The price of XRP has fallen by 8% from October 21 to 25, suggesting that altcoins may decline further. However, from Saturday, October 26, the XRP Bulls have strongly defended the crucial $0.50 support level and have started a slight rebound.

Historically, XRP has briefly rebounded at such levels before experiencing selling pressure again. This analysis examines whether XRP will undergo a similar retreat or if this rebound signals the start of a sustainable recovery.

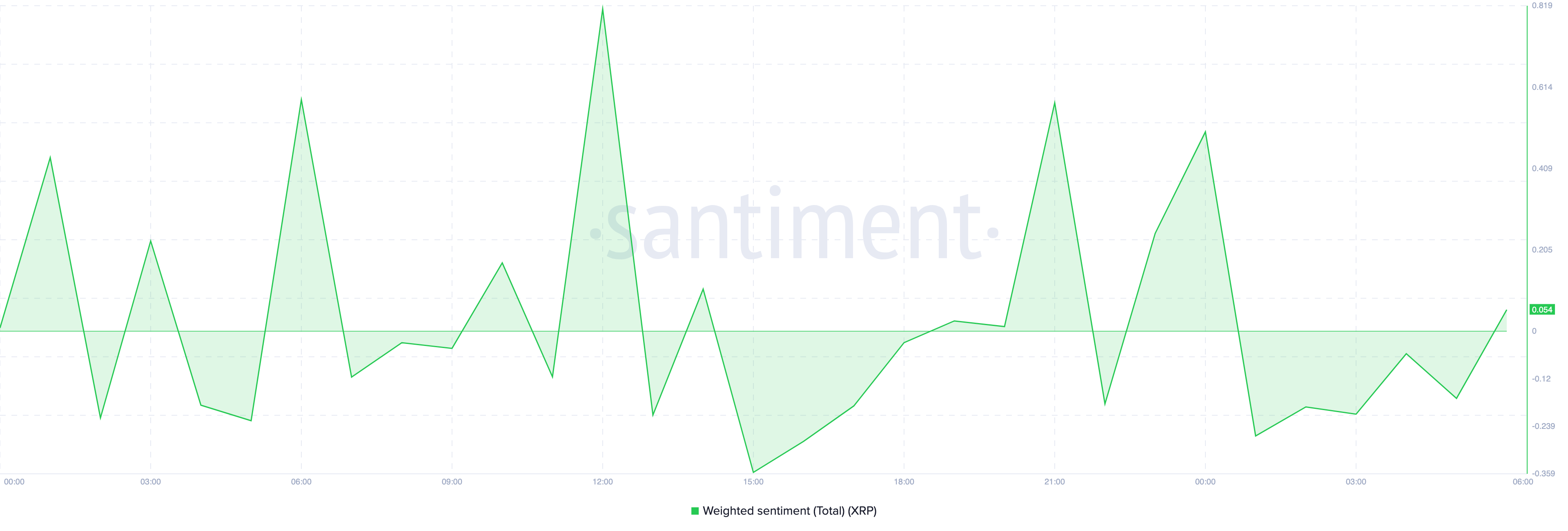

XRP shows positive sentiment among investors

According to on-chain data from BeInCrypto, Ripple's weighted sentiment has recently moved out of the negative territory, suggesting a more optimistic market outlook among investors.

An increase in weighted sentiment often indicates that traders and holders feel more positive about the asset. If sustained, this can lead to increased demand and is most likely to result in further price appreciation.

Conversely, negative readings of the indicator represent the pessimistic outlook of the average market participants. In most cases, this foreshadows a price decline, but in extreme cases of negative readings, it can also trigger a rebound.

However, in this case, sustained buying pressure will be crucial to confirm the uptrend. Sentiment alone may not be enough to drive XRP's price higher.

