The CEO of Cryptoquant, Ki Young Ju, recently posted that BTC could realize its potential as a global currency by 2030. His analysis particularly emphasizes the rapid evolution of the BTC ecosystem in terms of mining and institutional participation.

Satoshi Nakamoto, the mysterious creator of BTC, envisioned it as a decentralized P2P electronic cash system.

Cryptoquant founder imagines BTC as the currency of the future

In a post on X (formerly Twitter) on the 24th, CEO Ki Young Ju suggested that BTC is not just a speculative investment asset, but will be widely used as a low-volatility currency in the future. This vision is based on the way mining has dramatically changed since BTC was launched in 2009.

At that time, individual miners could easily mine 50 BTC with a single personal computer. The competitive landscape is now completely different.

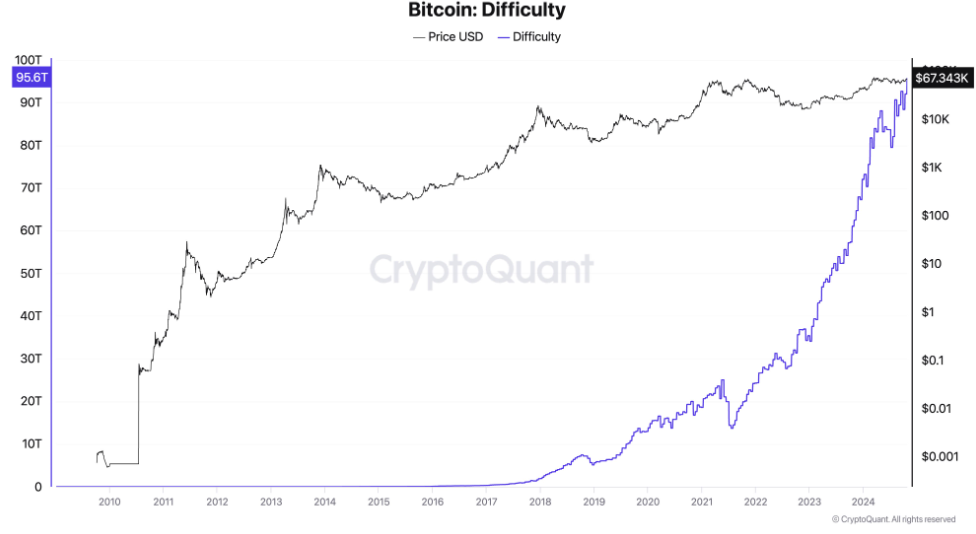

BTC mining difficulty, which measures the complexity of mining new blocks, has surged by a staggering 378% over the past three years. This reflects the intense competition in the industry, making it nearly impossible for individual miners to participate profitably.

Instead, large mining companies backed by institutional investors have come to dominate the industry. This shift towards institutional control has had far-reaching implications for the future of BTC. As institutional investors take the lead, the barriers to entry for mining have increased, and the BTC ecosystem has become more stabilized.

Read more: How to Buy BTC and Everything You Need to Know

Based on this background, the CEO analyzed that BTC's notorious price volatility will soon stabilize. This would be less attractive for day traders, but more appealing as a practical currency.

He referenced the BTC halving, which occurs approximately every four years. BTC halvings are events where the BTC mining reward is cut in half, typically leading to price increases. However, he believes that the next halving in April 2028 may result in a more noticeable decrease in volatility rather than a price surge.

Institutional adoption of BTC will surge by the next halving

Ki Young Ju believes that by 2028, institutional adoption will reach a critical mass, paving the way for BTC to be widely used in everyday transactions. The increasing presence of major fintech companies can also play a role in BTC's transformation into a currency. For example, Stripe's recent foray into the stablecoin infrastructure space could bring more e-commerce and global markets into the fold.

As regulatory clarity emerges, stablecoins can be widely adopted, which in turn can familiarize more people with blockchain wallets and other cryptocurrency-related technologies.

Volatility has long been a major barrier to BTC being used as a currency. If BTC's value fluctuates significantly daily, businesses and consumers are reluctant to use it for transactions. However, Ki Young Ju argues that this volatility is gradually decreasing as the ecosystem matures.

"As volatility decreases, the role of BTC as a currency becomes increasingly inevitable," Ki Young Ju added.

This reduction can be achieved through protocol advancements, the adoption of Layer 2 (L2) networks, or Wrapped BTC (WBTC). However, Ki Young Ju says that for BTC L2 to be competitive, institutional support is needed. As these improvements are made, BTC's potential as a stable currency grows.

This aligns with the vision of financial experts like billionaire investor Paul Tudor Jones, who sees BTC as a hedge against inflation and economic uncertainty. Jones believes BTC's finite supply is an attractive store of value in a world suffering from rising debt and inflation.

Similarly, MicroStrategy founder Michael Saylor believes BTC's unique characteristics make it a superior long-term store of value, explaining the company's ongoing BTC acquisition spree since 2020.

This increasing institutional trust can further stabilize BTC's price, potentially enhancing its appeal as a currency by the end of the decade.

"We're buying BTC to hold for 100 years. The drop from $66,000 to $16,000 shook the tourists. When it was $16,000, we were all ready to ride it to zero," Saylor recently said.

For Ki Young Ju, this transformation represents a return to BTC's original purpose. While many view BTC as "digital gold," Satoshi Nakamoto's true goal was for it to function as a P2P electronic cash system.

The perception that Bitcoin cannot become a currency no longer exists as the ecosystem matures and volatility continues to decrease. The founder of Cryptoquant believes that by 2030, Bitcoin can be used as a practical and low-volatility currency, which will realize Satoshi's long-held dream.