Bitcoin Hits New All-Time High

After a brief pause, the cryptocurrency rally sparked by Trump's victory in the US presidential election regained momentum during US trading hours on Wednesday.

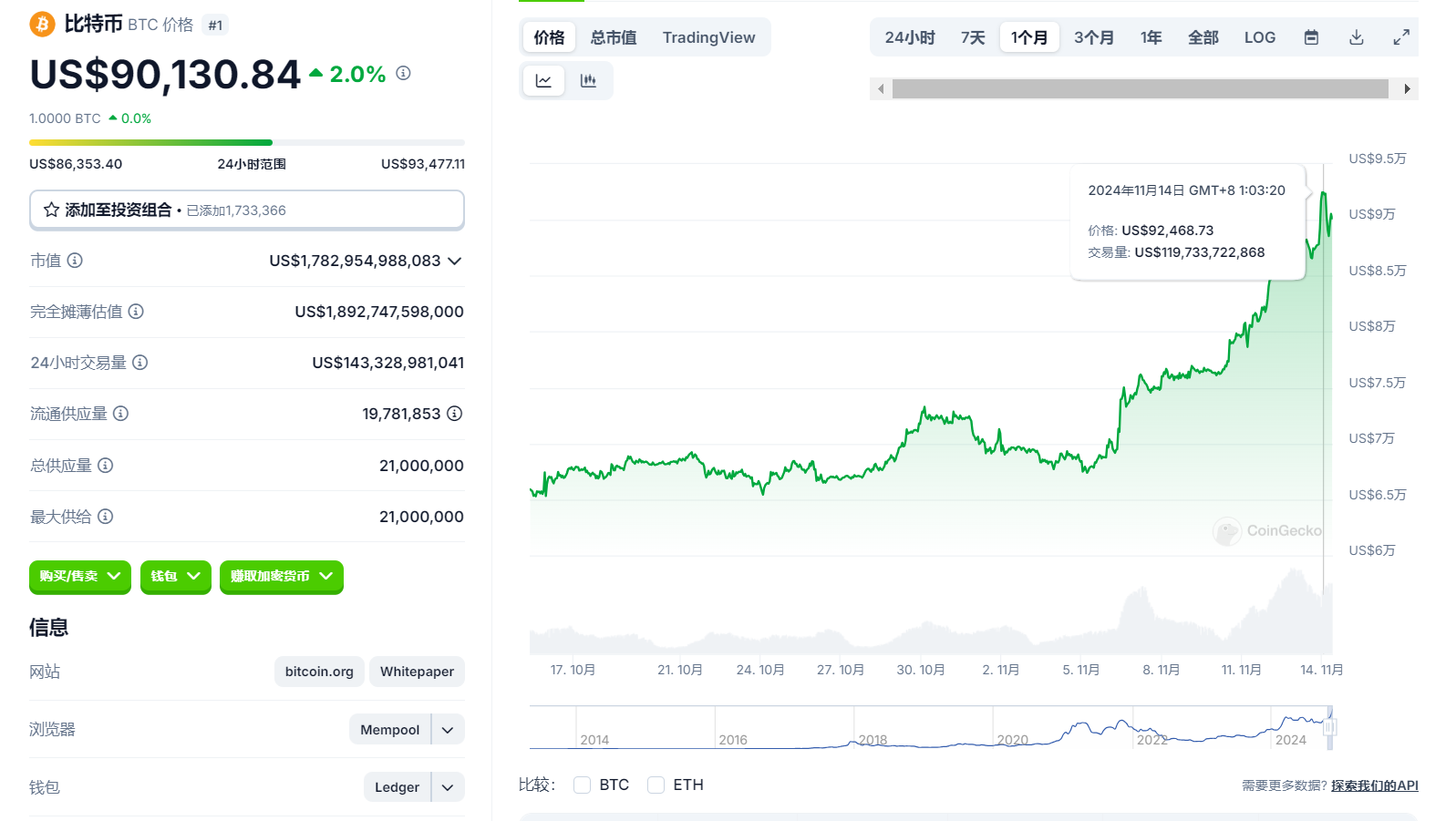

According to Binance data, Bitcoin broke through the important $90,000 mark, and then continued to surge, with a daily gain of 8.6%, reaching $93,300, a new all-time high. As of the time of writing, it has retreated, currently trading at $90,130.

