Coexistence of Multiple Chains - The Inevitable Trend of Blockchain Development

With the rapid development of Bit technology, more and more teams are now building their own Bit chains to compete for economic benefits and attract more users. This trend not only demonstrates the diversity of Bit technology, but also reflects the market's demand for various application scenarios.

Although some high-performance public Bit chains have tried to improve the performance of a single chain to meet the needs of developers, they still face some limitations in handling transaction volume and reliability. For example, during peak periods, some public Bit chains may experience congestion, leading to longer transaction confirmation times, and even shutdowns in extreme cases. These troubles not only damage the user experience, but also pose challenges to the confidence of developers.

In addition, as the number of Bit applications increases, the single-chain solution can no longer meet all the needs. Different application scenarios may require different technical architectures and execution environments. For example, financial applications may focus more on transaction speed and security, while gaming applications may focus more on low latency and high throughput. This requires the future Bit ecosystem to provide diversified execution environments to support the flexibility and scalability of various Bit applications.

With the continuous progress of technology and the change of market demand, we expect to see more types of execution environments emerge. These environments may include not only high-performance public Bit chains, but also dedicated chains, side chains, Layer 2 solutions, etc., to meet the needs of various applications. Through these diversified execution environments, the Bit industry will better address the current challenges and drive further technological development and widespread application.

What stage are we in the multi-chain landscape?

In the multi-chain ecosystem, Ethereum, as one of the earliest smart contract platforms, still plays a key role. With the launch of Arbitrum and Optimism's Ethereum Layer 2 (L2) scaling solutions, the Ethereum L2 ecosystem is thriving, aiming to improve Ethereum's processing capacity and reduce transaction costs to meet the growing user demand and application scenarios.

The replicability of technology makes it possible to quickly create new chains: there are already more than 50 chains based on the OP Stack's Superchain, and more than 50 chains at different stages of development on Arbitrum Orbit's Layer 3. In addition, other Layer 2 solutions based on technologies like zk-rollup are also flourishing. These innovations not only enhance Ethereum's scalability, but also provide more choices for developers, further enriching Ethereum's ecosystem.

However, this rapid growth also brings the problem of liquidity fragmentation. Each L2 network competes for the total value locked (TVL), further fragmenting Ethereum's liquidity. Vitalik Buterin pointed out on his personal Twitter that the main challenge Ethereum currently faces is the fragmentation of operations between different L2s. This fragmentation not only reduces the efficiency of liquidity utilization, but also increases the complexity for users to trade across different platforms.

In addition to Ethereum, other Layer 1 public Bit chains such as Solana, Sui, and BSC are also emerging in the competition, forming a multi-chain landscape with Ethereum in the lead and other public Bit chains coexisting. Each Layer 1 ecosystem has spawned multiple Layer 2 solutions, such as the multiple L2s catalyzed by the Ordinal craze in the Bitcoin ecosystem, Appchain, SVM Rollup and side chains on Solana, as well as L2 layouts on BSC and TON. This multi-chain development trend has led to the limited cryptocurrency market funds being scattered across many chains, causing a serious liquidity fragmentation problem.

There is still a lot of room for optimization in the market solutions

Although the current cross-chain bridges can help users bridge assets, the user experience is often not satisfactory, specifically:

- Complicated operations: Users need to switch between multiple websites, connect wallets, approve transactions, wait for confirmations, etc., which increases the user's operational burden.

- Time delay: Cross-chain transfers may take anywhere from tens of seconds to several minutes, affecting trading opportunities, especially in cases of high market volatility, the delay may lead to user losses.

- Insufficient liquidity: Users may encounter unfavorable prices during cross-chain transfers, with unpredictable losses, making it more difficult for users to obtain liquidity between different chains.

- Security risks: Cross-chain is seen as a weak link in the Bit ecosystem, with multiple security incidents (such as Wormhole, LI.FI, Across, etc.) highlighting this issue, reducing user trust in cross-chain transactions.

