Sławomir Mentzen, a candidate for the 2025 Polish presidential election, has promised to establish a strategic Bit reserve if elected.

Following in the footsteps of Donald Trump, Mentzen is positioning himself as a leader in cryptocurrency adoption, which could reshape Poland's economic strategy.

Candidate Sławomir Mentzen Declares Bit Holdings

In response to a policy framework shared by Lech Wilczyński, CEO of the cryptocurrency exchange Swap.ly, Mentzen has affirmed his intention to implement this plan. He emphasized the potential benefits Bit could bring to the country's resilience and independence from the traditional financial system.

"Poland should create a strategic Bit reserve. If I become the President of Poland, our country will become a cryptocurrency haven with very friendly regulations, low taxes, and a supportive approach from banks and regulators," Mentzen shared.

Mentzen's strategy goes beyond simple adoption. By creating a supportive environment for cryptocurrency companies, he aims to foster innovation and attract global investors. He has emphasized his intention to transform Poland into a competitive player in the global cryptocurrency market.

The vision includes cryptocurrency-friendly regulations, reduced taxes, and collaborative engagement with banks and regulators. The candidate also draws inspiration from the libertarian ideals often associated with cryptocurrencies, appealing to voters who prefer minimal government intervention and financial innovation.

These measures are set to propel Poland towards becoming a global leader in digital asset innovation. Mentzen's proposal is resonating with the growing cryptocurrency-savvy population in Poland, where Bit adoption has significantly increased in recent years.

Mentzen's cryptocurrency-centric policies are likely to play a pivotal role in shaping the economic future of the country in the May 2025 Polish election. If successful, his leadership could herald a transformative era, positioning Poland at the forefront of the cryptocurrency revolution in Europe.

"It may be the first in Europe, but it certainly won't be the last," commented an X user sharing their opinion.

Mentzen Seems Confident in the Global Trend

Mentzen's proposal aligns with the growing international interest in national Bit reserves. This concept gained momentum earlier this year when US President-elect Donald Trump pledged to establish a similar reserve, sparking a debate on the role of Bit in national finance.

Trump's stance has inspired state-level initiatives in the US, including a proposed Bit reserve bill in Pennsylvania and support in Florida. Additionally, Senator Cynthia Lummis has advocated for Bit as a national reserve asset, proposing that the Federal Reserve Board could fund this transition by selling gold.

Global interest is also expanding, with Hong Kong evaluating the inclusion of Bit in its financial reserves. This reflects the asset's potential as a hedge against economic volatility. Mentzen's initiative reflects this broader trend, positioning Poland as a leader in the cryptocurrency field by leveraging Bit's scarcity and decentralized nature.

While still in the campaign stage, Mentzen's promise reflects an ambitious alignment with the wider global shift towards cryptocurrency adoption. As other countries, including the US and Hong Kong, explore similar strategies, Poland's adoption of a Bit reserve could set a precedent for other mid-sized economies.

However, there are also critical voices regarding the volatility of Bit and the potential risks of it as a reserve asset. Investor Michael Novogratz has warned that national adoption could face resistance due to unpredictable markets and political complexities.

"The odds are low. The Republicans control the Senate, but they're not close to 60 seats. It would be very wise for the US to utilize the Bit it has and add a little bit more... I don't think it needs to be backed by the dollar," Novogratz argued.

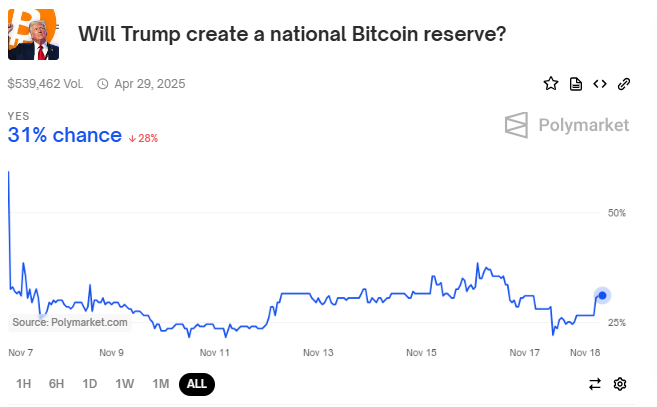

The probability market Polymarket, which successfully predicted Trump's victory, shows that the likelihood of Trump establishing a US Bit reserve is only 31%.

Despite the skepticism, Novogratz believes that such reserves would be beneficial for Bit, potentially driving its value to $500,000. Meanwhile, Bit Magazine CEO David Bailey argues that Donald Trump could establish a strategic Bit reserve without congressional approval.

"According to legal experts, the President has the authority to establish an SBR and implement a sizable acquisition program (billions of dollars) without Congress. Scaling it up further would require Congressional approval, but we could start immediately at a scale similar to MicroStrategy," Bailey revealed.