Introduction

Driven by global economic fluctuations and the trend of digitalization, the cryptocurrency market has once again attracted widespread attention. As a leading enterprise in the crypto field, MicroStrategy recently announced the addition of 51,780 Bitcoin, bringing its total holdings to 331,200, injecting strong confidence into the market. At the same time, the scale of digital asset funds has reached a historic high of $138 billion, and the popularity of spot Bitcoin ETFs continues to rise. All of this indicates that the Bitcoin market is welcoming a collective frenzy of institutional investors. This article will delve into the recent market dynamics of Bitcoin, the investment strategies of institutions, and the optimistic outlook of industry leaders for the future.

MicroStrategy Continues to Increase Bitcoin Holdings, Exceeding 330,000 Coins

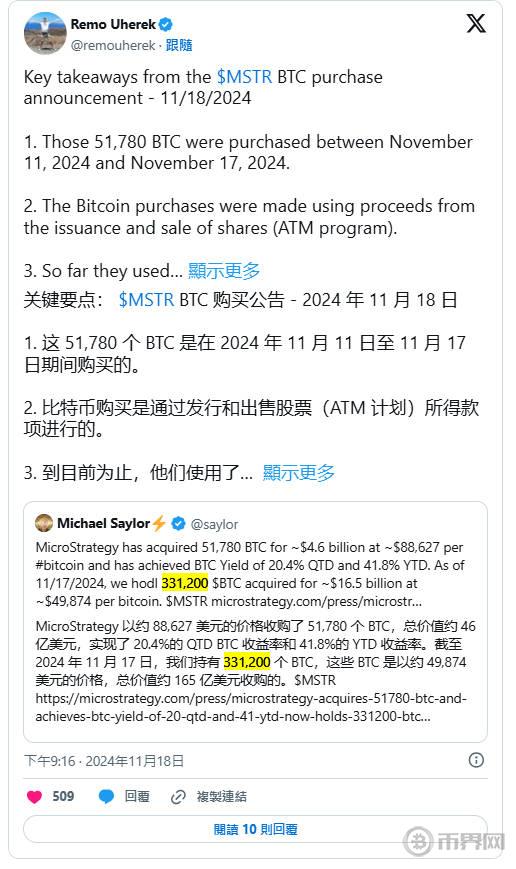

On November 18, MicroStrategy founder Michael Saylor announced on social media that the company had spent $4.6 billion to purchase an additional 51,780 Bitcoin at an average price of $88,627 per coin. This news undoubtedly injected a strong stimulus into the current slightly volatile Bitcoin market.

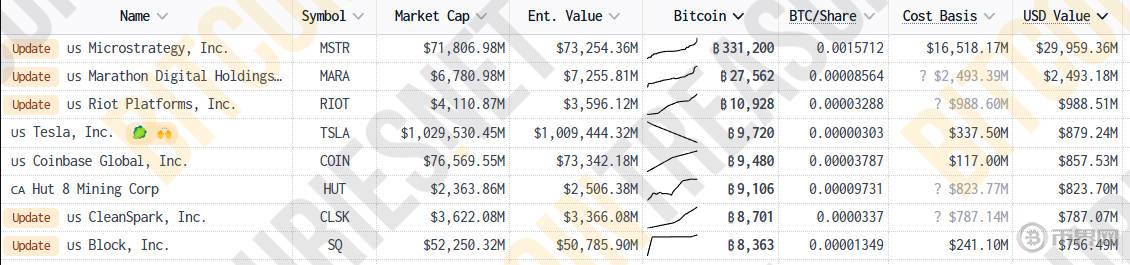

As of November 17, MicroStrategy already holds 331,200 Bitcoin, with a total cost of about $16.5 billion and an average purchase price of $49,874. Currently, the total value of its Bitcoin holdings is close to $29.954 billion, with an unrealized profit of about $13.4 billion. This also makes MicroStrategy the world's largest corporate holder of Bitcoin.

The funds for this large-scale Bitcoin purchase mainly came from MicroStrategy's fundraising through stock issuance and its "ATM plan" (At-the-Market Offering). To date, this plan has invested $5.7 billion in Bitcoin purchases, and the remaining $15.3 billion in funds can still be used for future increases. This not only reflects the company's strong confidence in the Bitcoin market, but also further highlights its firm stance as a "believer" in the cryptocurrency market.