Although the existing solutions have to some extent alleviated the liquidity problem, they still have significant limitations. In theory, concentrating all the liquidity of the cryptocurrency market in a centralized exchange (CEX) could provide the best user experience, but this approach is contrary to the idea of decentralization and is difficult to implement in practice. In this context, the emergence of DEX aggregators has improved the user experience within a single chain, but they face new challenges in a multi-chain environment. Current DEX aggregators can only aggregate liquidity within a single chain and cannot achieve cross-chain liquidity aggregation, which still makes it difficult for users to trade between different chains. Furthermore, on high-gas-fee networks like Ethereum, the cost of transmitting liquidity across chains is often higher than directly using the liquidity source, further limiting user choices.

Although the DEX aggregator model performs more effectively on low-cost, low-latency networks like Solana, they still cannot completely solve the problem of liquidity fragmentation in a multi-chain environment. Therefore, the industry urgently needs more innovative solutions to achieve more efficient cross-chain liquidity aggregation and enhance the overall trading experience for users.

To overcome these challenges, the industry needs more innovative solutions, especially in the areas of cross-chain interoperability and liquidity integration. Through continuous technological progress and ecosystem improvement, the Bit industry is expected to achieve more efficient asset flow and better user experience. Future solutions may include smarter cross-chain bridge technologies. Technological innovation will provide users with a safer and more convenient cross-chain trading experience, driving the widespread application of Bit technology.

Owlto Finance: An Innovative Cross-Chain Liquidity Solution

To address these challenges, Owlto Finance has proposed the concept of "intention-centric cross-chain liquidity trading", aiming to simplify the cross-chain transaction process. Users only need to submit a request containing the transaction intention, and the system will automatically integrate the liquidity pools across different chains to achieve efficient asset conversion and minimize transaction friction costs. This innovative solution is expected to significantly improve the user experience, providing a decentralized, secure and transparent trading environment, while achieving the best transaction cost and time efficiency in the deeply unified liquidity pool.

Owlto Finance, established just a year ago, has already become the leader in the cross-chain bridge track: it has over 2 million users in more than 200 countries and regions around the world; on defillama, it ranks among the top three in 24-hour cross-chain trading volume, with a peak market share of 33%. As a leader in the cross-chain field, Owlto Finance, with its excellent technical strength and market influence, is committed to solving the problems of cross-chain transactions and liquidity. To date, Owlto Finance has successfully completed over 100,000 cross-chain transactions, with an active user base of over 2 million. By integrating advanced technologies and innovative solutions, Owlto Finance provides users with an efficient and secure cross-chain trading experience, aiming to effectively address the challenges posed by liquidity fragmentation.

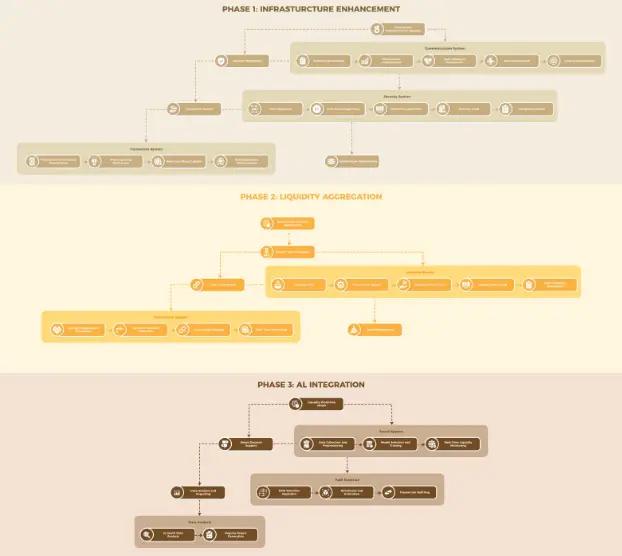

Owlto Finance will achieve the goal of cross-chain liquidity trading through a three-stage strategic plan. Each stage focuses on the improvement and integration of key technologies to ensure the efficiency, security and user experience of cross-chain transactions.

- Infrastructure enhancement: Improve the efficiency and security of cross-chain bridges, simplify the transaction confirmation process, and ensure a smooth user experience during the transaction process.

- Integrated multi-chain liquidity pool: Achieve single-chain liquidity aggregation, support cross-chain transaction smart contracts, ensure the accuracy and timeliness of liquidity data, and integrate liquidity pools from multiple chains to improve the depth and efficiency of cross-chain transactions, ensuring the security of liquidity interconnection.

