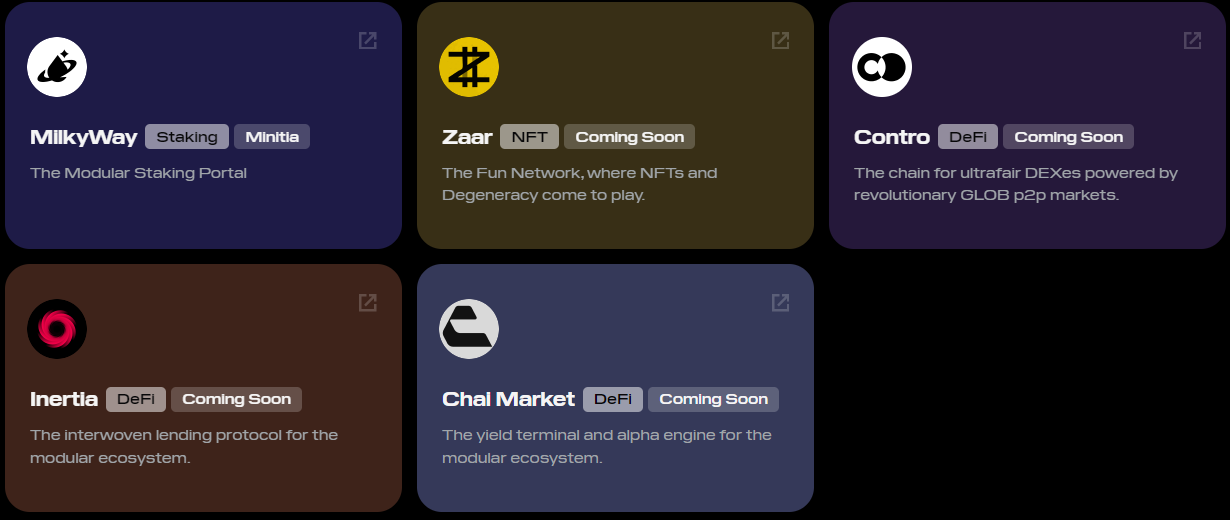

Initia Ecosystem Map

Currently, there are 11 projects on the official website, covering areas such as DeFi, GameFi, Social, AI, Non-Fungible Token, and Tooling, quite rich, and some have already launched on the mainnet, including Blackwing, Tucana, Lunch, Civitia, INIT AI, Minity, Milkyway, Zaar, Contro, Inertia, and Chai Market.

Recently, the leveraged trading platform Blackwing in the ecosystem launched its first token $Bid, and the founder Zon also responded on Twitter to support it. In a recent interview, he also mentioned that the projects currently on initia have raised a total of $13.5 million in funding, not much less than initia, which also represents the market's high expectations for the ecosystem's potential.

