Author: 1912212.eth, Foresight News

After Trump's victory, the crypto market has recently seen a massive surge. Bitcoin, Ethereum, Meme, re-pledging, DeFi, RWA, L2, AI, most of the tracks you can think of have seen a general rise, the difference is only the magnitude of the increase.

So how is the overall performance of the crypto market data now? Let's take a look.

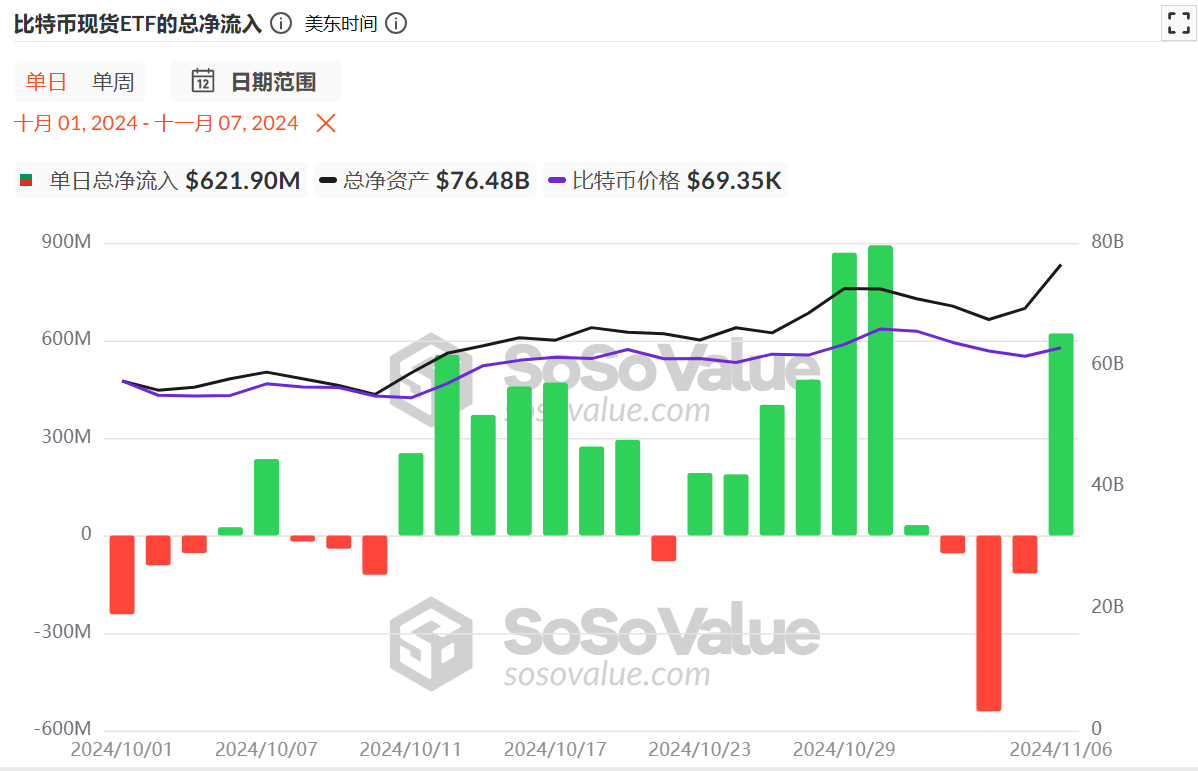

Bitcoin spot ETF net inflows exceed $600 million in a single day

Since October, the Bitcoin spot ETF data has been seeing large net inflows, and the net inflows, whether in terms of amount or number of days, are far greater than the net outflows.

In early November, due to the uncertainty of the US election, there was a 3-day net outflow, totaling about $700 million. However, on November 6, after the election results were confirmed, the net inflow reached a staggering $621.9 million in a single day, almost wiping out the net outflow difference in one day.

The total trading volume on that day reached $6.07 billion, a new high since March 15 this year. Among them, BlackRock's ETF IBIT had a single-day trading volume of $4.14 billion, setting a new high in its history.