- AI integration: Utilize AI technology to enhance the intelligence of liquidity management and transaction path optimization, achieving real-time liquidity forecasting and personalized transaction recommendations.

Through this series of phased measures, Owlto Finance is committed to providing users with an efficient and secure cross-chain transaction experience, solving the challenges brought by liquidity fragmentation.

Phase 1: Ensure the security of cross-chain asset flow through ZK and node security verification

In the crypto world, "decentralization" and "security" have always been the top priorities. The cross-chain field still faces challenges in "security" and "privacy protection". According to data from defillama, as of now, the cumulative funds stolen from cross-chain bridges have exceeded $2.8 billion, accounting for nearly 40% of the total amount of funds stolen in the entire Web3 industry. Therefore, the transmission and storage of transactions must have a high degree of security to prevent data tampering or theft. At the same time, the high transparency of on-chain transactions may also expose users' transaction intentions, posing privacy risks.

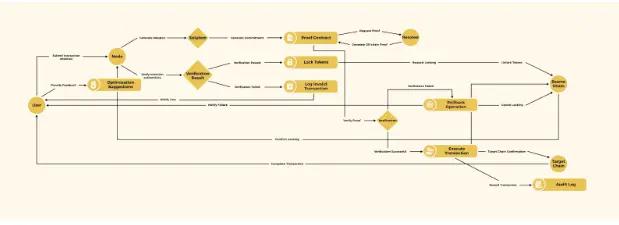

To this end, Owlto Finance is introducing the following two solutions to address the issues of "security" and "privacy protection":

- Node security verification: The decentralized solution effectively avoids single point of failure, thereby enhancing the security of asset flow between different networks. Owlto's "node security verification" adopts a staking mechanism based on a decentralized consensus mechanism, and introduces a "node punishment mechanism" and a "node incentive mechanism" to ensure data security. If a node transmits fraudulent data, the staked tokens will be penalized (Slashing mechanism); while nodes that actively participate and honestly execute will not only obtain additional benefits through staking, but also receive transaction fee sharing and token incentives for successfully executing transaction paths. This design ensures that nodes maintain honest behavior in a decentralized environment and avoid malicious behavior.

- Zero-knowledge proof: Introduce zero-knowledge proof technology to ensure that verifiers can confirm user intentions and correctly execute transactions without knowing the specific transaction information. If the intermediate link attempts to transmit forged protocols, the generated commitment will not be able to pass the verification, thereby ensuring the security of the entire transaction process and protecting user privacy. At the same time, in the verification process, zero-knowledge proof can also prevent maximum extractable value (MEV) attacks, further enhancing the system's security.

In addition, Owlto Finance will also strive to improve the efficiency, security and user experience of cross-chain bridges, with specific measures including:

- Simplified cross-chain communication: Implement advanced cross-chain communication protocols to reduce data transmission latency and improve transaction speed.

- Enhanced security: Introduce a multi-signature mechanism to ensure the integrity and tamper-resistance of transactions, and adopt zero-knowledge proof technology to protect user privacy and prevent data leakage.

- Optimized transaction confirmation: Optimize the transaction confirmation process, shorten the confirmation time, and improve the user experience; implement smart queuing and priority processing mechanisms to reduce transaction congestion; provide real-time transaction status updates to enhance user visibility of transaction progress.

- Improved scalability: Adopt a distributed system design to ensure high concurrency processing capabilities, and design a modular architecture to support future function expansion and upgrades.

Phase 2: Integrate cross-chain liquidity through interoperability

In this stage, Owlto Finance is committed to building a set of interoperability solutions that enable Web3 users to achieve full-chain asset liquidity. This goal is not an easy task, how does Owlto achieve it?

Owlto provides a cross-chain liquidity pool, enhancing the interoperability between different chains. For users, the stronger the interoperability function, the more chains connected, the richer the asset circulation scenarios. Especially by connecting different ecosystems and linking EVM and non-EVM heterogeneous chains, users can circulate funds from Chain A to Chain B with minimal friction, thereby improving the circulation and utilization efficiency of these assets in DeFi.

