Peter Schiff, an economist and well-known Bitcoin (BTC) critic, has continued to express his skeptical views through social media, offering scathing criticism of the cryptocurrency's rapid rise.

A long-time gold supporter, he has recently referred to the surge as a "bubble" and warned of disastrous consequences for investors and the economy.

Schiff Calls Bitcoin a Popular Delusion

Schiff's criticism of Bitcoin is not new. His recent statements reiterate his previous claims that cryptocurrencies and blockchain are being driven by speculative fervor, a "popular delusion."

"Cryptocurrencies and blockchain will go down as the biggest popular delusion and the madness of crowds in the history of the world. When the bubble finally bursts, the losses will be staggering," Schiff wrote on X (formerly Twitter).

He warned that not only speculative buyers but also the infrastructure and investments around Bitcoin will crumble. Schiff says this will be "the greatest misallocation of resources in the history of mankind."

Schiff also suggests that the collapse of Bitcoin could damage the reputation of libertarian capitalism and the concept of sound money.

These statements have sparked a new debate between his critics and Bitcoin enthusiasts, with some accusing him of secretly owning Bitcoin while publicly denouncing it. Many believe Schiff's scathing criticism is merely a strategy to drive down the price of Bitcoin so he can buy it at a lower price.

"It's funny to me that the Bitcoin cultists accuse me of secretly owning Bitcoin while publicly denying it. They just can't accept that I legitimately disagree with their Kool-Aid-induced perspective," Schiff responded to these claims.

Schiff dismisses the speculation and insists that he fundamentally disagrees with the value of Bitcoin. He sees it as an inevitable bubble that will burst.

The animosity between Schiff and Bitcoin supporters is not new. He has consistently dismissed cryptocurrencies from the beginning.

One user pointed this out, and Schiff responded, "No, I didn't realize the bubble would get this big. If I had known, I would have bought a lot of Bitcoin."

This admission acknowledges the scale of Bitcoin's price rise, but the economist still argues that the surge is unsustainable.

Peter Schiff "Hopes to Thwart US Bitcoin Reserve

Additionally, Schiff has recently commented on the possibility of the US government establishing a Bitcoin reserve, as promised by Donald Trump. However, the Bitcoin critic argues that such a move would be disastrous. He suggests it would trigger a series of inflationary shocks, destabilizing the economy.

Schiff's hypothetical scenario explains that if the US government were to purchase 1 million Bitcoins, it would drive up the price and incentivize long-term holders to cash out. According to Schiff, this would trigger a collapse, forcing the government to print more money to stabilize Bitcoin prices.

This, he warns, would lead to a decline in the value of the dollar. Schiff cautions that this cyclical process would result in hyperinflation, rendering the dollar worthless. Ultimately, he believes, this would lead to the collapse of Bitcoin.

"This would cause a market crash, forcing the US government to print more dollars to buy more Bitcoin to prevent the price from falling. Of course, a reserve of something you can never sell and must keep buying has no value as a reserve. To maintain the Bitcoin reserve having actual value, the US government would have to keep buying, destroying the dollar in the process," Schiff explained.

Schiff's pessimistic Bitcoin reserve scenario is rooted in his belief that Bitcoin lacks intrinsic value and is not a sustainable store of wealth. According to Schiff, a Bitcoin reserve would increase market volatility and lead to economic collapse. His apocalyptic outlook has been mocked by prominent Bitcoin supporters, including MicroStrategy's Michael Saylor, who have responded to his scenario.

"You finally made me laugh, Peter," Saylor joked.

The MicroStrategy executives' jest captures the ongoing tension between supporters who view Bitcoin as an innovative asset and skeptics who see it as a bubble.

Despite the skepticism of critics like Schiff, Bitcoin's trajectory has exceeded expectations for years. It has grown from a niche digital asset to a thriving ecosystem. Many investors and institutions, including BlackRock, now see it as a legitimate hedge against inflation and a decentralized alternative to traditional finance (TradFi).

However, Peter Schiff argues that Bitcoin's appeal is based on high interest rather than fundamental value, and he warns that the fallout from its eventual collapse will have lasting impacts on investors and society.

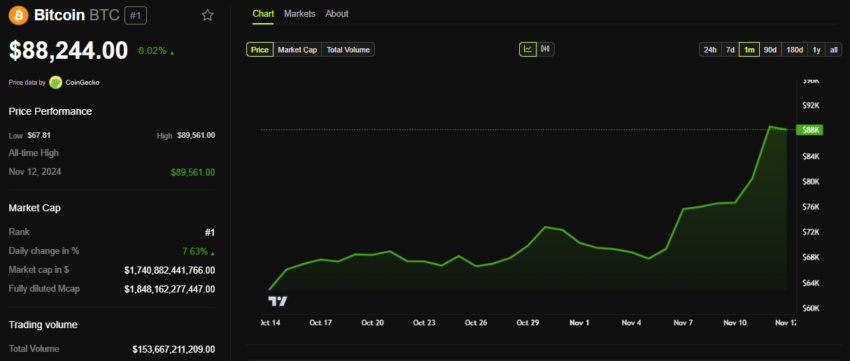

Meanwhile, Bitcoin's value shows no signs of slowing down. It has risen over 8% since the start of the Monday session. At the time of writing, Bitcoin is trading at $88,244.