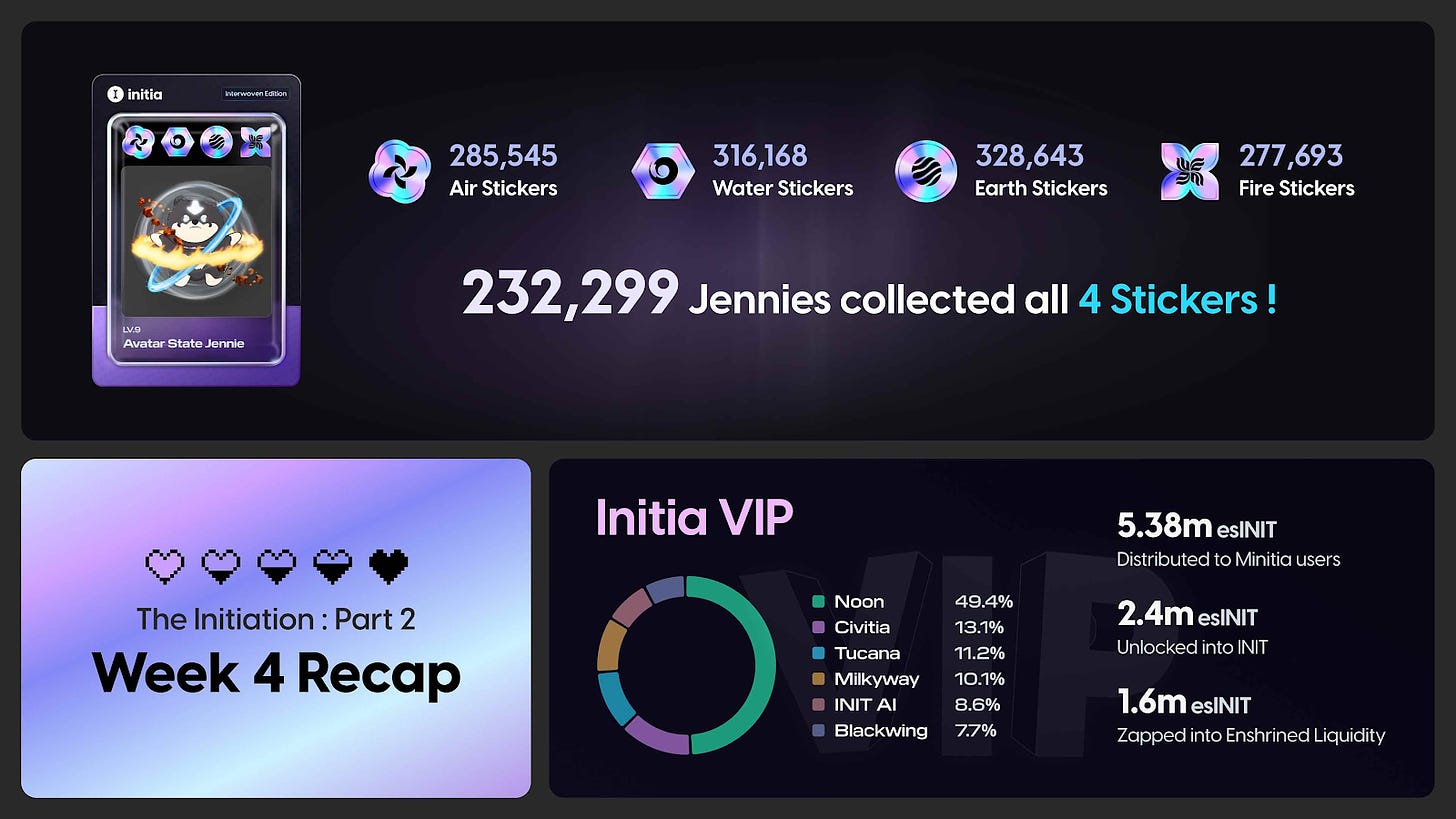

Airdrop Opportunities and Latest Progress

Initia launched its incentive testnet in May this year and went through 8-week and 4-week initiation incentive activities, aiming to allow users to experience the functions of the Initia ecosystem. According to the official data, more than 3 million wallets participated in this activity, and 230,000 addresses completed all tasks and obtained all Stickers, with extremely high community participation.

Initia also announced that it will launch its mainnet in the 4th quarter of this year, and the official has also been continuously updating the progress of the mainnet. The latest news is that the mainnet has completed 74% of the preparation on October 14, and the launch is imminent.

As for the airdrop, if you were unable to participate in the previous incentive testnet activities, some people believe that staking the Celestia token $Tia can also receive the airdrop, but this part has not been officially confirmed.

Summary - The Entire Chain Ecosystem is Imminent, Lacking an Explosion Point

Whether it's trading tokens, NFTs, or playing with DeFi and GameFi, each ecosystem has its pros and cons. However, if the entire chain can be connected and the trading experience optimized, this is also what users would like to see. Initia's ecosystem has also introduced many interesting applications, including games and casinos, and I would recommend everyone to go and experience them, as there may still be airdrops to be had!

As the founder Zon said, the Initia team is committed to building the project into a feature project with a high degree of community consistency and participants can obtain long-term benefits, so things like the VIP program, compatibility with multiple development environments, and ensuring stable liquidity are indispensable. I also hope that these mechanisms can lead the ecosystem and participants to succeed together.