Currently, Owlto's cross-chain liquidity pool has connected more than 50 networks, successfully connecting the asset liquidity between ecosystems such as Ethereum, Bitcoin and Solana, expanding the application scenarios of assets on different networks, and increasing the possibility of returns. Through Owlto's cross-chain transactions on the Bitcoin Layer 2, the number has exceeded 1.6 million, and the number of cross-chain transactions on other chains is about 8 million, with a total user base of over 2 million.

At the same time, Owlto has significantly improved user experience in terms of cross-chain speed and security, with 90% of cross-chain transactions completed within 30 seconds, and has received an AA rating on the CertiK security audit website.

Owlto Cross-Chain DEX Aggregator: Compared to ordinary DEXes, DEX aggregators are more like information trackers, able to find the best liquidity pools across different networks, thereby achieving lower slippage transactions and avoiding the high slippage problem caused by the limited liquidity of a single liquidity pool. Owlto has deployed DEX aggregator functions on about 20 chains, connecting the liquidity between different chains and different Tokens.

Through a series of measures, Owlto Finance has achieved comprehensive integration of liquidity pools on multiple chains, improving the depth and efficiency of cross-chain transactions. Specific measures include:

- Establishment of liquidity aggregation mechanism: Design and implement a liquidity aggregation mechanism to integrate liquidity resources from various chains, ensure the interoperability of liquidity pools, and reduce transaction slippage and price differences.

- Smart contract management and scheduling: Automatically manage and schedule cross-chain liquidity, realize dynamic liquidity allocation, and optimize resource utilization.

- Cross-chain liquidity bridging: Through liquidity bridging, realize the interconnection of liquidity between different chains, ensuring the security and efficiency of cross-chain liquidity.

- Real-time monitoring: Establish a real-time monitoring system to track the status and changes of liquidity pools.

- Liquidity retrieval and integration: Develop tools and interfaces to retrieve and integrate liquidity data from single-chain in real-time, ensuring the accuracy and timeliness of liquidity data, and providing support for cross-chain transactions.

Phase 3: Utilize AI technology to realize intent-centric cross-chain liquidity trading

In this stage, Owlto Finance will introduce an intent-centric trading model, which is different from the traditional trading method. It no longer adheres to a specific path to complete the transaction, but allows transactions through any path as long as the user's constraint conditions are met and the expected result is achieved.

Under this framework, users only need to sign a transaction intent, expressing their expectations for the final result. The protocol nodes will be responsible for evaluating different liquidity providers, including decentralized exchanges (DEXes) and market makers, across multiple blockchain networks. Through smart routing and algorithms, the nodes will select the optimal cross-chain liquidity path to ensure that the transaction result meets the user's intent. During this process, the user's assets will be held in a smart contract, and will only be released to the liquidity providers upon successful completion of the transaction, thereby ensuring the security of the user's funds.

For example, if a user wants to convert 1000 USDT on Ethereum to BNB on the BNB Chain, and wants to receive at least 1.2 BNB. After the user submits the transaction intent, the protocol will analyze the data and market conditions using AI algorithms to find the best path. The possible operation process may be: first exchange USDT for ETH on Arbitrum, then transfer ETH to the BNB Chain, and finally exchange ETH for BNB on the BNB Chain. Once the node selects the optimal path, the transaction will begin to execute. This approach can more effectively utilize the liquidity pools and favorable exchange rates on different chains, while reducing transaction costs and time.

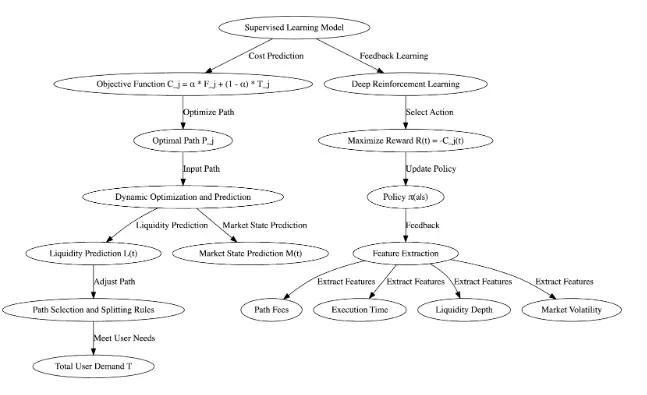

In this "intent-centric cross-chain liquidity trading" model, AI technology plays a crucial role:

- Liquidity Prediction: Through AI algorithm analysis of historical data and current market conditions, predict changes in liquidity across different chains, and proactively adjust liquidity pool configurations. Nodes can utilize liquidity resources from multiple chains to optimize transaction execution.

