Bitcoin has been showing a noticeable upward trend recently, breaking new all-time highs almost daily this week. Unlike previous peaks, this rally appears to be more sustainable, driven by solid market fundamentals.

The continuous growth of Bitcoin has attracted significant attention, granting the asset greater upside potential.

Bitcoin Showing Immense Strength... Not Overvalued According to NVT Metric

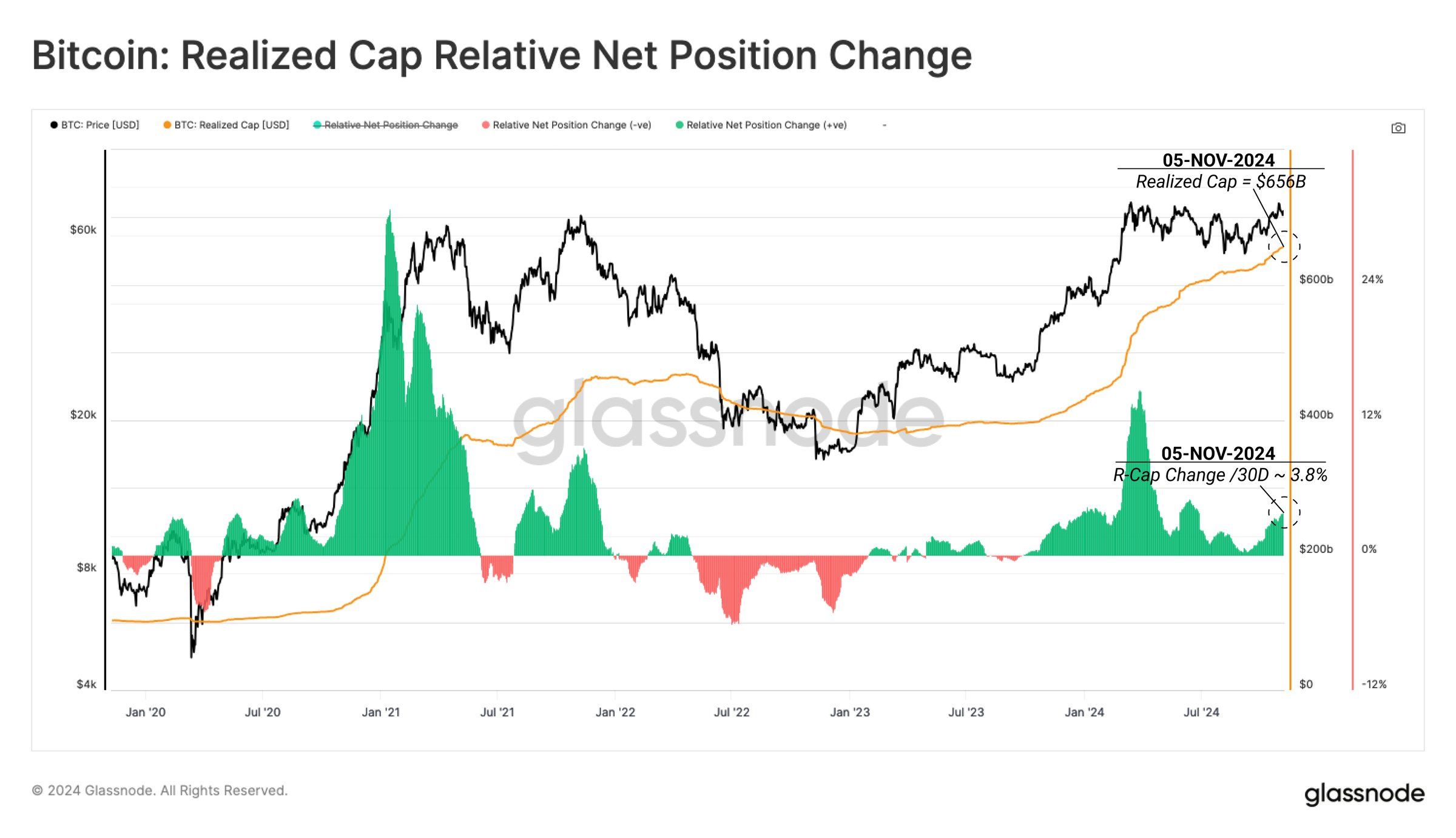

According to Glassnode's analysis, Bitcoin's realized capitalization has increased by 3.8% over the past 30 days, recording the largest inflow since January 2023. This increase reflects a rise in investment activity and growing confidence in the stability of cryptocurrency value.

"The realized capitalization is currently trading at an all-time high of $656 billion, with a net capital inflow of $2.5 billion over the past 30 days," Glassnode reported.

