The price of Ethereum (ETH) has lagged behind other major assets this year. It has only increased by 30%, compared to Bitcoin's 102% and Solana's 118% rise. However, recent indicators are hinting at a strong performance for ETH.

Whale accumulation is on the rise again, and key metrics such as the 7-day MVRV ratio and EMA alignment are suggesting a potential uptrend.

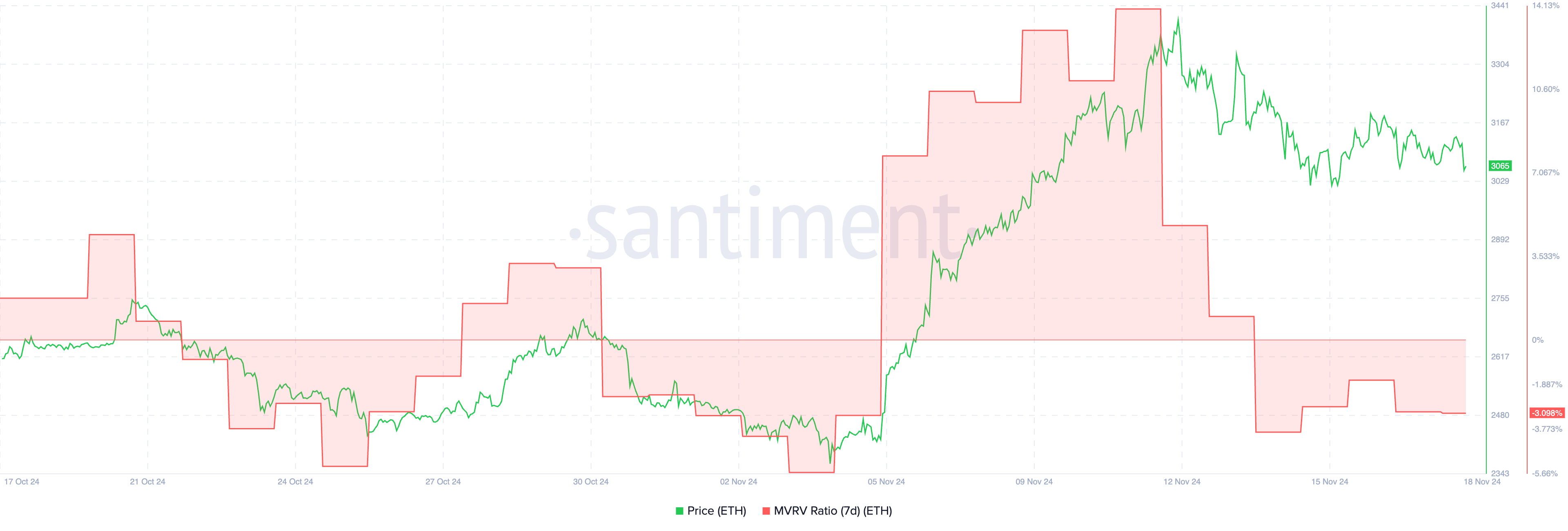

ETH 7-day MVRV Reaches an Important Level

The 7-day MVRV ratio of Ethereum is currently at -3%, indicating that short-term holders are experiencing a slight unrealized loss on average. This metric often signals whether an asset is undervalued or overvalued compared to recent market activity.

This negative MVRV ratio reflects that holders are less likely to sell, so an increase in demand could lead to price appreciation.

The 7-day MVRV ratio measures the average profit or loss of addresses that acquired Ethereum over the past 7 days.

Interestingly, on November 5th, the 7D MVRV ratio held a similar level, and shortly after, ETH surged from $2,400 to $3,400 in just one week, suggesting this could happen again.

