Summary

This article explores the current status and development characteristics of the Meme track in 2024 through observation and analysis of the Meme track, covering the popularity trend of Meme coins, the rise of platforms, the mode of dissemination, and market strategies, among other topics. The main points are as follows:

Meme coin craze and dissemination model: In 2024, Meme coins will show cyclical high heat, especially in the beginning of the year and the second quarter. The dissemination of Memes is similar to the spread of infectious diseases, relying on social media and community dissemination, usually accompanied by exponential growth. The development model in 2024 has shown new features.

The rise of Meme platforms: Memecoin Launchpads are an important innovation in this round, and platforms like Pump.fun and SunPump have simplified the creation and trading of Meme coins, attracting a large number of users. Each platform has its own characteristics in terms of user groups, revenue, and ecosystem support.

Market liquidity and strategies: Meme has already been seen as a "bridgehead" for the ecological development of major public chains and project parties. This is one of the biggest changes in this round. Meme coins are seen as the vanguard of the development of major blockchain ecosystems, attracting market attention and funds to promote subsequent ecological development. The investment strategy in the Meme track mainly involves grasping the leading coins, trading volume, and market sentiment.

The future outlook of Meme: With the easing of liquidity, direct participation by authorities, and the entry of VC investment, the Meme coin market is expected to continue to explode in the second half of 2024, and more professional and transparent Meme gameplay is expected to emerge.

