What initially attracted me to the crypto circle was the story of Bit's sudden wealth and the annual pizza day lament.

Once, as a staunch mainstream coin holder, I only used Binance and OKEx exchanges, feeling comfortable under the big tree, thinking that the coins bought on these platforms were reliable. Although I was not a full-time coin trader, I liked to follow the hot spots. By chance, I made some money on $Bome and $Pandora, and thought I was a genius trader.

But over time, the situation changed.

Whenever Bit went up, my holdings - $G, $Alt, $PIXEL, $Stark, $WLD, $TIA, $Ordi, etc. - didn't rise much; and whenever Bit went down, these coins followed suit, plummeting sharply.

When Bit broke through 70,000, I was dumbfounded, it was a bull market, but I had already been trapped by nearly 70%.

At one time, I always believed that buying good coins on good platforms could make me rich, but now this belief has collapsed. Where is the wealth effect? Where is the value investment? Where are the top-notch projects?

With each decline and rise, these coins seem to be trapped in an endless cycle, deeply trapped, without any signs of improvement.

Finally, I came to the conclusion - I can't get rich playing spot on Binance and OKEx.

The journey of unwinding, starting with MEME self-rescue

So I started to find ways to unwind. In the second half of the year, the MEME market became hotter and hotter, so I turned my attention to the MEME field. Originally I bought 50,000U of spot on Binance, and was trapped by about 70%, leaving only about 30% of the holdings, worth about 15,000U. I pledged and borrowed these tokens, and started to play MEME.

In early August, I started looking for opportunities on Twitter and TG, and participated in more than a dozen projects. Because I'm not a full-time web3, I can't stare at the screen for a long time, and most of the MEME projects I bought either didn't perform well or missed the best entry and exit timing, and by the end of the month I lost more than $700 (because I was just testing the waters in the early stage, and the investment was not large). At this point, I was about to give up, but by chance I saw on Twitter that LBank has recently focused on the MEME track, so I looked at the MEME projects that had been launched on LBank before, and found that they performed very well, so I decided to try some.

On August 30, I made my first trade on LBank, seeing that bruh was launched today, I researched its Twitter heat and style, feeling it had a MEME style, so I put in 200U, and after continuous observation, I found that the trading volume and heat were general, so I cautiously cleared the position and took profits.

On September 1, I bought ebull, the trading volume and heat were general, and I also made a profit of 20% and cleared the position.

There were no MEME projects launched in the next few days, until September 5, when vista was launched. I researched it and felt it was a hot spot, with a Pandora-like feel, so I decisively put in 1000u. But soon there was negative news, so I decisively cleared the position and left.

Then there were a few more days of waiting, until September 10, when Dogegov was launched. I checked on Twitter and found that its original name was D.O.G.E, with a high number of followers and heat, so I directly bought 1000U, held it for a few days without much upside, and then cleared the position.

Then MAO, DEV, CATALORIAN and a few other MEME coins were launched. MAO is an on-chain meme on the BSC chain, which I didn't have much interest in. DEV and CATALORIAN had general heat, and there was not much heat on Twitter either, so I didn't take any action.

On September 18, MOODENG was launched, and I also did the usual research and found that this IP had over 100 million heat on TikTok, so I decisively put in 2000U, and the heat then soared, and I held it until the end of the month, making a 1328% profit. Of course, I also made some other operations during this period:

September ended with a profit of 4210U. Looking back on the process of trading coins for half a year, I haven't made so much profit for a long time, and I've found the feeling of making money when I first entered the crypto circle.