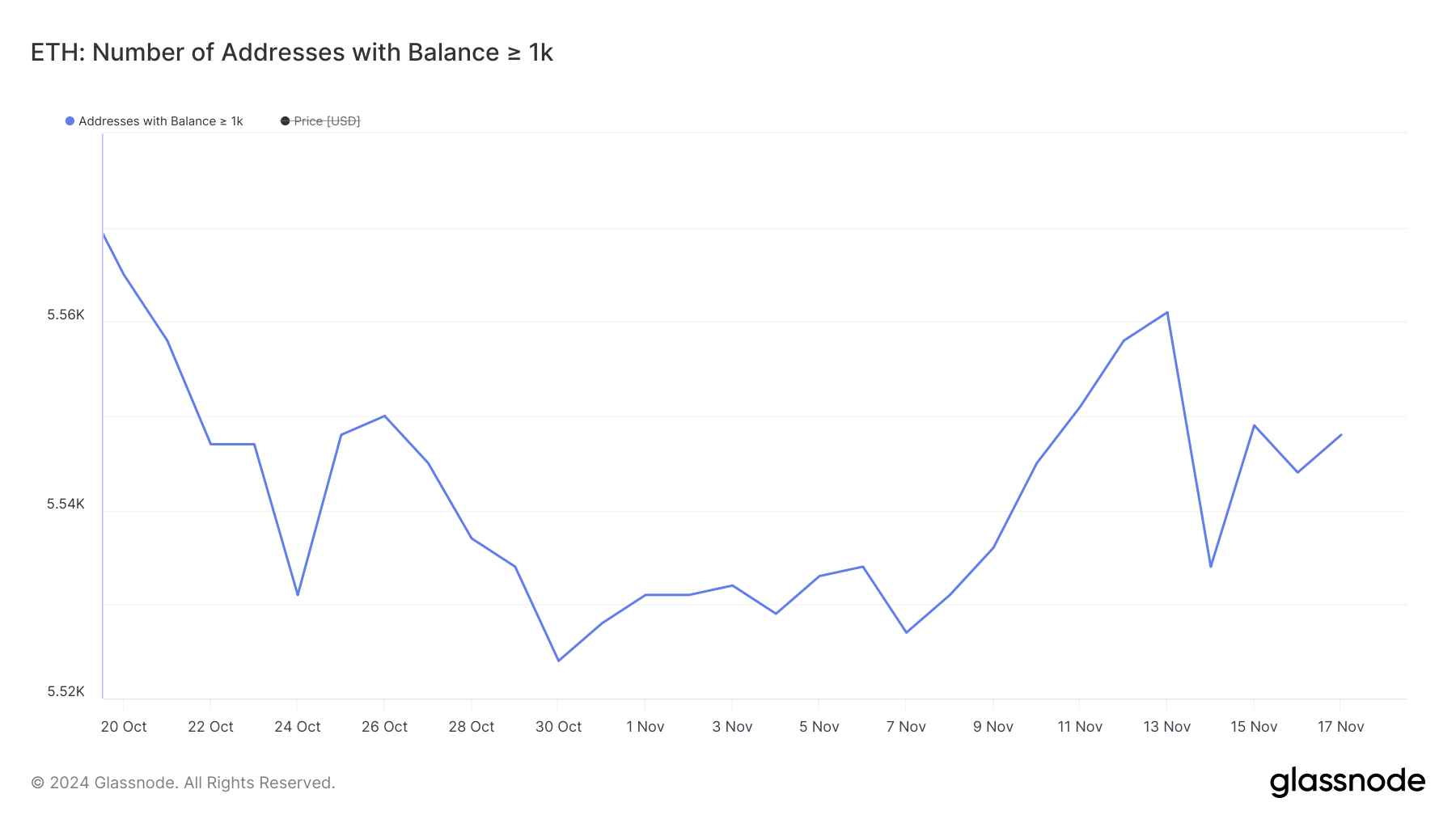

ETH Whales Slowly Accumulating Again

From November 7th to 13th, the number of whales holding at least 1,000 ETH increased significantly from 5,527 to 5,561. This represents the largest growth in this metric in 2024, indicating strong accumulation by large holders.

Such activity often reflects increased confidence in ETH, and whale accumulation can often signal a period of price appreciation due to reduced selling pressure and concentrated ownership.

Following this increase, the metric briefly dropped to 5,534 the next day, reflecting profit-taking. However, it has recently risen back to 5,548.

This renewed growth suggests that whales are re-establishing their positions, which could either strengthen the stability of ETH's price or potentially trigger a rally.

