As Solana's price surge approaches a new all-time high, it is generating optimism among traders and investors. The upward momentum of this altcoin reflects increased market activity, but Solana faces challenges in breaking through key resistance levels.

Despite these obstacles, SOL enthusiasts remain optimistic about the asset's long-term potential.

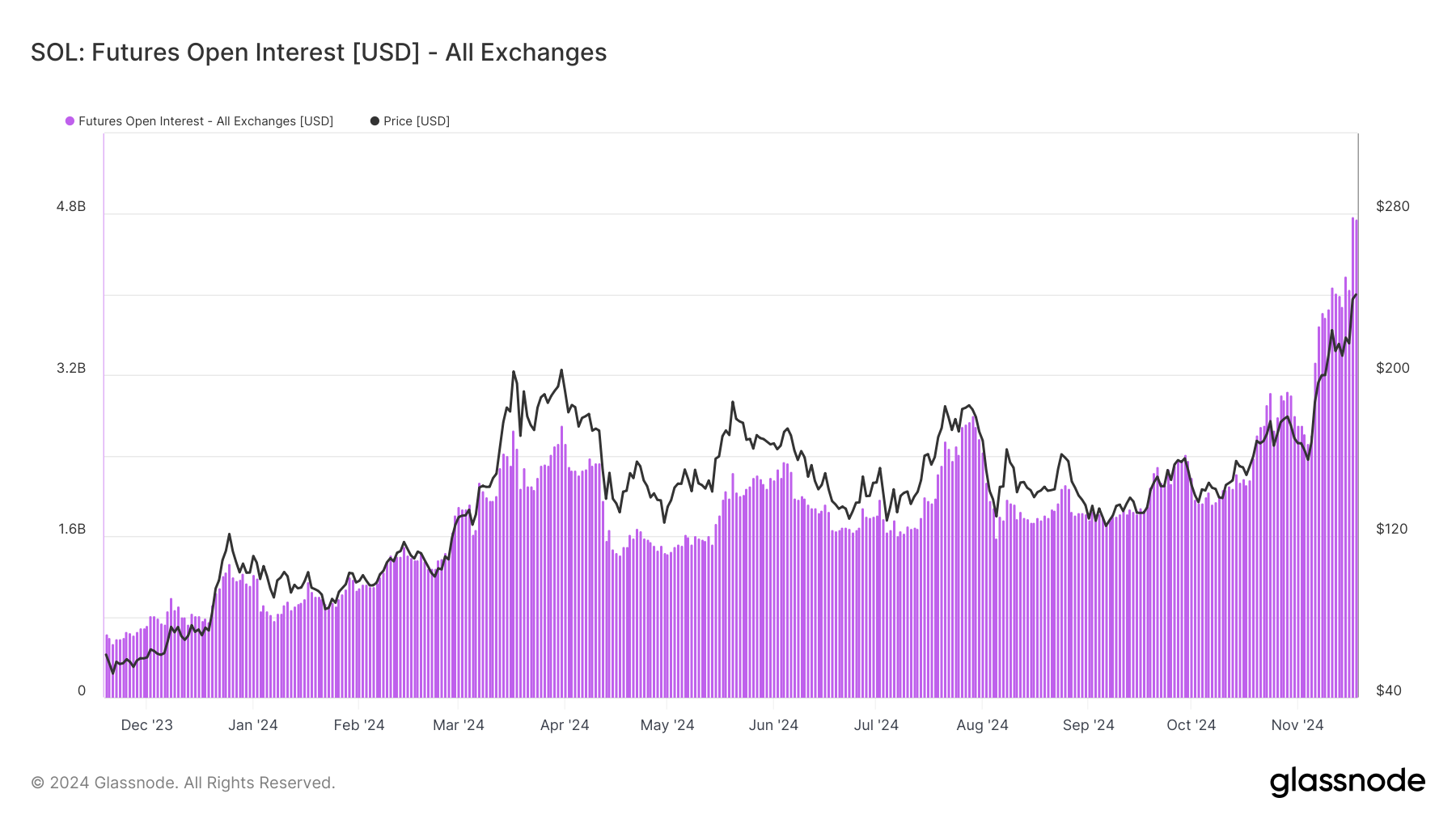

Record-breaking futures buying pressure yet to breach all-time high

Solana traders are showing strong optimism, with the asset's open interest reaching an all-time high of $4.7 billion. This surge emphasizes that traders are continuing to deploy significant capital into SOL amid the ongoing uptrend, indicating increased confidence. As open interest approaches $5 billion, Solana is experiencing a noticeable increase in market participation, fueling expectations for further gains.

However, this rising open interest reveals a disconnect between expectations and the current price movement. While traders are heavily invested, Solana's price has yet to break through key resistance levels. This contrast between open interest and price action raises questions about whether the bullish momentum can be sustained or if a correction may follow.

From a technical perspective, Solana's Relative Strength Index (RSI) is indicating an overbought condition, significantly above the neutral range. Historically, such RSI levels have triggered price corrections, and SOL may face headwinds in the short term. The price decline could occur as traders adjust their positions and lock in profits, potentially pushing the asset further away from its all-time high target.

Nevertheless, Solana's macro momentum remains strong, driven by broad market signals and increasing adoption. These factors contribute to the asset's resilience, but the overbought condition warrants caution. Investors will need to monitor whether Solana can maintain its uptrend or succumb to market pressures.

SOL Price Prediction: Uptrend Likely to Continue

Solana's price is trading just below the $245 resistance level, which serves as the final barrier before it can establish a new all-time high above $260. Breaching this critical level would confirm the continuation of SOL's rally and allow the asset to set a new milestone.

However, the mixed signals from market sentiment and technical indicators suggest potential difficulties in surpassing the $245 mark. Failure to break through could see Solana drop to $221 or lower, which would test investor confidence.

Nevertheless, if the broader market signals remain positive and $245 transitions to a support level, Solana could have the opportunity to surpass $260 and establish a new all-time high, invalidating the bearish narrative.