This week, the cryptocurrency market is closely watching various U.S. economic data. These events can impact the sentiment of traders and investors, and therefore, there may be volatility in trading strategies.

As traders prepare for potential volatility, Bit(BTC) is currently maintaining the psychological level of $90,000 at the time of writing.

Initial Jobless Claims

The U.S. Department of Labor releases weekly unemployment claims data. The report to be released this Thursday will show that initial claims for the week ending November 16 were 217,000, lower than the expected 223,000 and down from the unrevised 221,000 the previous week.

"The jobless claims (leading indicator) continue to suggest the labor market remains very healthy," said Richard Bernstein Advisors, a $15.6 billion asset manager.

The recent jobless claims indicate steady demand for workers despite recent disruptions from storms and strikes. If this downward trend continues, it could signal easing economic difficulties and a strengthening labor market, which could positively impact consumer spending and confidence, benefiting financial markets.

Declining jobless claims suggest more people are being hired or finding jobs, leading to increased disposable income and potentially more investment in assets like Bit(BTC).

U.S. Manufacturing PMI

The November U.S. Manufacturing Purchasing Managers' Index (PMI) is scheduled to be released on Friday. This is a key economic indicator measuring the performance and health of the U.S. manufacturing sector. The previous reading was 48.5, and the expected figure is 48.8. This is one of the U.S. macroeconomic indicators to watch this week.

A higher PMI reading indicates expansion in the manufacturing sector, signaling strong economic growth and increasing manufacturing activity. This can increase investor confidence in the overall economy, and this positive sentiment may spill over into the cryptocurrency market as investors seek high-yield investment opportunities like Bit(BTC).

Similarly, the PMI data can influence market sentiment and risk appetite among investors. Positive PMI figures can lead to a more optimistic investment environment, potentially benefiting risk assets like cryptocurrencies.

U.S. Services PMI

Another U.S. economic data point is the U.S. Services Purchasing Managers' Index (PMI), scheduled for release on Friday. This indicator measures the performance of the U.S. services sector, providing important insights into economic activity and business sentiment in service industries such as hospitality, finance, healthcare, and technology.

Changes in the Services PMI, previously at 54.1, can also impact Bit(BTC) and the broader cryptocurrency market. A higher Services PMI indicates growth in the services sector, which is a crucial driver of economic activity. This can translate into positive sentiment in financial markets, potentially benefiting alternative assets like cryptocurrencies that investors seek for growth potential.

A strong Services PMI can increase optimism about the business environment, encouraging investors to take on more risk, which may include investments in cryptocurrencies.

"The first signs of the economic trends in the world's major economies after the U.S. presidential election are expected in the November flash PMI surveys and U.S. consumer confidence," the PMI Insights account mentioned.

Nvidia Q3 Earnings

Nvidia (NVDA), the GPU leader, is scheduled to report its Q3 earnings on Wednesday, November 20. This report often highlights GPU demand for gaming, artificial intelligence, and cryptocurrency mining. Analysts expect revenue to surge 84% to $3.32 billion, driven by strong demand for AI infrastructure. Earnings per share are expected to rise from $0.37 to $0.70.

Strong GPU sales for AI can increase investor confidence in AI-centric sectors, including AI-focused cryptocurrencies. Historically, Nvidia's performance has impacted the prices of AI-related tokens, and if this week's earnings report suggests continued growth in AI and cryptocurrency applications, there may be upward momentum.

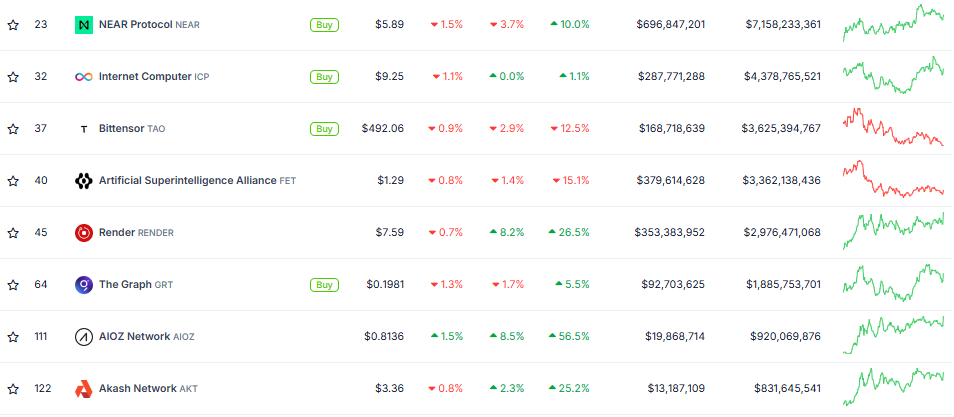

Sentiment around AI stocks ahead of Nvidia's Q3 earnings release may impact AI-centric cryptocurrencies such as Render (RNDR), Worldcoin (WLD), Near Protocol (NEAR), and Bittensor (TAO). The DePin project Aethir (ATH), known for its GPU rendering capabilities and often referred to as the 'Nvidia of cryptocurrencies,' may also be affected by the earnings report.

Nvidia's results are scheduled to be released shortly after the U.S. Supreme Court indicated it plans to issue a narrow ruling in a shareholder lawsuit against the company. As previously reported by BeInCrypto, this lawsuit alleges that Nvidia misled investors about its reliance on cryptocurrency mining revenue, which could introduce additional volatility to Nvidia's stock and the related cryptocurrency sector.