Author: BitpushNews

The financial market performance was flat at the start of the week, with Bitcoin encountering bearish resistance at $69,500, while the US 10-year Treasury yield soared, rising 10 basis points to 4.19%, the highest level since July.

Affected by the rise in US Treasury yields and the US dollar index, the major stock indices faced pressure, with the S&P 500 index and the Dow Jones index falling 0.18% and 0.80% respectively on the day, while the Nasdaq 500 index closed up 0.27%.

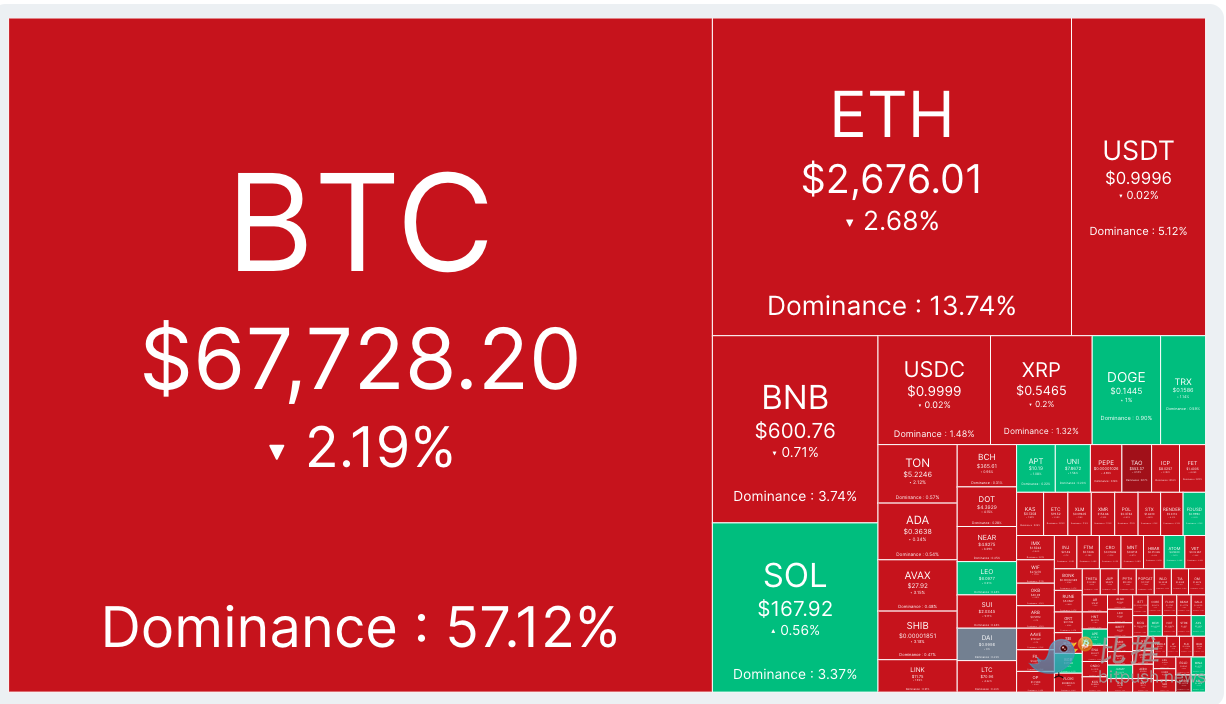

Bitpush data shows that after Bitcoin reached a high of $69,500 in the early hours of Monday, the bears pushed the price down to a daily low of $66,796, after which buyers stepped in at the low and pushed it back above $67,500, and as of the time of writing, BTC is trading at $67,728, down 2.19% in 24 hours.

Altcoins followed Bitcoin lower, with the majority of the top 200 tokens by market cap seeing losses. The biggest gainer of the day was Amp (AMP), up 9.8%, followed by Raydium (RAY) and cat in a dogs world (MEW), up 9% and 8.7% respectively. First Neiro on Ethereum (NEIRO) led the decline, falling 8.4%, while Blur (BLUR) fell 7.4% and Echelon Prime (PRIME) fell 7%.

The total cryptocurrency market capitalization is currently $2.34 trillion, with Bitcoin's market dominance at 57.1%.

Bitcoin futures notional open interest hits a new high

Coinglass data shows that the notional open interest in US dollar-denominated Bitcoin futures across major exchanges broke through $40.63 billion over the weekend, setting a new all-time high. In token terms, the open interest is 592,000 BTC, the highest level since December 2022.

Open interest refers to unsettled futures bets, indicating new money entering the market. The rise in this metric and the price increase confirm the upward trend.

In the BTC ETF space, significant capital inflows have been recorded, with BTC ETFs attracting $273.7 million in inflows, mainly from Ark, while BlackRock's IBIT ETF has performed outstandingly, attracting over $1.1 billion in inflows last week, the strongest performance since March, ranking third in year-to-date ETF inflows.

Expected to break $70,000 this week?

StealthEX CEO Maria Carola said: "The probability of Trump winning the election has recently risen, which has had a positive impact on the price of Bitcoin, and it is expected that Bitcoin will break through the important psychological threshold of $70,000 by Friday. However, the possibility of setting a new all-time high (ATH) this week is still low."

She added: "Geopolitical factors, such as the US election, conflicts in the Middle East, and the constantly evolving global regulation around stablecoins, could potentially bring about significant unexpected market events (black swans) in the crypto market before the holidays. In November, Bitcoin may surpass its historical high and steadily grow towards the next important milestone - $100,000 per coin."

MN Consultancy founder Michaël van de Poppe stated that regardless of whether Bitcoin sets a new high this month or next, "the bull market has already arrived".

CryptoQuant data shows that whale activity is still increasing, with the amount of accumulation also growing.

TradingView analyst Alan Santana said that as the post-halving bull market begins to heat up, Bitcoin's price in this cycle could rebound to $300,000, and could soar to $130,000 by early 2025.

Santana in his latest update said: "We don't expect $100,000 and $130,000 to be small targets in 2025, as these figures are quite easily achievable and are likely to be the first important milestones reached after the bullish momentum intensifies around March 2025 or later, the wrong idea is to think that these levels can be reached now, in October, November or even December 2024. Bitcoin is still testing the 200MA support."

Alan Santana explained: "Bitcoin tends to reach its peak in the late stages of a bull market. This is to allow the rest of the market to play its part. Considering this, we will have enough time for the bull market wave to develop, which will require months of price appreciation. Imagine Bitcoin fully rallying to new highs by the end of the first quarter of 2025, then a mild correction, consolidating for a few months, and then further price appreciation. We can see 3-7 months of consolidation before the final bull run that will produce a new all-time high, with a peak price between $155,000 (conservative estimate) and $180,000 to $208,000 (inflation/war premise). This is more consistent with Bitcoin's past performance."