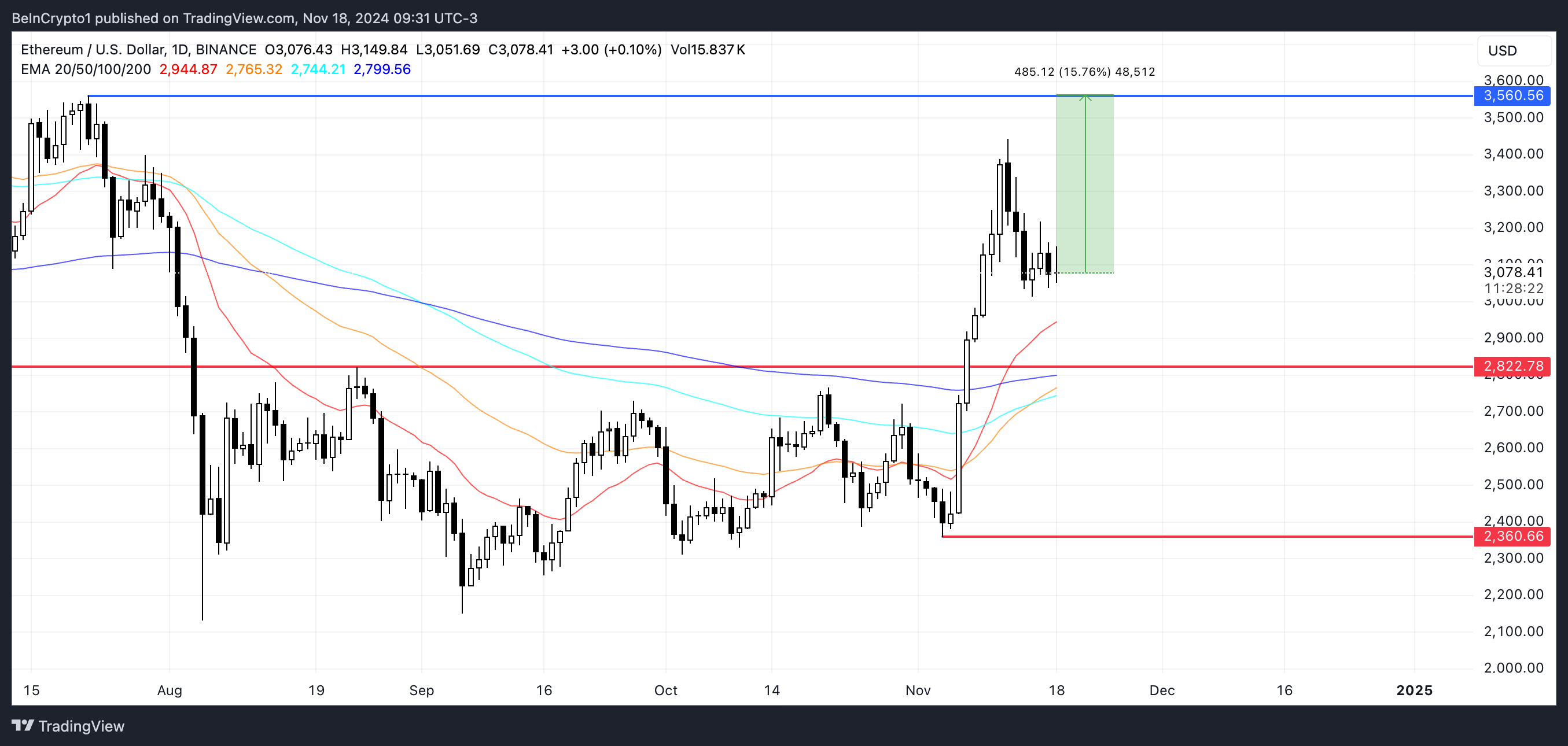

ETH Price Prediction: 15% Upside Potential if Whale Trend Holds

With the 7D MVRV ratio at -3% and whales resuming accumulation, ETH's price appears to be entering an uptrend. This outlook is further supported by the price being above all the EMAs, with the short-term EMA crossing above the long-term EMA, forming a golden cross.

This technical setup often signals the start of a strong uptrend and reflects the market's momentum.

If the upward momentum is sustained, ETH could challenge the $3,560 resistance level, which represents a potential 15% upside from current levels.

However, if the uptrend weakens, ETH may test the support around $2,822, and if it fails to hold that area, a deeper correction towards $2,360 could follow. These levels will be crucial in determining whether ETH can sustain its recovery or face additional adjustments.