New Features of the Meme Track This Round

Continued heat, showing cyclicality

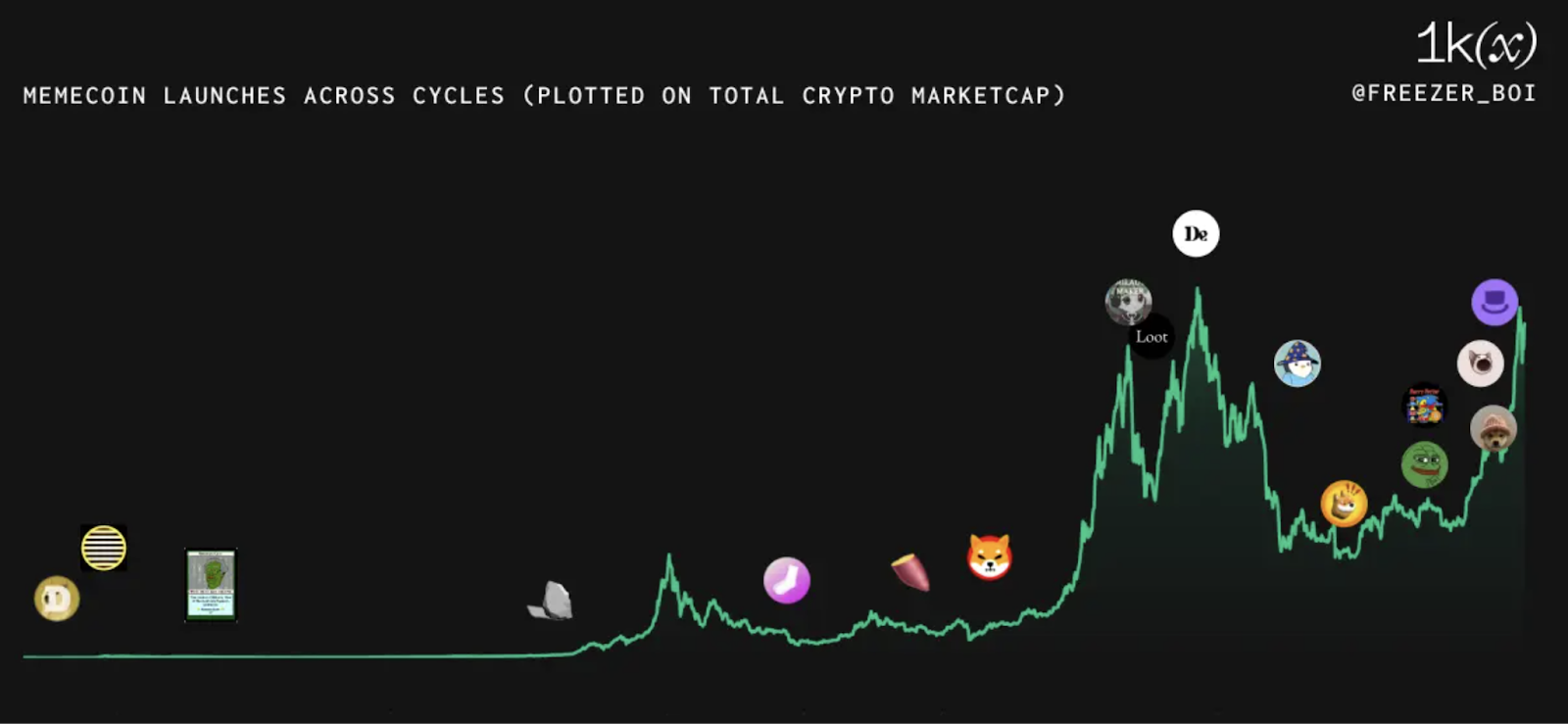

Unlike the previous stage-by-stage Meme waves, in this round of the cycle, the heat of Meme coins has reached an unprecedented high, especially in the first half of the year from February to April.

Whether it is the average weekly gain of 6 times for 20 popular coins like PEPE, or the continuous refresh of the shortest time record for listing on CEX for tokens like WIF and BOME, they are all conveying a signal to the cryptocurrency market investors: the Meme craze is rising again.

The dissemination of Internet memes has many similarities with the spread of infectious diseases. Just like viruses, memes rely on "hosts" - that is, user sharing and dissemination - to spread rapidly. Once a meme enters a popular social network, it can spread rapidly by "infecting" a large number of users, especially when it evokes a strong emotional response or has elements that are easy to imitate. The Meme craze of ORDI at the beginning of 2024 and SOL in the second quarter all reflect this characteristic.

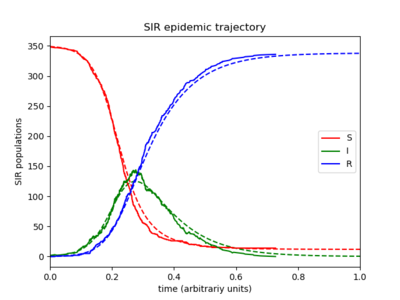

The dissemination of Memes often has the characteristic of exponential growth. Initially, only a few people come into contact with the meme, but within a short period of time, it will spread to a large number of people. In addition, the dissemination of memes is also affected by network nodes - similar to super-spreaders of infectious diseases, some users with a large number of followers can significantly accelerate the dissemination of memes, thereby expanding their influence. This dissemination pattern reflects the behavior of infectious diseases in many ways, relying on close connections and interactions between people. As shown in the figure below:

The dissemination of Internet memes is similar to the spread of infectious diseases, as shown in this SIR model.

Red=susceptible, green=infected, blue=recovered.