Bitcoin Price Fluctuates, Bulls and Bears Battle Fiercely

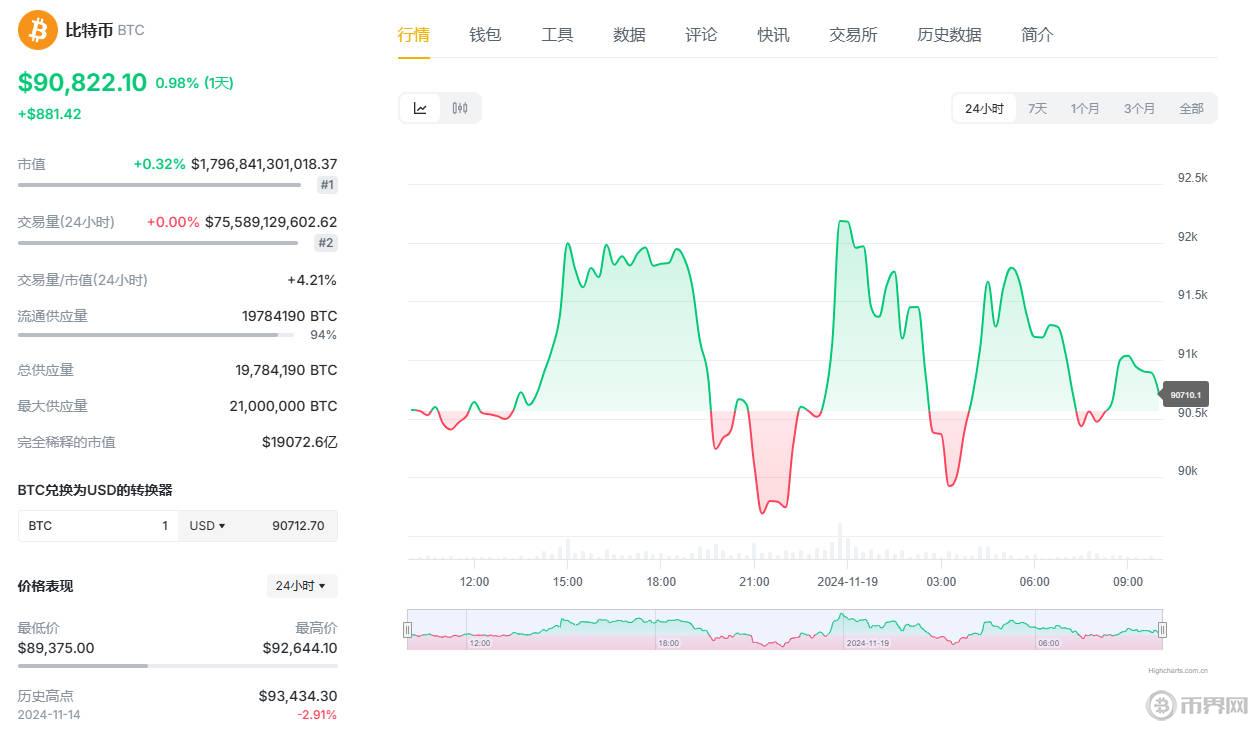

Recently, the Bitcoin price has been fluctuating repeatedly in the range of $90,000 to $92,000. On the evening of November 18, Bitcoin once fell to $89,375, but then rebounded, reaching a high of $92,644. However, subsequent selling pressure caused the Bitcoin price to continue to fluctuate within a narrow range. As of the time of writing, Bitcoin is reported at $90,989, up 0.57% in the past 24 hours.

Against this backdrop, the battle between the bulls and bears in the cryptocurrency market is becoming increasingly fierce. According to data from Coin World, the total liquidation amount in the past 24 hours reached $336 million, of which the long position liquidation amount was $203 million and the short position liquidation amount was $133 million, with more than 110,000 people being liquidated.

