The Ethereum price has faced several attempts to break out of the adjustment range that has continued since early August, and is currently moving around $2,700.

However, the recent rally triggered by the rise in Bitcoin price can continue if long-term Ethereum holders do not sell and maintain their positions. This restraint of long-term holders will be crucial in supporting the upside potential of Ethereum.

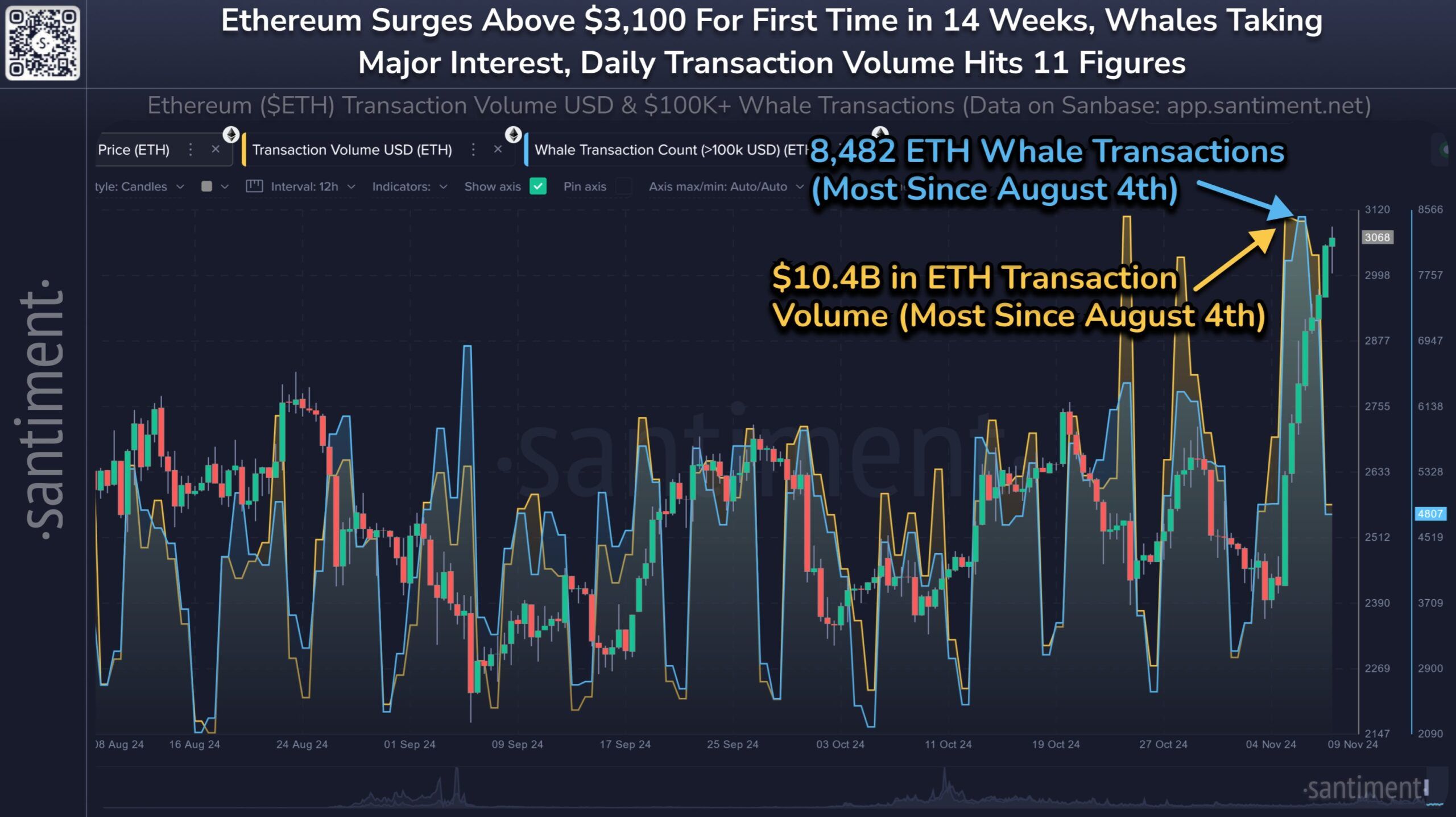

Ethereum Whale Activity Reaches Highest Level in 14 Weeks

Ethereum whales' activity has soared to a 14-week high, drawing increasing attention among large investors. Last week, there were 8,482 transactions exceeding $1 million, the highest since August. Along with this, whale trading volume exceeded $10.4 billion, emphasizing the importance of these large wallet holders. Their actions often have a significant impact on the Ethereum price, providing stability and driving momentum.

"In this bull run, we can expect Bitcoin's growth, and the profits may be redistributed to Ethereum, where network activity looks very healthy as it pushes towards its all-time high," Santiment says.