- Path Optimization: AI algorithms will be used to find the best trading paths, ensuring users get the best liquidity while minimizing transaction costs and time. If necessary, transactions may be split into multiple small portions and executed through multiple paths to ensure optimal liquidity utilization and cost minimization.

- Data Analysis and Reporting: In-depth analysis of cross-chain transaction data, generating detailed reports and insights to help protocol developers and users better understand market dynamics and liquidity conditions.

Through these measures, Owlto Finance will leverage AI technology to enhance the intelligence of liquidity management and transaction path optimization, specifically including:

- Liquidity Prediction Model Development: Develop and train AI models to analyze historical data and market trends, real-time predict liquidity changes, and support dynamic adjustment of liquidity pool configurations.

- Transaction Path Optimization: Integrate AI algorithms to analyze transaction data and market conditions, optimize transaction paths, and improve transaction execution efficiency.

- Intelligent Decision Support: Utilize AI to generate transaction recommendations and strategies, assist user decision-making, provide personalized transaction optimization solutions, and enhance user experience. Continuous Learning and Improvement: Implement machine learning mechanisms to continuously update and optimize AI models, collect user feedback and market data, and improve the accuracy and efficiency of AI algorithms.

Through this series of AI-driven initiatives, Owlto Finance will further enhance the efficiency and security of cross-chain liquidity trading, providing users with an even better trading experience.

Owlto Finance: The Leader in Cross-Chain Liquidity Trading

Owlto Finance has become the leader in the cross-chain field, committed to solving the current problems of cross-chain and liquidity fragmentation through a comprehensive liquidity solution. Our technical upgrades enable liquidity aggregation to provide users with multiple advantages:

- Enhance User Experience: By providing a unified user interface, users can easily access and manage assets across different chains. This consistency not only improves operational efficiency but also enhances the overall user experience. Liquidity aggregation allows users to access liquidity pools across multiple chains on a single platform, reducing the need to switch between different platforms and simplifying the transaction process.

- Improve Transaction Execution: The liquidity aggregator can find the best prices among multiple liquidity sources, providing users with better transaction execution, reducing transaction costs, and improving the overall user experience. Enhance Market Efficiency: Liquidity aggregation, by integrating these fragmented liquidity sources, reduces market fragmentation and improves overall market efficiency. By aggregating liquidity from different chains, the liquidity aggregator can increase the utilization rate of liquidity pools and reduce the waste of idle capital.

- Support Cross-Chain Interoperability: Liquidity aggregation supports cross-chain transactions within the chain abstraction, allowing users to seamlessly exchange assets between different blockchains. This capability is crucial for the interoperability of the multi-chain ecosystem. By optimizing transaction paths and reducing intermediate steps, the liquidity aggregator can lower the cost of cross-chain transactions, enabling users to perform cross-chain operations at a lower fee.

- Enhance Transaction Reliability: The liquidity aggregator, by selecting the optimal liquidity path and execution strategy, reduces the risk of transaction failures and price slippage. By providing transparent information on transaction execution and liquidity sources, the liquidity aggregator can enhance user trust in the transaction process.

Although the current DeFi ecosystem still has many inconveniences and security risks, Owlto Finance's vision is to build an intent-centric cross-chain liquidity protocol. We will integrate intent, zero-knowledge proofs, smart contracts, and AI technology, using transaction splitting algorithms and smart transaction routing algorithms to help users obtain the best liquidity across multiple chains and choose the best path to reduce transaction costs. Through secure and decentralized means, Owlto Finance is committed to solving the complexity of cross-chain trading and the lack of market liquidity, providing better services for billions of users.