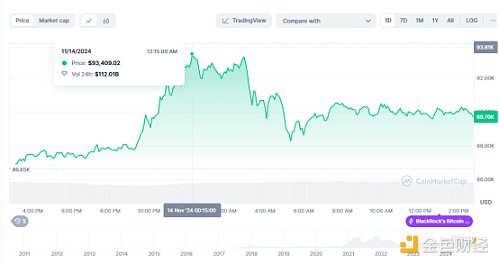

From $70,000 to $90,000, Bit only took a week. Just this morning, Bit hit a new high, rising all the way to break through the $90,000 mark, reaching a high of over $93,000, just one step away from the $100,000 predicted by analysts.

The raging bull market is emerging, the crypto world is boiling, and the news is also burning. Can this trend continue? How far can the Trump effect go? The market is also full of different opinions.

Before the election, Bit surged to $74,000, and at the time, the market still had doubts, with bearish and conservative voices, but the facts have proven that the Trump effect is more worth expecting than imagined.

This morning, Bit rose nearly 6% intraday, officially standing at $90,000, reaching a high of $93,462, although it later fell back to $90,000, but as of now, Bit has risen more than 33% since the US election. And after breaking through $93,000, Bit's market value briefly rose to $1.84 trillion, surpassing Saudi Aramco, temporarily rising to the 7th position among the world's mainstream assets.

The crypto market is also boiling, with the USDT market value breaking through $127.84 billion, setting a new high, and the mainstream sectors mostly rising, with new coins such as PUNT in the MEME sector continuing to rise. In the early morning, US stocks and crypto concept stocks collectively rose, with MicroStrategy up more than 4%, Coinbase up 3.7%, and Riot Blockchain up 2%, while the crypto sector in the Hong Kong stock market also continued to rise, with Ecochain up more than 10%.

The same volatility brings the same recipe for liquidation. Coinglass data shows that as of this morning, the 24-hour crypto market had a total of $659 million in contract liquidations, of which $374 million were long liquidations and $284 million were short liquidations. BTC had a total of $161 million in liquidations, and ETH had $87.1368 million in liquidations.

As for the reasons for the rise, the Trump agenda and the outlook for Federal Reserve policy are the main positive factors, but on the other hand, the bullish sentiment of large institutions and the trend of nationalization of reserves have also become important reasons.

From the Federal Reserve's perspective, after cutting rates by 25BP in November, lowering the federal funds rate to 4.5%-4.75%, the market is generally cautious about further rate cuts, especially with the obvious inflationary risks in Trump's policy ideas. But the CPI data released yesterday made rate cuts more feasible. The data released on Wednesday showed that the US CPI rose 2.6% year-on-year in October and 0.2% month-on-month; the core CPI (excluding volatile factors such as energy and food) rose 3.3% year-on-year and 0.3% month-on-month in October, indicating that the October non-farm payrolls were disrupted by hurricanes but in line with expectations of inflation.

Against this backdrop, traders have increased their bets on the Federal Reserve cutting rates further next month. According to the CME Fed Watch, the probability of the Federal Reserve keeping the current rate unchanged in December is 17.5%, and the probability of a cumulative 25 basis point rate cut is 82.5%. The probability of keeping the current rate unchanged in January next year is 11.9%, the probability of a cumulative 25 basis point rate cut is 61.7%, and the probability of a cumulative 50 basis point rate cut is 26.5%.

The loose environment seems to be able to continue, and the prices of risky assets are pushed up accordingly. But what is more noteworthy is that the current rise in the crypto market is undoubtedly highly dependent on the expected regulatory benefits brought by Trump.

The new administration is just getting started, and Trump has recently begun to update his post-inauguration agenda and personnel changes. As president, Trump needs to nominate 15 cabinet members, and those highly related to crypto are undoubtedly Musk and Robert Kennedy. Although Robert Kennedy has not yet taken office, the boots of the Government Efficiency Department have already fallen.Trump announced that Musk and Vivek Ramaswamy will jointly lead the proposed "Government Efficiency Department", and stated that the agency will pave the way for dismantling the government bureaucracy, reducing redundant regulatory laws and wasteful spending, and reorganizing federal agencies.

Musk has reposted the appointment on social media, saying that the Government Efficiency Department is not a threat to democracy, but a threat to bureaucracy. The efficiency of the Government Efficiency Department is also lightning fast, as the official X account of the Government Efficiency Department has already gone online today, and Musk's support for crypto is no less, as he not only released a LOGO with the DOGE word, but also @DOGE on the official account, which also added fuel to the DOGE community.

On the SEC side, which the market is most concerned about, from a regulatory perspective, the president cannot remove Gensler from the commission without a legitimate reason, and Gensler himself also seems to have no intention of resigning. But for the Senate candidates, Trump has also made some hints, saying he will bypass the Senate's confirmation process to appoint his government members, and if this statement is true, the probability of Gensler's position being insecure will be greatly increased. On the other hand, the Senate Majority Leader next year will be Senator John Thune, who supports crypto legislation, which has laid a solid foundation for a positive policy direction.