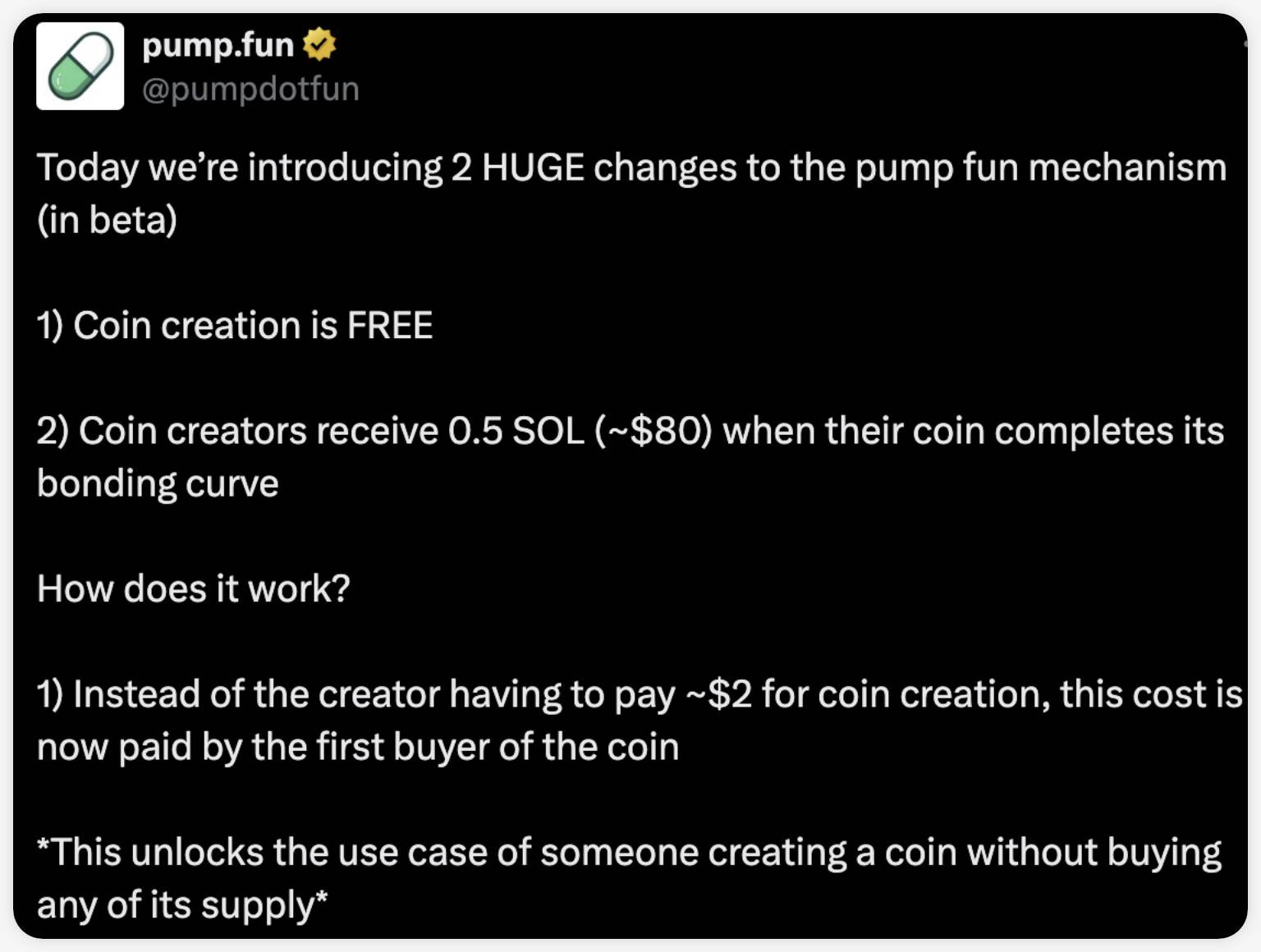

The rise of Meme platforms is a major feature of this round

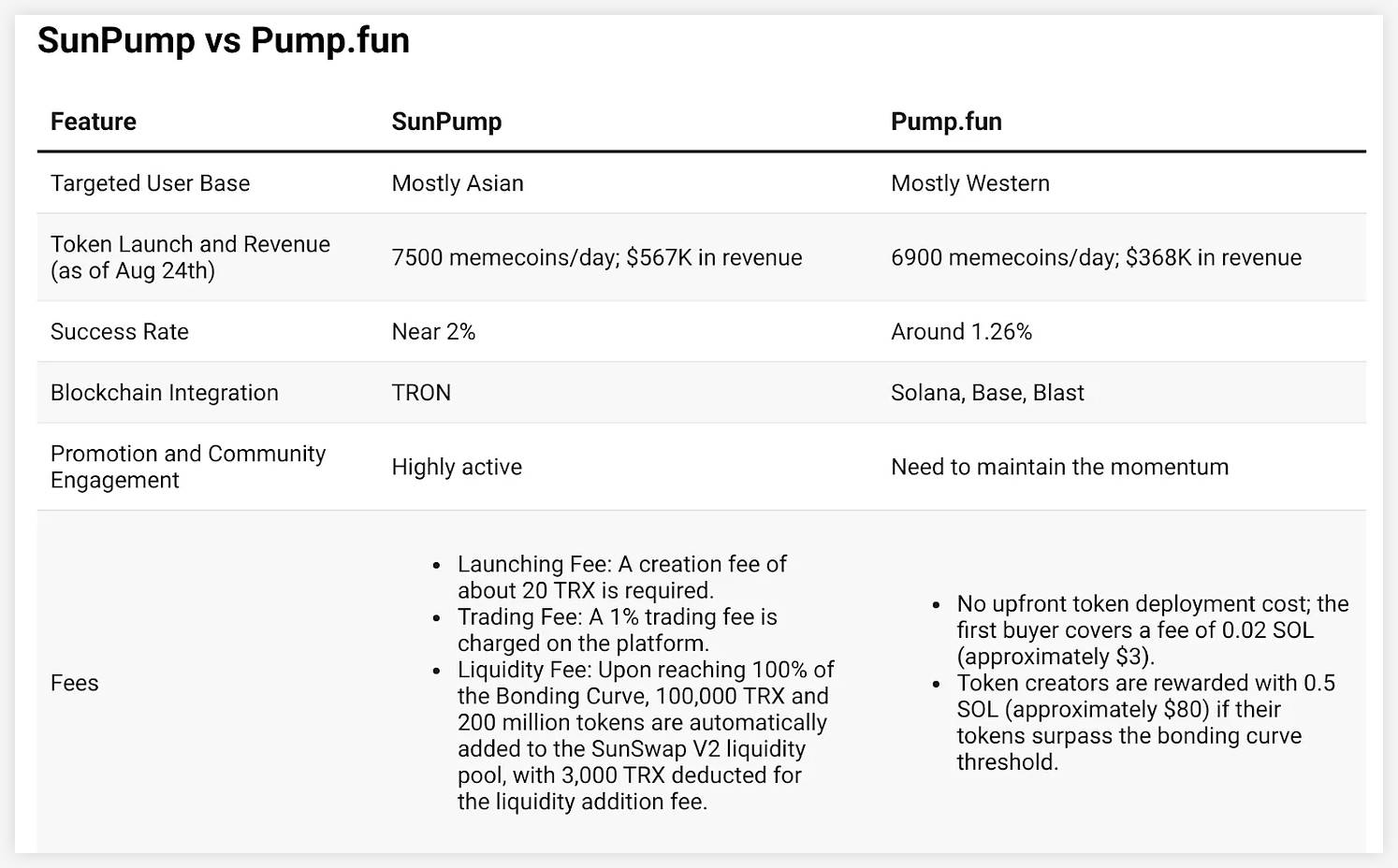

Memecoin Launchpads are a major feature of the rise of the Meme track in this round. Such as the emerging Memecoin launch platforms Pump.fun and SunPump. In this round of the cycle, Memecoin platforms have attracted a large number of users by simplifying the creation and trading process of Memecoins and seamlessly integrating with mainstream blockchains. They have their own characteristics in terms of user positioning, daily issuance, returns, project success rate, ecosystem integration, market promotion, and community participation.

With the continuous development of the crypto industry, the Memecoin field is full of opportunities and challenges, and innovation is particularly important. The key to the success of Memecoin platforms is to build products with unique selling points, combining cultural trends and technological innovation.

Launchpad Comparative Analysis

Source: Tiger-Reseach

Target Users

In terms of the user groups of the two typical Meme platforms, the early Pump.fun was mainly aimed at Western groups, while Justin Sun's SunPump was more prevalent in the Asian region. At the same time, SunPump combined Justin Sun and his team's marketing on Twitter and other media, and performed more prominently on TRON.

