Before Bitcoin hit a new all-time high, the iShares Bitcoin Trust experienced rare outflows.

BlackRock's spot Bitcoin exchange-traded fund (ETF) has seen net outflows for the sixth consecutive day since its launch in January.

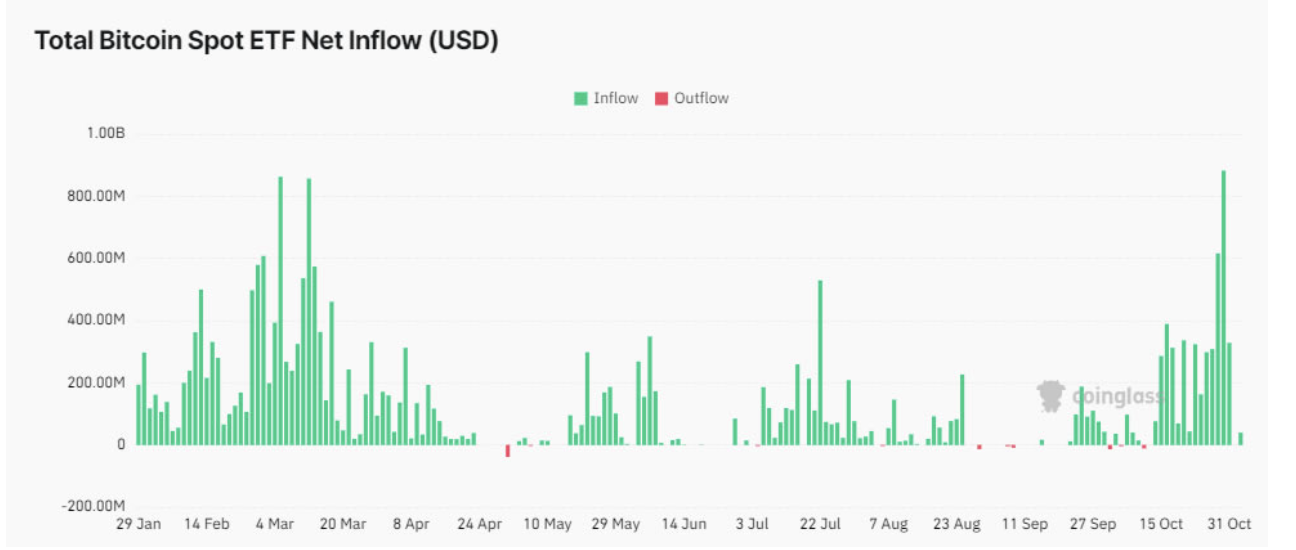

According to CoinGlass, institutional investors appear to be hedging ahead of the US election, as the iShares Bitcoin Trust saw $442 million in outflows on November 5.

This is the sixth day of net outflows in the ETF's brief history, and the first since $108 million flowed out of the fund on October 10.

Overall, the 11 US spot Bitcoin ETFs saw net outflows of $116.8 million, with the Fidelity Wise Origin Bitcoin Fund seeing net outflows of $68.2 million.

The only inflow on the day was to the Bitwise Bitcoin ETF, which saw $19.3 million in inflows.

Liquidity of the BlackRock IBIT ETF. Source: Coinglass

This is the third consecutive trading day that US spot Bitcoin ETFs have seen outflows, and just a day earlier, the outflows from these 11 funds hit a record high of $541.1 million.

With the announcement of the US election results, the spot cryptocurrency market soared after US trading hours, with Bitcoin BTC reaching $75,000, a new all-time high.

Apollo Crypto's Chief Investment Officer, Henrik Andersson, told Cointelegraph: "Bitcoin is currently the election trade for global traders."

Analyzing betting markets and traditional news sources, he estimated Donald Trump's chances of winning at 80% to 90%. "We think Bitcoin is reflecting that, and in the short term, it may have already completed 80% of its rally, currently sitting above $74,000."

He predicted that if Trump ultimately wins, Bitcoin's price will reach $100,000 by the end of this year.

ETF Store President Nate Geraci, in a blog post on November 5, said the overall impact of the election on investments is often overstated. However, the regulatory environment, particularly the leadership of the SEC, could have a significant impact on ETF innovation.

He added, "No one knows exactly how this will all play out - the best long-term solution is to implement a bipartisan, comprehensive crypto framework - but this election is likely to impact the pace of crypto ETF innovation in some way."