After the election results were confirmed, off-market funds flowed back into the market, ending their hesitation. Currently, the total net inflow of Bitcoin spot ETFs has risen to $24.12 billion.

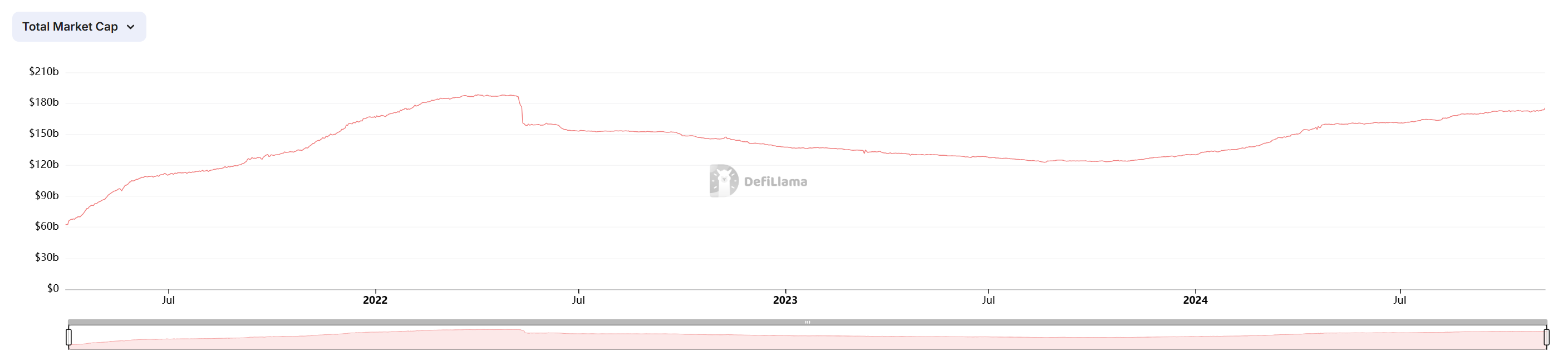

Stablecoin market capitalization approaches historic highs

Stablecoins, which measure market liquidity, have also performed well. The total market capitalization has now risen to over $1.75 trillion, close to the historic high of $187 billion. Over the past 7 days, its market value has increased by 1.47%, indicating that funds are constantly flowing in.

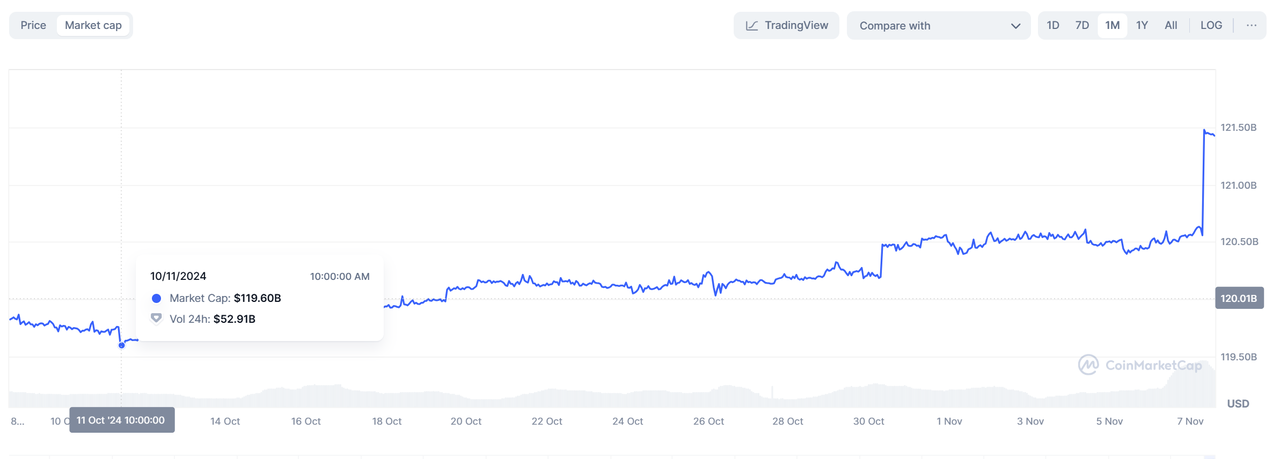

Among them, USDT has risen from a market value of $120 billion to $121.5 billion. It is worth mentioning that on November 7, the market value soared from $120.6 billion to $121.4 billion in a single day, an increase of over $800 million.