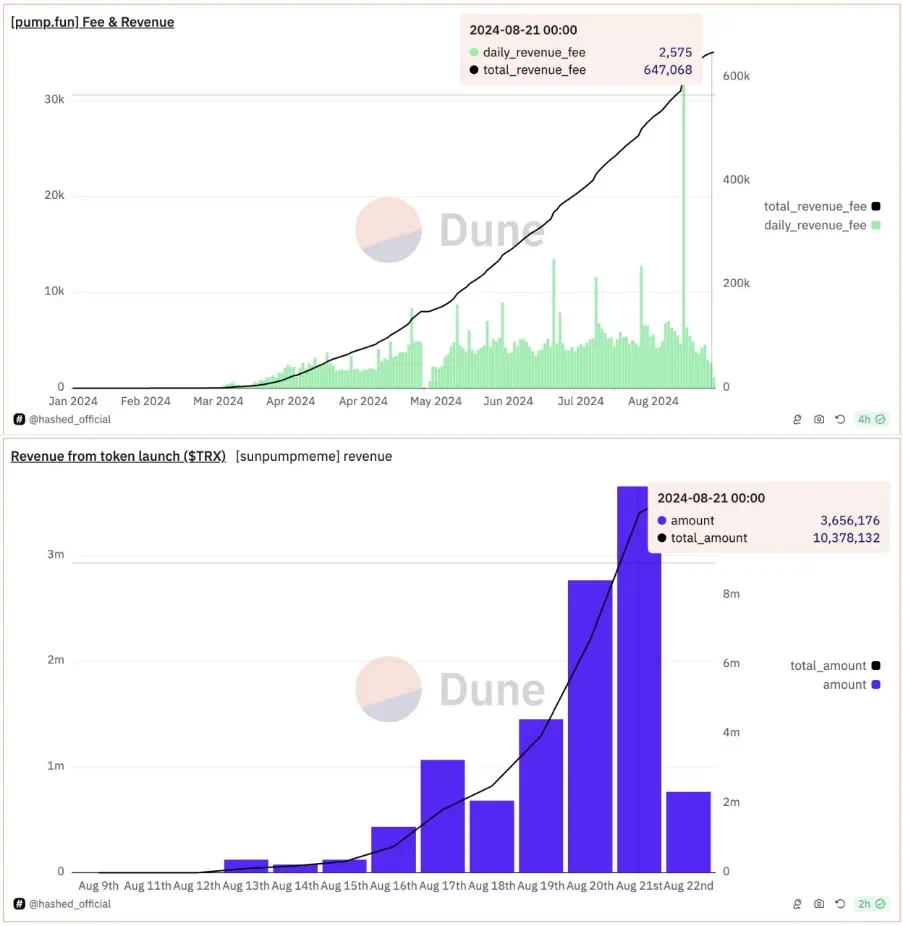

Platform Revenue & Fees

SunPump was launched later, but by the end of August, its revenue was about $567,000, and it issued about 7,500 Memcoins per day. Pump.fun, on the other hand, generates around 7,000 per day, not much different from SunPump. Both platforms charge a 1% transaction fee.

Ecosystem Support

Pump.fun is a third-party development, which was launched on the Sol chain in the early stage, and was integrated into the Base chain around May-June this year, and later integrated into the Blast chain. In comparison, SunPump mainly runs on the TRON blockchain, supported by its payment system (with a large number of users using USDT for payment) and exchange infrastructure.

