DeFi companies are concerned about implementing a "value accrual mechanism" for their tokens under the supervision of the U.S. Securities and Exchange Commission - but this may change with the inauguration of President-elect Donald Trump.

An industry analyst said that decentralized finance tokens have risen more than 30% as traders expect the Trump administration to increase the "investment appeal" of holding "utility" tokens.

UNI was one of the biggest winners on November 6-7, rising over 35% to a local high of $9.58.

BTC Markets' CFO and cryptocurrency analyst Charlie Sherry explained to Cointelegraph: "Until recently, DeFi tokens have been widely labeled as 'worthless governance tokens' that have no value beyond the ability to vote on protocol changes through governance voting."

"However, investors and token holders have been buying in because they believe that one day these protocols will be able to channel value back to the tokens through the fees earned by the protocol."

Sherry pointed out that this "value accrual mechanism" has not yet been implemented, as many DeFi protocols are concerned about enforcement action by the U.S. Securities and Exchange Commission, citing the SEC's investigation into Uniswap Labs as a typical example.

On November 6, Donald Trump was elected President of the United States, defeating Vice President Kamala Harris by a landslide. 10x Research said that SEC Chairman Gary Gensler is likely to resign as early as December or January.

Sherry said these two factors may have jointly triggered a "regulatory optimism sentiment.""The market is now digesting the expected regulatory shift, and DeFi projects and their tokens are expected to face a more friendly environment."

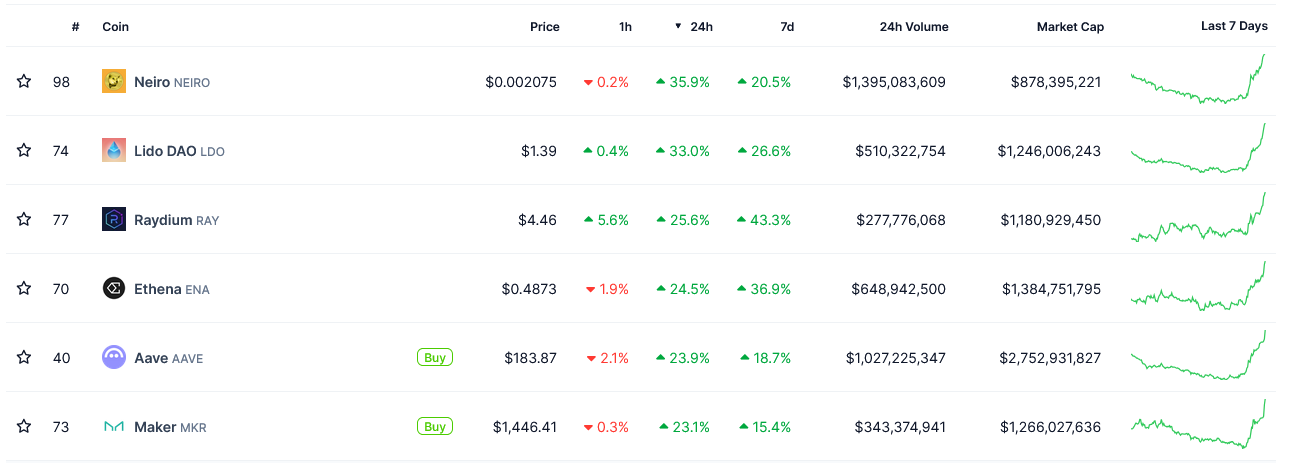

Best performing tokens in the last 24 hours. Source: CoinGecko

Sherry further explained the value accrual mechanism, stating that the "fee capture" proposal of the lending protocol Aave would be "an important step in creating intrinsic value for AAVE token holders."

Similarly, Sherry pointed out that a portion of the fees from Uniswap's new Layer 2 Unichain will also flow to UNI token holders - "transforming UNI from a governance token to a utility asset and expanding its investment appeal."

Sherry noted that the DeFi protocols behind LIDO, ENA, MKR and Frax (FXS) may also see similar "value accrual" changes.

Meanwhile, 10x Research head of research Markus Thielen said the rise in DeFi tokens may be due to some traders adopting a "buy the laggards" strategy - buying assets that performed poorly the previous year, which may become the leaders the following year.

Thielen told Cointelegraph that there are also speculations that BlackRock may "get more aggressive" in promoting its spot Ethereum ETF in 2025.

Thielen said that if Ethereum manages to break through the $2,700 level, it could reach $3,000.

As of the time of writing, Ethereum is currently trading at $2,845, up 8.5% in the last 24 hours.