Focus on new coin dynamics, become a sniper in the secondary market

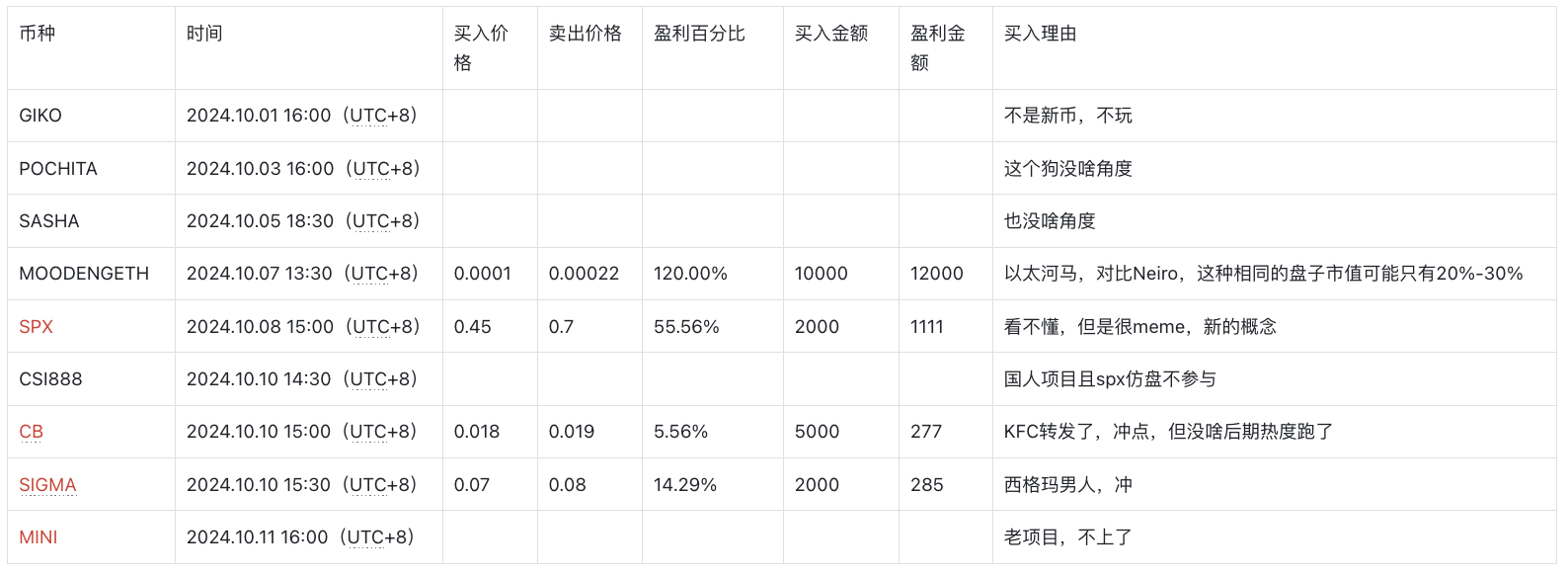

In October, I paid more attention to LBank's new coin dynamics, because there are usually big hot spots that come out during holidays like National Day and May Day. So I always follow LBank's listing pace during the holidays and make operations.

On October 12, the big one came. It was just like any other day, LBank launched GOATSEUS, and I checked the relevant content on Twitter, found that I didn't understand it at all, but the heat and traffic were abnormal. My instinct told me that the more I don't understand something, the more opportunities there are, so I decisively put in 5000U.

Sure enough, GOATSEUS took off, soaring over 100 times in two weeks, and my profit reached 8,788.00%, turning 5000U into over 400,000U.

Chasing hot spots, getting more opportunities from the secondary market

Looking back on my experience of trading coins on Binance, 50,000U turned into 15,000U; and then on LBank, 5,000U turned into nearly 500,000U, I found that the wealth effect on Binance is getting less and less, and most projects take Binance as the ultimate goal, which determines its ceiling. But for a coin, if you can see the ceiling at a glance, where is the profit potential. But for the coins on LBank, the secondary market, they may have just started, and have unlimited possibilities in the future. Buy on LBank, sell on Binance, I think it's fine.

Here are my 6 principles for choosing MEME:

1. Don't play Chinese-based projects;

2. The market cap of imitation projects can only reach 20%-30% of the original project;

3. The more unfamiliar, the more you should get in;

4. Dare to take a heavy position;

5. Decisively switch positions when the heat drops;

6. Must have an angle for hype, without an angle, you definitely won't make money;

In the fierce PVP battle, staying ahead is the key to victory.