Read more: XRP ETF Explained: What It Is and How It Works

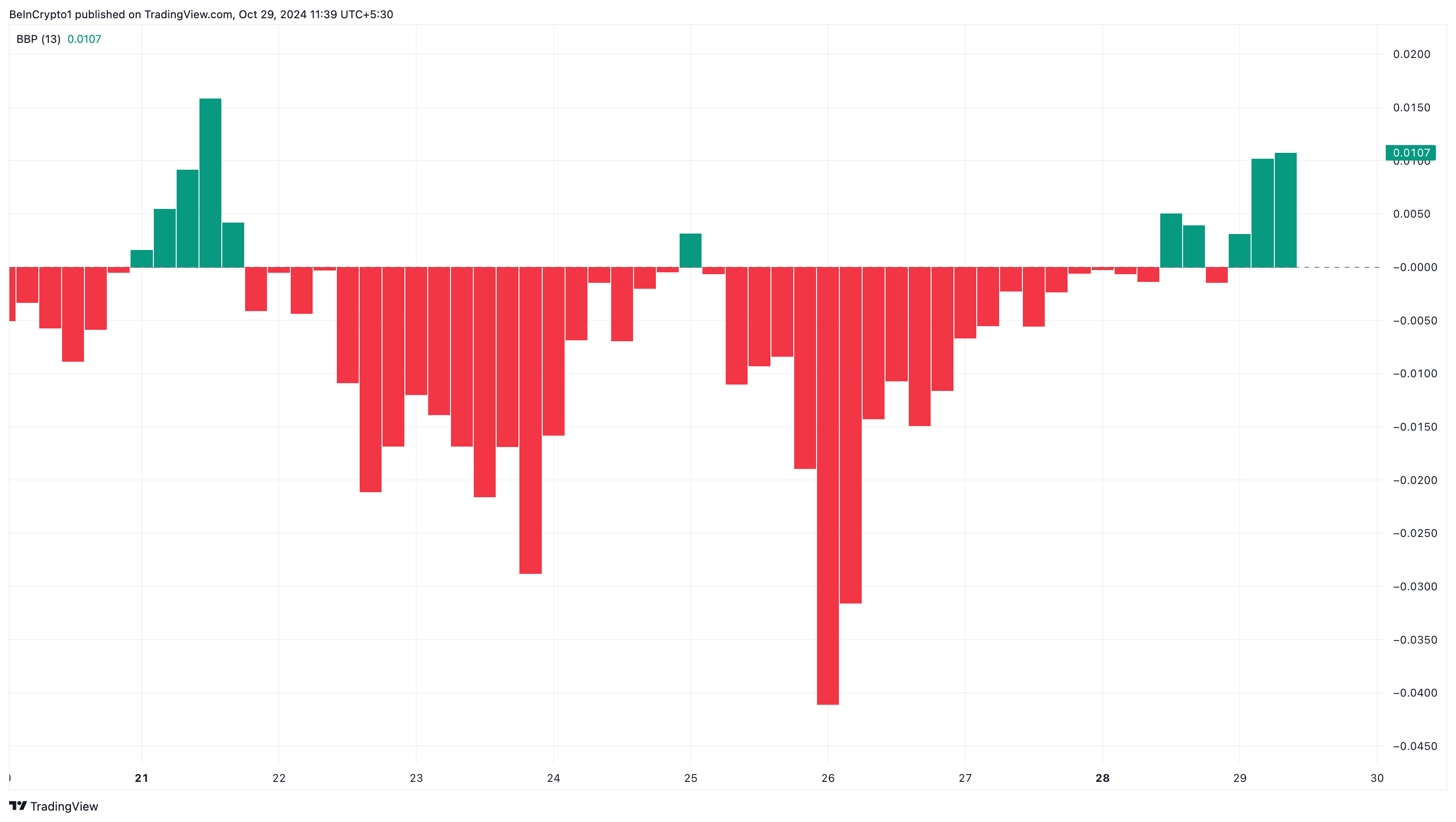

Interestingly, the 4-hour chart shows that XRP buyers have been determined to maintain the recent uptrend. This is evidenced by the Bull Bear Power (BBP) indicator.

BBP measures the balance of buying and selling pressure. When the indicator remains in positive territory, it often signals the continuation of bullish momentum. However, a decline in BBP indicates weakening buying power and can signal a potential pullback.

At the time of writing, the BBP indicator shows that buyers have a much stronger presence than sellers. If XRP buyers can keep the BBP indicator above neutral levels, XRP may be able to break through the nearby resistance.

XRP Price Prediction: Altcoin Challenges $0.6

On the daily chart, XRP's price fell below the 20-day Exponential Moving Average (EMA) on October 21, suggesting a short-term bearish shift. The EMA is a technical indicator used to assess an asset's trend.

When the price trades below this level, it often indicates that selling pressure has intensified, which can hinder the Bulls' ability to maintain the uptrend. Nevertheless, the XRP Bulls were able to recover the $0.50 support, providing the altcoin an opportunity to break through higher resistance levels.

Considering the current buying pressure, XRP's price is likely to rise above the 50 EMA (yellow). If this occurs, the altcoin could climb to $0.55 and potentially break through $0.60 in the near term.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

On the other hand, investors holding short positions will want to ensure that XRP does not rise above $0.55 to realize their profits. If this scenario plays out, the price could fall to $0.49.