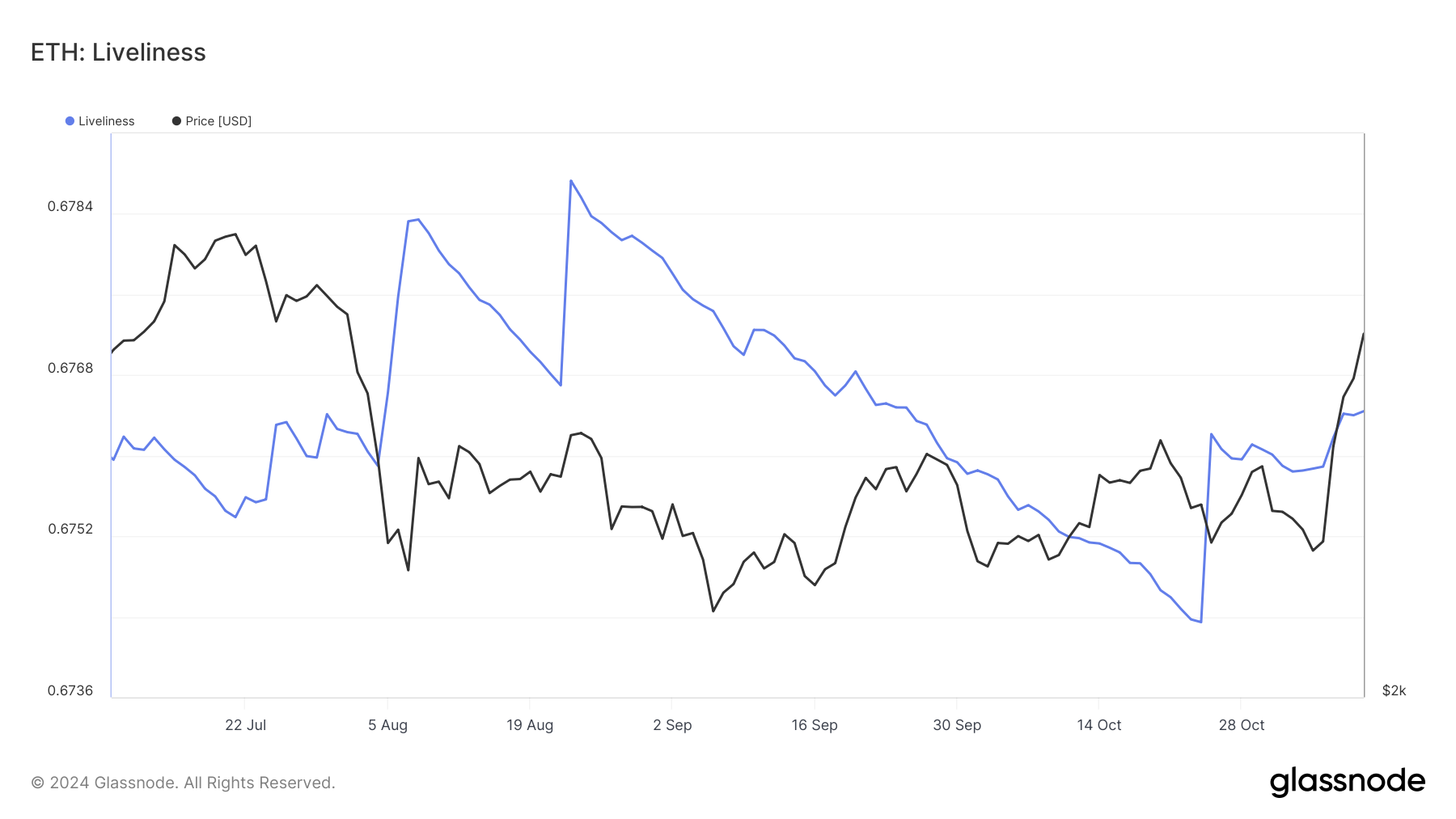

Ethereum's macroeconomic momentum is also influenced by the increase in the 'activity' indicator, which tracks the behavior of long-term holders. An increase in activity indicates that long-term holders are liquidating their positions, while a decrease shows accumulation. The recent increase in activity suggests that some long-term holders are realizing gains from the Ethereum price rally, and if more people decide to sell, the rally may slow down.

However, if Ethereum's long-term holders choose to hold rather than liquidate, the altcoin rally could gain more support. Activity among long-term holders is a double-edged sword: their sales provide liquidity but also increase the risk of downward pressure on prices. Therefore, activity remains an important factor in reflecting whether long-term holders will support or hinder Ethereum's growth.

ETH Price Forecast: Next Resistance is $3,327

Ethereum's price has risen 31.8% over the past 5 days and is currently trading at $3,193. For Ethereum to maintain its upward momentum, the next resistance level it needs to break through is $3,327. Overcoming this resistance could signal a new bullish trend in the market and propel Ethereum to further gains.

If the bullish momentum is sustained, Ethereum could turn the $3,327 resistance into a support level, which could push altcoins to $3,524. This additional rally will depend on the continued buying interest of retail and whale investors, further strengthening Ethereum's price stability.

However, if long-term holders continue to liquidate, Ethereum may struggle to break through the $3,327 level, and there is a possibility of a decline to $2,930. If it falls below this support level, the current bullish outlook will be invalidated, requiring caution among investors.