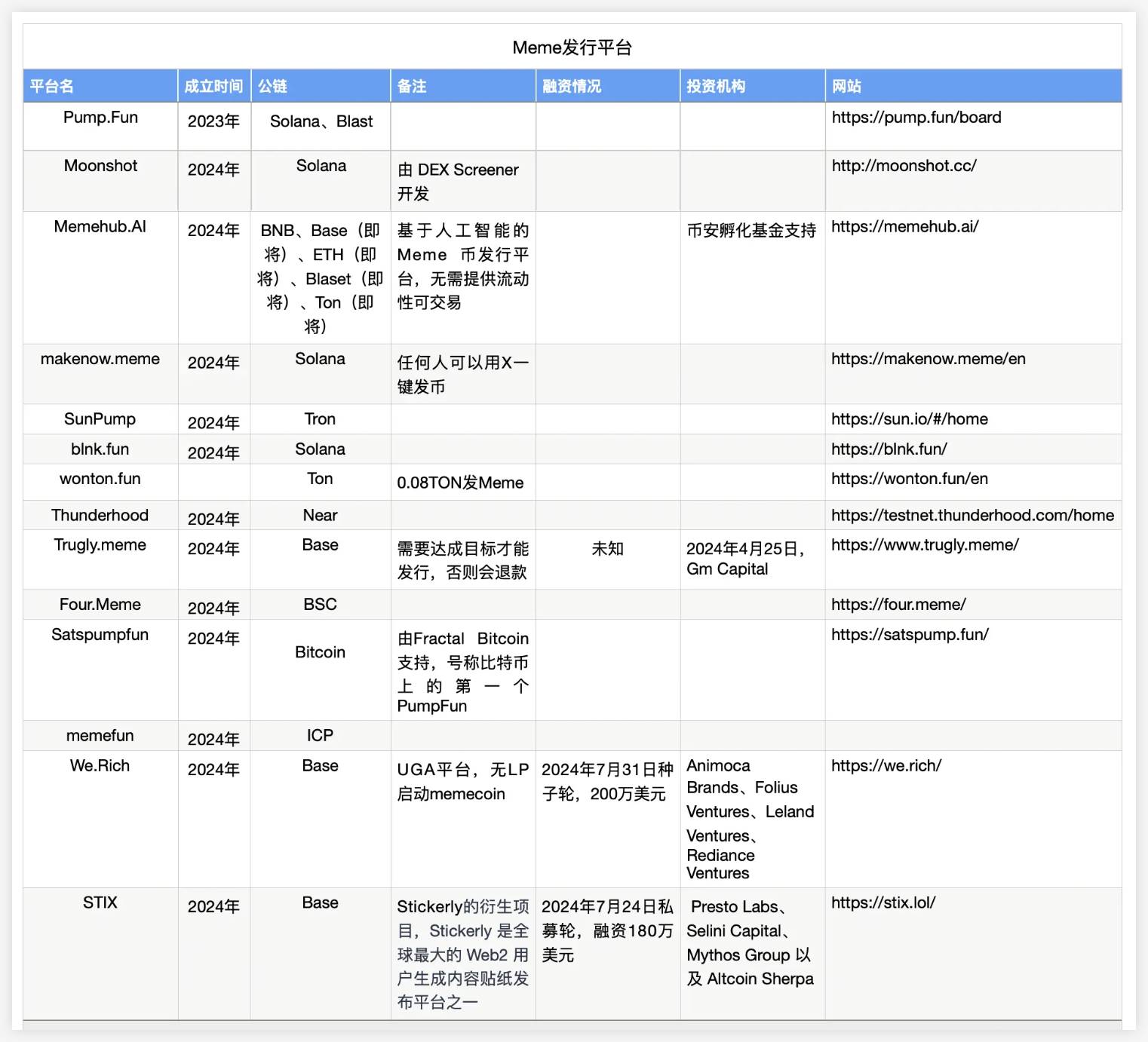

Other Meme Platform Situations

Source: Rootdata, ChainCatcher

In addition to the aforementioned Pump.Fun and SunPump, there are also Launchpads in various sub-tracks, such as Memehub.ai, which is an AI-based launch platform, wonton.fun, which is a dedicated launch platform on the Ton chain, and Satspumpfun, which is a launch platform in the BTC ecosystem.

Their main supported public chains and functional situations are different, as shown in the table above.

Typical Launchpad-- SunPump

SunPump's performance has outperformed most Meme Launchpads

TRON founder Justin Sun pointed out that although the Meme coin market is still in its infancy, TRON is implementing a long-term strategy, focusing on building a solid infrastructure and continuously optimizing the user experience to meet the needs of different users.

Justin Sun mentioned that SunPump, as TRON's Meme launch platform, together with TRON's payment network and DeFi layer, has built a three-tier system, of which SunPump is an important part.

First, a widely recognized stablecoin payment network, where TRON has already surpassed Ethereum and Solana in daily revenue and has become the leading stablecoin payment platform.

Second, the DeFi layer, providing stable investment returns.

Third, SunPump, which combines mature DeFi technology and blockchain performance, focusing on high-risk, high-return investment opportunities.

SunPump has the following advantages:

Strong team: The SunPump team has a deep understanding of the Meme market and can accurately grasp investor demand and predict potential user groups, ensuring product quality leadership.

Liquidity support: The TRON platform has issued over $60 billion in stablecoins, with over 2 million active users per day, far exceeding Solana. TRON's huge user base and high trading volume provide strong liquidity for the Meme market.

Community support: SunPump has received strong community support, especially from Asia, laying a solid user base.

With the continuous launch of SunPump tokens, the number of active addresses on TRON reached 1.9 million in August, while the number of active addresses on Solana was 1.09 million, demonstrating TRON's obvious advantages in this field.

Meme Ecology and Liquidity

The author believes that Meme has performed quite eye-catching in this round, and it has occupied a large amount of market attention. One of the biggest features is that the market parties have combined liquidity with the Meme ecology, using Meme to activate and lead the market enthusiasm, liquidity and the vanguard of the ecology. It is mainly manifested in the following two aspects:

Meme has been seen as the "bridgehead" for the ecological development by major public chains and project parties. This is the biggest change I see in this round. From the initial Sol founder wearing a silly dragon costume, to the recent Pump.fun, to the "fascia gun track" of NOT, Meme has always been the pioneer. Meme is like the hook product in the web2 product matrix. It can take the lead in the market and consolidate funds through Meme, and then be absorbed by the basic infrastructure in the ecology, such as DeFi, lending, and other products. Attracting funds through Meme and then launching products with utility is one of the strategic paths for the ecological parties and project parties to develop in this round.