Latest Price Trends of Bitcoin BTC & Ethereum ETH

Institutions Pouring In, Digital Asset Fund Scale Reaches Historic High

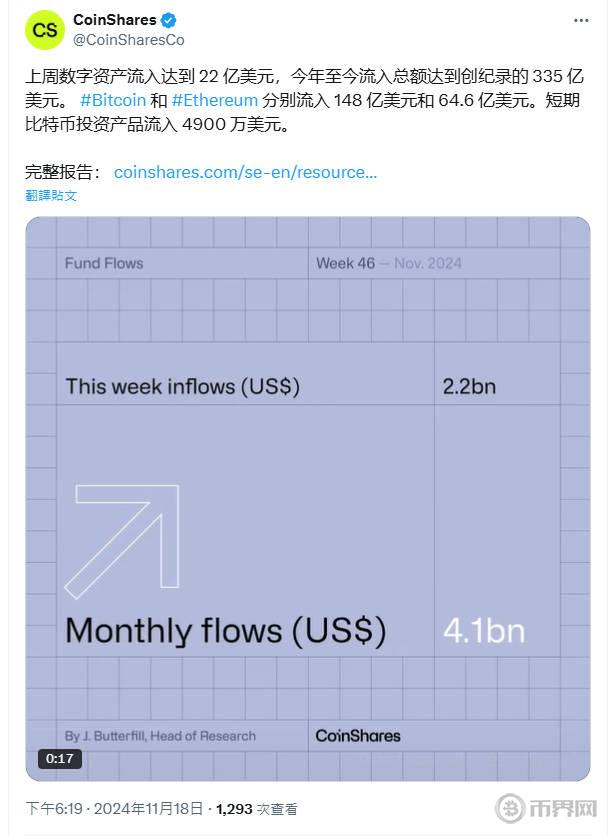

In addition to MicroStrategy's frequent increases, the boom in the cryptocurrency fund sector is also not to be ignored. According to a report released by the European asset management company CoinShares, the assets under management of cryptocurrency investment tools have reached a historic high of $138 billion. This achievement is due to the $2.2 billion in funds that investors have injected into digital asset funds in the past week.

CoinShares' data shows that these funds have mainly flowed into spot Bitcoin ETFs in the US market. Since January, the US Securities and Exchange Commission (SEC) has approved 11 new spot Bitcoin ETFs, including those from BlackRock, Fidelity, and Grayscale, providing a convenient and regulated investment channel for various investors.

In addition, other digital assets such as Ethereum have also received widespread attention from the market. The report points out that investor enthusiasm for Ethereum has risen significantly, with $646 million flowing into Ethereum-related products in the past week alone.

Favorable Policies and Capital Inflows Promote Market Growth

The booming digital asset market is not only influenced by market dynamics, but is also closely related to the political environment. Since the announcement of the results of the US presidential election on November 8, the cryptocurrency field has seen a large influx of capital. The president-elect Trump promised to support the digital asset industry during the campaign, providing policy guarantees for its development. This commitment has boosted investor confidence and significantly increased market activity.

The continued rise of Bitcoin prices to a new high of $93,000 is partly due to investors' pursuit of US spot ETFs. Loose monetary policy has also provided strong support for the cryptocurrency market.

Michael Saylor and Cathie Wood Outlook on the Future of Bitcoin

Regarding the long-term value of Bitcoin, Michael Saylor and "Goddess of Stocks" Cathie Wood have extremely optimistic predictions. In an interview, Michael Saylor stated that Bitcoin is not just a digital currency, but a tool for optimizing capital structure. By incorporating Bitcoin into the balance sheet, companies can significantly enhance their attractiveness in the capital market and promote the flow and growth of capital. He even likened Bitcoin to "digital energy", believing that it will bring about a capital revolution, helping companies fight against tech giants and disrupt the traditional financial system.

Cathie Wood, on the other hand, pointed out in another interview that even though Bitcoin has broken through the historical high of $90,000, its future growth potential is still huge. She believes that by 2030, the price of Bitcoin will reach $650,000, and in a bull market, it may soar to between $1 million and $1.5 million.

MSTR Stock Price Surges, Market Confidence Rises

Driven by the rise in Bitcoin prices and MicroStrategy's continued increases, the company's stock price (MSTR) has accumulated a 59% increase this month, currently trading at $343 with a total market value exceeding $70 billion. This trend further reflects the market's confidence in MicroStrategy's investment strategy and the future development of Bitcoin.

Conclusion

With the continuous increase of institutional investors like MicroStrategy and the continuous rise in the scale of global digital asset funds, the Bitcoin market is showing unprecedented vitality. In addition, the implementation of supportive policies by the US government for digital assets has also expanded the future development space for Bitcoin.

However, amid the optimistic market atmosphere, investors still need to be alert to the violent fluctuations and potential risks in the market. For long-term investors, Bitcoin may indeed be an asset worth investing in, but a rational investment strategy is still the key to success.