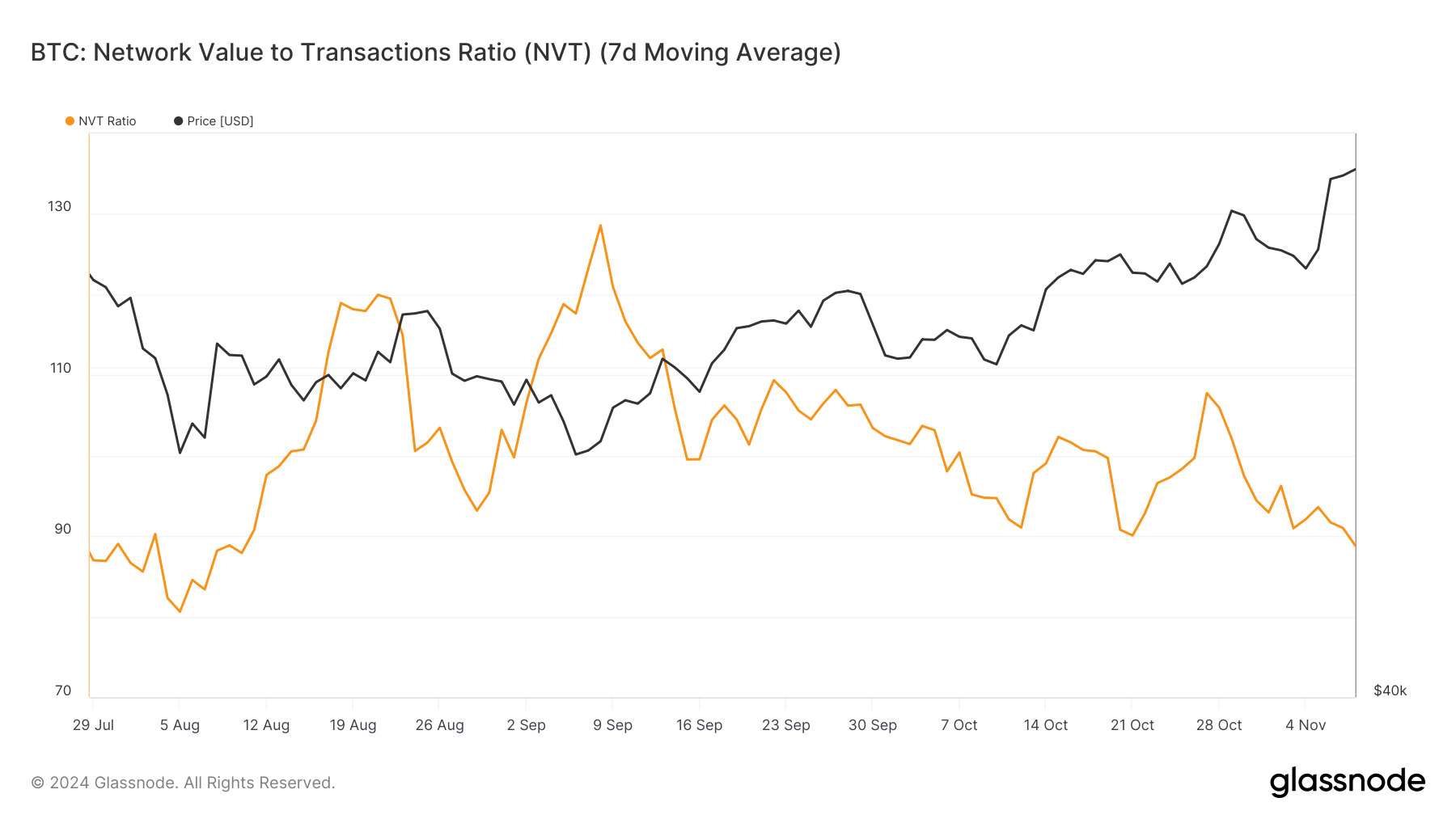

Bitcoin's macroeconomic momentum is strong, supported by its current 3-month low NVT (Network Value to Transactions) ratio. The low NVT ratio indicates that Bitcoin is not overvalued, reducing the likelihood of an immediate correction.

The undervaluation shown by NVT suggests that Bitcoin's growth is not driven by speculative excess, as in previous rallies. Rooted in trading strength, Bitcoin is in a good position to maintain its upward trend, earning the trust of investors who view it as entering a more stable growth phase.

BTC Price Forecast: New All-Time Highs Likely to Continue for Now

At the time of writing, Bitcoin is trading at $77,290, and on the 10th, it reached a new all-time high of $77,500. This sustained upward movement reflects Bitcoin's strength and confirms strong buyer interest, despite broader economic changes.

While Bitcoin is attempting to break above $80,000, it may see a slight pullback to test support around $73,773. Such an adjustment will allow Bitcoin to resume its upward trend without triggering an overbought condition, enabling healthy growth.

However, if Bitcoin fails to bounce back from this level and investors start taking profits, the price could decline further. A drop below $73,773 could lead to a decline to $71,367, challenging the current bullish outlook and requiring caution from short-term traders.