The difference in dissemination time provides liquidity with flow time. There is a time difference between the traditional outsiders' concept and web3. A small number of people have entered the cryptocurrency circle, and the first thing they encounter is the high-yield wealth creation myth in the Meme sector. High volatility, which means they may be able to achieve high returns in a short period of time. Retail investors who can enter the circle may be attracted by this opportunity to get rich quickly, and many Meme coins are relatively low in price compared to Bitcoin, which allows retail investors to buy a large number of tokens with a relatively small investment amount. For retail investors with limited budgets, this low-threshold investment is more attractive.

Meme as a Case Study of Ecological Liquidity

As mentioned above, Meme has been used as the vanguard of liquidity by major chains, project parties, and ecological parties in this round, and there are many cases.

Linea Chain: $Foxy.

$Foxy is a Meme initiated by the Linea Chain official foundation and the parent company of MetaMask. Although there was not much disclosure in the early stage, the driving force behind it was Linea Chain and its related parties. Foxy, combined with KOL financing and promotion, achieved around 40 times the return on the first day of trading.

Base Chain: $Degen, $Enjoy, $High.

There are countless Meme issuances on the Base Chain. The most representative one is $Degen, which was hot in February-March 2024. Degen was originally a community Meme project with 100% Meme attributes, and as the attributes of the Degen high-hat gentleman became more prominent, the official APP later endowed Degen with utility as a tip token for the Farcaster social platform, but it still did not change its Meme attributes, with about 80% Meme attributes and 20% utility attributes. Not to mention the subsequent support for Degen from the Farcaster and Base ecosystems. As for $High, it is the Meme of the Zora public chain.

There are many other cases, which are listed as follows:

Manta Chain: Announced a $10 million Moon Mission Meme Grants in June 2024.

Avalanche Chain: $COQ, $KIMBO, $TECH, $GEC. The Meme liquidity strategy of the Avalanche chain was mainly issued in the first half of 2024, supported by the Avalanche official foundation.

Fantom: Launched the Meme season for Sonic Memecoin, starting in June.

zkSync: Meme logo Zeekcoin $MEOW.

Main Types of Meme Projects in 2024

Manipulated Coins

BOME/ SLERF/ MEW/ MANEKI ...

The author classifies all kinds of large pools as manipulated coins, characterized by large pools and rapid pump, with large positions and high multiples that can be invested, but often quickly reach a high market value, making it difficult to enter.

Hot Topic Coins

GME/ BODEN/ TREMP/ DJT/ NCAT ...

Hot topics, such as the actions and words of figures with huge traffic like Musk, Trump or Roaring Kitty, can often find corresponding meme coins on the chain, but this type of meme coin will also cause price fluctuations due to various news. For example, the DJT Trump coin attracted many people to speculate due to rumors that Trump's son Barron Trump was involved, but also plummeted due to the exposure of the inside story by famous CT figures like Zach XBT and GCR; similarly, $GME went crazy due to Roaring Kitty's comeback post, but soon plummeted as Roaring Kitty's live video turned out to be nothing.

Community Coins

POPCAT/ MICHI/ SC/NEIRO

The author believes that this type of cat and dog community tokens are high-yield but also high-failure-rate memes, with high yields because these tokens often have a long enough bottom time to accumulate cheap chips, but at the same time, due to the lack of high scarcity, they are also easy to fail. Whether the token icon is eye-catching is the first priority, but more importantly, the community atmosphere.

In addition, the author believes that for community-type meme coins, in a good market environment, they can slowly gather retail consensus and drive the price to slowly rise, but when the market environment is not good, the decline will be the fastest due to factors such as holding a large number of scattered chips.

Celebrity Coins

MOTHER / RNT / PAJAMES

Celebrity coins are the latest trend on the SOL chain in the past few weeks, but most celebrities are not willing to operate the tokens in the long run, and many are so-called one-wave flows, but at the same time, if celebrities with huge off-chain traffic are willing to operate, the tokens will have great potential. Currently, the most successful celebrity coin is $MOTHER, where rapper Iggy Azalea, with millions of fans, has been actively promoting and interacting with CT figures and community members, which has allowed the heat to last so long.

Others

WEN/ BONK/ WIF ...