Although from the agenda Trump has currently announced, the first day's work will start with the relatively easy-to-implement large-scale deportation of illegal immigrants residing in the US, crypto is not on the list, but as pro-crypto members continue to join the ruling party, the long-term certainty of positive factors is obviously clear, such as the legal counsel of the heavily regulated Ripple, who believes that the new government will withdraw the digital asset cases, and the market sentiment will be turbulent accordingly.

Unexpectedly, large institutions are also giving real support. MicroStrategy took the lead, announcing on the evening of November 11 that it had purchased 27,200 Bit between October 31 and November 10, spending about $2.03 billion, at an average price of about $74,463 per Bit. The funds for this purchase came from the company's ATM stock sales. Currently, MicroStrategy's total holdings have reached 279,420 Bit, with a total purchase cost of about $11.9 billion and an average purchase price of about $42,692 per Bit.

Wall Street is not to be outdone either, as after the US election, Bit ETF and Ether ETF have seen a surge in net inflows. The US Bit spot ETF has seen net inflows for 6 consecutive days, with a total inflow of $4.705 billion, reaching a total asset management scale of $56.475 billion and a total market value of $95.688 billion. The Ether spot ETF is slightly inferior, but has also seen net inflows of over $759 million in the past 6 days.

It is clear that institutions are showing a bullish sentiment on Bit, to the extent that they are making large-scale purchases at what can be considered the current high price, and it is worth mentioning that the large-scale purchases by institutions have also provided price support for Bit. Analysts also point out that the current cost basis of new investors or short-term investors is around $66,800.

In addition, the Bit US reserve asset proposed by Trump is gradually being implemented in other countries. The pioneering El Salvador and Bhutan have already reaped substantial rewards, and taking Bhutan as an example, the government of the Kingdom of Bhutan, with a population of less than 800,000, holds 12,576 Bit, worth over $1.1 billion, making it the fourth largest government Bit holder in the world, with the total value of Bit holdings exceeding 25% of the country's GDP. Venezuela and Germany have also had lawmakers propose the inclusion of Bit in the national reserve. And just recently, Bitcoin Magazine CEO David Bailey disclosed on social media that at least one sovereign nation is actively acquiring Bit and has already joined the ranks of the top five holders. The sovereign nation has not been revealed, but the market largely suspects it is the cash-rich Qatar and Saudi Arabia, as the relatively economically backward regions would find it difficult to support such a large capital volume at the current price.

With the gathering of various favorable factors, it is not surprising that Bitcoin is advancing rapidly. In the bull market, any bullish factor can drive its continuous rise, and the decline is also the same. However, it is evident that Trump is still the main driver of this round of the bull market, and therefore, his subsequent policies will be closely watched, which also brings uncertainty to the market.

Although he has already controlled the Congress, after taking office, Trump's primary focus will inevitably be on national affairs such as the economy and fiscal policy, and the priority of the cryptocurrency industry will continue to be postponed. The more direct one is the dismissal of the SEC chairman. Trump has mentioned that he will dismiss Gensler after taking office and will also establish a Bitcoin and cryptocurrency presidential advisory council. This action may be a directly observable short-term indicator, which can be quickly revealed after January 20.

As for the US reserve assets that the market is highly concerned about, it is just an ideal, but the reality is quite different. On the one hand, the high volatility of Bitcoin does not meet the principle of strategic reserves; on the other hand, in terms of implementation, the inclusion of Bitcoin in the national reserves still faces legal, security, and traditional institutional obstacles. At the legal level, the regulatory regulations of Bitcoin are not yet clear, and there will be major changes in the existing regulations, whether in classification, custody, or taxation, and there may even be security risks. Even if the regulations are improved, the erosion of the Fed's independent policy by decentralized currencies will also arouse the opposition of the central bank, not to mention the adaptability issues of traditional financial institutions and other vested interests. Some people also point out that Trump is not targeting Bitcoin, but is conducting risk-free arbitrage through the coordination of stablecoins and Bitcoin, but there is no evidence yet, and it is currently only a speculation.

Of course, the resistance is huge, but if it is truly implemented, the benefits will also be huge. The well-known cryptocurrency investor Novogratzy has predicted that if it is established, Bitcoin will soar to $500,000, and ArthurHayes even believes that it will reach $1 million in the future.

In any case, given the current upward trend of Bitcoin, the $100,000 that many analysis agencies believe is only a step away, and JPMorgan Chase has also stated that Bitcoin will continue to benefit from the Trump effect in the next 8 weeks, while CNBC and Copper both believe that Bitcoin can reach $100,000 before the presidential inauguration.

It is worth noting that for short-term investors, the correction after a sharp rise is also normal. Glassnode's analyst believes that Bitcoin has entered the price discovery stage, and historically, this stage lasts about 22 days on average, after which a major correction will occur, during which about 5% of the circulating supply may be pushed down below the original purchase price. It has been in a high-profit position for 12 consecutive days.

But based on the current situation, the expectation still has support, and the correction before Trump's formal inauguration will be relatively limited.