Author: Nancy Lubale, CoinTelegraph; Compiled by: Tao Zhu, Jinse Finance

With Donald Trump winning the presidential election, the United States' growing interest in a crypto-friendly business environment has led to a surge of over 37% in the price of Ethereum in the past seven days, reaching its highest level since July 24.

ETH/USD daily chart. Source: TradingView

At the time of writing, Ethereum is trading at $3,392, with increasing demand for Ethereum ETFs through spot markets, and on-chain indicators suggesting that the Altcoin uptrend remains intact.

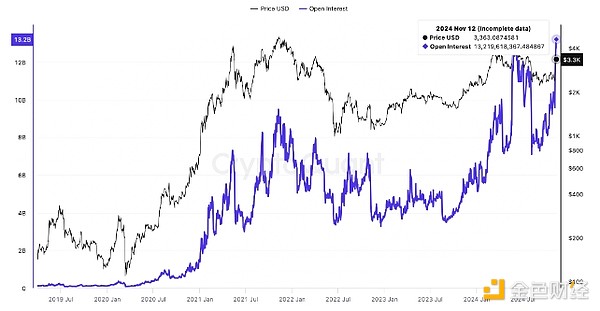

Ethereum Open Interest Reaches All-Time High

In the past seven days, leading up to Ethereum's rally, long positions in the futures market have increased. Data from on-chain market intelligence firm CryptoQuant shows that the total open interest in Ethereum derivatives reached an all-time high of 13.2 million ETH on November 11, up from 9.8 million ETH on November 5.

Total ETH open interest across all exchanges. Source: CryptoQuant

"ETH has finally set a new all-time high in futures OI, indicating that interest in the Altcoin king has finally returned," trader Alan said in a post on X, adding that the market can never ignore ETH.

Trader Olek believes that the rising Ether OI indicates "increasing liquidity and market participation".

Olek added:

"Ethereum is signaling a recovery, with increased activity suggesting the market is ready for action."

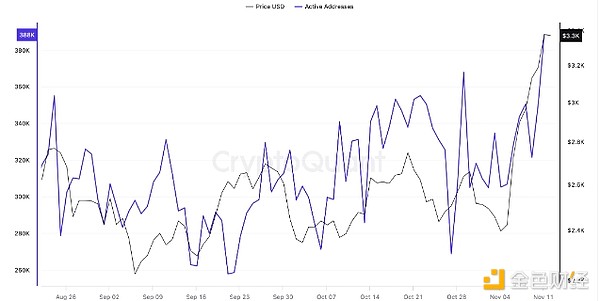

Increased ETH Demand

CryptoQuant data shows that demand for ETH seems to be regaining attention as on-chain activity increases, evidenced by the rising number of daily active addresses (DAA) on the Ethereum blockchain. The chart shows that Ethereum's DAA increased from 306,751 on November 5 to 388,350 at the time of writing this article on November 12, a 26% increase after Donald Trump's victory in the 2024 US presidential election last week.

Active addresses on Ethereum. Source: CryptoQuant

Therefore, on-chain data suggests that user interaction with the Layer 1 blockchain is increasing, indicating a rise in Ethereum transaction volume.

According to DappRadar, the active addresses of Ethereum DApps have increased by 8% in the past seven days. Overall, considering the significant growth in other DeFi metrics (such as total value locked, transaction volume, and Non-Fungible Token trading volume) over the past week, these data points are encouraging.

Top Layer 1 blockchains; 7-day DApp activity. Source: DappRadar

Sustained Ethereum network growth is required to generate the demand needed to push ETH to $4,000.

US Spot Ethereum ETF Inflows Reach $295 Million

Following Trump's victory, Ethereum has started to recover, with spot ETH ETF flows turning positive, after net outflows of $73 million in the last two days before the November 5 election.

According to data from SoSoValue, these investment products recorded their largest single-day inflow since their launch on July 23, with over $295 million in inflows on November 11.

Ethereum ETF spot flow activity. Source: SoSoValue

The Fidelity Ethereum Fund (FETH) led the inflows with a record $115.5 million, followed by the iShares Ethereum Trust ETF (ETHA) issued by BlackRock with $101 million.

The Grayscale Ethereum Trust ETF (ETH) came in third with $63.3 million in inflows, while the Bitwise Ethereum ETF (ETHW) recorded $15.6 million. All other US spot Ethereum ETFs had zero inflows.

Additional data from CoinShares shows that for the week ending November 8, the total inflows into Ethereum investment products were $157 million, bringing the year-to-date inflows to $915 million and assets under management to $12 billion.

CoinShares commented in the accompanying note that this was "the largest inflow since the ETFs launched in July, signaling a significant improvement in market sentiment".

The latest inflows continue the significant trend that began a week ago, suggesting that institutional demand for Ethereum investment products is increasing, potentially driving its price above the $4,000 high seen on March 12.