A few days ago, Ethereum (ETH) was ready to rise towards $3,000. However, as the end of last month approached, the momentum changed, and the price of Ethereum, the second most valuable cryptocurrency, fell below $2,600.

Will Ethereum's price recover? It is one of the things investors want to know. In this on-chain analysis, BeInCrypto explains why altcoins may soon be able to reverse the trend.

Easing Ethereum Bearish Outlook

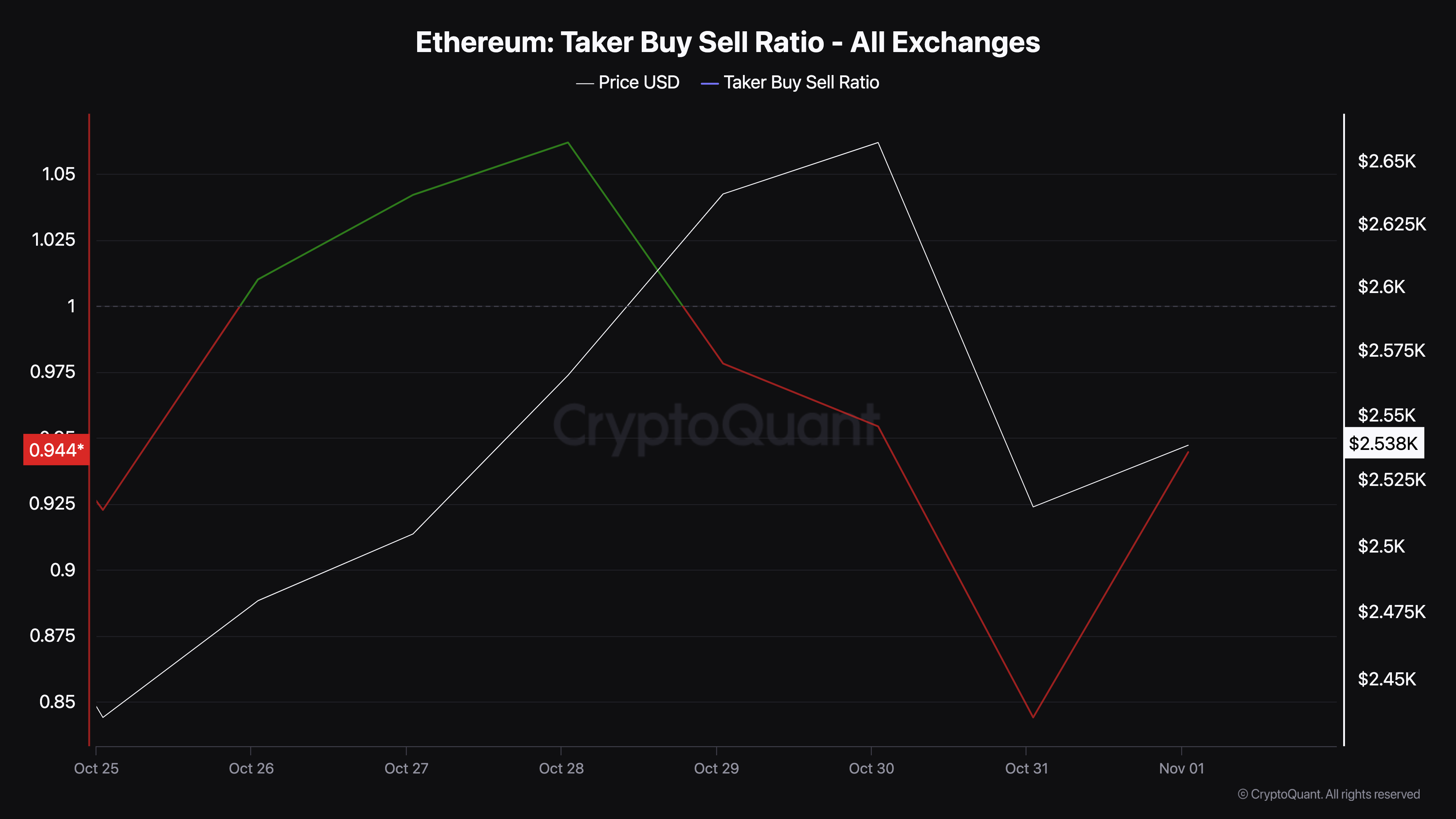

According to the on-chain data platform CryptoQuant, the decline in Ethereum's price has led to a decrease in the taker buy/sell ratio. This ratio is calculated by dividing the buy volume by the sell volume in perpetual swap trades.

A value greater than 1 indicates an uptrend, while a value less than 1 indicates a downtrend. On October 31, Ethereum's taker buy/sell ratio was 0.84, indicating a downtrend at that time.

However, at the time of writing this, the figure is increasing and is approaching 1. If the evaluation of the indicator continues to rise, Ethereum's price may also move in the same direction and could approach $2,800 as it did a few days ago.

Read more: Ethereum ETF Explained: What It Is and How It Works

Another indicator supporting the bullish bias is the 30-day Market Value to Realized Value (MVRV) ratio. The MVRV ratio provides insights into the market's peaks and bottoms by comparing the current market value and realized value of a cryptocurrency asset.

A high MVRV ratio suggests the asset may be overvalued, indicating a potential market top. Conversely, a low MVRV ratio indicates undervaluation and can point to a potential bottom.

Currently, Ethereum's MVRV ratio has turned positive, which coincides with Ethereum's price rising above $2,700 in mid-October. Based on this historical pattern, if the MVRV ratio continues to rise, Ethereum's price may also see a similar upward trend.

ETH Price Forecast: Chances of Rebound Increasing

On the daily chart, Ethereum's price is at risk of falling below $2,500. This scenario may occur, but the support around $2,345 will help the altcoin to rebound.

However, if that happens, the cryptocurrency will have to face the resistance at $2,790. As can be seen below, the Balance of Power (BoP) indicator has risen. BoP measures the balance of power between buyers and sellers.

A decrease in this indicator value means the market is dominated by sellers. But when BoP rises, buyers dominate, which is the case now. If this state persists, Ethereum's price could rise to $2,824.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

In a very bullish scenario, Ethereum could rise up to a maximum of $3,262. On the other hand, if it falls below the support, this bias could be invalidated. In such a case, Ethereum could drop to $2,115.