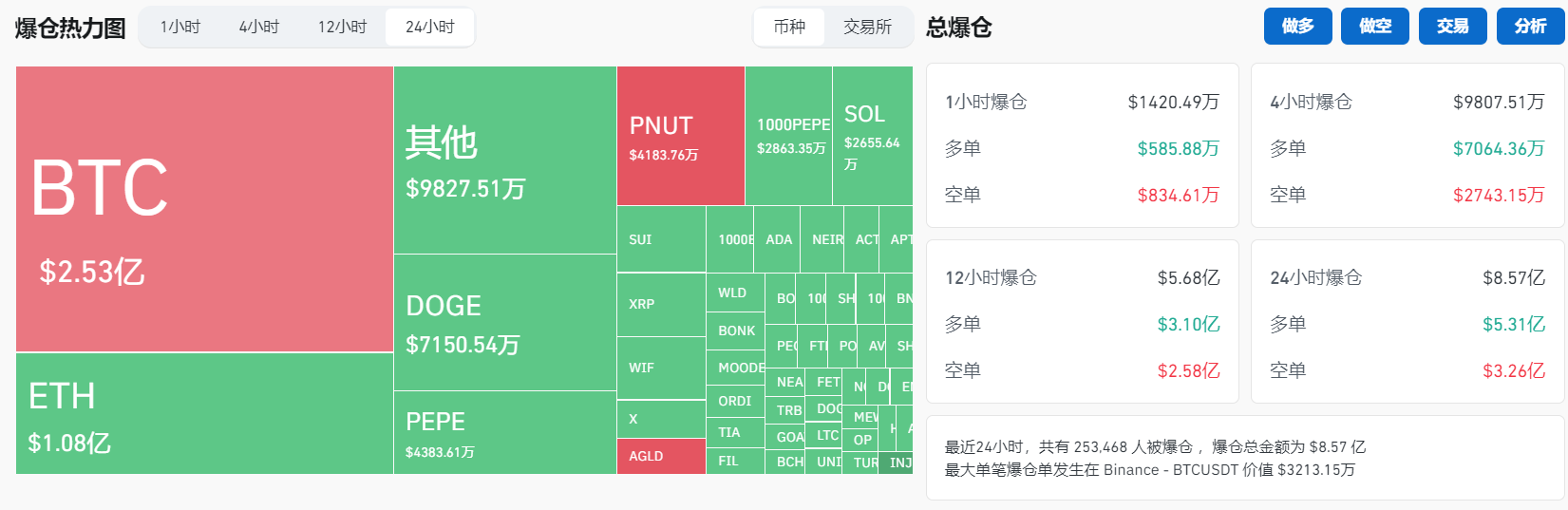

Coinglass data shows that in the past 24 hours, a total of 253,846 people were liquidated, with a total liquidation value of $857 million. The largest single liquidation occurred on Binance - BTCUSDT, worth $32.13 million.

Affected by the news of "Listing on Robinhood" and "Roadmap for Listing on Coinbase", the PEPE token price has surged, breaking through $0.000021, currently trading at $0.0000214, a 24-hour increase of 45%, with a market capitalization of $9 billion, setting a new all-time high.

Meanwhile, Coinbase has included dogwifhat (WIF) in its listing roadmap. The WIF token price has surged, breaking through $4.15, just one step away from its all-time high of $4.8.

Top Cryptocurrencies by Market Cap Surge Across the Board

Dogecoin, which Musk supports, surged more than 16% in a single day. Dogecoin has been one of the strongest performing cryptocurrencies in the recent period. After strongly supporting Trump's victory in the US presidential election, on November 12th local time, Trump announced that Musk will be one of the leaders of the Trump "Department of Efficiency" (DOGE) plan. The acronym of the department clearly endorses Dogecoin.

In the cryptocurrency concept stocks, BTC Digital surged more than 71%, the double long Bitcoin ETF rose about 6.3%, and among Bitcoin ETFs, BTCW rose 3.3% and ARKB rose more than 3.1%.

According to data from the derivatives exchange Deribit, call option bets are concentrated on Bitcoin reaching $100,000.

At the beginning of this week, inflows into US spot Bitcoin ETFs exceeded $1 billion.

Wall Street generally believes that Trump's promise to fully invest in the cryptocurrency field has pushed Bitcoin's price to new highs. Trump has vowed to turn the US into the world's cryptocurrency capital. Bitcoin speculators are betting on a more relaxed regulatory environment, and expect the authorities may establish a cryptocurrency reserve fund to help boost sustained demand.

Michael Novogratz, CEO of Galaxy Digital, said, people need to sell long-end bonds in the bond market. Bitcoin's price could rise to $500,000. Bitcoin should rival gold within a decade. The possibility of Bitcoin becoming a reserve asset is relatively low. The US dollar's status as an international reserve currency does not need something to support it.

Some analysts also point out that the relatively moderate leverage in the cryptocurrency market has reduced the risk of a sharp correction. The market's breather is likely to be temporary, and the tailwind remains strong.

However, there are also doubts in the market. Some industry insiders point out that while further upside cannot be ruled out, a lot of good news has already been priced into Bitcoin's price. In addition, US Treasury yields and the US dollar are both rising, and the relatively high borrowing costs are unfavorable for risky assets like cryptocurrencies.