USDC data has also performed well, rising from a low of $34.38 billion to $36.7 billion in the past month, an increase of over $2 billion. The inflow of US funds remains strong.

The total market capitalization of the crypto market has risen to $2.5 trillion, approaching the historical high

The peak total market capitalization of the previous crypto market cycle was $2.86 trillion. In April this year, the total market capitalization once reached $2.7 trillion, and the current market capitalization has risen to over $2.5 trillion, not far from the historical high.

Institutional and trader views

Bitfinex analyst: A large amount of capital is expected to be released for the crypto sector in the short term after Trump's election

With the industry expecting the federal agencies to take a less hostile attitude towards cryptocurrencies, this trend is expected to drive more capital into the Web3 space. The analyst said: "We expect a large amount of capital to be released for the crypto sector in the short term. In addition, this may also have an impact on the approach taken by the US SEC, which the industry generally believes has a hostile attitude towards the crypto industry.

Matrixport: BTC adoption rate is close to 8%, Trump's support may drive BTC price to break $100,000

Matrixport's weekly report shows that the Bitcoin adoption rate is close to the critical 8% threshold, and Trump's support may drive the price to break through. The report shows that about 7.51% of the global population (617 million people) use cryptocurrencies, close to the 8% adoption rate threshold. Reaching this threshold may mark a turning point for Bitcoin's mainstream application. In addition, Trump promised at the 2024 Bitcoin conference to include Bitcoin in the national financial reserves, support Bitcoin mining, and plan to set up an advisory committee to support cryptocurrencies. Meanwhile, a Wyoming senator has proposed the "2024 Bitcoin Act" to establish a strategic Bitcoin reserve and purchase 1 million Bitcoins within five years. The report predicts that in this supportive environment, Bitcoin may reach $100,000 in the next few months.

10x Research: The market narrative is shifting, and Bitcoin is aiming for $100,000

10x Research said that with the parabolic growth in ETF demand, Bitcoin will follow suit, and it is expected to reach $101,694 by the end of January 2025. The strong bullish window will last until the first quarter of 2025. The narrative no longer positions DeFi as an external alternative to the traditional financial system, but shifts to Bitcoin as the digital gold. This framework will treat Bitcoin as a permanent, long-term asset in institutional portfolios.

CryptoQuant CEO: Advises Bitcoin holders to gradually sell, warns of the risk of cross-margin buying

Ki Young Ju, CEO of the crypto analysis platform CryptoQuant, tweeted that new investors often hold Bitcoin during bear markets, and after experiencing losses, they will sell around two years when the market stabilizes. He believes that this is the time of this transition, and Bitcoin may rise another 30-40% from the current level, but will not see a 368% increase from $16,000 again. He advises investors to consider gradually selling, rather than continuing to "cross-margin buy".

Meme coin KOL Murad: Bitcoin will exceed $100,000

Meme coin KOL Murad tweeted that Bitcoin will exceed $100,000, and top meme coins will rise over 100 times. The tweet received over 6,000 likes.

Trader Ansem: If the regulation is favorable, an unprecedented Altcoin bull market will come

Ansem tweeted that if the US implements favorable regulatory policies for DeFi in the next few years, we will see an unprecedented Altcoin bull market.

Trader Eugene: Don't underestimate the breakthrough of the historical high

Trader Eugene tweeted yesterday that in the most uncertain times in the market, you should follow the oldest rules of the market. Don't underestimate Bitcoin breaking through the historical high.

Trader Nachi: The real super cycle has begun

Trader Nachi tweeted that Trump's landslide victory marks the beginning of the real super cycle, which will last at least 4 years.