In addition to the above, there are many other types of hot meme coins, such as $WEN launched by the Jupiter team, or the rumored $Bonk launched by the Solana Foundation to revive Solana; in addition, $WIF, the largest market cap and also the wind vane of Solana Memecoins, is the most difficult to classify as a meme coin, as it was born as a community coin but later received the favor of capital, and thus soared, becoming the strongest target in this round of bull market Memecoins.

Outlook for the Meme Track in the Second Half

Altcoin Index at Historical Bottom

In addition to the above supporting points, from the current macro cycle perspective, the Altcoin Season Index is at 35, and from the trend, this is also an important reason why the author believes the Meme track will return in the second half of the year.

Official Participation and Meme Track Consensus Formed

With the launch of platform Meme, ecological Meme and various Meme launchers, the Meme track has not only won the favor of retail investors, but also the direct affirmation and participation of the official. From May to August this year, various officials have come out to launch platforms and announce Meme tokens for their ecosystems. Compared to the previous period, the consensus on the Meme track has become stronger.

Meme as the vanguard is expected to develop in four aspects for the future of ecosystem building and project development.

First, continue to establish various Meme foundations, support programs, or community programs, in the form of innovation funds to support the development of Meme in this ecosystem;

Second, VC investment parties will join, starting from the second half of 2024, many VCs will announce their participation in Meme infrastructure investment, from the Meme resisting VC to the VC embracing Meme;

Third, the gameplay of Meme will be more professional and more transparent.

The fourth is that after the creation of liquidity, there will be more accepting units, which means that secondary products based on Meme will have a new development. Such as Meme management tools, meme creation and secondary dissemination platforms, and secondary creation tools based on Meme will also have a wave of development.

Liquidity tends to be loose, and the Meme environment is relatively good

It is expected that in the second half of 2024 and the first half of 2025, interest rates will show a downward trend, and we are moving towards a more relaxed macroeconomic environment. Meme coins, due to their small market capitalization, high awareness, and low participation threshold, are expected to achieve growth.

About HTX Ventures

This article was written by the research team under HTX Ventures. HTX Ventures is the global investment department of Huobi HTX, integrating investment, incubation, and research, with the aim of identifying the best and brightest teams globally. As an industry pioneer, HTX Ventures has over 11 years of blockchain building experience and is adept at identifying cutting-edge technologies and emerging business models in this field. To drive growth in the blockchain ecosystem, we provide comprehensive support for projects, including financing, resources, and strategic advice.

HTX Ventures currently supports over 300 projects covering multiple blockchain domains, and some high-quality projects have already been traded on Huobi HTX. In addition, as one of the most active FOF funds, HTX Ventures invests in 30 top global funds and collaborates with global top blockchain funds such as Polychain, Dragonfly, Bankless, Gitcoin, Figment, Nomad, Animoca, and Hack VC to jointly build the blockchain ecosystem. Visit us.

For investment and cooperation, please feel free to contact VC@htx-inc.com

Disclaimer

1. HTX Ventures has no association with the projects or other third parties mentioned in this report that could affect the objectivity, independence, and fairness of the report.

2. The materials and data cited in this report are all from compliant channels, and the sources of the materials and data are considered reliable by HTX Ventures, and necessary verification has been made for their authenticity, accuracy, and completeness, but HTX Ventures does not guarantee their authenticity, accuracy, or completeness.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice for the relevant digital assets. HTX Ventures will not be liable for any losses caused by the use of the content of this report, unless otherwise clearly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose their independent judgment due to this report.

4. The materials, opinions, and speculations contained in this report only reflect the judgment of the research staff on the date of finalization of this report. In the future, due to changes in the industry and updates of data and information, there is a possibility that the views and judgments may be updated.

5. The copyright of this report belongs solely to HTX Ventures. If you need to quote the content of this report, please indicate the source. If you need to quote the report extensively, please inform us in advance and use it within the permitted scope. In no case shall the report be quoted, excerpted, or modified in a way that is contrary to the original intention.

Reference

Tiger Research: https://www.tiger-research.com/

ChainCatcher: https://www.panewslab.com/zh/articledetails/uwls3xdn.html

$Foxy situation: https://twitter.com/FoxyLinea

Manta chain meme plan: https://x.com/MantaNetwork/status/1803440654426710098

Avalanche chain community meme support plan: https://x.com/AvalancheFDN/status/1768262658346897428

Rootdata: https://www.rootdata.com/zh