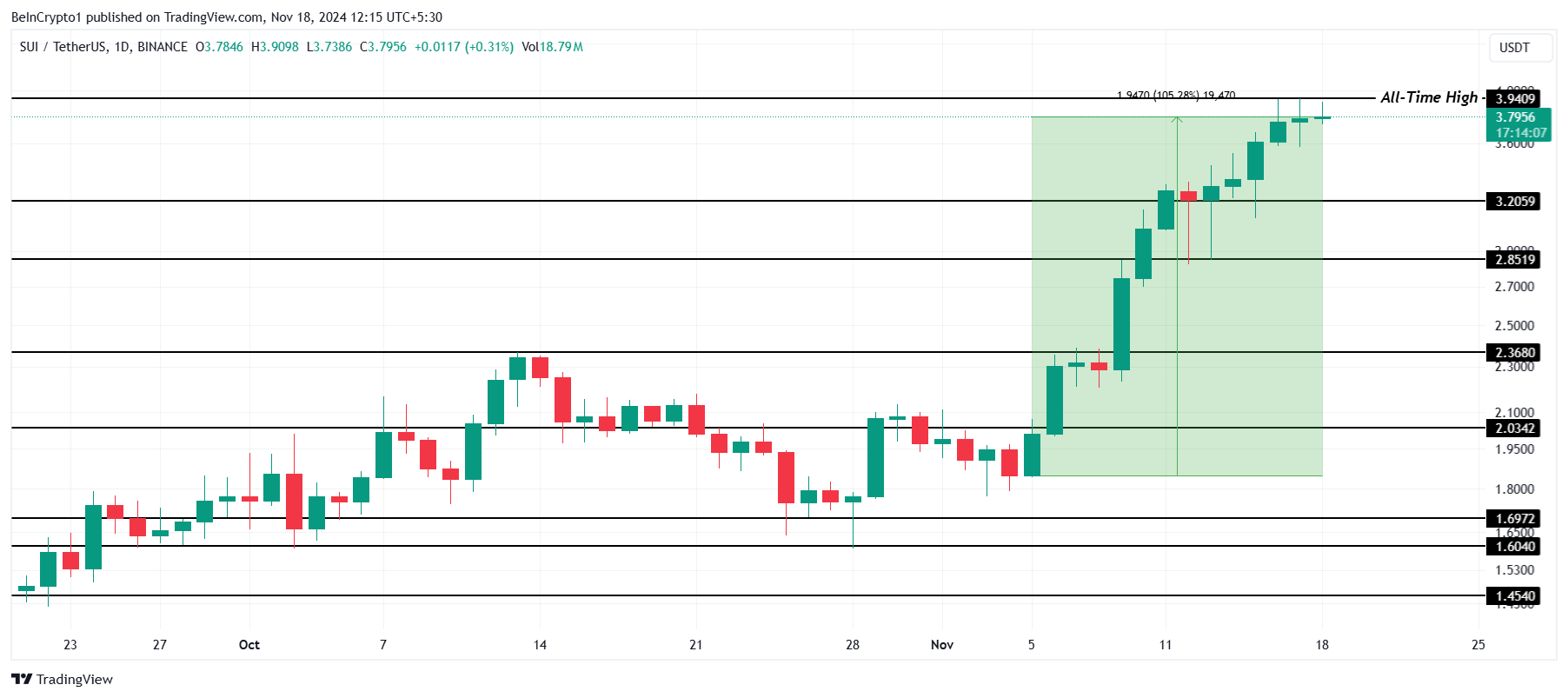

SUI's price has risen sharply this month, setting a new all-time high over the weekend.

This altcoin, which has risen 105% over the past 2 weeks, is currently showing outstanding performance in the cryptocurrency market. SUI, which is trading just below its all-time high, has a high potential for further upside.

Why is SUI likely to rise further?

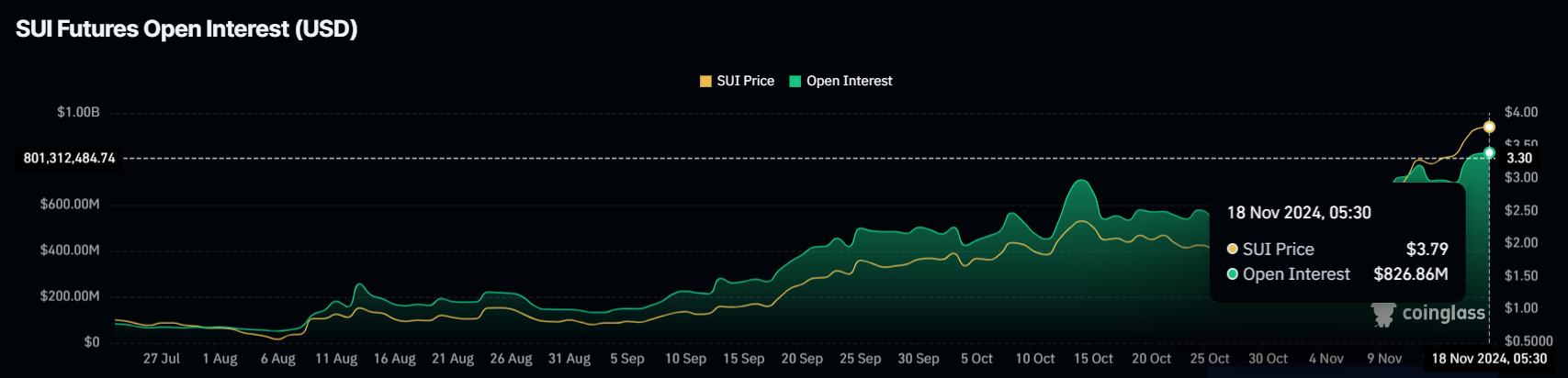

Analyst Michael van de Poppe recently identified SUI as the "best buy" during the correction phase of Bitcoin. The popularity of SUI, along with the trend on major platforms, is reflected in the all-time high open interest (OI) of $826 million, indicating strong investor demand and confidence.

The increasing capital inflow into SUI reflects the broad enthusiasm in the market. Traders are looking at SUI as a reliable option amidst the volatility of larger cryptocurrencies like Bitcoin. This increased interest is raising SUI's visibility and attracting the attention of retail and institutional investors.

SUI's macroeconomic momentum is further strengthened by the Chaikin Money Flow (CMF) indicator, which is well above the typical 0.20 to 0.30 reversal range. This level indicates increasing investor interest, and historically, when CMF reaches such levels, a reversal occurs, but the current breakout suggests the potential for exponential growth.

This strong inflow demonstrates the asset's resilience and sustained investor participation. If this trend continues, SUI could attract more capital and strengthen its position as a high-growth altcoin in the market.

SUI Price Prediction: Expecting a New All-Time High

SUI is currently trading at $3.79, having come close to its all-time high of $3.94 reached over the weekend. The impressive 105% rally of this altcoin has firmly established its position as the top-performing cryptocurrency this month.

Considering the sustained upward momentum, SUI is likely to maintain its gains. The factors mentioned earlier suggest that if the current trend continues, SUI has the potential to set a new all-time high.

However, a reversal due to profit-taking or a change in sentiment could lead to a price decline. In such a scenario, SUI could fall to the $3.20 support level, and a breach of this level would invalidate the bullish outlook.